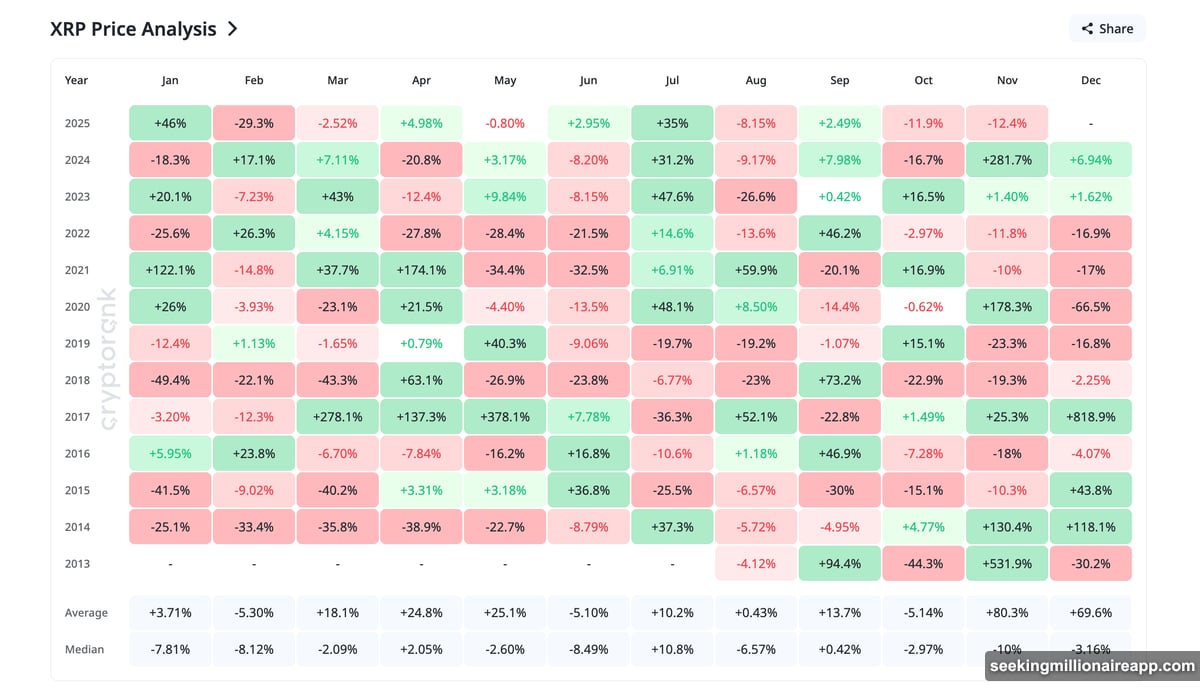

XRP enters December nursing a 13% November loss. Bulls want to believe seasonal patterns predict another rally. But the data tells a more complicated story.

December looks strong on paper. The average historical gain sits near 70%. That’s misleading though. One monster 818% surge in 2017 inflates the whole average. Strip that outlier out and the median December return drops to negative 3.16%.

Recent years show more modest gains. XRP rose 6.94% in December 2024 and just 1.62% in 2023. So the “December magic” narrative doesn’t hold up when you examine actual performance.

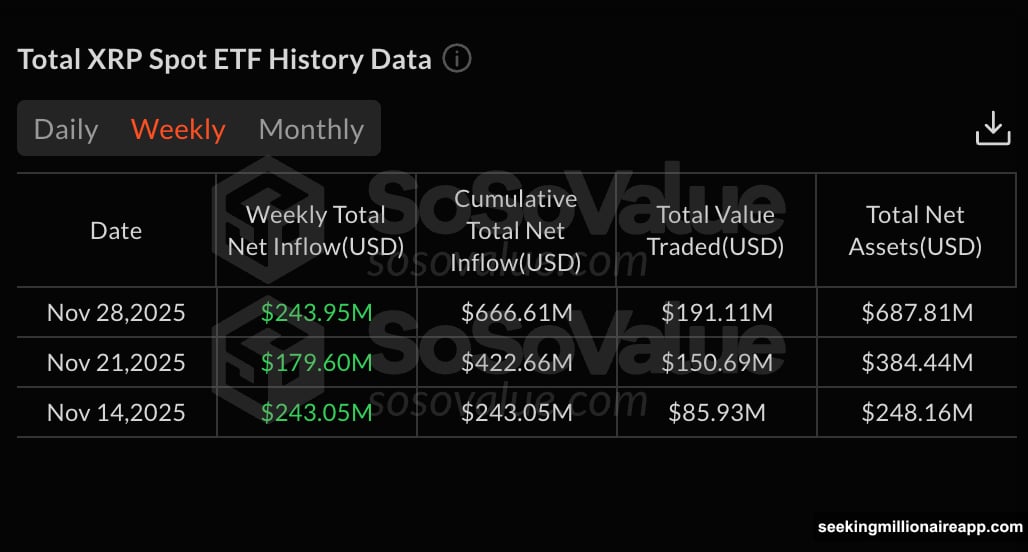

This year brings something new. Institutional money flows through ETF products now. That changes the game entirely.

ETF Inflows Create Fresh Momentum

XRP racked up over $640 million in ETF inflows during a multi-day streak. That’s real institutional capital entering the market. Ray Youssef, CEO of NoOnes, points out this fundamental shift in market structure.

He told BeInCrypto that December 2025 will likely behave differently because institutional demand arrived through ETFs. The momentum from ETF buzz attracted substantial capital from the start. Plus, those inflows create buying pressure that wasn’t present in previous December cycles.

However, Youssef remains cautious. If broader market conditions weaken and ETF flows reverse, XRP will probably follow Bitcoin and Ethereum movements. That scenario could push prices back to test $2.00 support.

So the bullish case depends entirely on whether institutional demand sustains. One month of strong inflows doesn’t guarantee continued momentum. Markets change direction fast when sentiment shifts.

Long-Term Holders Quietly Exit Positions

On-chain data reveals concerning behavior. Long-term holders keep reducing their positions despite rising prices. HODL Waves data shows supply distribution across different holding periods. The picture isn’t pretty.

Holders in the 1-2 year cohort dropped from 9.72% to 8.516% over the past month. Meanwhile, the 2-3 year group declined from 14.80% to 14.251%. These changes might seem small. But these groups control massive portions of circulating supply.

Their selling creates persistent overhead resistance. Every rally attempt faces fresh supply from profit-takers. That explains why XRP struggles to maintain momentum above key levels.

The cost basis heatmap reinforces this risk. The strongest supply cluster sits between $2.445 and $2.460, where roughly 1.749 billion XRP waits. This exact zone acted as resistance before. Breaking through requires absorption of all that selling pressure.

Youssef warns that long-term holders still control a disproportionate share of supply. XRP can only record substantial December gains if institutional demand offsets this selling pressure. Otherwise, the token stays range-bound.

Technical Setup Points to $2.60 Target

XRP trades near $2.196 after forming a double-bottom pattern. The token bounced from $1.772 twice—once in October and again in late November. That structure supports a recovery attempt.

But XRP must clear two critical levels first. The immediate resistance sits at $2.307. Above that, the key breakout zone waits at $2.459. This level perfectly aligns with the cost basis heatmap clusters and historical resistance.

A clean daily close above $2.459 unlocks the next target near $2.612. This lines up with the 0.618 Fibonacci level and heavy supply concentration. Youssef sees this zone as the realistic December target. He believes a clear breakout above $2.60 would signal the first firm indication of a bullish shift.

That $2.60-$2.61 zone represents where technical analysis and fundamental targets converge. Both the chart pattern and institutional flow dynamics point to this area as the next major test.

If buyers fail to break $2.459, momentum stalls. A close below $2.119 exposes the $1.772 support again. At that point, XRP likely retests lower ranges and extends sideways action.

The Path Forward Depends on Bitcoin

XRP doesn’t trade in isolation. The token follows broader crypto market movements. If Bitcoin and Ethereum experience another downturn, XRP will probably drop alongside them.

Youssef specifically mentioned this correlation. When major crypto assets pull back, altcoins like XRP follow suit. That means monitoring Bitcoin’s price action matters as much as tracking XRP-specific metrics.

The current setup creates two distinct scenarios. Sustained ETF demand combined with stable Bitcoin prices can drive a break above $2.459. From there, $2.60-$2.61 becomes achievable. That’s the bullish case.

The bearish scenario plays out if ETF flows weaken or broader markets decline. Without continued institutional buying, XRP lacks the fuel to break resistance. In that case, the token remains tied to Bitcoin’s direction and retests support zones.

December historically shows mixed results. This year adds the new variable of institutional flows. But long-term holders keep selling into strength. The technical setup shows clear levels to watch.

Whether XRP reaches $2.60 this month depends on forces beyond seasonal patterns. ETF sustainability and broader market stability will determine if bulls can finally break through overhead resistance or if sellers win another round.