Cross-chain bridges processed more annual transfers than most national economies in 2025. That’s not a typo.

While you were checking your portfolio, blockchain infrastructure quietly evolved from fragmented islands into a living, interconnected system. Plus, the numbers prove this isn’t hype—it’s already happening at massive scale.

Let me show you why omnichain connectivity matters and where this train is headed.

Bridges Grew Up Fast

Remember when cross-chain bridges felt sketchy? Assets would lock on one chain, mint on another, and you’d pray the security held. Those days are ending.

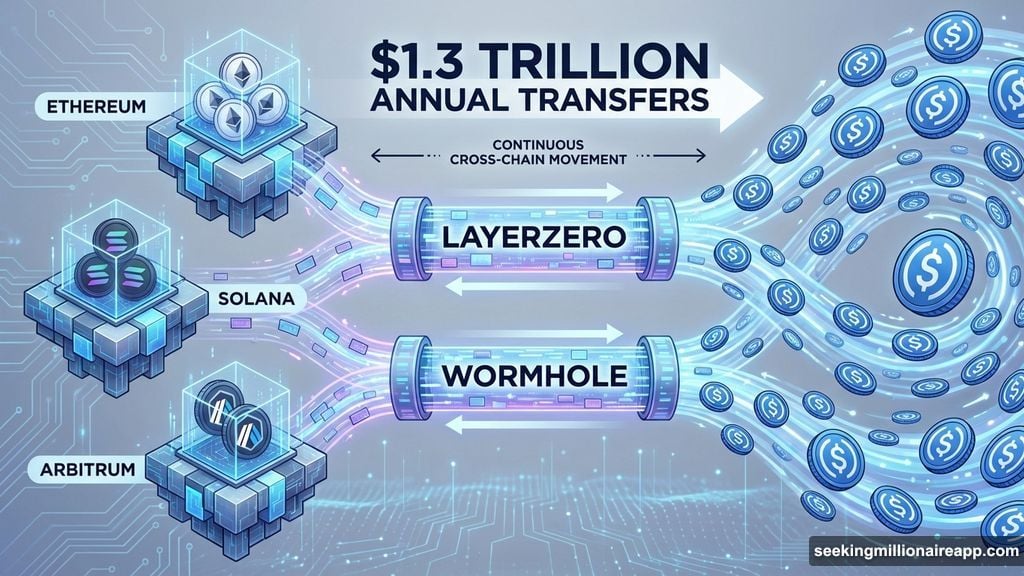

Today’s bridges operate at real scale. Total value locked in cross-chain bridges reached $19.5 billion by January 2025. Moreover, these bridges collectively facilitate over $1.3 trillion in annual transfers. That accounts for 54% of all DeFi activity.

LayerZero now processes over $5 billion monthly. Wormhole has moved $52 billion in lifetime transfers. These aren’t experimental tools anymore. They’re critical infrastructure handling tens of billions in routine transactions.

The technology matured alongside the volume. Axelar and LayerZero reduced liquidity fragmentation dramatically. Instead of assets trapped on single chains, liquidity flows freely between networks. So what was once a technical curiosity became fundamental plumbing.

Omnichain Means More Than Token Movement

The term “omnichain” describes something bigger than just moving tokens between chains. It enables logical continuity across blockchain networks.

Here’s what that means in practice. DeFi strategies can execute on Ethereum, settle via Arbitrum, and get arbitraged on Solana—all within minutes using cross-chain protocols. One trader on BSC can tap Ethereum’s deep liquidity pools. Another on Solana can access Base’s newest applications.

LayerZero processes messages between 130+ networks and has delivered over 150 million cross-chain communications. Axelar’s cross-chain activity surged 536% in just one year. These platforms enable a single codebase to run across multiple chains simultaneously.

This creates genuine composability. Your wallet doesn’t need separate balances on five different chains. Applications don’t need to pick winners in the blockchain wars. Everything connects, everything flows.

Enterprises Are Building On This Infrastructure

Corporate adoption follows working technology. USDC transformed from primarily an Ethereum token into a globally native stablecoin through Circle’s Cross-Chain Transfer Protocol (CCTP).

Now USDC operates natively across Ethereum, Arbitrum, Avalanche, Solana, and Base. Tokenized bonds on one platform can settle via code on another network. Custodians and exchanges are building multichain settlement layers.

The infrastructure parallels traditional finance messaging systems like SWIFT. But these systems operate with cryptographic verification and near-instant settlement. Banks take days to clear international transfers. Cross-chain protocols do it in minutes.

Enterprises need this speed and flexibility. So they’re building serious financial products on omnichain infrastructure, not just experimenting with pilots.

Security Remains The Biggest Risk

Bridges are complex software running critical operations. The track record shows the danger clearly: over $2.8 billion stolen from bridge exploits, accounting for roughly 40% of all crypto hacks.

Centralized points of failure exist even in “decentralized” bridges. Trusted operator models like CCTP’s custody approach concentrate risk. Semi-decentralized validator sets can face collusion. Many bridges rely on small, fast relayers vulnerable to coordinated attacks.

Off-chain oracles and governance systems introduce additional vulnerabilities. These components can freeze funds or get manipulated. Dependency on a single bridging network creates systemic risk for the entire ecosystem.

Mitigation requires careful key management and diversified trust models. LayerZero’s decentralized oracles and Axelar’s multi-chain validator sets represent progress. But better UX is equally critical to prevent users from making blind transfers.

The technology is improving. Yet the stakes remain enormous when billions flow across these systems daily.

Regulators Found A New Target

Cross-chain bridges processed $1.5 billion in stolen funds during the first half of 2025 alone. That scale is impossible for regulators to ignore.

Bridges have become a compliance nightmare. Money laundering thrives on systems that obscure transaction origins. Traditional financial rails have reporting requirements. Bridges historically had none.

However, modern bridges can embed compliance logic directly into transfers. Token movements can carry provenance data, respect whitelists, and enforce transfer limits. Circle’s CCTP demonstrates this approach with full transparency to token issuers.

Collaboration on standards will allow chains to communicate while remaining compliant. The alternative is regulatory crackdowns that fragment the ecosystem again. So bridge developers are working with regulators, not against them.

Standards will emerge that balance privacy with accountability. This maturation is necessary for institutional adoption and long-term viability.

Innovation Pipeline Looks Promising

Current bridges work but aren’t perfect. The industry is actively developing next-generation solutions.

Restaked validator services could dramatically speed settlement times. Zero-knowledge proofs promise trustless cross-chain transfers without validator sets. These technologies are moving from research papers to prototype implementations.

Startups are building ZK-based bridge designs that eliminate trust assumptions entirely. “Intent networks” abstract away routing complexity by using solver markets for optimal execution. Users express what they want; the system figures out the best path.

The infrastructure isn’t finished. But the alternative—fragmented ecosystems where each chain operates in isolation—proved inefficient and user-hostile. Cross-chain applications are becoming seamless, supporting faster development cycles and smoother user experiences.

Innovation continues because the problems are clear and the incentives are aligned. Better bridges mean more users, more volume, and more value for everyone building in this space.

ChangeNOW Sees This Evolution Daily

ChangeNOW processes swaps across 110+ chains. Customers exchange assets without needing to think about the underlying bridge infrastructure. They don’t care which validator set secured their transaction or which protocol routed their swap.

Demand keeps growing even through volatile markets. Monthly trading volume exceeds $1 billion. That scale reveals something important: omnichain interoperability is transitioning from curiosity-driven experimentation to core infrastructure.

2026 may mark the inflection point where “multichain” support becomes baseline and “omnichain” becomes the expectation. Tools enabling seamless cross-chain development will make the underlying chain largely invisible to end users.

Wallets will abstract complexity away. Applications will route transactions optimally without user input. The technology will recede into the background while functionality improves.

Regulators might lag behind market realities. They often do. But markets drive efficiency and interoperability forward regardless.

What Omnichain Actually Means

Interoperability isn’t just growing incrementally. It’s scaling almost vertically. Bridges already power 54% of DeFi transactions. We’re on a clear trajectory toward a unified blockchain ecosystem.

The fragmented infrastructure of 2021 will soon seem antiquated. Multiple wallets managing different chains. Manual bridging with high fees and long wait times. Liquidity trapped on single networks.

That era is ending. The omnichain future means deploying applications that work everywhere, accessing liquidity from any chain, and building strategies that execute across multiple networks simultaneously.

Before long, today’s scattered infrastructure will be a distant memory. The question isn’t whether omnichain connectivity will dominate. It’s how quickly the transition completes and who builds the winning infrastructure.

Smart money is betting on sooner rather than later. The technology works. The demand exists. The incentives align. Now we watch it scale to match traditional finance in speed and capability while maintaining crypto’s core advantages.