One in seven Americans already loses track of their own property. Now imagine your heirs trying to find your bitcoin stash after you’re gone.

The recent crypto selloff grabbed headlines. But there’s a quieter crisis brewing that could erase digital fortunes entirely. Between 14% and 17% of U.S. adults now own cryptocurrency, according to recent Gallup and Pew Research surveys. Yet most of these investors haven’t planned how their crypto wealth will transfer after death.

This isn’t just theoretical. Estate attorneys are already dealing with millions in lost bitcoin because families couldn’t access private keys. Plus, the problem gets worse as more people buy crypto without updating their legal documents.

Most Wills Don’t Mention Digital Assets

Only 24% of Americans even have a will, according to Caring.com surveys. That’s already problematic. But here’s the bigger issue: nearly one in four people with wills haven’t updated them since they were originally drafted.

Think about what that means for crypto owners. If you wrote your will ten years ago, it probably contains zero language about digital assets. So your executor might lack legal authority to access your bitcoin or ether holdings.

“It’s very common for people not to update their estate planning documents for 10, 20 years or sometimes longer,” said Patrick D. Owens, shareholder at Buchalter law firm. “If that’s the case, you’re behind.”

Without proper digital asset language, your heirs face court battles just to access your crypto. They’ll probably win eventually. But the process drains time and money while your crypto sits frozen.

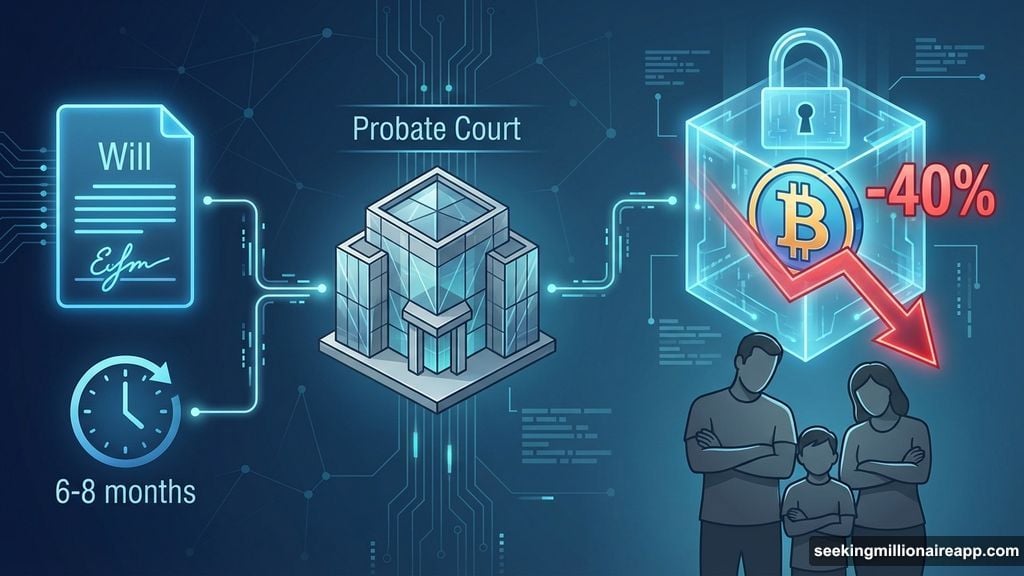

Standard Wills Leave Crypto Stuck in Probate

Even updated wills create problems for crypto inheritance. That’s because wills must go through probate, which can take six to eight months or longer.

Meanwhile, bitcoin could crash 40%. Your heirs would watch helplessly as their inheritance evaporates. They can’t sell or transfer anything while the estate sits in probate court.

Azriel Baer, partner at law firm Farrell Fritz, recommends clients transfer crypto to revocable living trusts instead. This gives trustees immediate access upon death, bypassing probate entirely.

Plus, revocable trusts offer more privacy than wills. Wills become public records through probate. So everyone can see what you owned and who inherited it. Trusts keep that information private.

Most estate attorneys pair revocable trusts with pour-over wills. This catches any assets you forgot to transfer into the trust before death.

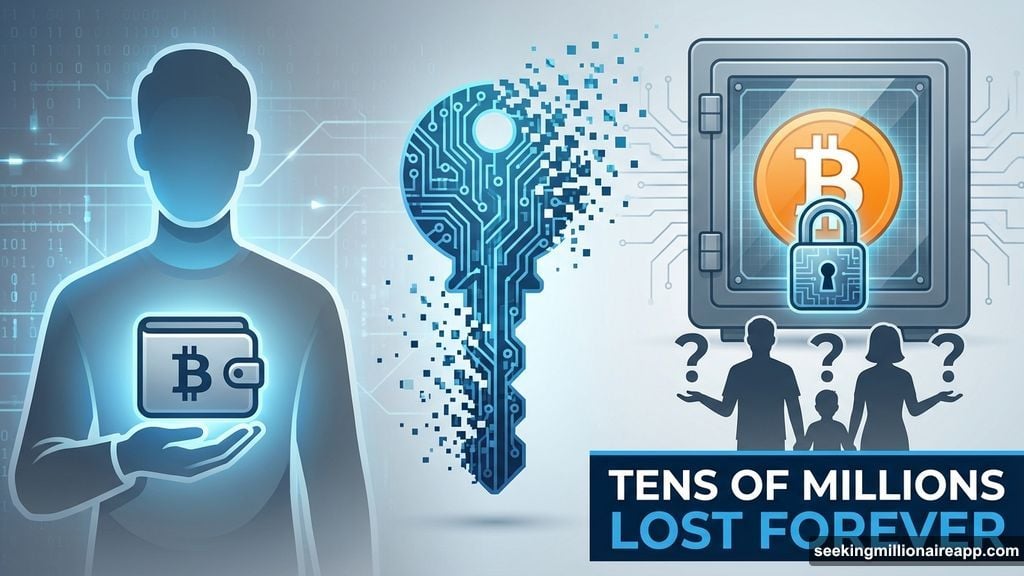

Lost Private Keys Mean Lost Fortunes

Baer worked on an estate where tens of millions in crypto vanished forever. The heirs knew the deceased owned significant bitcoin holdings. But they couldn’t find the private keys needed to access those funds.

Private keys function like digital passwords for crypto wallets. Lose them and your bitcoin is effectively gone, even if you legally own it. Blockchain technology makes recovery impossible without those keys.

You don’t need to tell your children exactly how much crypto you own. But someone trusted needs to know how to access it after you die. Store written instructions in a safe deposit box, home safe, or with your attorney.

Never put private keys directly in your will. Remember, wills become public through probate. You’d essentially publish your crypto passwords for anyone to see.

Several crypto inheritance services now help families access digital assets after death. These services securely store access information and release it to designated heirs when needed.

Your Estate Executor Might Not Understand Crypto

Uncle Bob might be perfect for managing your traditional investments. But can he handle volatile digital assets that require technical knowledge to transact?

Bitcoin’s recent price swings illustrate this problem. If your executor needs weeks to figure out how crypto works, your estate could lose significant value while they learn.

“Uncle Bob may be a great person, but he may have more challenges transacting with an asset class he’s totally not familiar with,” Baer said.

Sometimes even professional trustees won’t touch crypto. Owens had a client die with half a million dollars in bitcoin and ether. The institutional trustee overseeing the account refused to handle the digital assets.

Luckily, the deceased client had a tech-savvy nephew who stepped in as special trustee. But finding suitable replacements often costs serious time and money.

Crypto ETFs Solve Some Problems

The rise of spot bitcoin and ethereum ETFs helps mitigate some inheritance issues. Products like the iShares Bitcoin Trust (IBIT) and Fidelity Ethereum Fund ETF (FETH) gained popularity after SEC approval in 2024.

These ETFs provide crypto exposure without requiring investors to manage private keys or wallet security. They trade like regular stocks, making them much easier for executors and heirs to handle.

Plus, ETFs integrate seamlessly with existing brokerage accounts. Your heirs access them the same way they’d access your stock portfolio. No technical crypto knowledge required.

However, many crypto enthusiasts prefer holding actual bitcoin rather than ETF shares. So estate planning for direct crypto ownership remains critical for millions of investors.

Estate Tax Bills Can Devastate Unprepared Families

Massive crypto gains create substantial tax liabilities that catch families off guard. These include both income taxes and estate taxes, depending on holding size and jurisdiction.

The federal estate tax exemption for 2025 stands at $13.99 million per individual. Some states impose additional state-level estate taxes at lower thresholds.

Jonathan Forster, shareholder at Weinstock Manion law firm, works with clients whose crypto holdings exceed $50 million. They needed efficient strategies to reduce eventual estate taxes for their children.

His solution involved creating limited liability corporations to hold crypto assets. Then they gifted LLC interests to irrevocable trusts for their minor children. This moved assets out of their taxable estates while maintaining some control through trust structure.

Forster emphasizes the importance of tracking cost basis for all crypto purchases. Cost basis determines capital gains taxes when assets are eventually sold. Without accurate records, your heirs might overpay taxes or face IRS audits.

“It can be onerous to keep track of basis, but it’s important,” Baer noted. Poor record-keeping during your lifetime creates nightmares for heirs trying to properly account for inherited crypto.

The Divorce Factor Complicates Everything

Married millennials face additional crypto complications. Digital assets often remain hidden during divorce proceedings, either intentionally or through negligence.

Cryptocurrency’s pseudonymous nature makes it easier to conceal than traditional investments. Plus, many couples never discussed their separate crypto holdings during marriage.

This creates ugly situations when relationships end. One spouse might discover the other controlled significant crypto wealth they never disclosed. Proving ownership and dividing those assets becomes extremely difficult.

Estate planning attorneys recommend discussing crypto holdings openly with spouses. Document what each person owns separately versus jointly. Update estate plans together to reflect current crypto portfolios.

Three Steps to Protect Your Crypto Legacy

First, update your estate planning documents immediately. Make sure your will or trust includes explicit language about digital assets. Give your executor clear authority to access and manage cryptocurrency holdings.

Second, create secure instructions for accessing your crypto. Write down private keys, wallet passwords, and exchange account details. Store this information somewhere safe but accessible to your designated trustee or executor.

Third, consider converting some crypto holdings to ETFs. This simplifies inheritance while maintaining crypto exposure. Your heirs can sell ETF shares through normal brokerage accounts without mastering blockchain technology.

Regular estate plan reviews become essential as crypto portfolios grow. Schedule annual checkups with an attorney familiar with digital asset planning. Technology and regulations change fast in this space.

The Real Issue Everyone Ignores

Estate planning for traditional assets is straightforward. Lawyers have centuries of precedent and established procedures. Crypto inheritance is the Wild West by comparison.

Courts are still figuring out how to handle digital asset disputes. Regulations vary wildly between jurisdictions. Plus, blockchain technology introduces technical challenges that most judges don’t fully understand.

This uncertainty means proactive planning matters more than ever. You can’t rely on courts to sort things out smoothly after your death. The technology simply doesn’t allow for recovery if proper access wasn’t arranged beforehand.

Your crypto could be worth millions today and worthless tomorrow. Or it could be worth millions forever but completely inaccessible to your heirs. Only careful planning prevents the latter scenario.

Take action now while you can still control the outcome. Your family’s financial security might depend on instructions you write this week.