The crypto market hit pause Monday. Traders are holding their breath before Wednesday’s Federal Reserve meeting. But one altcoin ignored the memo entirely.

Bitcoin can’t break free from its two-month downtrend. The total crypto market cap refuses to budge past $3.05 trillion. Meanwhile, Zcash rockets toward $400 while everyone else watches nervously.

So what’s driving this standoff? And which assets might move once the Fed announces rates? Let’s dig into the data.

Bitcoin Trapped Under October’s Ghost

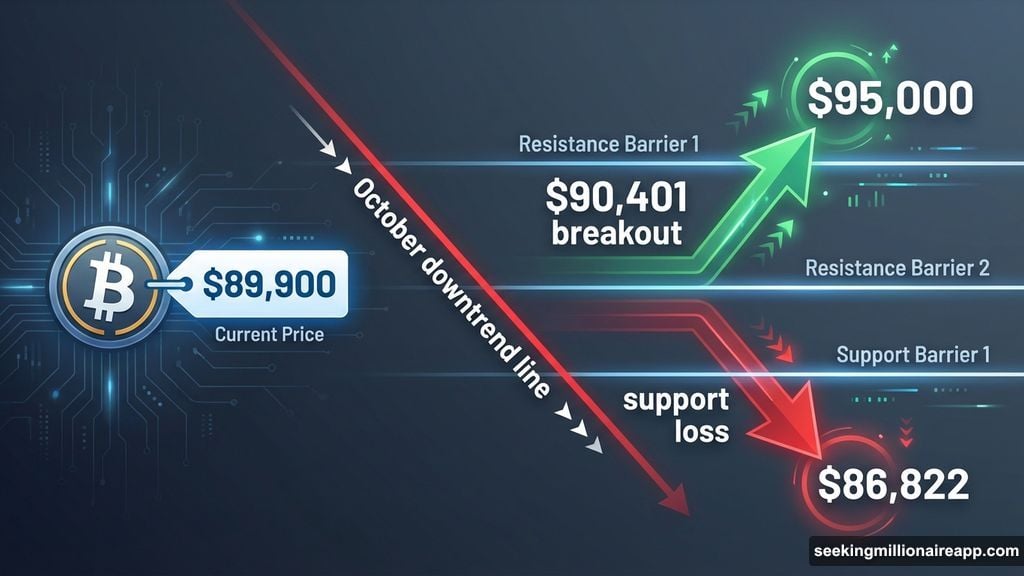

Bitcoin stays stuck at $89,900. That’s basically unchanged from yesterday. More importantly, it’s pinned beneath a downtrend line that’s controlled price action since late October.

This isn’t just psychological resistance. The technical pattern matters. Every time BTC approaches that line, sellers show up. Without stronger buying momentum, Bitcoin can’t reclaim the $90,401 level that would signal a real recovery attempt.

Here’s what needs to happen. Buyers must push past $90,401 and hold it as support. Then Bitcoin could target $95,000 in the next few days. That move would finally break the October curse.

But if sentiment shifts negative? Bitcoin drops toward $86,822 support. Losing that level would kill the bullish case entirely and open the door to deeper losses.

Market Cap Hits Concrete Ceiling

The total crypto market cap added just $2.21 billion in 24 hours. That brings it to $3.04 trillion. Sounds big. But the market has bounced off $3.05 trillion resistance three times this week.

Why can’t it break through? Wednesday’s Federal Open Market Committee meeting has everyone frozen. Traders expect a 25 basis point interest rate cut. If that happens, crypto could surge to $3.09 trillion or higher as risk appetite returns.

However, the setup cuts both ways. If the market loses the $3.00 trillion floor before the announcement, expect a slide toward $2.93 trillion. That would erase weeks of sideways grinding and invalidate the bullish structure entirely.

So we wait. The crypto market rarely moves big ahead of major Fed decisions. Smart money sits tight until the news breaks.

Zcash Ignores Everything and Pumps

While Bitcoin and the broader market sit frozen, Zcash decided to party alone. ZEC jumped 15.5% in 24 hours, climbing from $340 support to $396.

That puts it right beneath $403 resistance. Break that level? Zcash could sprint toward $442. The Ichimoku Cloud indicator shows bullish momentum intact, suggesting buyers have room to push higher.

But momentum doesn’t guarantee results. If selling pressure emerges before ZEC clears $403, price could reverse hard. A drop back to $340 would erase today’s gains and kill the bullish setup.

So what’s behind the surge? Volume and positioning matter more than news here. Privacy coins often move independently when whales accumulate. Whether this rally continues depends entirely on breaking $403 with conviction.

MicroStrategy Keeps Stacking Sats

Michael Saylor’s company bought another 10,624 BTC for nearly $1 billion. That brings their total holdings to 660,624 Bitcoin. The purchase comes as the company faces growing criticism during Bitcoin’s recent weakness.

Critics question the timing. Why buy more BTC when price struggles to break resistance? Saylor’s answer remains consistent. He views Bitcoin as the ultimate treasury asset regardless of short-term price action.

The move matters because it signals conviction from one of crypto’s largest institutional holders. But it also highlights the disconnect between believers and skeptics as Bitcoin fails to reclaim $100,000.

CFTC Opens Door for Crypto Collateral

The Commodity Futures Trading Commission launched a pilot program allowing Bitcoin, Ethereum, and USDC as margin collateral in derivatives markets. The updated guidance on tokenized collateral represents a significant regulatory shift.

This matters more than most realize. Traditional finance historically rejected crypto as valid collateral. Now the CFTC explicitly permits it in regulated derivatives trading. That legitimizes crypto’s role in mainstream financial infrastructure.

The immediate impact? Probably minimal. But the long-term implications could be massive for institutional adoption. When major banks and trading firms can use BTC and ETH as collateral, it fundamentally changes crypto’s utility in the financial system.

Rate Cut Holds All The Cards

Everything hinges on Wednesday’s Fed announcement. Markets have priced in a 25 basis point rate cut. If that comes through as expected, risk assets including crypto should catch a bid.

Lower rates make cash and bonds less attractive. That typically pushes capital toward higher-risk investments like stocks and crypto. So a rate cut could finally break Bitcoin through its October downtrend.

But what if the Fed surprises with hawkish guidance? Even if they cut 25 basis points, tough talk about future rate decisions could crush the rally before it starts. That would send crypto tumbling toward those support levels we discussed earlier.

Markets hate uncertainty more than bad news. Once Wednesday’s announcement clears, we’ll see which direction traders want to push. Until then, expect more sideways grinding around current levels.

The standoff continues. Bitcoin needs help. Zcash doesn’t care. And everyone’s watching the Fed.