The Federal Reserve’s final rate decision of 2025 drops tomorrow at 2 p.m. ET. Markets expect a quarter-point cut. But surprises could shake crypto hard.

Bitcoin and Ethereum investors watch closely. The outcome shapes liquidity conditions heading into 2026. Plus, Jerome Powell’s press conference might matter more than the rate move itself.

Here’s what each scenario means for your portfolio.

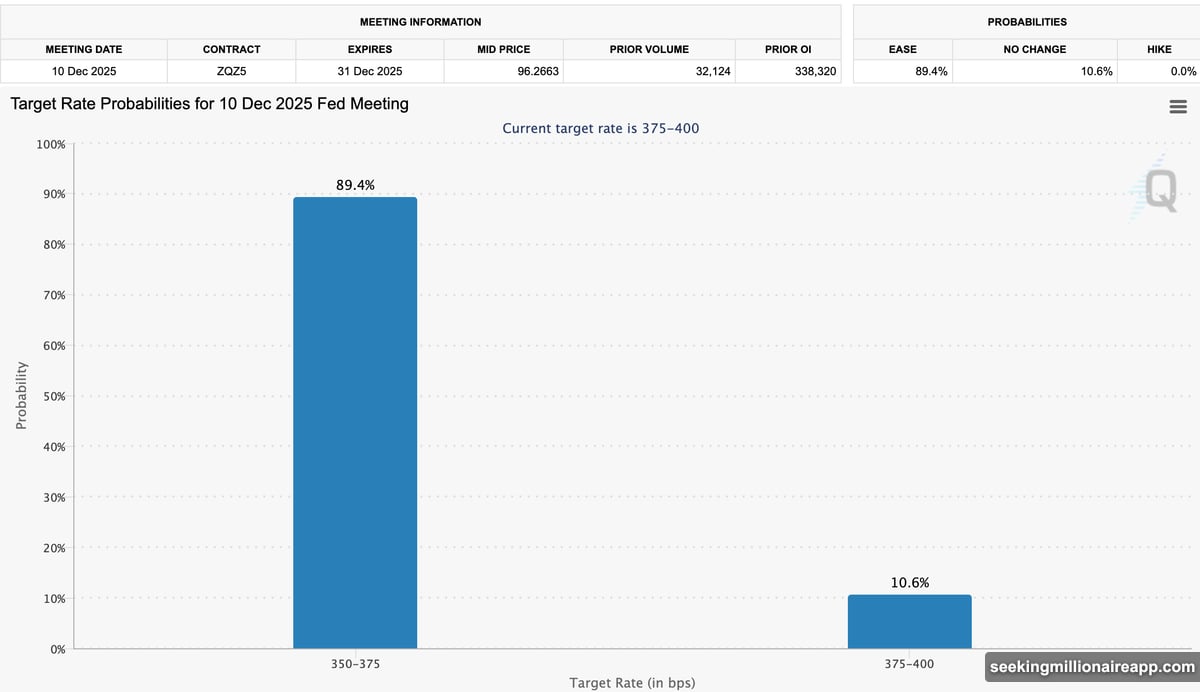

Markets Price In Another Cut

CME FedWatch data shows 89.4% odds of a 25-basis-point cut. Only 10.6% of traders expect rates to hold at the current 3.75%-4.00% range.

That confidence stems from the Fed’s recent pattern. September and October both brought cuts. Another reduction would push rates down to 3.50%-3.75%.

Yet confidence doesn’t equal certainty. The Fed remains split internally. Powell warned last month that December’s move “is not a foregone conclusion, far from it.”

Economic data dried up recently too. The government shutdown halted Bureau of Labor Statistics reports. So policymakers are driving blind through fog, as Powell himself described.

If the Fed Cuts: Mild Bullish Signal

A standard 25-basis-point cut is already baked into prices. Markets won’t explode just from the announcement itself.

September’s cut did lift Bitcoin and Ethereum briefly. The dollar dropped to its weakest level since early 2022. But October’s cut barely registered amid broader market turbulence.

This time, analysts focus on Powell’s tone instead. Bank of America expects hints about “reserve management purchases.” That’s code for liquidity injections to stabilize funding stress at smaller banks.

If Powell sounds dovish and says inflation is cooling, markets get the green light for more cuts ahead. Bitcoin could rally. But if he strikes a hawkish tone like last meeting, crypto will dump hard.

“If Powell sounds dovish and says that inflation is calming, tariffs haven’t changed the trend, and labor is softening, it’ll give markets the green light to expect more cuts. But if he sounds hawkish, similar to the last FOMC meeting, Bitcoin and alts will dump,” one analyst noted.

The real action happens in the press conference, not the rate announcement.

A Bigger Cut? Don’t Count On It

Some voices expect a 50-basis-point reduction. That would signal aggressive easing and flood markets with liquidity.

The probability sits near zero. Yet the impact would be massive. A half-point cut would weaken the dollar sharply. Risk assets like Bitcoin would likely surge on expanded money supply.

For now, this remains wishful thinking. The Fed telegraphs moves carefully. A surprise double cut would shock markets and question the central bank’s credibility.

If Rates Hold: Short-Term Pain

A rate hold would blindside markets. Crypto sentiment would turn bearish immediately.

The Fed has reasons to pause. Inflation data remains mixed. Labor markets show resilience. Plus, officials mentioned “strongly different views” about December’s path forward.

Powell’s October comments dampened rate cut expectations deliberately. He’s preparing markets for potential patience.

Still, a hold doesn’t doom crypto long-term. The Fed plans to buy $45 billion in Treasury bills monthly starting January 2026. That liquidity injection supports risk assets eventually.

“This would inject massive liquidity into the markets. This only means one thing: QE is coming back. But this time they won’t call it QE,” analyst Lark Davis stated.

So even a December hold sets up bullish conditions for early 2026.

Data Blackout Complicates Fed’s Job

The government shutdown killed crucial economic reports. The Fed is making decisions with incomplete information.

“What do you do if you’re driving in the fog? You slow down,” Powell said in October.

That caution suggests a hold might be more likely than markets expect. Without clear data, the Fed may prefer waiting rather than cutting into uncertainty.

This creates tail risk for crypto. A surprise hold would force rapid repricing across digital assets.

Powell’s Press Conference Holds the Key

Market veterans know the announcement itself matters less than Powell’s guidance.

His tone signals the Fed’s 2026 intentions. Dovish comments about cooling inflation and softening labor markets green-light more cuts. That’s bullish for crypto.

But hawkish warnings about persistent inflation or economic strength suggest the cutting cycle is done. Bitcoin and altcoins would sell off sharply.

The press conference starts 30 minutes after the rate announcement. Expect volatility to spike during Powell’s remarks and Q&A session.

Traders should watch for specific language about inflation trends, labor market conditions, and the Fed’s reaction function to incoming data.

Crypto Volatility Already Elevated

Bitcoin swung between $90,000 and $98,000 over the past week. Ethereum chopped through its range without clear direction.

Tomorrow’s Fed decision adds fuel to already nervous markets. Sharp moves in both directions are likely.

Position sizing matters more than predicting the outcome. The range of possible scenarios is wide. From dovish surprise cuts to hawkish holds, each path triggers different crypto reactions.

Risk management beats forecasting in this environment.

Liquidity Matters More Than Rates

Long-term crypto investors should focus beyond tomorrow’s decision. The Fed’s broader liquidity stance shapes 2026 more than any single rate cut.

The planned Treasury bill purchases starting in January represent significant new money entering the system. That liquidity eventually flows into risk assets.

Meanwhile, the dollar’s recent weakness supports Bitcoin regardless of tomorrow’s outcome. A weaker dollar makes dollar-denominated assets like crypto relatively more attractive.

So whether the Fed cuts 25 basis points, holds, or surprises with a bigger move, the underlying trend favors crypto over time. Tomorrow’s volatility is just noise against that bigger picture.

The real question isn’t what the Fed does tomorrow. It’s how much liquidity they inject in 2026.