XRP can’t catch a break. The token dropped 10% this month despite a small weekly bounce. Now it’s stuck between $2.31 and $1.98, unable to escape in either direction.

Here’s the twist. Whales are dumping while smaller holders keep buying. That tug-of-war is keeping XRP locked in a falling wedge pattern that refuses to resolve. The breakout everyone’s waiting for might not come as quickly as expected.

Big Wallets Quietly Exit Their Positions

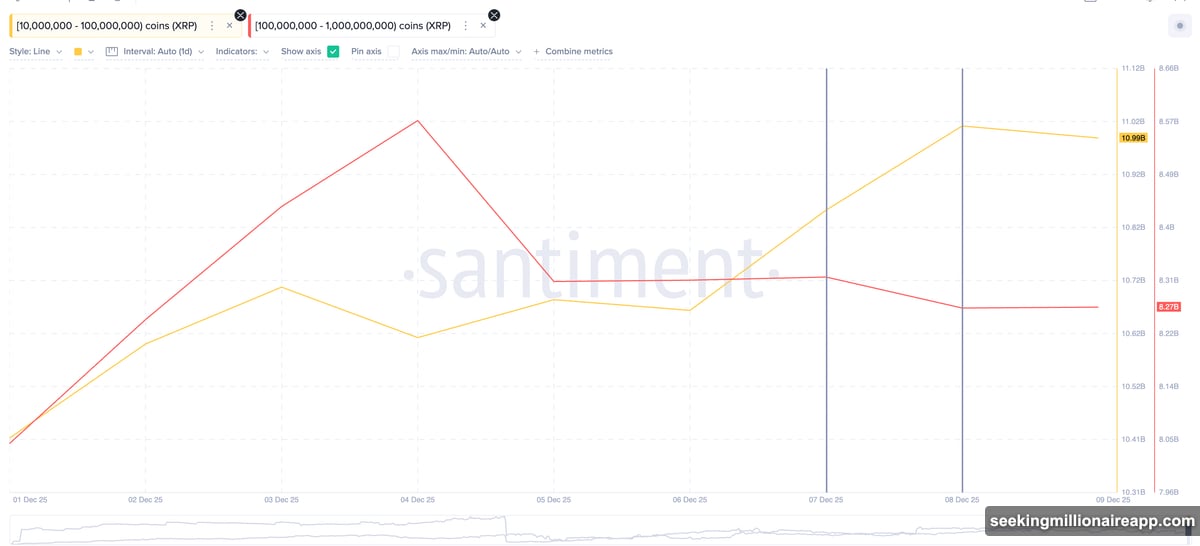

The numbers tell a clear story. Whales holding 100 million to 1 billion XRP cut their balances from 8.32 billion to 8.27 billion tokens starting December 7. Another group with 10 to 100 million XRP reduced holdings from 11.01 billion to 10.99 billion on December 8.

In total, these groups offloaded roughly 70 million XRP over 48 hours. At current prices, that’s about $143 million walking out the door.

The timing stings. XRP was trying to stabilize after a brutal month. Instead of support from large holders, the token faced fresh selling pressure right when it needed momentum. That explains why every rally attempt has stalled before gaining traction.

Moreover, this selling didn’t come from panic. These wallets moved deliberately, choosing specific exit points. That suggests they’re taking profits or reducing risk rather than responding to short-term price swings.

Short-Term Holders Step Up as Whales Step Back

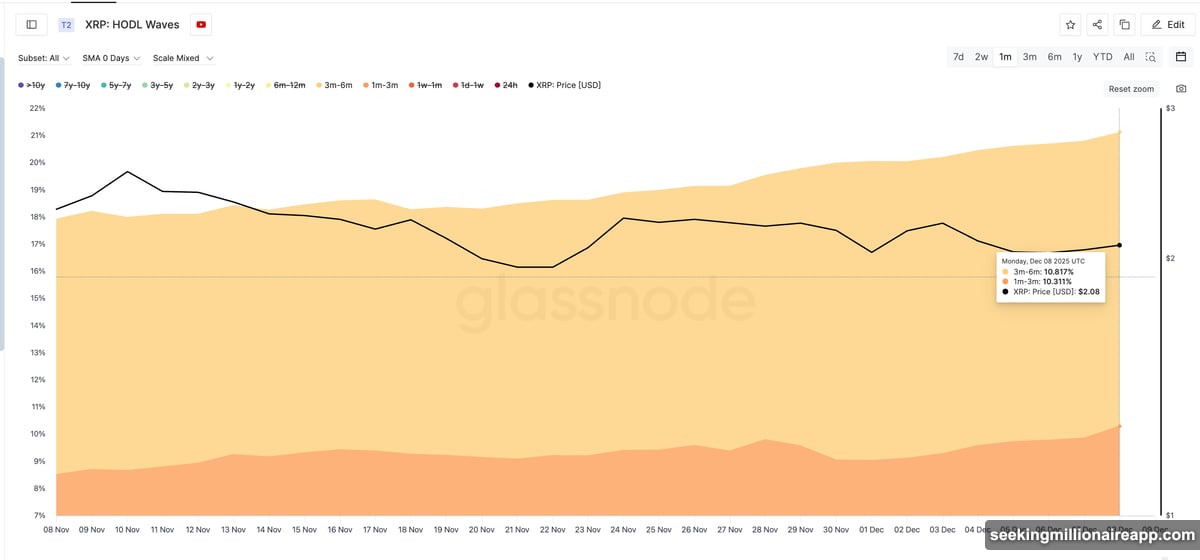

While big wallets sold, a different group accumulated. HODL Waves data shows holders keeping tokens for one to three months increased their share from 8.52% to 10.31%. The three to six month group expanded from 9.40% to 10.87%.

HODL Waves track how long tokens remain unmoved. These metrics reveal which groups believe the current price offers value. Short and mid-term holders typically buy during consolidation when they expect upside to outweigh downside risk.

Plus, they’re buying into a 10% monthly decline. That takes conviction. These holders apparently believe the wedge pattern will eventually resolve upward, even as whales cash out.

So XRP sits in a standoff. Large holders exit on strength. Active buyers accumulate on weakness. Neither side has enough power to break the stalemate. The token remains trapped inside its narrowing structure.

Falling Wedge Holds Structure But Lacks Breakout Catalyst

XRP is forming a falling wedge, a pattern that usually precedes bullish reversals. But only if buyers can force a decisive breakout above resistance.

Right now, the wedge functions more as a holding pattern than a launch pad. Whale selling caps upside momentum. Accumulation from smaller holders prevents deeper drops. The token trades between $2.31 and $1.98 without committing to either direction.

The critical level sits at $2.46. That’s where the descending trendline meets current price action. A strong daily close above this point would confirm a reversal and open targets at $2.61, $2.83, and possibly $3.11.

However, a breakdown below $1.98 invalidates the pattern. That exposes $1.82, which served as structural support earlier this cycle. Losing that level would signal the wedge failed and sellers regained control.

For now, the setup remains valid but unconfirmed. The wedge will not resolve until one side overwhelms the other. Whale selling delays the breakout. Mid-term accumulation keeps the structure alive.

The Real Problem: Nobody Wants to Blink First

This situation reflects a deeper issue with XRP’s recent price action. The token moved too far, too fast. That attracted profit-taking from whales who entered lower. At the same time, dip-buyers see the pullback as a chance to accumulate before the next leg up.

Both sides have logical reasons for their positions. Whales booked profits after a strong run. Holders accumulated at what they perceive as a discount. Neither group is wrong based on their own risk tolerance and time horizon.

Yet this creates paralysis. The token can’t break out while whales sell into strength. It won’t break down while buyers absorb supply. The falling wedge captures this tension perfectly — a narrowing range that must eventually resolve but lacks a clear catalyst.

What breaks the stalemate? Either whale selling exhausts and buyers push through $2.46, or accumulation slows and sellers drive price below $1.98. Until then, XRP remains trapped in a battle where both sides refuse to surrender.

The next few days will reveal which group has more ammunition left.