Silver hit $63 per ounce today. That’s a new all-time high for the metal that many investors dismissed as boring.

Meanwhile, Bitcoin dropped over 2% in the same period. In fact, crypto’s entire top 20 fell into the red. This performance gap reveals something important about where money is flowing right now.

But here’s the twist. Some analysts think silver’s rally isn’t about safety at all. Instead, they argue it signals the exact opposite.

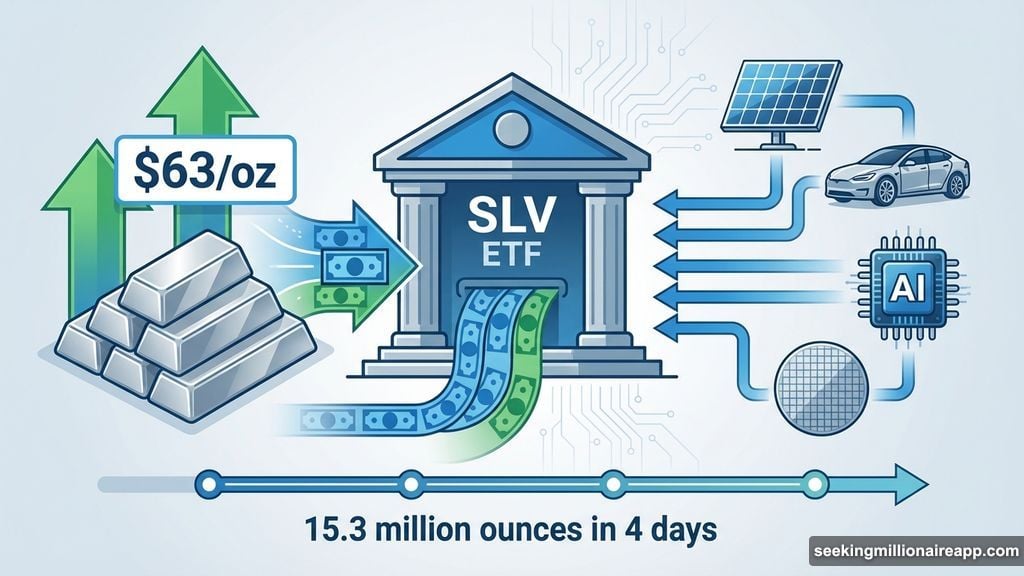

Physical Silver ETFs Are Absorbing Everything

The numbers tell a shocking story. Silver-backed ETFs soaked up more than 15.3 million ounces in just four days.

That’s nearly as much as the entire month of November. Plus, these funds are now on track for their 10th consecutive monthly inflow. That pattern only happens during serious market stress.

SLV, the world’s largest silver ETF, saw almost $1 billion flow in last week. That’s more than major gold funds received. So investors aren’t just buying silver. They’re rushing to get exposure fast.

Trader Michael called this “desperation,” not simple demand. He pointed to two converging crises driving the surge. First, governments are piling up debt at unsustainable rates. Second, industries need silver for AI infrastructure, solar panels, electric vehicles, and semiconductors.

When financial uncertainty meets physical scarcity, prices don’t just rise. They detach from normal patterns. That’s exactly what’s happening now.

Bitcoin Can’t Keep Up With Silver’s 2025 Performance

Year-to-date comparisons paint a brutal picture. Silver is crushing not just Bitcoin, but also gold and major stock indices.

The S&P 500 posted solid gains this year. The Nasdaq performed well too. Yet silver outpaced both while Bitcoin lagged behind.

Economist Peter Schiff noted that Bitcoin lost over half its value when priced in silver over the past four years. That’s a stunning reversal for an asset once touted as digital gold.

Traditional safe-haven behavior explains part of this divergence. When uncertainty spikes, investors historically turn to precious metals. Silver and gold have played this role for centuries.

But Bitcoin? It promised to be digital gold. Instead, it’s acting more like a risk-on tech stock. So the performance gap keeps widening.

The Risk-On Versus Risk-Off Debate

Not everyone agrees on what silver’s rally means. Some see it as a classic flight to safety. Others argue the opposite.

Crypto analyst Ran Neuner believes markets are now in “FULL risk-on mode.” He points to silver’s breakout as evidence that investors are taking more risk, not less.

Neuner also cited the ETH/BTC ratio climbing above its 50-week moving average. That suggests renewed interest in cryptocurrencies beyond Bitcoin. Moreover, the Russell 2000’s recent breakout and the Federal Reserve’s latest policy shift support his risk-on thesis.

“Soon the sellers in Bitcoin will dry up and the big catch-up trade will begin,” Neuner claimed.

Yet traditional market analysts disagree. They see silver’s 10-month ETF inflow streak as a textbook risk-off signal. Sovereign debt concerns and monetary system stress typically drive investors toward hard assets.

So which interpretation is correct? The answer matters enormously for crypto investors trying to position portfolios.

Industrial Demand Versus Monetary Concerns

Silver sits at a unique intersection. It’s both a precious metal and an industrial commodity.

Industries need silver for semiconductors, solar panels, and electric vehicles. AI infrastructure expansion is driving additional demand. These factors create genuine physical scarcity.

But monetary concerns matter too. Companies Market Cap data shows silver now ranks sixth among global assets with a $3.5 trillion market cap. The Kobeissi Letter noted this marks silver’s strongest 12-month performance since 1979.

“A new era of monetary policy is coming,” they wrote.

That 1979 comparison is haunting. The last time silver surged this dramatically, the global monetary system was undergoing massive stress. Inflation was rampant. Central banks struggled to maintain credibility.

Today’s situation echoes those challenges. Governments worldwide are running unprecedented deficits. Central banks are caught between inflation concerns and recession fears.

What This Means for Crypto Markets

Bitcoin’s underperformance relative to silver raises uncomfortable questions. If Bitcoin is truly digital gold, why is it lagging so badly?

One explanation is that Bitcoin never fully convinced institutional investors of its safe-haven status. During genuine stress, they still prefer traditional metals.

Another possibility is that Bitcoin is transitioning roles. Maybe it’s not digital gold after all. Instead, it might be a growth asset that thrives during risk-on periods but suffers when uncertainty spikes.

The crypto market’s 2.74% drop over the past day supports the second interpretation. If investors were treating Bitcoin like gold, it would rise alongside silver during flight-to-safety moments.

Instead, Bitcoin is behaving like tech stocks. When risk appetite fades, crypto falls. That’s not how gold works.

Can Bitcoin Catch Up?

Several analysts expect Bitcoin to rebound. They argue that once selling pressure exhausts itself, buyers will return aggressively.

The question is timing. If Neuner is right about risk-on conditions, Bitcoin could see strong demand soon. Historically, Bitcoin performs well during periods of monetary expansion and risk appetite.

But if silver’s rally reflects genuine monetary system stress, Bitcoin might continue struggling. Safe-haven flows would keep favoring precious metals over cryptocurrencies.

The Federal Reserve’s next moves matter enormously. Policy shifts could either validate the risk-on thesis or confirm flight-to-safety trends.

Meanwhile, Bitcoin holders are watching silver’s breakout with a mix of frustration and hope. They believed crypto would outperform during this exact type of monetary uncertainty.

So far, that belief hasn’t matched reality. Silver is soaring while Bitcoin treads water. Whether that gap closes or widens will define the rest of 2025 for crypto markets.