Elon Musk just confirmed what space industry insiders have been whispering about for months. SpaceX is going public.

The announcement came through Musk’s typical style. Space journalist Eric Berger posted his analysis predicting an imminent SpaceX IPO. Musk replied on X with a simple endorsement: “As usual, Eric is accurate.” That’s as close to an official confirmation as you’ll get before the paperwork hits.

But there’s more to this story. In the same 24-hour window, Musk revealed he won’t return to government service. His brief stint leading the Department of Government Efficiency left a bitter taste, marked by vandalized Teslas and modest results.

The Numbers Behind SpaceX’s Public Debut

SpaceX isn’t planning a small IPO. According to Bloomberg, the company targets a $1.5 trillion valuation. That’s massive.

The fundraising goal exceeds $30 billion. If executed, this would surpass Saudi Aramco’s 2019 IPO as the largest in history. SpaceX aims to list shares by mid-to-late 2026, though market conditions could push the timeline into 2027.

Current secondary offerings price SpaceX shares around $420 each. That values the company above $800 billion already. So the IPO target represents nearly doubling the current private valuation.

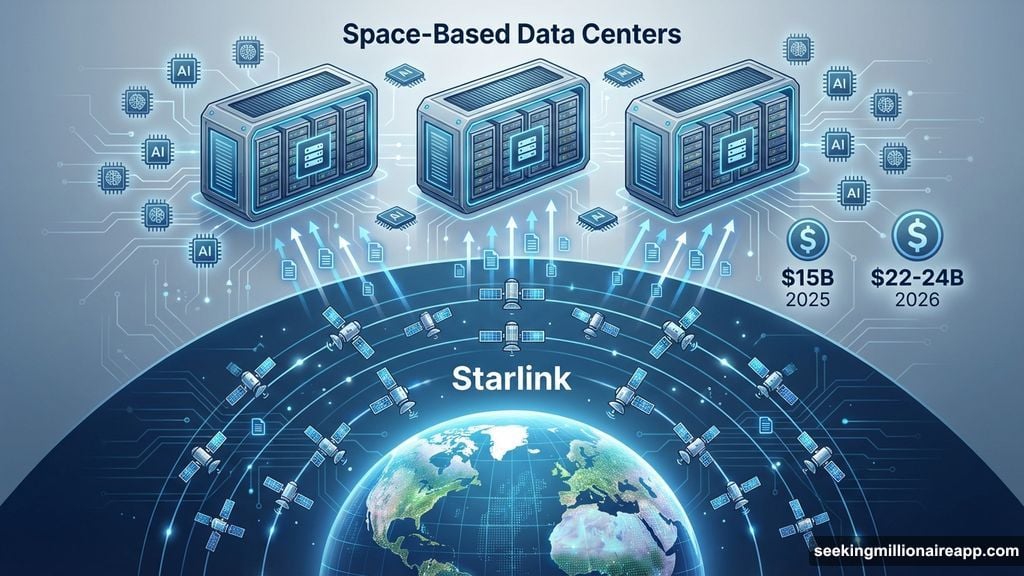

What’s driving this growth? Starlink revenue is exploding. SpaceX expects $15 billion in revenue for 2025, jumping to $22-24 billion in 2026. Most of that comes from satellite internet subscriptions.

Plus, SpaceX has ambitious plans for IPO proceeds. The company wants to build space-based data centers and buy AI chips to power them. That’s a completely new business line, separate from rockets and satellites.

Why SpaceX Stayed Private Until Now

SpaceX deliberately avoided public markets for years. Going public means quarterly earnings calls and short-term pressure from Wall Street analysts.

Musk wanted freedom to pursue long-term projects. Starship development costs billions with no immediate revenue. Mars exploration sounds great but offers zero return on investment for decades. Public shareholders hate that.

Private funding let SpaceX focus on moonshots without explaining every expense to day traders. But Starlink changed the equation. Recurring subscription revenue makes SpaceX look more like a traditional telecom company.

Moreover, private markets have limits. Raising tens of billions from venture capital gets harder as valuations climb. Public markets offer deeper liquidity and easier access to capital.

Berger’s analysis, backed by Musk’s endorsement, signals this strategic shift is happening. The company that revolutionized space access will soon join the stock market it disrupted.

Tokenized SpaceX Shares Already Exist

Most people can’t buy private company shares. Accredited investors and venture funds get access. Regular investors stay locked out.

However, tokenization offered a preview of public SpaceX ownership. Robinhood launched tokenized SpaceX shares for European users in June through its crypto app.

The platform gave away $500,000 in SpaceX tokens as a promotion, alongside $1 million in OpenAI tokens. These tokens trade on Arbitrum, an Ethereum layer-2 network.

That experiment showed retail demand exists. But tokenized shares remain niche products with limited liquidity. An actual IPO would give millions of investors direct access to SpaceX equity.

The tokenization move also highlighted how crypto intersects with traditional finance. Blockchain technology enables fractional ownership of assets that were previously restricted to wealthy investors.

Musk’s Government Stint: “Somewhat Successful”

While confirming SpaceX’s IPO plans, Musk also closed the door on his political career. In a podcast with Katie Miller, he was asked if he’d lead DOGE again.

“No, I don’t think so,” Musk replied. “I think instead of doing DOGE, I would’ve basically worked on my companies, essentially. And they wouldn’t have been burning the cars.”

That last comment referenced vandalism at Tesla dealerships and charging stations during his government role. Musk’s political involvement came with real business costs.

He described DOGE as “a little bit successful” and “somewhat successful.” That’s surprisingly modest from someone known for bold claims. Working from a small office in the executive building, Musk spent months cutting federal workforce and agency funding.

The actual impact remains murky. DOGE’s website claims $214 billion in cuts. But independent observers say those figures don’t represent real savings. Budget accounting is complex, and claimed cuts often just shift spending elsewhere.

Musk broke spectacularly with Trump in June over tax and spending legislation. He called the White House’s flagship bill “utterly insane and destructive.” That public split effectively ended his government career.

What This Means for Investors

SpaceX going public changes everything for space investing. Currently, your only options are aerospace contractors like Boeing and Lockheed Martin, or emerging small-cap space companies.

SpaceX offers something different. Proven technology, massive revenue growth, and market dominance in commercial launches. Plus, Starlink’s subscriber base keeps expanding globally.

However, that $1.5 trillion valuation assumes tremendous future growth. Investors would be betting on space-based data centers, Mars missions, and continued Starlink expansion. Those are ambitious goals with real execution risks.

The timing matters too. IPO markets follow cycles. A 2026 listing depends on stable equity markets and investor appetite for growth stocks. If markets turn volatile, SpaceX could delay.

Moreover, Musk’s return to full-time business leadership removes uncertainty. His DOGE stint divided attention between government and SpaceX. Now he’s back focused on the companies that made him the world’s richest person.

Musk’s confirmation signals he’s ready to bet on public markets again. SpaceX joining exchanges would mark the biggest space industry milestone since NASA’s moon landing.

The IPO won’t just raise capital. It’ll validate commercial space as a mainstream investment category. Every portfolio manager will need to decide: own SpaceX or explain why you don’t.