Old ghosts don’t stay buried in crypto. Especially when they’re worth millions.

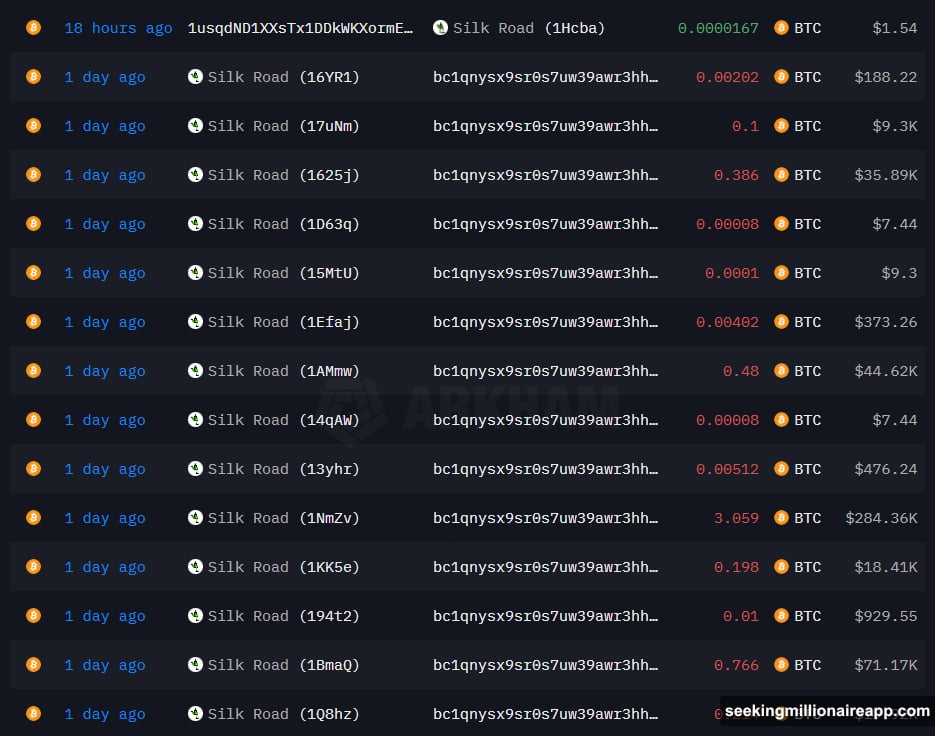

Bitcoin tied to Silk Road—the infamous dark web marketplace that shut down over a decade ago—just moved for the first time in years. Around $3.14 million shifted through 176 separate transfers from dormant wallets. But before panic sets in, the pattern tells a different story than you might expect.

Not a Dump. A Cleanup Operation

The movement looked suspicious at first glance. Dormant wallets from early dark web markets usually spark immediate concern among traders. Everyone assumes the worst: someone’s about to flood exchanges with old coins.

However, blockchain data reveals something more mundane. The transfers happened in small, evenly structured batches. That’s the signature of wallet consolidation, not panic selling.

Plus, the coins didn’t move toward exchanges. They didn’t hit mixing services either. Instead, they quietly reorganized into fresh addresses. Think of it like cleaning out old filing cabinets and moving everything into new ones. Same contents, better organization.

Three Possible Explanations

So who’s moving these coins? And why now?

First possibility: government custody. The US government seized massive amounts of Bitcoin from Silk Road. They’ve consolidated holdings before selling them through official channels. Courts approved the sale of 69,000 BTC from Silk Road seizures earlier this year. This could be prep work for another official liquidation.

Second possibility: recovered access. Someone might have finally cracked open an old wallet after years of searching. Early Bitcoin users from 2011-2013 occasionally resurface with coins they thought were lost forever. Estate transfers and recovered keys happen more often than people realize.

Third possibility: private holder reorganization. An original Silk Road participant could be updating their security setup. After a decade, old wallet structures become outdated. Moving coins to modern address types makes sense for long-term holders.

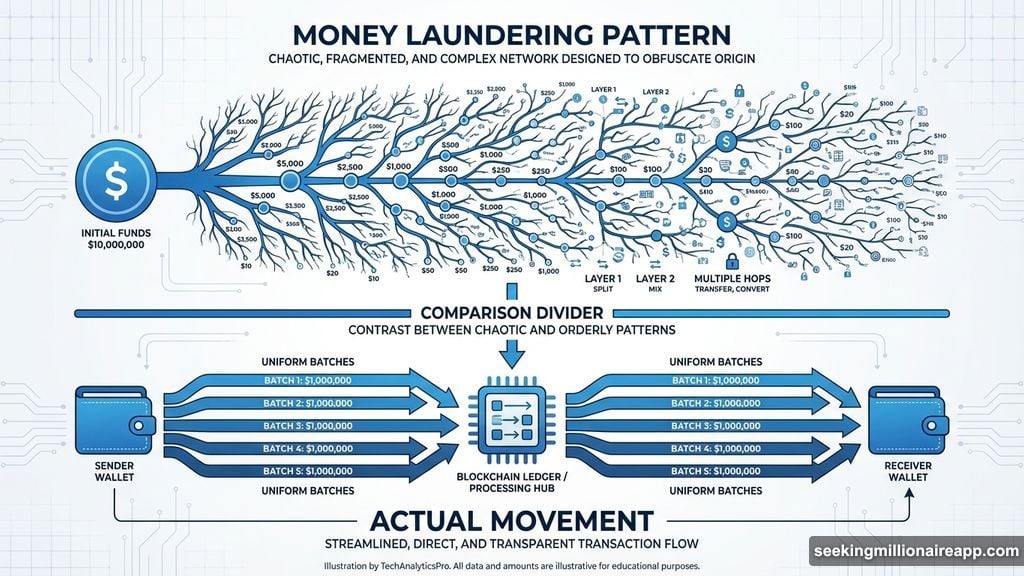

Why This Isn’t Money Laundering

The pattern rules out typical laundering activity. Real laundering operations look completely different on-chain.

Criminals use thousands of micro-transactions. They create peel chains that split funds into progressively smaller amounts. They route everything through mixers and privacy protocols immediately. None of that happened here.

Instead, we see clean, organized consolidation. The kind of behavior you’d expect from someone managing assets carefully, not trying to hide them. Frankly, it looks boring. And boring is good news for Bitcoin holders worried about market impact.

What It Means for Bitcoin’s Price

Short answer: probably nothing immediate.

The coins haven’t moved toward exchanges yet. That means no selling pressure hitting the market right now. Until those consolidated addresses forward funds to Coinbase, Binance, or OTC desks, traders can relax.

However, analysts will watch those new addresses closely. If coins start flowing toward trading platforms in the next few weeks, then market impact becomes likely. A sudden $3 million sell-off wouldn’t crash Bitcoin, but it would create ripples during volatile trading sessions.

Moreover, the symbolic weight matters. These movements prove that Bitcoin from over a decade ago remains traceable. The blockchain never forgets. Every coin that moved through Silk Road carries permanent markers that anyone can track.

The Bigger Picture

This situation highlights something crucial about Bitcoin that newcomers often miss. The blockchain is transparent and permanent. Actions from 2011 can suddenly become relevant again in 2025.

That transparency cuts both ways. It helps law enforcement track criminal activity. But it also means institutional investors can verify the entire history of any Bitcoin they purchase. Clean provenance matters when you’re managing billions in assets.

Furthermore, dormant supply occasionally waking up creates uncertainty. Bitcoin’s fixed supply of 21 million coins includes millions that haven’t moved in years. When old coins suddenly activate, it raises questions about how much “dormant” supply might actually return to circulation.

The crypto market has evolved dramatically since Silk Road’s heyday. Back then, Bitcoin served primarily as dark web currency. Now it trades on Wall Street alongside traditional assets. ETFs hold hundreds of thousands of coins. Institutions analyze every significant on-chain movement.

What Happens Next

The next few weeks will reveal the true intent behind these transfers.

If the coins stay dormant in their new addresses, it confirms simple consolidation. If they move toward exchanges or OTC desks, selling pressure becomes real. If they split into smaller amounts and start hopping through privacy tools, then laundering concerns resurface.

Meanwhile, anyone tracking Silk Road–linked addresses will keep watching. These wallets represent one of Bitcoin’s earliest use cases—and one of its most controversial chapters. Every movement tells part of the story about where crypto came from and where it’s heading.

The irony is thick. Bitcoin was supposed to enable anonymous digital cash. Instead, it created the most transparent financial system ever built. Every transaction lives forever on a public ledger. Even coins from a defunct criminal marketplace can’t escape that reality.