The Federal Reserve just cut rates again. Markets cheered briefly. Then reality set in.

Bitcoin and Ethereum traders expected fireworks. Instead, they got a sobering message: this rally season might not happen. The Fed’s latest move helps stocks and precious metals, but leaves crypto fighting for scraps.

Let’s break down why smart money is getting defensive.

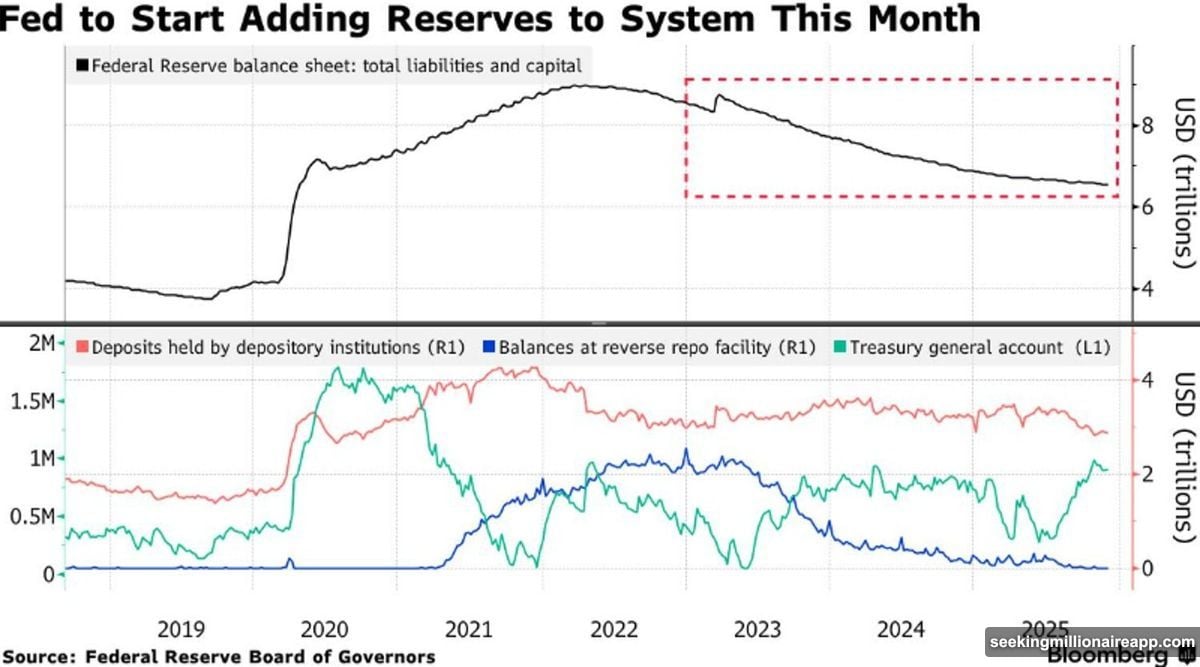

The Fed Expanded Its Balance Sheet. Crypto Still Loses

The Fed announced balance sheet expansion through Treasury bill purchases. Sounds bullish, right? Not quite.

Officials plan to buy $40 billion in T-bills this month. Plus, they removed caps on the Standing Repo Facility. But Fed Chair Jerome Powell made the goal crystal clear: stabilize banking system liquidity, not pump asset prices.

This matters because crypto thrives on excess liquidity flooding into risk assets. In 2021, aggressive Fed easing sent Bitcoin soaring past $60,000. Now the Fed is playing defense, not offense.

Meanwhile, the dollar weakens as gold and silver surge. European markets benefit too. But crypto? It’s stuck competing with safer havens while investors nurse limited risk appetite.

For dollar-denominated assets like Bitcoin and Ethereum, that’s a brutal setup.

Powell’s Message: We’re Not Here to Rescue Your Portfolio

The Fed cut rates for the third consecutive meeting. But internal divisions run deep.

Some officials worry about sticky inflation. Others fret over cooling employment. The result? Zero enthusiasm for further easing.

Powell emphasized T-bill purchases serve “reserve management” purposes only. Translation: we’re maintaining stability, not launching quantitative easing 2.0.

This disconnect between what crypto needs and what the Fed delivers explains market weakness. Bitcoin requires sustained liquidity injections to rally hard. Short-term band-aids don’t cut it.

Plus, Powell’s tenure ends in May 2026. He’ll oversee just three more FOMC meetings. That creates policy uncertainty right when markets crave clarity.

The comparison to 1970s stagflation is telling. Back then, the Fed’s stop-start approach let inflation become entrenched. Today’s similar dilemma leaves officials paralyzed between competing priorities.

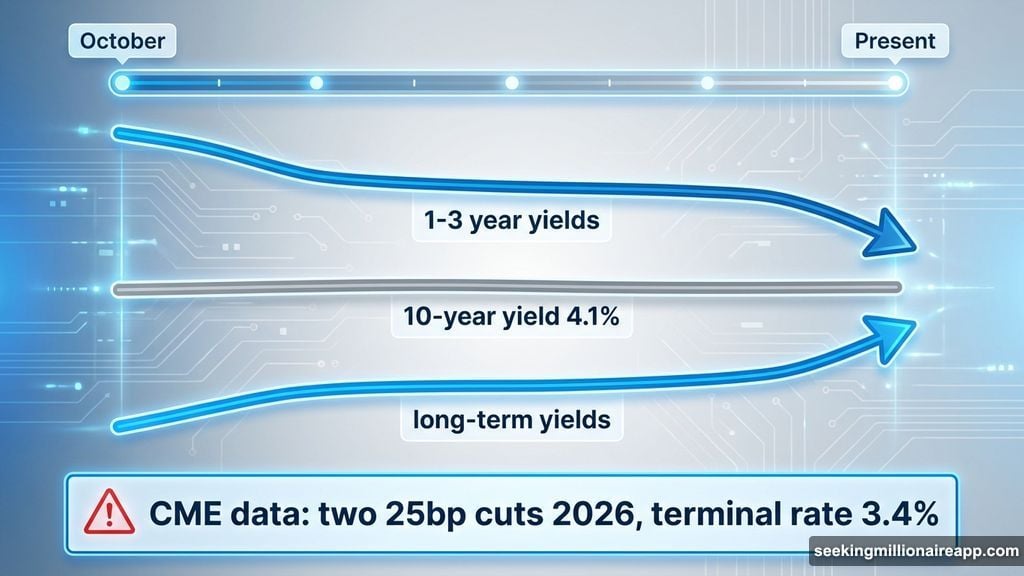

Bond Markets Are Screaming Caution

Treasury yields tell the real story. And it’s not pretty for risk assets.

Since late October, only short-term Treasury yields (under three years) have fallen. The 10-year yield sits stubbornly above 4.1%. Long-term bond yields actually rose.

What does this mean? Long-term financing costs remain elevated. Companies and investors face expensive borrowing for the foreseeable future.

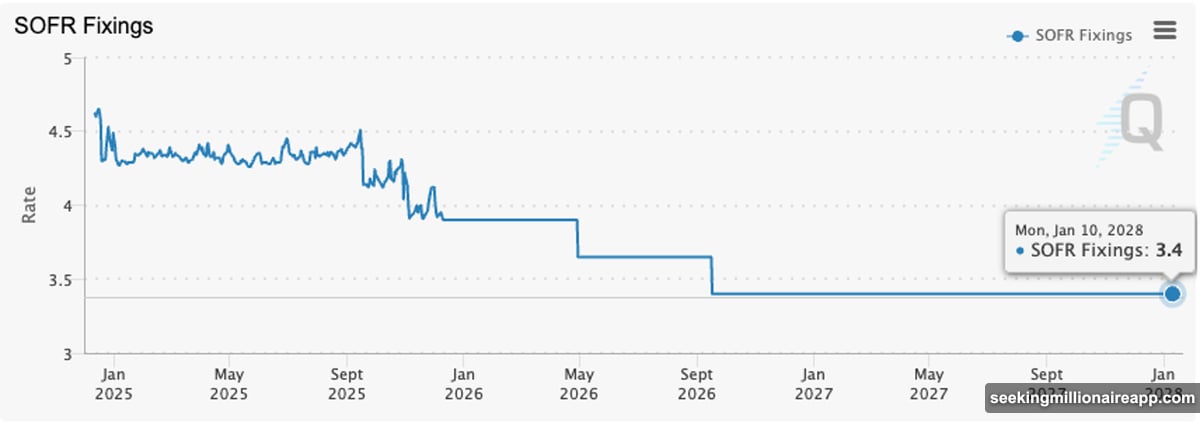

CME Group data shows traders now expect just two 25 basis point cuts in 2026. That’s down from pre-meeting expectations. No further easing comes until January 2028, leaving the terminal rate around 3.4%.

Bond traders are more conservative than they were before the Fed meeting. That’s a red flag for crypto, which needs cheap money to thrive.

Higher long-term rates drain liquidity from speculative markets. Bitcoin and altcoins suffer most when capital flees to safer yields.

Options Markets Reveal Institutional Bearishness

Professional traders aren’t buying the rally narrative. Options data proves it.

Bitcoin and Ethereum options show entrenched long-term bearish sentiment. Bullish positioning exists only in zero-day-to-expiry (0DTE) contracts, which are pure short-term gambles.

Ethereum’s situation is particularly concerning. Previously persistent far-month bullishness completely evaporated. Sentiment shifted to neutral-bearish territory.

According to Amberdata Derivatives, Ethereum’s implied forward yield sits at just 3.51%. Compare that to Bitcoin’s 4.85% and suddenly ETH looks unappealing to institutions.

Treasury bonds offer similar yields with far less volatility. Why would rational investors choose crypto?

They wouldn’t. And that’s the problem.

Bitcoin fares slightly better but still struggles. At best, institutions view it as a “hold” rather than an active buy. When Treasury yields match Bitcoin’s implied returns, crypto’s risk premium disappears.

Mag 7 Stocks Beat Crypto on Risk-Adjusted Returns

Here’s the uncomfortable truth: “Magnificent 7” tech stocks offer better risk-adjusted returns than crypto right now.

These stocks (Apple, Microsoft, Google, Amazon, Meta, Tesla, Nvidia) have lower beta than Bitcoin and Ethereum. When equities rise, gains from Mag 7 positions can fund crypto options protection.

If markets fall, crypto’s higher sensitivity means far-month put options generate superior returns. It’s a win-win hedge structure.

Smart money is reallocating. They’re reducing crypto exposure and parking capital in stocks with stronger fundamentals. The carry trade yields from crypto no longer cover the cost of portfolio insurance.

Bitcoin’s implied forward yield now matches T-bond yields. That eliminates crypto’s comparative advantage entirely.

Meanwhile, the dollar weakens as the Fed cuts. This makes euros an attractive cash reserve. With the ECB likely holding rates steady and the Bank of Japan potentially intervening, euro appreciation looks probable.

Trading Strategies for a Defensive Market

So what should traders do? Aggressive speculation looks increasingly foolish.

First, consider risk reversal structures. Use previous profits to enter 30-60 day expiry positions. Sell a put, buy a call at the closest absolute delta. Keep ample cash on hand.

When prices rise and you capture gains, roll the position over. If price movement stays muted, profit from the spread between options near expiry. The significant negative skew in crypto options makes this viable.

If prices fall hard, use cash reserves to accumulate underlying assets at lower levels. But only if fundamentals justify it.

Second, buy far-month put protection for crypto holdings. Yes, it costs money. But directional bets without insurance are reckless in this environment.

Third, monitor leverage indicators obsessively. Open interest data reveals when speculation gets excessive. Tighten risk parameters accordingly.

Fourth, reduce overall crypto exposure. If you must maintain long positions, diversify into assets with institutional pricing power like Bitcoin and Solana. Avoid altcoins dominated by retail speculation.

Fifth, hold some cash in euros. Dollar depreciation is a real risk. European inflation shows signs of rebounding, which supports ECB rate stability. That’s constructive for euro strength.

Why Year-End Rallies Need More Than Hope

Historical crypto rallies depended on massive liquidity injections. The 2021 surge came from unprecedented Fed easing and fiscal stimulus.

Today’s environment is fundamentally different. The Fed is managing reserves, not flooding markets with cash. Long-term investors stay cautious while short-term speculators dominate price action.

This creates a toxic mix: short-term rebounds clash with long-term bearish expectations. Assets with strong institutional backing (Bitcoin, XRP, Solana) face persistent downward pressure. Assets without it (Ethereum, most altcoins) swing wildly on leverage-induced volatility.

Neither scenario supports sustainable rallies.

The structural problem is clear. Crypto needs cheap, abundant capital to rally hard. The Fed isn’t providing it. Treasury yields offer competitive returns with far less risk. Stocks deliver better risk-adjusted performance.

Until these dynamics change, betting on a “Santa rally” is wishful thinking.

The Uncomfortable Truth About Crypto’s Position

Survival matters more than speculation right now. The Fed’s policy stance hasn’t fundamentally altered crypto’s landscape.

Any sharp rally lacking fundamental support should be viewed as risk, not opportunity. Leverage indicators like open interest deserve close monitoring. Tightening risk parameters is essential.

The rate cut objectively benefits equities and precious metals. The dollar weakens. Gold and silver rise. European markets gain.

But crypto? It’s stuck in no-man’s-land, competing with safer alternatives while investors limit risk appetite.

Bitcoin’s best case scenario is treading water. Ethereum faces even tougher odds given its weaker yield profile. Altcoins remain speculation vehicles for traders willing to stomach extreme volatility.

This isn’t 2021. The liquidity taps are off. And until they turn back on, expecting meaningful rallies is naive.