Bitcoin price sits frozen near $90,000. The chart looks boring. Most traders see dead money.

But dig beneath those flat candles and something different emerges. Volume patterns shifted. Selling pressure faded. Large holders kept accumulating even as prices went nowhere.

So when analysts like Tom Lee stick to aggressive targets above $100,000, they’re not just hoping. Three distinct signals support those bullish Bitcoin price predictions, even without a breakout yet.

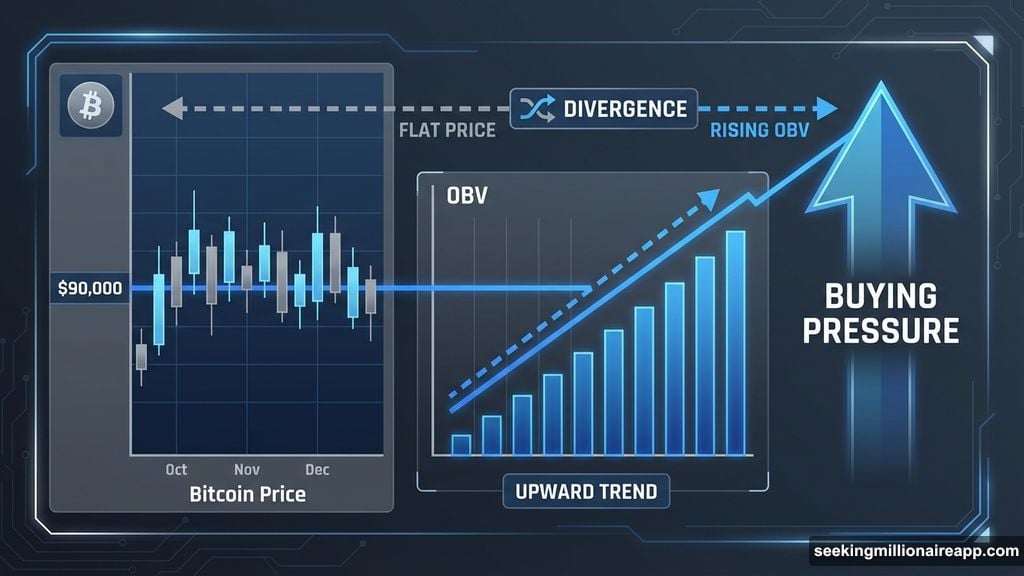

Volume Tells a Different Story Than Price

On-Balance Volume (OBV) tracks whether buyers or sellers control the flow of capital. It’s like watching money move instead of just watching price.

Between December 9 and December 11, Bitcoin price made a lower high. Meanwhile, OBV made a higher high. That means buyers showed up with more force even as price struggled to push higher.

Then between December 10 and December 12, Bitcoin price made a lower low. But OBV formed a higher low. Sellers pushed price down with less conviction than before.

These two divergences work together. First, buyers got stronger while price stalled. Second, sellers got weaker while price dropped. Both point to the same conclusion. Selling pressure is fading beneath the surface.

This doesn’t guarantee a rally. But these patterns typically appear right before one starts. Price consolidates while smart money positions quietly.

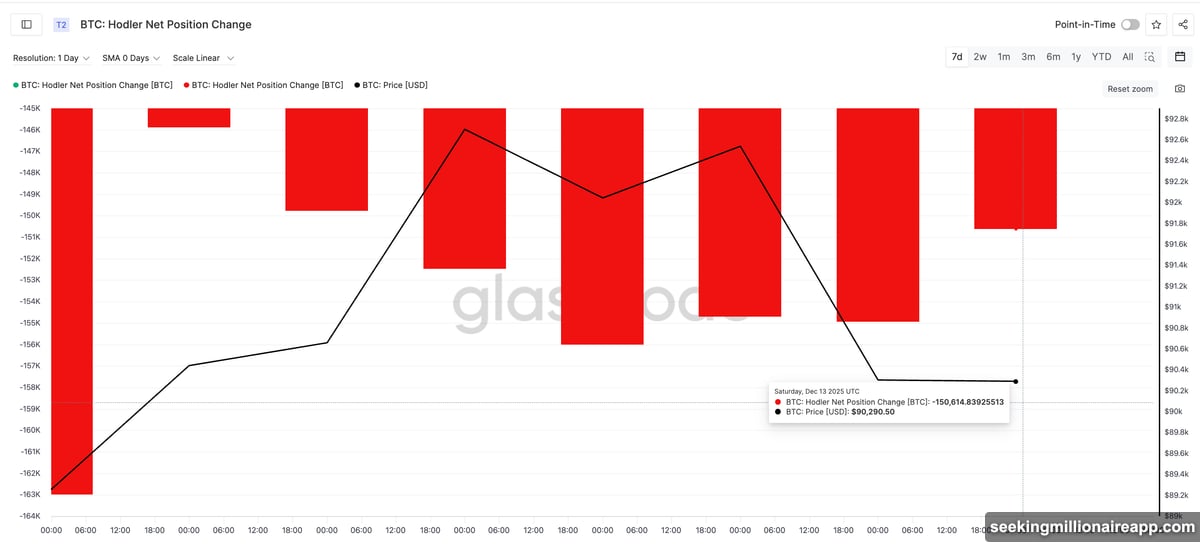

Long-Term Holders Are Selling Less

Holder behavior matters more than short-term trader noise. On-chain data shows exactly what long-term holders are doing.

On December 10, long-term holders distributed around 155,999 BTC. By December 13, that number dropped to roughly 150,614 BTC. That’s a 3.4% reduction in selling pressure over just three days.

The change isn’t massive. But the direction matters. Bitcoin price traded sideways in a tight range. Yet holders reduced their selling activity anyway.

That’s not panic. That’s not distribution. That’s patience. Holders typically slow down selling during consolidation phases, not during breakdowns.

Moreover, this behavior suggests they’re not spooked by the flat price action. They’re waiting for something better. And they usually don’t wait without reason.

Whales Keep Accumulating Despite Flat Prices

The strongest signal comes from whales. Entities holding at least 1,000 BTC remain near six-month highs.

Since late October, Bitcoin price corrected and then moved sideways. During that same period, whale entities kept adding. Price weakened. Large holders accumulated.

That creates a clear divergence. And it’s the kind that matters. Whales don’t build positions during sideways markets without conviction. They see value others miss or don’t care about short-term noise.

Plus, whale accumulation near multi-month highs shows sustained interest. It’s not just one entity buying. Multiple large holders continue positioning even as retail traders lose interest.

This behavior explains why bullish Bitcoin price predictions from analysts like Tom Lee haven’t disappeared. On December 13, Lee reiterated that Bitcoin likely bottomed and could hit $180,000 by January end.

That target sounds aggressive. But it’s not based on hopium. It’s built on reduced selling, improving volume structure, and steady whale accumulation.

The $94,600 Level Decides What Happens Next

Signals are great. But Bitcoin price needs confirmation. The most important level sits at $94,600.

A daily close above that zone would break the upper boundary of current compression. That’s roughly a 5% move from here. More importantly, it would show buyers regained short-term control.

If $94,600 breaks, the next resistance sits near $99,800. A sustained move above that level could open the path toward $107,500. That would be the first real catalyst toward Lee’s aggressive $180,000 outlook.

On the downside, if Bitcoin loses $90,000, support lies near $89,200. Below that, $87,500 becomes the next key level. A break under these zones would invalidate the bullish setup, at least in the short term.

The range is tight. But the stakes are clear.

Why Flat Price Action Doesn’t Kill Bull Cases

Most traders judge markets by price movement. When candles go sideways, they assume nothing’s happening.

But that’s surface-level thinking. Volume divergences, holder behavior, and whale positioning all tell a different story. These factors move before price does.

Bitcoin has seen this pattern before. Consolidation phases where price goes nowhere while smart money positions quietly. Then price breaks out and catches most traders off guard.

That doesn’t mean a breakout is guaranteed. But it explains why bullish Bitcoin price predictions from experts haven’t disappeared despite flat price action.

The market is setting up. Whether it delivers depends on breaking above $94,600. Until then, patience wins over panic.