JPMorgan Chase isn’t testing blockchain anymore. The banking giant just launched a tokenized money market fund on Ethereum with $100 million of its own capital.

This isn’t a pilot program. It’s a production deployment of core financial infrastructure on a public blockchain. Plus, it signals that Wall Street views Ethereum as serious settlement infrastructure, not just a speculative asset network.

Fundstrat’s Tom Lee called the move “bullish for ETH.” Here’s why he’s right and what this means for crypto’s institutional future.

JPMorgan Bets Big on On-Chain Finance

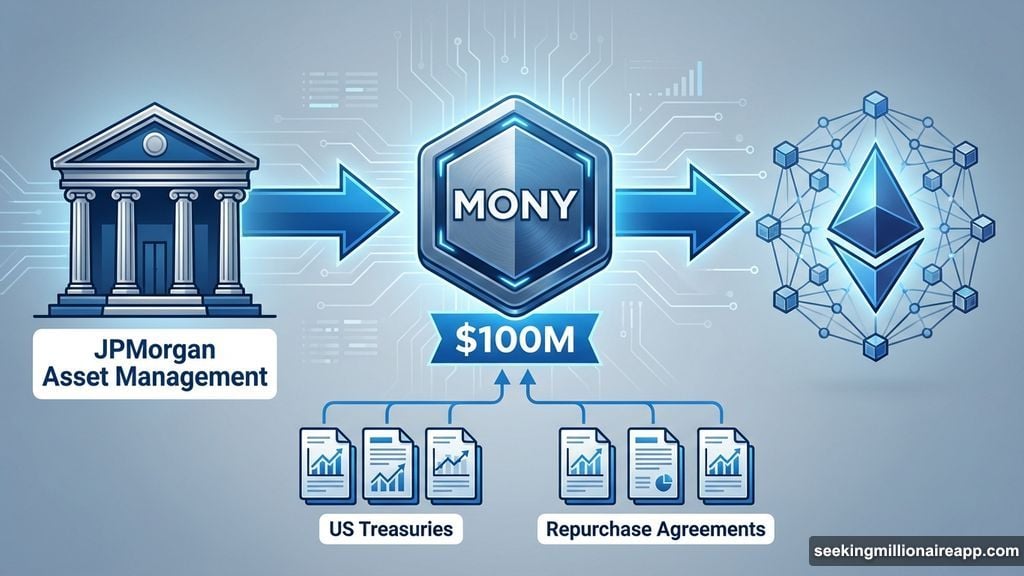

The bank’s asset management arm launched the My OnChain Net Yield Fund (MONY). It’s a private money market fund built on Ethereum using JPMorgan’s tokenization platform, Kinexys Digital Assets.

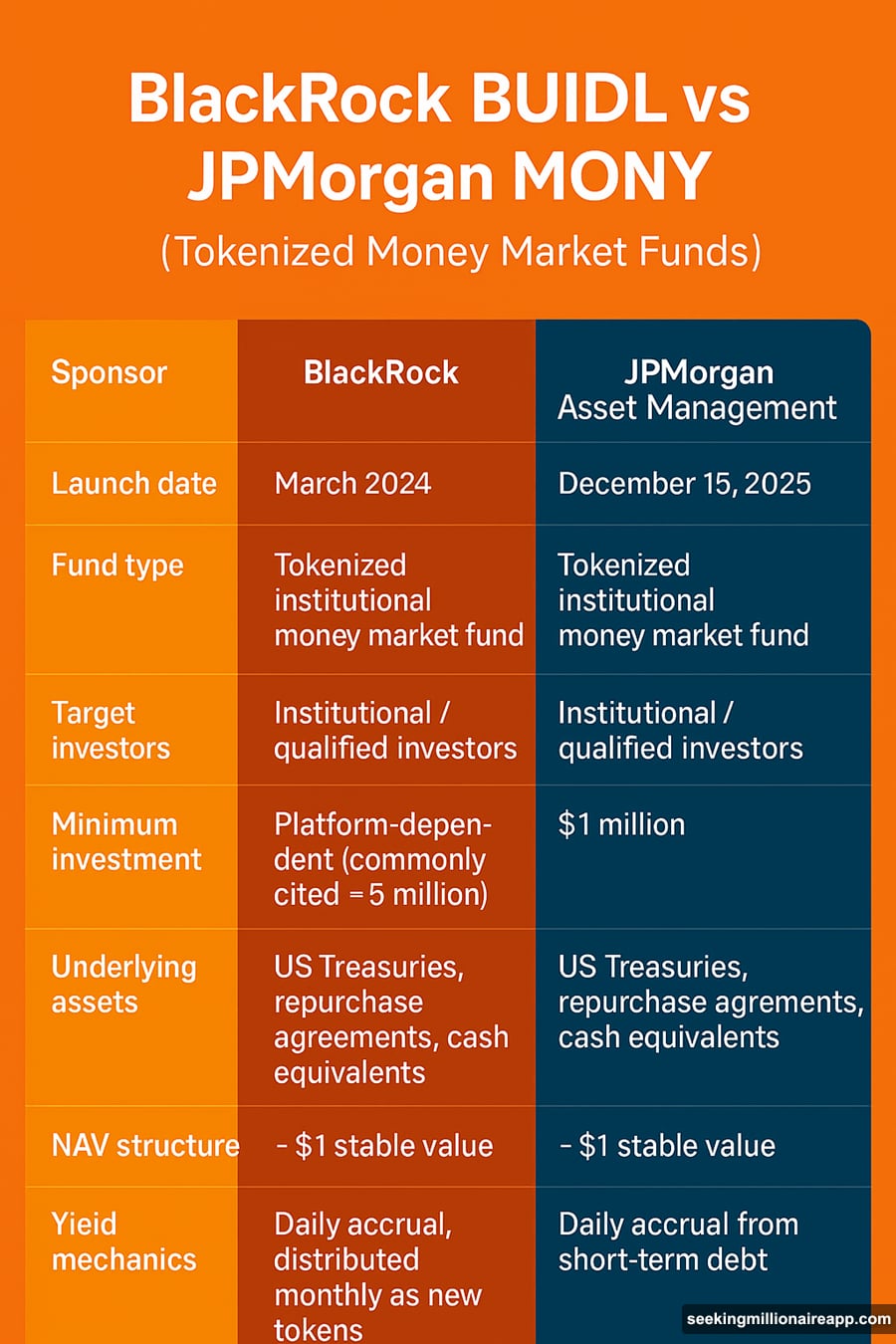

MONY invests in short-term US Treasuries, repurchase agreements, and cash equivalents. So it functions like a traditional money market fund. But investors receive digital tokens representing their shares instead of conventional account entries.

The structure targets institutions and high-net-worth individuals. Qualified investors need either $5 million in investable assets (individuals) or $25 million (institutions). Plus, there’s a $1 million minimum investment threshold.

John Donohue, JPMorgan’s head of global liquidity, told the Wall Street Journal that client demand drove the launch. “There is a massive amount of interest from clients around tokenization,” he said. The bank expects to lead the space by offering blockchain versions of traditional money market products.

JPMorgan will seed MONY with $100 million internally before opening it to outside investors. That internal capital commitment signals strong conviction. Banks don’t deploy nine-figure sums on experiments.

Why Ethereum Won the Institutional Race

JPMorgan could have built MONY on a private blockchain. Or chosen another public network. Instead, it picked Ethereum.

That choice matters. Ethereum offers deep liquidity, proven security, and widespread developer adoption. More importantly, it’s becoming the de facto settlement layer for tokenized financial products.

BlackRock’s tokenized money market fund (BUIDL) already manages $1.83 billion on-chain. Like MONY, it invests in short-term Treasuries and cash equivalents. Both products validate Ethereum as infrastructure for regulated financial assets.

Tom Lee’s “bullish for ETH” comment highlights the network effects. Each institutional product deployed on Ethereum increases transaction activity, smart contract usage, and total value locked. That reinforces Ethereum’s position as the base layer for on-chain finance.

Crypto commentators pointed out another angle. Ethereum isn’t just hosting speculative tokens anymore. It’s settling real money for real institutions managing real client assets. That shift from experimental to essential infrastructure matters more than any price prediction.

The Genius Act Opened the Floodgates

This year’s GENIUS Act established a US regulatory framework for stablecoins. While the legislation focused on stablecoins specifically, it signaled broader regulatory clarity for tokenized assets.

Financial institutions read that signal correctly. Since the act passed, major banks accelerated their blockchain initiatives. Tokenized funds, bonds, and real-world assets moved from pilot programs to production deployments.

JPMorgan itself has experimented with tokenized deposits, private equity funds, and institutional payment tokens. MONY isn’t an isolated experiment. It’s part of a multi-year strategy to modernize financial infrastructure using blockchain rails.

The timing makes sense. Regulatory uncertainty previously kept traditional finance on the sidelines. Now that clarity exists, institutions are moving fast to build positions in what they see as the future operating system of finance.

Traditional Finance Races Stablecoins

Money market funds traditionally offered safe, liquid, yield-bearing investments. But stablecoins emerged as competitors. They provide similar benefits with faster settlement, programmability, and blockchain composability.

Tokenized money market funds represent traditional finance’s response. They preserve familiar investment structures while adding blockchain benefits. Investors get Treasury-backed yields plus on-chain transferability and settlement speed.

JPMorgan and BlackRock aren’t just defending market share. They’re recognizing that clients want blockchain-native financial products. Institutions see value in programmable assets, instant settlement, and integration with DeFi protocols.

Yet tokenized funds maintain regulatory compliance, insurance protections, and institutional custody that pure DeFi often lacks. That hybrid approach attracts conservative investors who want blockchain benefits without abandoning traditional safeguards.

The competition isn’t zero-sum. Stablecoins and tokenized funds can coexist. But together they’re driving massive capital on-chain and validating public blockchains as financial infrastructure.

What This Means for Ethereum’s Future

Ethereum’s critics argue it’s too slow, too expensive, and too decentralized for institutional use. JPMorgan’s $100 million deployment suggests otherwise.

The bank chose Ethereum despite its perceived limitations. That implies the benefits outweigh the costs. Network security, liquidity, and composability with existing DeFi infrastructure apparently matter more than raw transaction speed.

Moreover, layer-2 scaling solutions address Ethereum’s performance constraints. Institutions can settle final transactions on Ethereum’s base layer while executing higher-frequency operations on L2s. That hybrid approach delivers both security and speed.

BlackRock’s $1.83 billion BUIDL fund proves institutional products can scale on Ethereum. JPMorgan’s entry reinforces that trend. Together, these products represent nearly $2 billion in tokenized assets using Ethereum as settlement infrastructure.

The network effects compound. As more institutions deploy products on Ethereum, it becomes harder for competitors to displace it. Developer tools, liquidity, and institutional integrations all favor the established leader.

Wall Street Isn’t Testing Anymore

JPMorgan’s internal $100 million commitment distinguishes MONY from typical blockchain pilots. Banks test new technologies with small allocations. They deploy real capital when they’re serious.

This move signals confidence in both blockchain technology and Ethereum specifically. JPMorgan expects institutional demand for tokenized money market products to justify the investment in infrastructure and compliance.

The bank’s asset management arm oversees $4 trillion. MONY’s initial $100 million represents a tiny fraction. But the infrastructure built to support MONY can scale to handle billions more.

That scalability matters. If client demand materializes, JPMorgan can rapidly expand MONY’s assets under management. The hard work of building tokenization platforms, custody solutions, and regulatory frameworks is done.

Other banks are watching. When JPMorgan validates a new approach, competitors follow quickly. Expect more tokenized money market funds from major financial institutions in 2025.

The Tokenization Wave Just Started

Tokenized money market funds are just the beginning. Wall Street sees potential for tokenized bonds, equities, real estate, and private credit.

Blockchain offers clear advantages for these assets. Fractional ownership becomes simple. Transfer settlement happens in minutes instead of days. Smart contracts automate compliance, dividend distribution, and voting rights.

The infrastructure being built for money market funds will support these future products. JPMorgan’s Kinexys Digital Assets platform can tokenize virtually any financial asset once the regulatory frameworks exist.

That’s why the GENIUS Act matters so much. It established a template for how traditional assets can operate on-chain while maintaining regulatory compliance. Future legislation will likely follow similar patterns for other asset classes.

Tom Lee’s bullish Ethereum call assumes this trend continues. If Wall Street tokenizes even a fraction of traditional financial assets, Ethereum’s role as settlement infrastructure becomes enormous. The network effects from that adoption could dwarf previous bull market drivers.

JPMorgan just placed a serious bet that this future arrives faster than skeptics expect. When the largest US bank by assets puts $100 million on Ethereum, the signal is clear.

The blockchain revolution isn’t coming. It’s here. And it’s being built by the same institutions that crypto natives spent years criticizing.

Funny how that works.