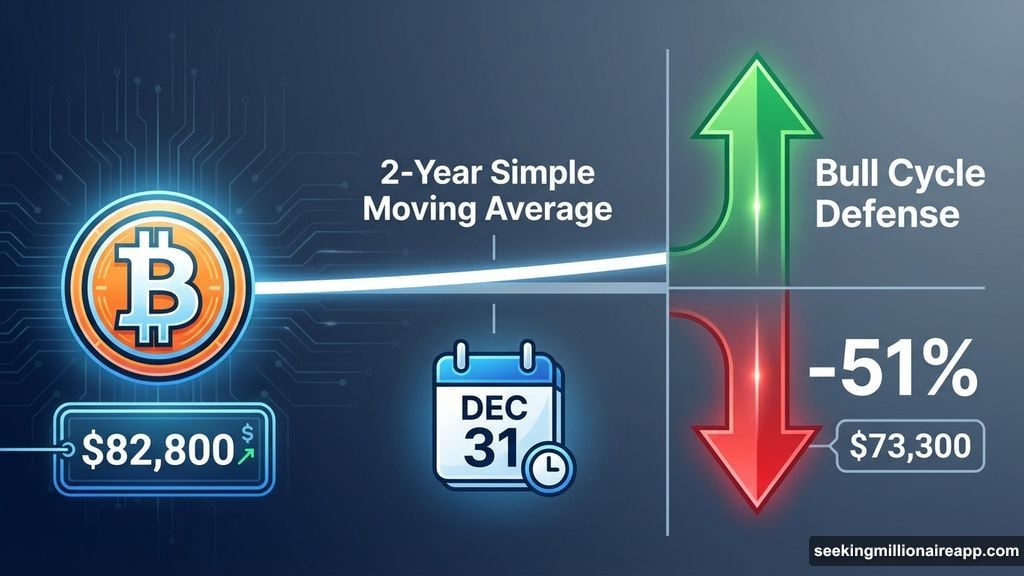

Bitcoin sits on thin ice. The price hovers near $82,800, testing a support level that has defined bull and bear cycles since the cryptocurrency’s inception.

This isn’t just another line on a chart. It’s the 2-Year Simple Moving Average, and history shows what happens when Bitcoin falls below it. The last breakdown in mid-2022 triggered a brutal 51% crash. Now, with just weeks left in 2025, Bitcoin faces the same test again.

The Line That Matters Most

The 2-Year SMA sits at $82,800 right now. Traders track this metric using daily closes, but cycle analysts measure it by monthly candles. That makes December 31 crucial.

When the final candle closes for December, the market gets an official verdict. Either Bitcoin defended long-term trend support, or it printed a confirmed breakdown signal. There’s no middle ground once the month ends.

Alphractal, a respected on-chain analyst, flagged this exact level on December 16. “Whenever Bitcoin closes below the 2Y SMA on a monthly basis, extended bearish phases follow,” the firm noted. Monthly defenses above this line have historically marked cycle survival.

So Bitcoin needs to stay above $82,800 through month-end. Anything less opens the door to serious downside risk.

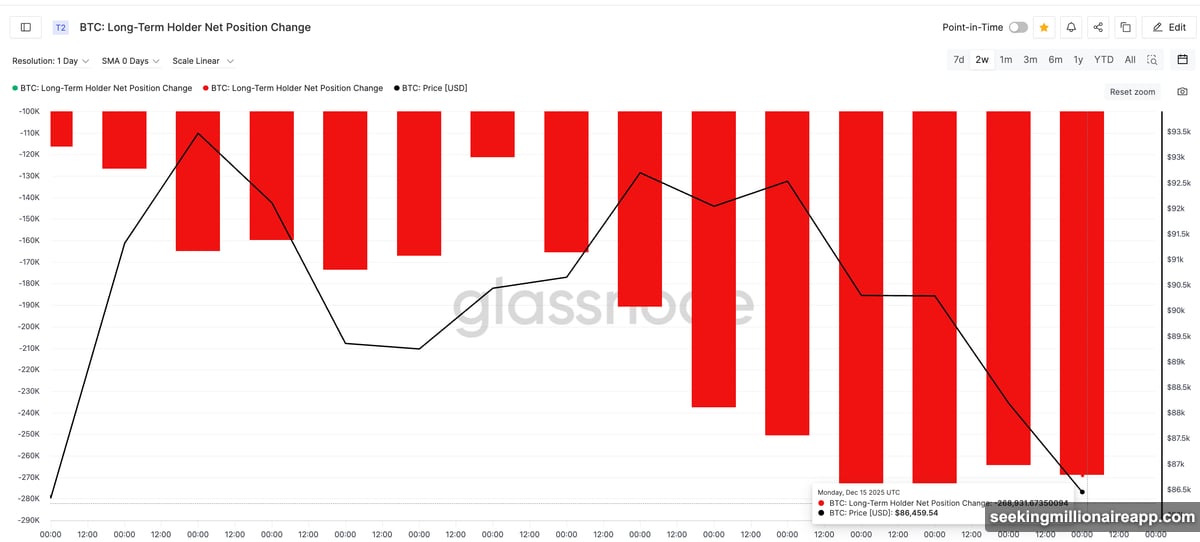

Long-Term Holders Are Dumping

The pressure isn’t just technical. On-chain data reveals growing stress beneath the surface.

Long-term holders, wallets that have held Bitcoin for more than 155 days, ramped up selling throughout December. According to Glassnode data, net outflows jumped from roughly 116,000 BTC earlier in the month to nearly 269,000 BTC by December 15.

That’s a 130% increase in selling pressure over just two weeks. These aren’t day traders chasing momentum. Long-term holders typically sell only during periods of risk reduction or profit-taking near cycle tops.

Their continued distribution adds weight to the downside. Plus, it makes defending critical support zones like the 2Y SMA significantly harder. When committed holders start exiting positions into weakness, bulls lose their strongest backstop.

What Happens if Support Breaks

Bitcoin’s current structure leaves little margin for error. If the price fails to hold the $82,800 to $81,100 zone into the December close, downside targets expand quickly.

A confirmed monthly break below this region points toward $73,300 next. That represents roughly a 15% drop from current levels. The move would also mark Bitcoin’s first sustained breakdown below the 2Y SMA since the 2022 bear market bottom.

Historical precedent isn’t encouraging. The last time Bitcoin traded below this moving average for multiple months, it eventually crashed more than 50% before finding a bottom. While past performance doesn’t guarantee future results, the risk of deeper correction increases substantially once long-term cycle support fails.

Bulls Need to Reclaim These Levels

On the upside, Bitcoin must reclaim $88,200 to reduce immediate pressure. That level marks the first resistance zone where sellers have consistently defended rallies over the past two weeks.

A sustained move above $94,500 would be needed to restore bullish market structure. That breakout would shift momentum back in favor of buyers and potentially trigger short covering from traders positioned for further downside.

Until then, Bitcoin remains trapped between long-term cycle support below and rising selling pressure from committed holders. The market sits at a decision point with less than two weeks remaining before the monthly close.

Nobody Knows What Happens Next

Here’s what bothers me about this setup. Bitcoin has respected the 2Y SMA for most of its existence. But markets don’t follow rules just because traders expect them to.

December could end with a dramatic defense that sparks a year-end rally. Or Bitcoin could slice through support like it doesn’t exist, triggering a cascade of stop-losses and forced liquidations. Both outcomes remain possible until the final candle prints.

What’s clear is this: the next two weeks matter more than the previous two months. Long-term holders are selling. Technical support is being tested. The December close will either validate cycle support or confirm a breakdown that opens the door to much lower prices.

Watch $82,800. If Bitcoin can’t hold that level through month-end, buckle up for a rough start to 2026.