Pi Coin just hit an eight-week low. The damage? A brutal 25% drop in under three weeks.

Bitcoin’s recent weakness pulled PI down hard. But that’s not the whole story. On-chain data reveals something worse: investors are bailing out fast. Capital outflows hit levels not seen in eight months. Plus, those who remain show little confidence in a quick rebound.

Let’s break down what’s killing Pi Coin’s price and whether any support levels can hold.

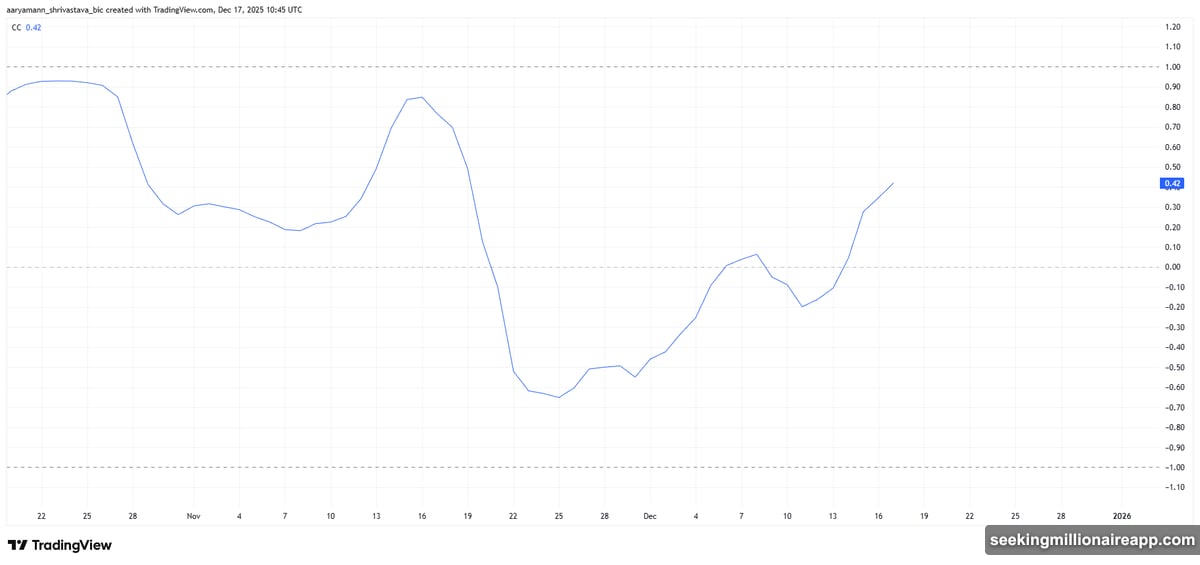

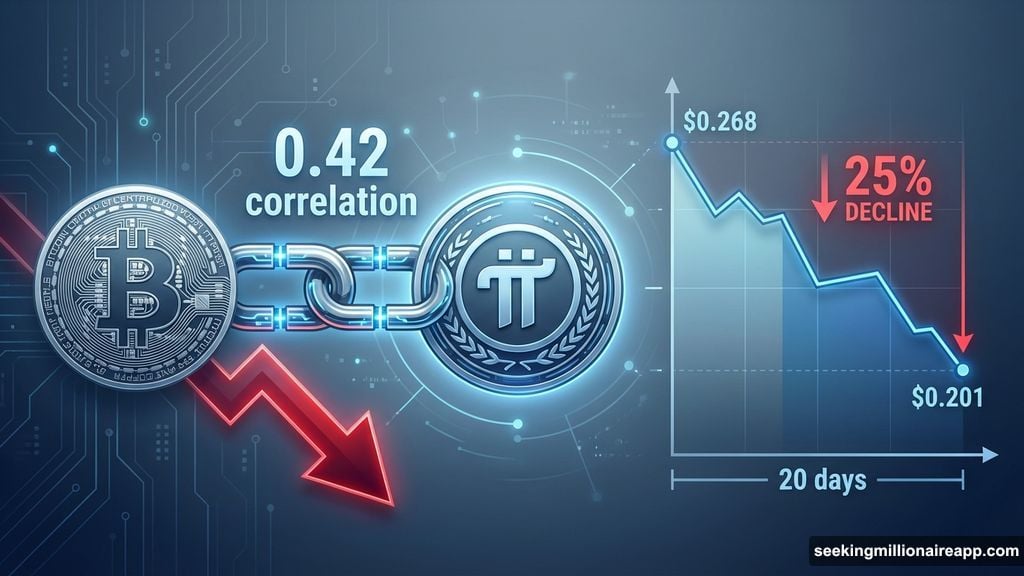

Bitcoin’s Weight Crushes Independent Recovery

Pi Coin can’t escape Bitcoin’s gravity right now. The correlation between PI and BTC hit 0.42 this week. That reading turned positive after climbing steadily for nearly three weeks.

Here’s why that matters. During Bitcoin’s correction, Pi Coin amplified the losses instead of holding steady. A rising correlation during a downtrend spells trouble. Independent recovery becomes nearly impossible without broader market stabilization.

In fact, most altcoins struggle when they’re this tightly linked to Bitcoin during bearish phases. PI needs either Bitcoin to reverse course or a significant catalyst to break free from this pattern. Right now, neither scenario looks likely.

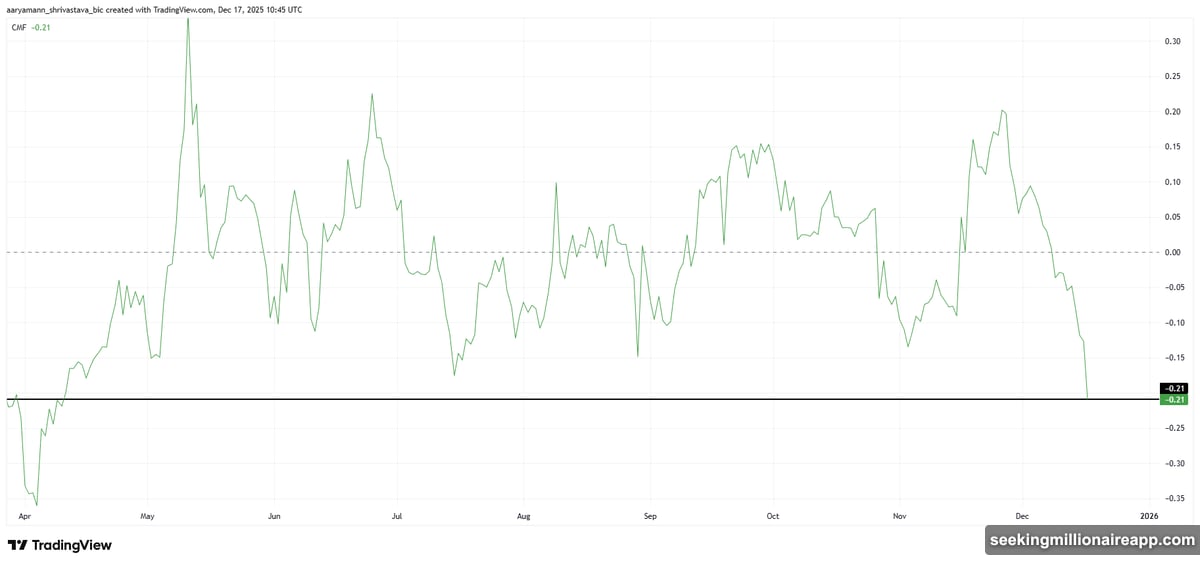

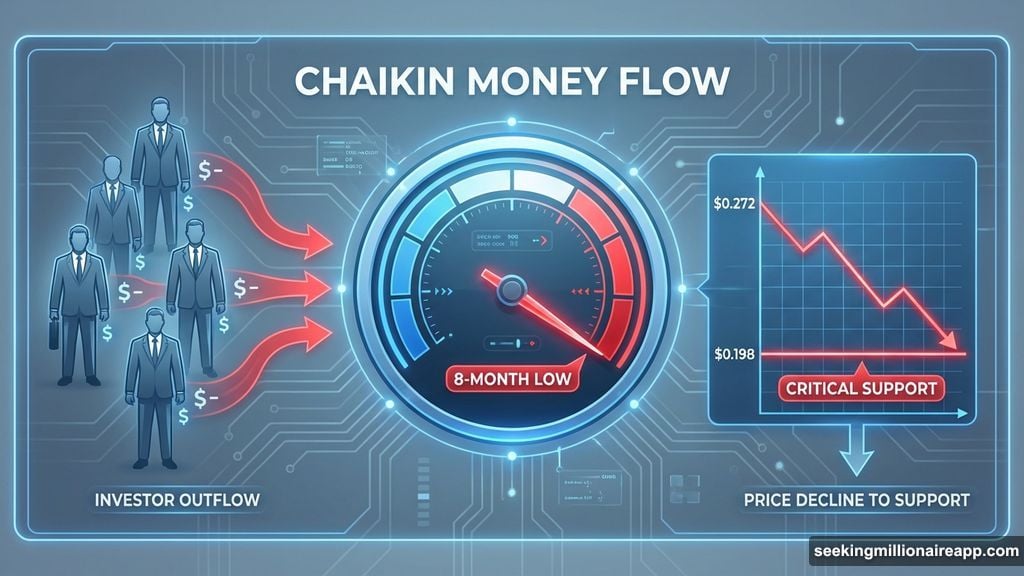

Heavy Outflows Signal Investor Capitulation

The Chaikin Money Flow tells a grim story. This indicator tracks capital movement in and out of an asset. For Pi Coin, it just dropped to an eight-month low.

What does that mean? Heavy withdrawals. Sustained selling. Investors reducing exposure as fast as possible.

Moreover, this isn’t panic selling from a single event. The outflows have been consistent for weeks. Many holders clearly decided they’re done waiting for a recovery. Failed breakout attempts above $0.272 broke their patience.

This kind of persistent selling creates a vicious cycle. As more investors exit, price drops further. Lower prices trigger more exits. Breaking this pattern requires either exhaustion of sellers or fresh buying interest. Neither has appeared yet.

Critical Support at $0.198 Gets Tested Again

Pi Coin now trades at $0.201, down 25% over 20 days. The price sits dangerously close to $0.198 support, an eight-week low that previously held as a floor.

This level matters more than most. Historically, $0.198 has acted as a psychological barrier where buyers stepped in. But this time feels different. Momentum indicators remain bearish. Volume patterns show weakness rather than accumulation.

So what happens if $0.198 breaks? The next support levels sit at $0.188 and $0.180. That would extend the downtrend and potentially trigger another wave of stop-loss orders. Technical damage would worsen significantly.

However, one scenario could change the trajectory. If Pi Coin bounces from $0.198 and reclaims $0.208 as support, the bearish case weakens. Such a move might push PI toward $0.217, offering temporary relief.

But here’s the catch. That recovery depends on either Bitcoin stabilizing or Pi-specific positive catalysts. Without those factors, any bounce will likely get sold into.

The Bigger Picture: Altcoin Vulnerability

Pi Coin’s struggle reflects broader altcoin market dynamics right now. When Bitcoin corrects, altcoins with weaker fundamentals or less established use cases get hit hardest.

PI faces additional challenges beyond macro pressure. The token’s correlation with Bitcoin limits independent upside potential. Meanwhile, sustained outflows suggest the holder base is shrinking. Fewer committed holders means less buying support during dips.

Furthermore, failed breakout attempts above resistance levels damaged technical momentum. Each rejection at $0.272 reinforced bearish sentiment. Traders who bought those breakouts likely exited at losses, adding to selling pressure.

What Comes Next for Pi Coin

The next few days will determine Pi Coin’s short-term trajectory. Either $0.198 holds and triggers a relief bounce, or it breaks and accelerates the decline.

For bulls to regain control, several things need to happen. First, Bitcoin must stabilize or reverse higher. Second, Pi Coin needs to reclaim $0.208 and hold it as support. Third, outflows must slow or reverse.

None of those conditions exist right now. In fact, all momentum indicators point to continued weakness. Selling pressure remains high. Buyer interest stays minimal. Bitcoin shows no signs of a strong reversal.

So the most likely scenario? Further downside unless something fundamental changes. Pi Coin holders hoping for a quick recovery might be waiting a while longer.