Ethereum just failed its breakout attempt. Again.

ETH dropped below $3,000 for the third time this month. Worse, on-chain data shows investors are losing faith fast. Network activity fell to levels not seen since May. Plus, both short-term and long-term holders are barely making profits anymore.

This isn’t just a price correction. The entire ecosystem is showing signs of stress.

Profits Vanish Across All Holder Types

Something unusual is happening with Ethereum holders. Long-term and short-term investors now show nearly identical profit levels. That’s rare and concerning.

Typically, long-term holders sit on larger unrealized gains. But not anymore. The convergence suggests nobody’s making meaningful money at current prices. So conviction is fading across the board.

The MVRV Long/Short Difference metric confirms this trend. It slipped below zero, indicating neither group holds dominant unrealized profits. In fact, if this indicator drops further, short-term holders could start showing better profits than long-term believers.

That’s backward. And it signals fragile investor sentiment throughout the market.

Network Activity Collapses to May Levels

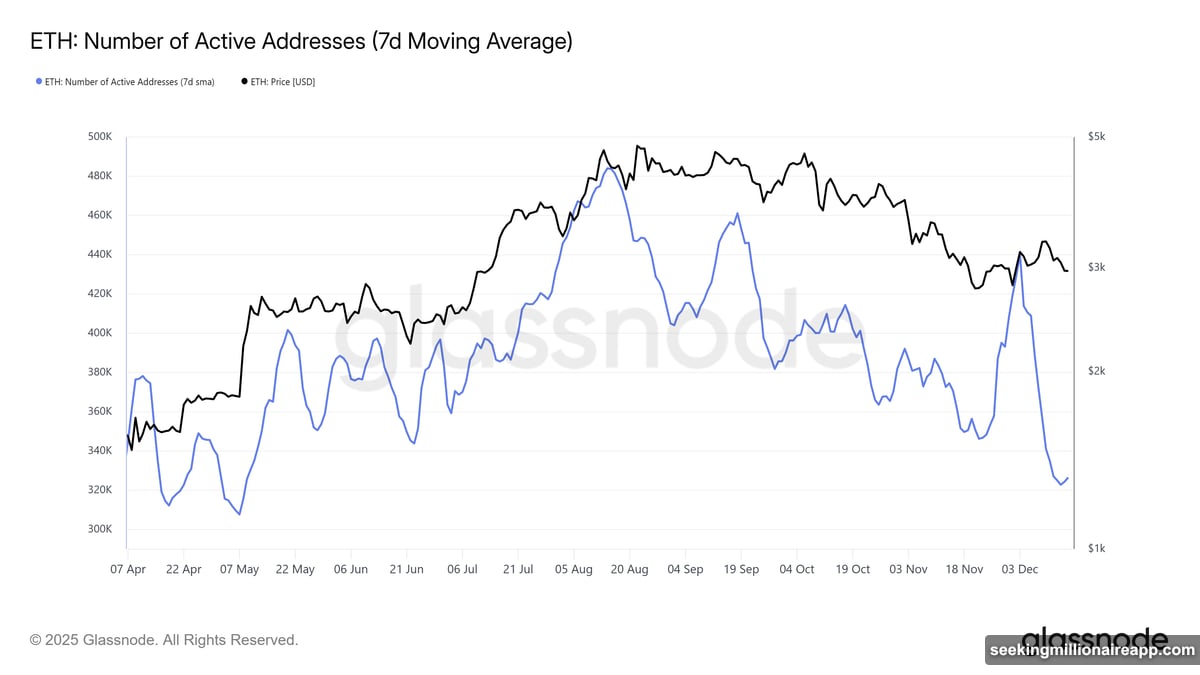

Active addresses on Ethereum hit a seven-month low. That’s a brutal signal about network health.

Fewer people are using Ethereum right now. Transactions are down. Engagement has dropped sharply. This isn’t just price weakness – it’s actual declining participation in the network itself.

Lower activity usually means investors see limited reasons to transact. Why move ETH around when there’s no clear direction? Without catalyst-driven activity or renewed demand, Ethereum struggles to build momentum.

Moreover, reduced network usage often precedes extended price weakness. People stop using a blockchain when they lose confidence in its near-term prospects. That’s what the data shows happening now.

$2,762 Support Level Under Threat

ETH trades at $2,929 today. Below $3,000 again, marking the third breach this month.

Last week’s breakout attempt failed completely. The rejection reinforced the two-month downtrend and showed limited buying interest at higher levels. Bears are clearly in control right now.

Technical indicators point to a potential retest of $2,762 support. This price level has historically acted as a critical floor for ETH. But downside pressure is building. If $2,762 breaks, the next support sits much lower.

However, a deeper collapse isn’t guaranteed yet. Unless broader crypto market conditions deteriorate significantly, ETH should hold above $2,700. That’s the line in the sand.

One Scenario Could Flip the Script

A shift in investor sentiment could change everything overnight. But it needs to be genuine, not just another failed rally attempt.

Reclaiming $3,000 as solid support is essential. ETH needs to hold above this level for several days, not just hours. Sustained buying pressure would signal real renewed interest.

If that happens, Ethereum could challenge $3,131 resistance. Breaking that level would invalidate the bearish thesis completely. It would mark a clear breakout from the downtrend and potentially trigger fresh momentum.

But that’s a big “if” right now. Current data doesn’t support optimism.

The Bigger Problem Nobody Mentions

Ethereum isn’t just facing price pressure. It’s dealing with an engagement crisis.

Seven-month low network activity means real users are stepping away. They’re not just holding and waiting – they’re actively using the network less. That’s fundamentally different from a simple price correction.

Price can recover quickly with renewed interest. But network activity takes longer to rebuild. Users need compelling reasons to return. New applications, improved user experience, or major protocol upgrades typically drive that kind of revival.

Right now, none of those catalysts are visible on the horizon. So Ethereum faces a grinding recovery rather than a sharp bounce.

Meanwhile, competitors continue launching features and attracting developers. Every day Ethereum stagnates, alternative Layer 1 blockchains gain ground. That competitive pressure adds another layer of concern for ETH’s medium-term outlook.