BitMine just watched its stock crater 24% in five days. Ethereum holdings? Deep underwater. Yet two of crypto’s biggest believers just dropped millions buying more.

Something doesn’t add up here. Or maybe it does, depending on who you ask.

The split brewing between institutional crypto strategies just got a lot more interesting. While some investors bail on Ethereum entirely, others are doubling down with conviction that borders on defiant.

BitMine’s Stock Slide Reflects Mounting Losses

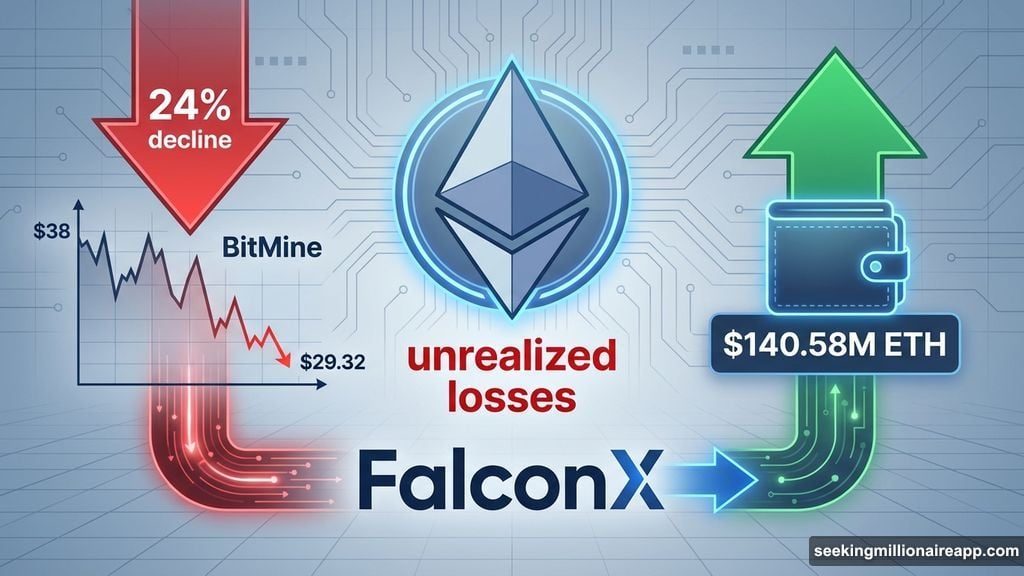

BitMine shares closed Wednesday at $29.32, down 6.59% for the day. That caps a brutal five-day stretch that wiped out nearly a quarter of the company’s value.

The culprit? Unrealized losses on the world’s largest corporate Ethereum treasury continue piling up. Plus, broader market weakness isn’t helping matters.

But here’s where it gets weird. While shareholders head for the exits, BitMine’s own chairman is heading in the opposite direction.

Tom Lee Buys Another $140 Million in Ethereum

On-chain data from Arkham Intelligence caught something remarkable. Two fresh wallets just received $140.58 million worth of ETH from crypto prime broker FalconX.

The transaction patterns match BitMine’s previous purchase behavior perfectly. So Tom Lee, BitMine’s chairman, just bought the dip. Again. At scale.

“Tom Lee continues to buy the dip,” Arkham noted in their analysis. That’s putting it mildly.

This isn’t panic buying or averaging down to salvage a bad position. Lee’s conviction looks deliberate and systematic. He clearly believes Ethereum remains structurally undervalued despite current price action screaming otherwise.

His thesis? Regulatory clarity, institutional adoption, and expanding on-chain use cases will eventually justify today’s purchases. The market just hasn’t caught up yet.

Cathie Wood’s Ark Invest Joins the Buying Spree

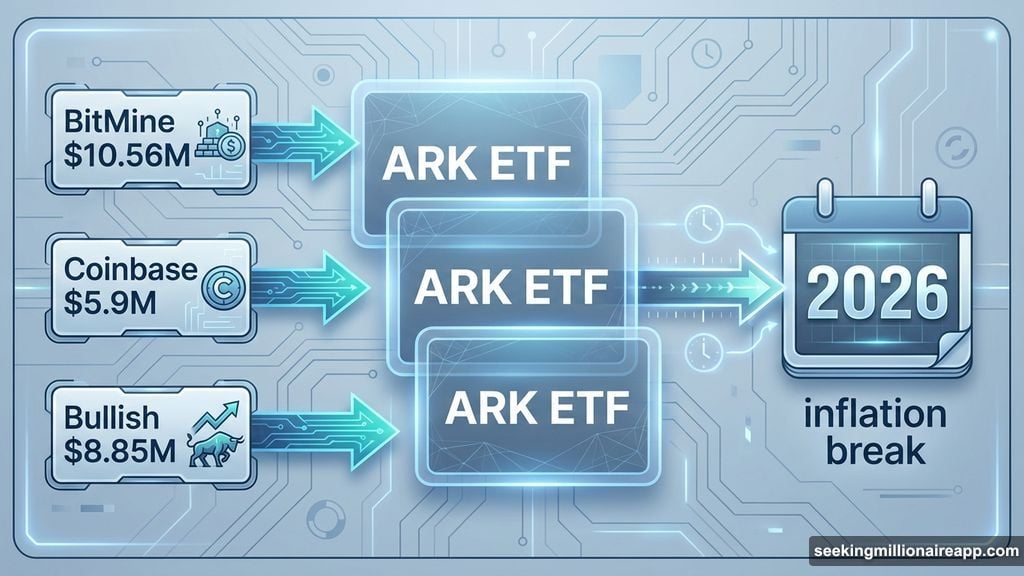

Tom Lee isn’t alone in his conviction. Cathie Wood’s Ark Invest just purchased $10.56 million worth of BitMine shares on Wednesday across three exchange-traded funds.

That followed an earlier $17 million purchase the same week. So Ark accumulated nearly $28 million in BitMine shares while the stock was actively bleeding.

But Ark didn’t stop there. The firm also added $5.9 million in Coinbase shares and $8.85 million worth of Bullish stock. All three positions were trending lower when Ark bought in.

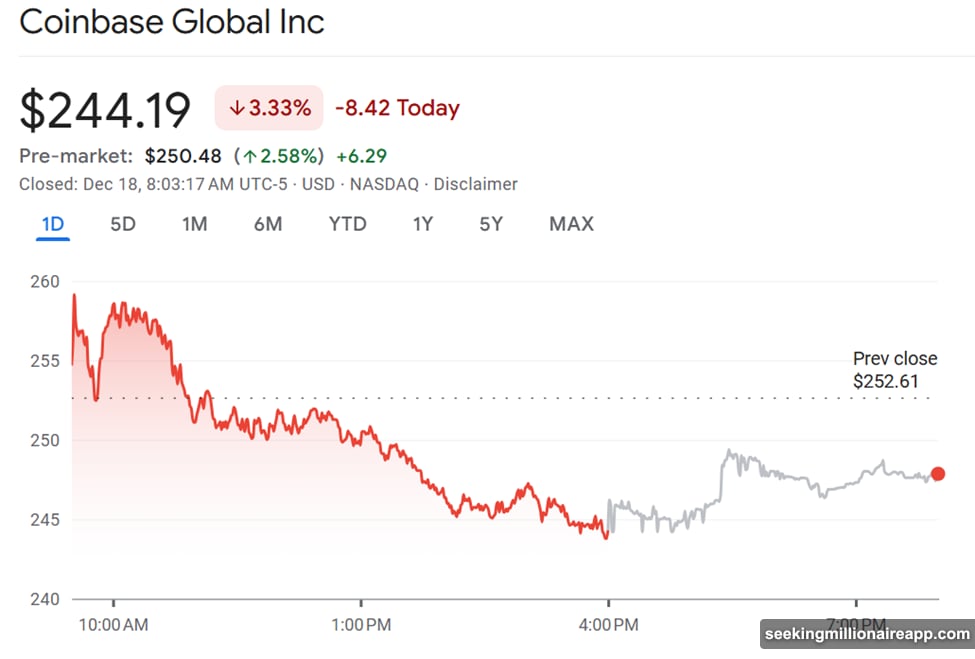

Coinbase fell 3.33% Wednesday to $244.19. Bullish slipped 1.89% to $42.15. Yet Ark kept buying crypto equities that most investors were actively dumping.

Wood’s Macro Bet: Inflation Breaks in 2026

What drives this conviction? Cathie Wood has repeatedly argued that easing inflation and improving liquidity conditions could trigger a renewed crypto rally.

“A real break in inflation is coming in 2026,” Wood stated recently. Her firm’s aggressive accumulation reflects that macro outlook.

BitMine’s leadership mirrors this optimism. The company continues purchasing ether weekly during the downturn. Lee previously argued that regulatory shifts in Washington, combined with rising institutional engagement, mean “the best days for crypto” still lie ahead.

Plus, the Trump administration’s pro-crypto stance could accelerate institutional adoption faster than markets currently expect. That’s the bull case, anyway.

Meanwhile, Some Investors Exit Ethereum Entirely

Not everyone shares Lee and Wood’s conviction. Analyst Samson Mow just took the opposite approach with a clean break from Ethereum exposure.

“I’ve decided to liquidate all BitMine Ethereum holdings and pivot to a Bitcoin-only treasury strategy,” Mow wrote. His rationale? Why accept Ethereum’s volatility when Bitcoin offers clearer institutional adoption paths?

This philosophical split within crypto treasuries is growing sharper. Is diversification into Ethereum strategic foresight or unnecessary risk?

For Bitcoin maximalists like Mow, the answer is obvious. Ethereum introduces complexity, regulatory uncertainty, and technical risks that Bitcoin avoids. So why bother?

But for Ethereum bulls like Lee, that complexity represents opportunity. Smart contracts, DeFi infrastructure, and tokenization platforms all run on Ethereum. Bitcoin can’t compete in those use cases.

Treasury Strategies Diverge as Volatility Tests Patience

BitMine now sits at the center of this debate. The company’s unrealized losses make the strategy’s risks painfully visible.

Yet Lee and Ark’s continued buying suggests they see something others miss. Maybe they’re catching a falling knife. Or maybe they’re accumulating before the market reprices Ethereum higher.

Either way, institutional patience is being tested. Ethereum’s volatility isn’t new, but watching treasury holdings bleed while competitors pursue Bitcoin-only strategies creates real pressure.

The question isn’t whether Ethereum will recover. It always has before. The question is whether institutional treasuries will maintain conviction through the drawdown or pivot to simpler Bitcoin strategies.

What Happens Next Depends on Market Conditions

If Wood’s inflation thesis proves correct and liquidity conditions improve, Lee’s aggressive buying could look brilliant in hindsight. Ethereum would likely rally hard as institutional capital flows back into risk assets.

But if macro conditions worsen or regulatory clarity fails to materialize, BitMine’s strategy faces prolonged pain. Unrealized losses could mount further, and shareholders might demand strategic changes.

For now, the split between Ethereum treasuries and Bitcoin-only approaches highlights crypto’s maturation. Institutional investors now have genuine strategic choices rather than simply following Bitcoin’s lead.

That creates real risk. Some companies will make the right call. Others won’t. BitMine’s bold bet on Ethereum supremacy might define the next cycle of institutional crypto adoption.

Tom Lee clearly believes the payoff justifies the pain. Time will tell if conviction or caution wins this round.