Inflation data drops soon. And crypto whales aren’t playing it safe.

Instead, they’re making opposite bets across three tokens. Some are loading up. Others are quietly selling. One group can’t even agree with itself.

The November CPI print is expected near 3.1% year-over-year. Core inflation hovers around 3.0%. Labor markets keep softening. That creates tension between rate cut delays and fresh easing hopes in 2026.

So let’s break down exactly what the smart money is doing right now.

Pippin Whales Are Stacking Tokens

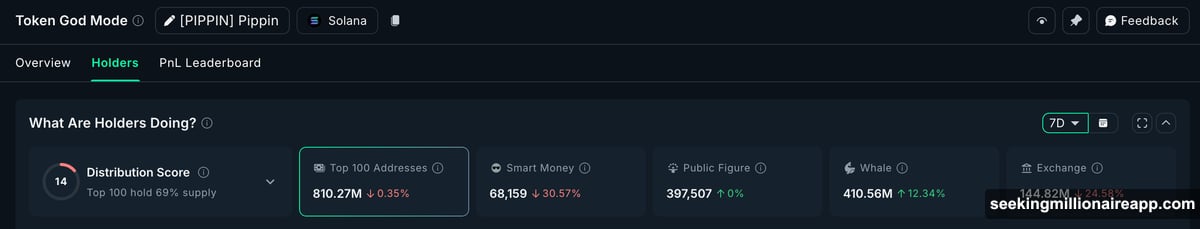

One clear pattern emerges from the data. Whales are aggressively accumulating Pippin (PIPPIN) ahead of the CPI release.

Holdings jumped 12.34% over the past week. That’s 45 million tokens added to whale wallets. At current prices, that’s roughly $19 million in fresh capital.

Plus, the buying hasn’t stopped. Balances continue rising even in the last 24 hours. Slow and steady. This isn’t day-trading behavior. It’s positioning.

So why the confidence? Price structure tells part of the story.

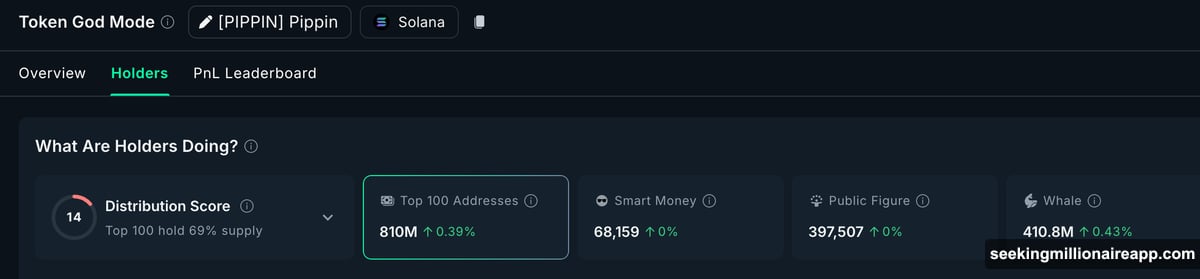

Pippin touched its all-time high on December 16. Now it trades just below that level, trapped inside a bullish flag pattern. These continuation setups often break higher when macro conditions turn favorable.

Whales seem to be betting on exactly that. A neutral or slightly soft CPI print keeps rate cut hopes alive into 2026. That scenario favors risk assets.

The key breakout level sits at $0.52. A clean daily close above that zone confirms the move and opens price discovery. From there, momentum could carry PIPPIN significantly higher.

But downside risk exists too. A drop below $0.22 weakens the flag structure. A deeper breakdown toward $0.10 invalidates the entire bullish case.

Still, whale behavior here is clear. They’re adding exposure where technical structure supports upside, betting macro data cooperates.

Maple Finance Sees Distribution Into Strength

On the flip side, Maple Finance (SYRUP) shows whales heading for the exits.

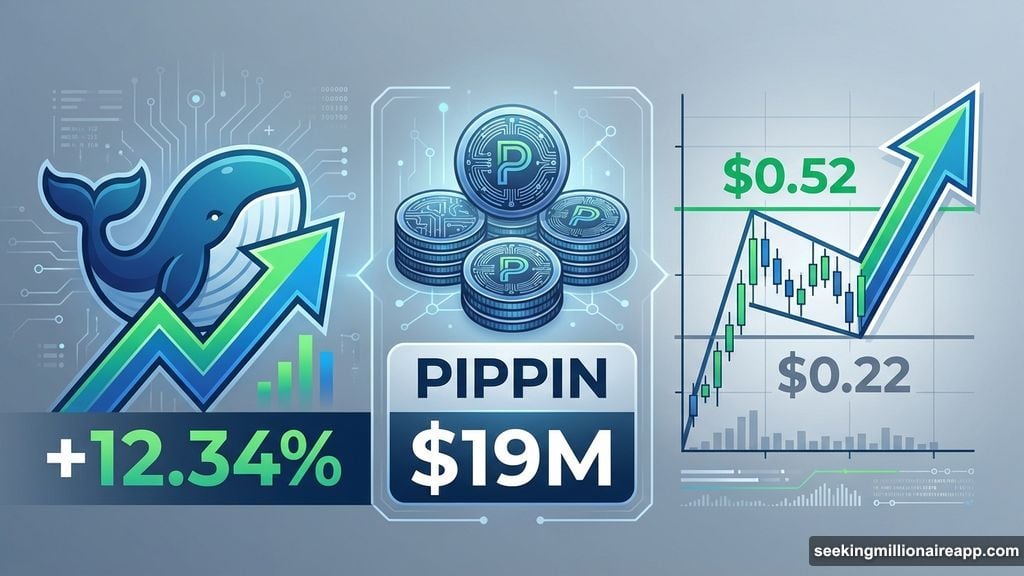

SYRUP rallied nearly 4% in 24 hours. It’s up 5% over seven days, outperforming a weak broader market. Yet whales are selling into that strength.

Holdings peaked at 507.83 million SYRUP on December 15. Since then, balances fell to 502.37 million. That’s 5.46 million tokens sold in just days. Roughly $1.5 million in net distribution.

Price goes up. Whale supply goes down. That divergence matters, especially heading into major macro events.

From a technical perspective, things look worse. SYRUP printed a lower high between November 24 and December 18. Meanwhile, the RSI made a higher high.

This creates hidden bearish divergence. Momentum improved, but price didn’t follow. That combination usually signals exhaustion, not strength.

Immediate downside risk sits at $0.25. A break there opens $0.23. For bulls, SYRUP must reclaim $0.31 with a clean daily close to invalidate the bearish setup.

Without that confirmation, rallies remain vulnerable. And whale behavior suggests they’re not waiting around.

This selling makes sense as macro hedging. If CPI prints hot and rate cuts get delayed, higher-beta DeFi exposure becomes less attractive. Whales are trimming risk before that possibility materializes.

Fartcoin Whales Can’t Agree

The most conflicted setup belongs to Fartcoin (FARTCOIN). Price action has been brutal. Down nearly 17% in 24 hours.

Normally, that kind of drop triggers broad selling. Smaller whales are doing exactly that. Standard whale balances dropped 3.83%, shedding roughly 4.6 million tokens.

But mega whales tell a different story entirely. The top 100 addresses increased holdings by 4.3%. They added supply while others dumped.

This creates direct conflict between whale cohorts. Smaller whales respect the bearish structure. Mega whales are positioning early, likely betting on volatility and sharp reflex bounces.

Technically, a bearish EMA crossover is forming on the 12-hour chart. The 20-period EMA is drifting below the 50-period EMA. That setup favors more downside.

The most important level sits around $0.26. This zone aligns with the 0.618 Fibonacci retracement and a structurally active demand area. A clean break below opens the door toward $0.23, potentially $0.17 if selling accelerates.

For bulls, FARTCOIN must reclaim $0.35. That level has capped every rebound since December 14. Without a decisive break above, the bearish case stays intact.

Mega whales appear to be playing the volatility angle. Solana-based meme coins often see sharp bounces during macro-driven moves. They’re betting CPI creates that kind of environment.

What This Means for CPI Day

These three setups reveal different whale strategies heading into the inflation print.

Pippin represents selective risk-on positioning. Whales are adding where technical structure supports upside, anticipating favorable macro conditions.

Maple Finance shows defensive hedging. Whales are trimming higher-beta DeFi exposure before potential disappointment.

Fartcoin exposes internal conflict. Smaller whales sell the weakness. Mega whales bet on the bounce.

No consensus exists. That makes sense given the setup. CPI could go either way. A hot print delays rate cuts and pressures risk assets. A soft print keeps easing hopes alive and favors speculative plays.

Smart money is preparing for both outcomes. Some are hedging. Some are positioning. Some are doing both.

The real move happens after the data drops. Until then, whale behavior reveals more about uncertainty than conviction.