Decentralized governance is broken. Most DAO tokens give you a vote but zero real power over assets or legal protection.

Ownership coins flip that model completely. They bundle voting rights with actual economic and legal control in one asset. Analysts now predict at least one ownership coin will crack $1 billion market cap by 2026.

This isn’t just hype. Early projects like AVICI are showing unusual holder loyalty despite brutal price swings. Plus, the legal framework finally exists to make onchain governance actually enforceable.

Traditional DAO Tokens Fall Short on Power

Most governance tokens in crypto today only let you vote on proposals. But voting without economic stake or legal backing creates weak incentives.

Token holders can’t directly claim assets or enforce decisions in court. So governance becomes theater rather than actual control. This gap has plagued DAOs since their inception.

Take a typical DAO treasury vote. Members vote to allocate funds, but the actual transfer depends on social consensus and multisig cooperation. No legal mechanism forces compliance. So major stakeholders can simply ignore votes they dislike.

That’s where ownership coins diverge. According to Galaxy Digital research, these tokens merge three critical rights into one enforceable package. You get economic stake, governance power, and legal recognition all at once.

This creates what Galaxy calls “digital companies” where blockchain governance carries legal weight. Token holders become true owners with enforceable claims on assets and decisions. Not just participants in a social experiment.

MetaDAO Pioneered the Model on Solana

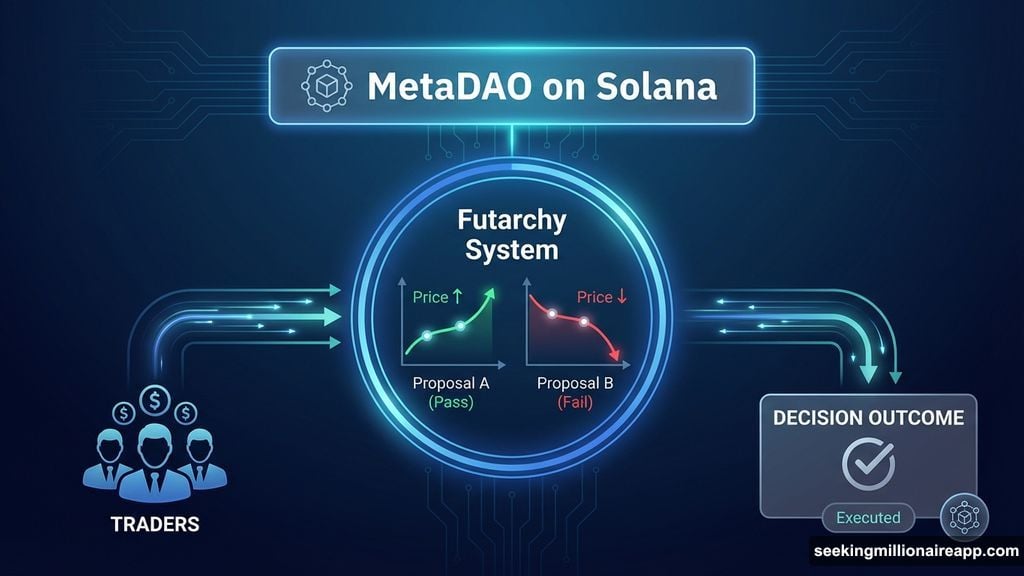

MetaDAO launched in November 2023 as one of the first ownership coin implementations. Instead of traditional voting, it uses futarchy—a governance system based on prediction markets.

Here’s how it works. Members trade in markets predicting outcomes rather than voting directly. Market prices guide decisions. So instead of debating proposals endlessly, traders bet on which option delivers better results.

This approach shifts power from rhetoric to economic stake. Plus, it creates accountability through market mechanisms. Traders who consistently back bad proposals lose money. Those who spot winning ideas profit.

MetaDAO built this on Solana for speed and low transaction costs. The framework shows how ownership coins can operate as legally recognized entities while maintaining fully onchain governance.

AVICI Leads Early Adoption Despite Volatility

AVICI has emerged as the strongest ownership coin performer over the past year. Messari’s 2026 Theses report highlights it as the sector’s biggest winner so far.

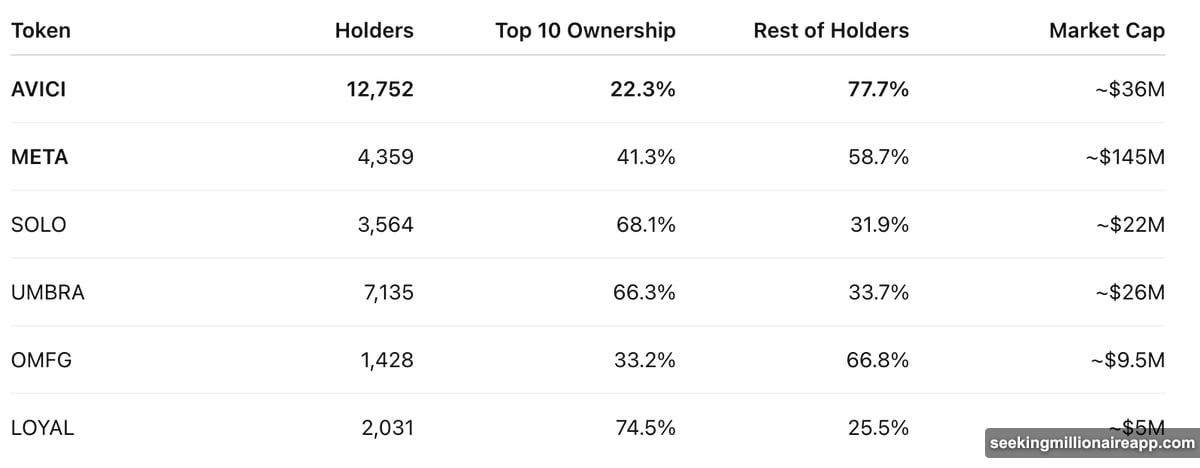

The token’s holder metrics stand out. As of mid-December 2025, AVICI counted 12,752 holders with relatively low whale concentration. Analyst crypto_iso tracked the growth from 4,000 initial holders to 13,300 within 45 days.

But here’s what matters. During a brutal 65% price crash, AVICI lost only 600 holders. That’s just 21% of its initial growth rate. Most tokens see holder counts collapse faster than prices during downturns.

The project added roughly 200 holders daily at peak growth. During the sharp decline, it lost about 43 per day. So even in rough conditions, net holder growth remained positive.

This retention signals genuine community belief rather than speculation. Traders who bought AVICI didn’t immediately dump when prices fell. They held through volatility, suggesting conviction in the ownership coin model itself.

Low whale concentration also helps. When a few large holders control most supply, they can manipulate prices easily. AVICI’s broad distribution reduces that risk.

Market Remains Early with Major Upside Potential

No ownership coin has yet reached $1 billion fully diluted valuation. For comparison, major governance tokens like UNI and AAVE are valued in the billions.

This valuation gap creates opportunity. Analyst Anglio called ownership coins his “biggest bet for 2026,” noting the sector sits at an unusually early stage despite solving real problems.

Social media discussion increasingly frames 2026 as the “year of the ownership coin.” Both retail and institutional investors are watching for breakout projects that combine innovation with enforceable legal structure.

The appeal is straightforward. Ownership coins offer genuine innovation rather than rehashing old token models. Plus, early entry timing lets investors position before major capital flows in.

But success depends on execution. Projects must deliver working legal frameworks, sustainable governance systems, and real economic value. Most ownership coin projects remain in development as of late 2025.

Legal Recognition Varies Across Jurisdictions

Ownership coins face regulatory uncertainty in many regions. The legal status of hybrid onchain-offchain entities isn’t clearly defined in most countries.

Some jurisdictions like Wyoming in the US have created legal structures for DAOs. Others remain silent or hostile. This fragmentation complicates global adoption and investment flows.

Projects launching in 2026 will need clear legal opinions and jurisdictional strategies. Without proper legal standing, ownership coins risk collapsing into traditional governance tokens with no enforceable rights.

The integration of legal and governance rights also creates compliance obligations. Token issuers may need to register securities, follow corporate governance rules, or meet disclosure requirements depending on jurisdiction.

These challenges aren’t insurmountable. But they require careful legal planning that many crypto projects historically ignore until regulators intervene.

This Could Reshape Capital Formation in Crypto

If ownership coins succeed, they enable entirely new organizational structures. Blockchain-native companies with enforceable onchain governance could raise capital, hire talent, and operate without traditional corporate structures.

Investors gain clearer rights and protection compared to typical DAO governance tokens. That should attract institutional capital currently sitting on the sidelines due to governance risks.

The model also fixes long-standing DAO problems like low participation and plutocracy. When governance carries economic and legal weight, participants have stronger incentives to engage thoughtfully rather than apathetically or tribally.

But 2026 will test whether this vision materializes or fades like past crypto governance experiments. Projects must deliver working products, sustainable economics, and genuine legal enforceability.

The $1 billion market cap milestone matters as a signal. It would prove the market believes ownership coins solve real problems worth significant capital allocation. Without it, the sector risks remaining a niche experiment.

Either way, ownership coins represent the most serious attempt yet to fix decentralized governance. The coming year will determine if they actually work.