Bitcoin broke past $88,000. The total crypto market cap hit $2.95 trillion. Plus, major altcoins like Zcash surged 13% in just 24 hours.

So what triggered this sudden recovery? Three factors converged at once. But the rally remains fragile. Whether it holds depends on what happens next at critical resistance levels.

Bitcoin Tests Key Resistance at $88,210

Bitcoin trades at $88,173 right now. That puts it just below the $88,210 resistance level that’s capped gains all month.

Here’s why this matters. This zone previously blocked every upside attempt in December. Buyers need to flip this level into support to confirm the recovery holds. Failure means another pullback looms.

If Bitcoin breaks through cleanly, the next target sits at $90,308. That level would restore some confidence among traders. Moreover, it could attract fresh capital that’s been sitting on the sidelines waiting for confirmation.

But here’s the risk. Losing momentum here sends Bitcoin back to $86,361 support. A break below that exposes $84,698 as the next downside target. Traders are watching these levels closely.

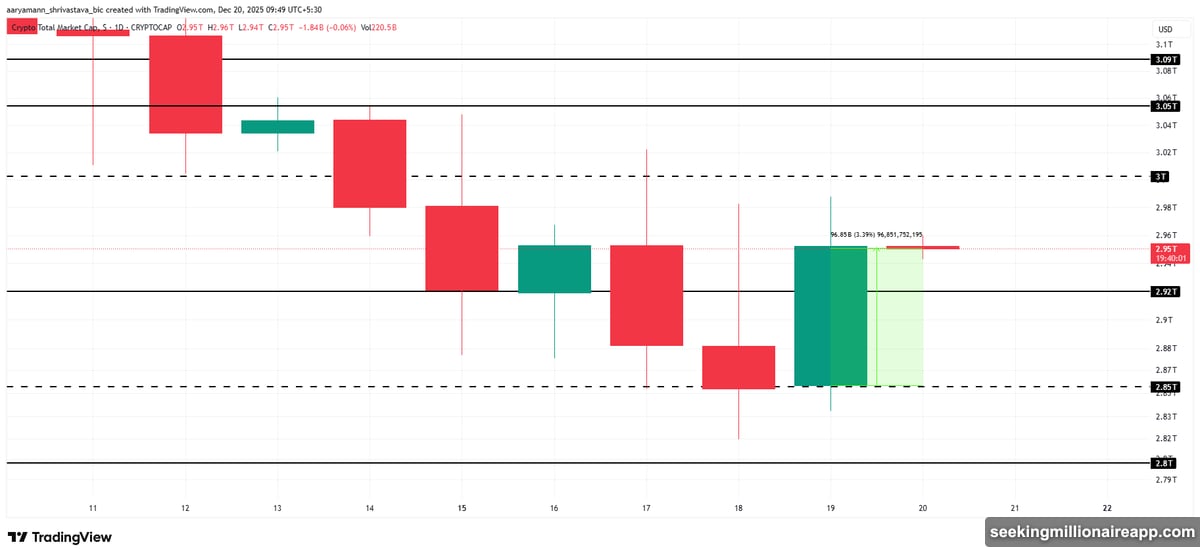

Total Market Cap Needs to Reclaim $3 Trillion

The total crypto market cap added $96 billion in 24 hours. That’s significant. But it’s still below the $3.00 trillion psychological threshold.

Why does this number matter so much? Because it represents peak confidence from November. Reclaiming it would signal that buyers have regained control. Plus, breaking through could trigger momentum trading that pushes prices higher.

Right now, the market sits at $2.95 trillion. That’s progress from recent lows. Yet it’s not enough to declare victory. Markets need sustained buying pressure to hold these gains.

If the recovery stalls, support sits at $2.92 trillion. Below that, $2.85 trillion becomes critical. Losing both levels would confirm the rally failed and invite more selling pressure.

Zcash Leads Altcoin Gains With 13% Rally

Zcash exploded 13% to reach $440. That makes it the top performer among major altcoins. But can it hold these gains?

The price sits just below $442 resistance right now. Converting this zone into support is essential. Moreover, the Ichimoku Cloud indicator shows bullish momentum remains intact. That suggests buyers control the short-term trend.

If momentum continues, Zcash targets $520 next. That would represent a significant breakout from recent consolidation. However, macro conditions need to cooperate for this move to materialize.

The downside risk? Failure at $442 could push ZEC back to $403 support. A breakdown below that level targets $340. That would invalidate the bullish setup entirely and signal a return to correction mode.

Regulatory News Creates Background Support

Two regulatory developments contributed to today’s positive sentiment. First, the SEC finalized civil settlements with three former FTX executives. That closes a major chapter in the exchange’s collapse saga.

Why does this matter for crypto prices? It removes uncertainty. Markets hate not knowing what comes next. Plus, closing high-profile cases suggests regulators are moving past enforcement toward clearer frameworks.

Second, Poland’s parliament advanced the Crypto-Assets Market Act. Lawmakers overrode a presidential veto 241-183. The bill now heads to the Senate.

This signals growing mainstream acceptance in Europe. Clear regulations often precede institutional investment. So while the immediate price impact is small, it builds long-term confidence.

Why This Recovery Remains Fragile

Here’s what bothers me about this rally. It lacks the volume and conviction you’d expect from a sustainable reversal.

Bitcoin gained ground, sure. But it’s still trading below key resistance. The total market cap recovered but didn’t break through the critical $3 trillion level. Moreover, most altcoins remain well below their recent highs.

This looks like a relief rally after oversold conditions. Not a new bull run starting. The difference? Relief rallies fade quickly when they meet resistance. Real reversals smash through resistance levels with conviction.

So what should you watch? Bitcoin needs to close above $88,210 and hold it. The total market cap must reclaim $3 trillion decisively. And altcoins need to maintain momentum rather than giving back gains.

Without these confirmations, expect choppy trading to continue. The crypto market hasn’t decided its next move yet. Today’s gains feel tentative, not triumphant.