Michael Saylor just hinted at another massive Bitcoin purchase. His timing couldn’t be more defiant.

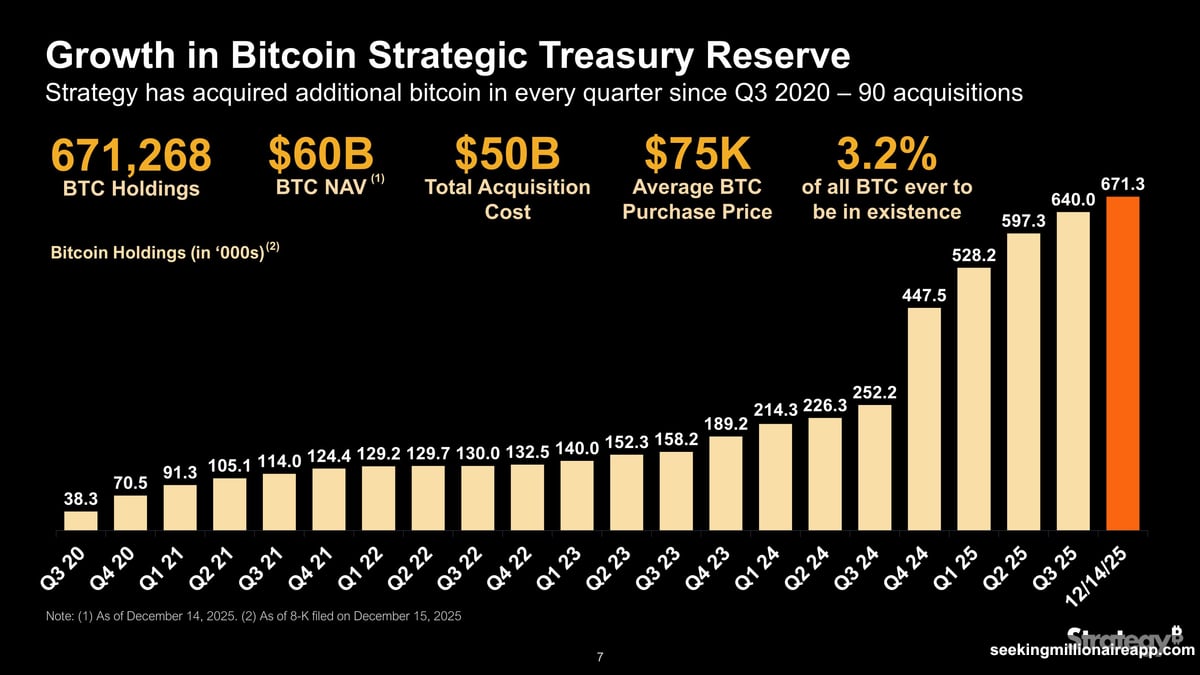

Strategy’s stock collapsed 43% this year while regulators circle and passive funds prepare to dump $11 billion worth of shares. Yet Saylor’s doubling down on the same playbook that built a 671,268 BTC empire now worth $50.3 billion.

This isn’t just corporate treasury management anymore. It’s a high-stakes gamble on whether conviction beats conventional finance.

The Weekend Teaser That Signals Monday Money

Saylor posted his signature cryptic signal on December 21. A simple image with the caption “Green Dots ₿eget Orange Dots” referenced Strategy’s portfolio tracker.

Crypto watchers recognize this pattern immediately. For a year straight, Saylor’s weekend social media hints preceded Monday morning SEC filings announcing fresh Bitcoin buys. The ritual became so predictable that traders now position themselves ahead of the official announcement.

But this time feels different. Strategy already owns 3.2% of Bitcoin’s total supply. That’s not a hedge or diversification play. It’s an all-in bet that traditional corporate treasury models are obsolete.

The company touts a “BTC Yield” metric showing 24.9% accretion of Bitcoin per share. Yet markets ignore this proprietary measurement. Instead, they’re fixating on mounting external pressures that threaten to unravel the entire structure.

MSCI Removal Could Trigger Massive Forced Selling

The real danger isn’t Bitcoin’s 30% drop from its October peak of $126,000. It’s what happens if MSCI kicks Strategy out of its global indices during February’s review.

Index provider concerns are straightforward. Strategy stopped functioning as an operating software company and transformed into what looks like a Bitcoin investment vehicle. MSCI’s classification system wasn’t designed for companies that hold single assets representing multiples of their market cap.

JPMorgan analysts calculated the damage. Approximately $11.6 billion in forced selling would hit as passive ETFs and index-tracking funds mechanically liquidate their MSTR positions. These funds don’t make judgment calls. They follow index composition rules automatically.

That selling pressure creates a vicious cycle. Lower stock prices make future Bitcoin purchases harder to fund through equity offerings. Plus, the stock price could decouple from Bitcoin’s value entirely during a liquidity crisis.

Strategy fired back hard in its formal response. The company called MSCI’s proposal “arbitrary, discriminatory, and unworkable.” Their argument? Singling out digital asset companies while ignoring other holding-heavy conglomerates amounts to unfair treatment.

“The proposal improperly injects policy considerations into indexing. The proposal conflicts with U.S. policy and would stifle innovation,” Strategy argued in official comments.

Why Another Bitcoin Buy Makes Strategic Sense Now

Saylor’s timing looks counterintuitive. MSTR shares trade around $165 after bleeding value all year. Bitcoin itself retreated sharply. Market conditions suggest caution, not aggression.

Yet a new purchase accomplishes two critical goals simultaneously.

First, it lowers Strategy’s average cost basis during a market correction. Buying Bitcoin at current levels improves the company’s position for when prices eventually recover. Basic dollar-cost averaging applied at corporate scale.

Second, and more importantly, it sends an unmistakable message to markets. Despite regulatory threats, index removal risks, and stock collapse, the strategy remains unchanged. Saylor isn’t hedging, diversifying, or retreating. He’s accelerating.

That signal matters because institutional investors are watching for cracks in the conviction thesis. Any sign of doubt would validate concerns that the model is unsustainable. But continued accumulation during adversity suggests Saylor sees temporary turbulence, not permanent failure.

Some analysts question whether this constitutes prudent corporate governance. Traditional treasury management emphasizes stability, liquidity, and risk mitigation. Strategy’s approach resembles venture capital portfolio construction more than corporate cash management.

The Bigger Question Nobody’s Asking

Here’s what bothers me about this entire situation. We’re witnessing a fundamental clash between old financial infrastructure and new asset classes playing out in real time.

MSCI’s index methodology was built for 20th century companies. Manufacturers. Retailers. Service providers. Firms that generate cash flow from operations and hold reasonable working capital. The system breaks down when a company decides its entire business model is accumulating a non-productive asset.

But is that really Strategy’s fault? Or is it evidence that traditional classification systems need updating for digital asset era?

Saylor would argue that Bitcoin is the ultimate treasury asset. No counterparty risk. Fixed supply. Global liquidity. Incorruptible ledger. From that perspective, holding Bitcoin makes more sense than holding dollars that lose purchasing power through inflation.

Yet markets clearly disagree with that assessment right now. The 43% stock decline proves investors see unsustainable risk, not visionary treasury management.

So what happens next depends on whether Saylor’s conviction outlasts the market’s skepticism. If Bitcoin rebounds strongly and Strategy’s stock follows, the whole episode becomes a masterclass in contrarian investing. If not, it becomes a cautionary tale about conflating belief with prudence.

The Monday announcement will tell us whether Saylor’s still pushing chips to the center of the table. My guess? He absolutely is.