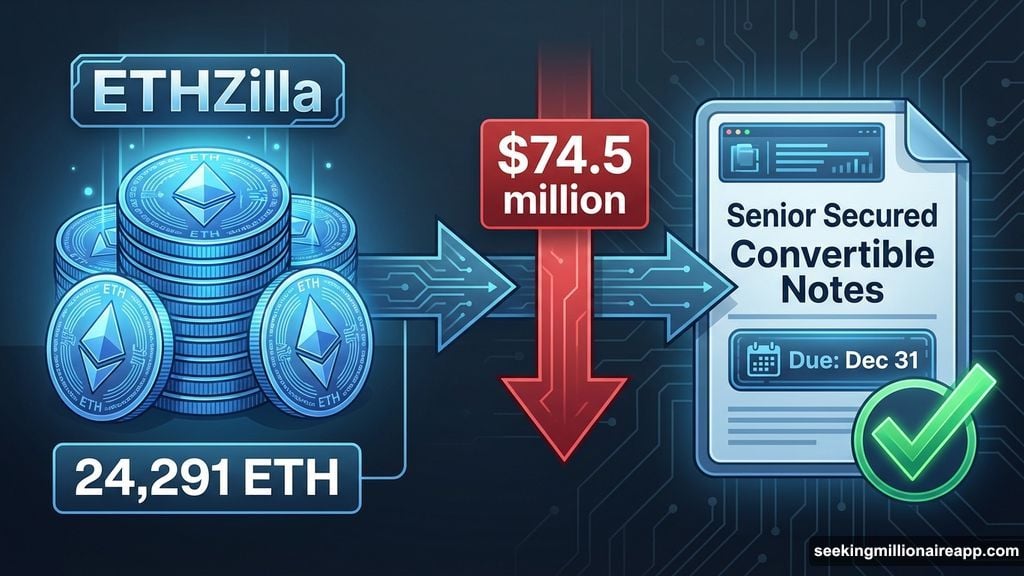

One of America’s top five Ethereum holders just sold 24,291 ETH worth $74.5 million. The move triggered immediate panic across crypto forums and social media.

But here’s the twist. This wasn’t a bearish bet against Ethereum. It was something far more mundane yet equally important for understanding how institutional crypto holders actually operate.

Let’s break down what really happened and why it matters for ETH’s near-term price action.

ETHZilla Had to Repay Debt Fast

ETHZilla didn’t sell because they lost faith in Ethereum. They sold to pay off loans coming due before New Year’s Eve.

The company held senior secured convertible notes. These are high-priority debts that demand repayment in cash, not crypto promises. So when redemption deadlines approached, ETHZilla had two choices. Sell liquid assets or default.

They chose the former. The entire $74.5 million in proceeds went straight toward debt repayment. This is standard corporate treasury management, not market speculation.

Plus, senior secured notes rank at the top of the repayment hierarchy. Companies must prioritize these obligations over almost everything else. Failing to pay triggers serious consequences including potential bankruptcy proceedings.

In other words, this sale was mechanical and predictable. Anyone tracking ETHZilla’s balance sheet could have anticipated it weeks ago.

The Company Is Pivoting Away From Pure Crypto Holdings

ETHZilla made another significant announcement alongside the sale. They’re discontinuing their net asset value dashboard that previously tracked Ethereum holdings.

Why does this matter? Because it signals a fundamental business model shift.

The company now wants investors to value them based on revenue and cash flow from real-world asset tokenization. Not based on how much ETH sits in their treasury. That’s a major strategic pivot from crypto treasury play to operating business.

Think of it like a gold mining company that decides to focus on selling pickaxes instead of mining gold. The underlying asset still matters, but it’s no longer the core value proposition.

This explains the timing perfectly. ETHZilla needed to clean up their balance sheet and retire debt before repositioning as an RWA tokenization platform. The Ethereum sale was part of corporate housekeeping, not a market call.

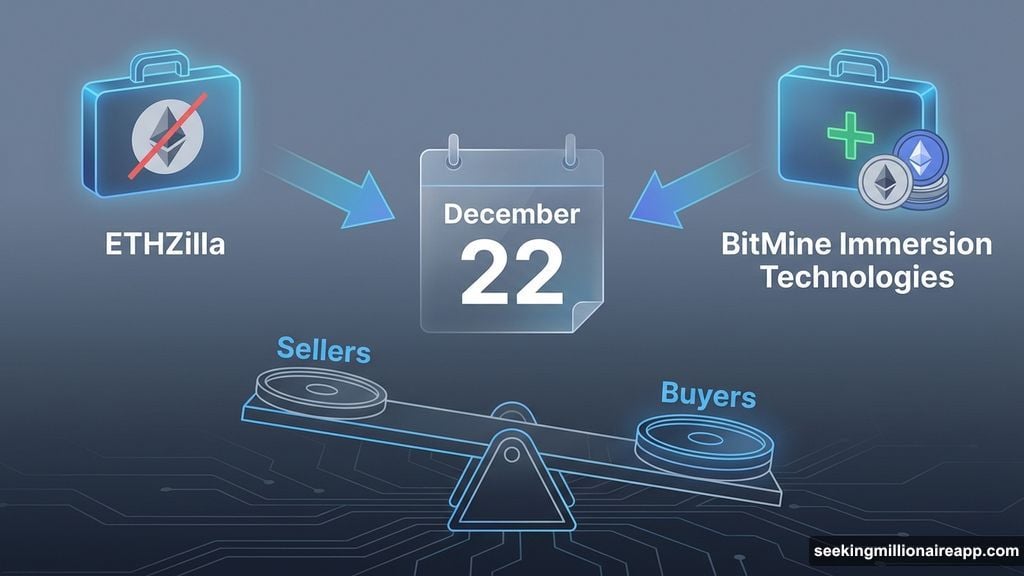

Other Whales Are Still Buying Aggressively

Here’s where the story gets interesting. While ETHZilla sold for debt reasons, other major players continue accumulating ETH.

BitMine Immersion Technologies, linked to Wall Street bull Tom Lee, bought more Ethereum on December 22. That’s the same day ETHZilla announced their sale. BitMine has been building their ETH position throughout December’s price weakness.

Meanwhile, Arthur Hayes moved millions in ETH to exchanges recently. Social media immediately screamed “Hayes is dumping.” But Hayes himself clarified he’s rotating into DeFi positions, not exiting Ethereum entirely.

So the institutional picture isn’t uniformly bearish. Instead, we’re seeing selective rebalancing. Some firms selling for specific reasons. Others buying the dip. That’s normal market behavior, not a directional exodus.

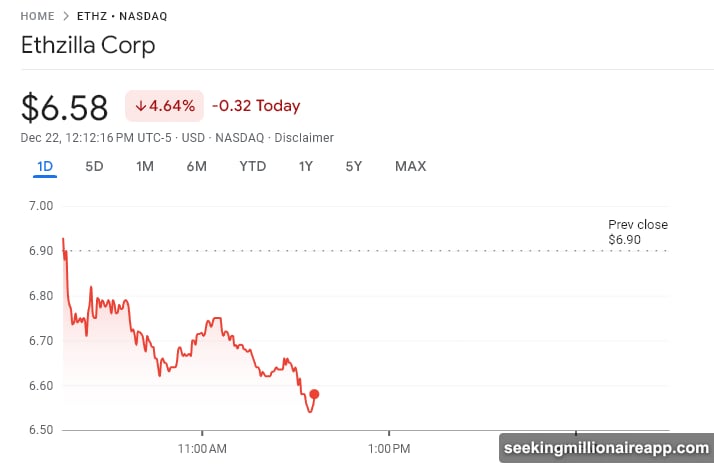

ETH Price Action Stays Range-Bound

Ethereum has traded sideways near $3,000 for weeks. The ETHZilla sale briefly pushed prices lower but didn’t break key support levels.

That makes sense. A one-time $74 million sale creates temporary selling pressure. But it doesn’t represent ongoing institutional sentiment. Once the debt repayment concludes, that selling pressure disappears completely.

Year-end liquidity tends to thin out dramatically. So any large transaction creates outsized short-term price moves. But these effects rarely persist beyond a few days once normal trading volumes return in January.

Plus, ETH already absorbed this sale. The market knew it was coming. Smart money positioned accordingly. So the actual execution didn’t cause the panic some expected.

Treasury Sales Don’t Always Mean What You Think

Most investors see “whale sells 24,000 ETH” and immediately assume bearish market outlook. But corporate treasury operations are far more complex than simple market timing.

Companies sell crypto for many reasons unrelated to price expectations. Debt obligations, regulatory requirements, operational expenses, and strategic pivots all drive sales decisions. None of these necessarily reflect views on Ethereum’s long-term value.

In fact, the most bullish scenario often involves firms selling assets to fund growth initiatives. If ETHZilla uses this capital to scale their RWA tokenization business successfully, they might eventually buy even more ETH than they sold.

That’s the overlooked angle here. Short-term selling for strategic reasons can support long-term bullish positioning. Markets rarely work in straight lines.

What This Really Tells Us About Institutional Ethereum

The ETHZilla sale reveals three important insights about institutional Ethereum holdings.

First, corporate treasury management drives more crypto transactions than pure speculation. Balance sheet discipline and debt obligations matter more than price predictions for many holders.

Second, the line between “crypto companies” and “companies using crypto” continues blurring. ETHZilla is shifting from treasury play to operating business. That trend will accelerate as crypto matures.

Third, isolated whale transactions carry less predictive value than investors assume. Without understanding the specific context and motivations, it’s impossible to extract meaningful signals from large transfers or sales.

So next time you see headlines about major ETH movements, dig deeper. The real story usually involves boring corporate finance rather than dramatic market calls.