Bitcoin just punched through $90,000 after weeks of sideways grinding. But before you start celebrating, there’s a massive derivatives event Friday that could flip this rally on its head.

The timing is brutal. Holiday liquidity is thin. Options traders are circling. And $24 billion in contracts expire December 27. So this breakout needs to prove itself fast, or we’re headed right back down.

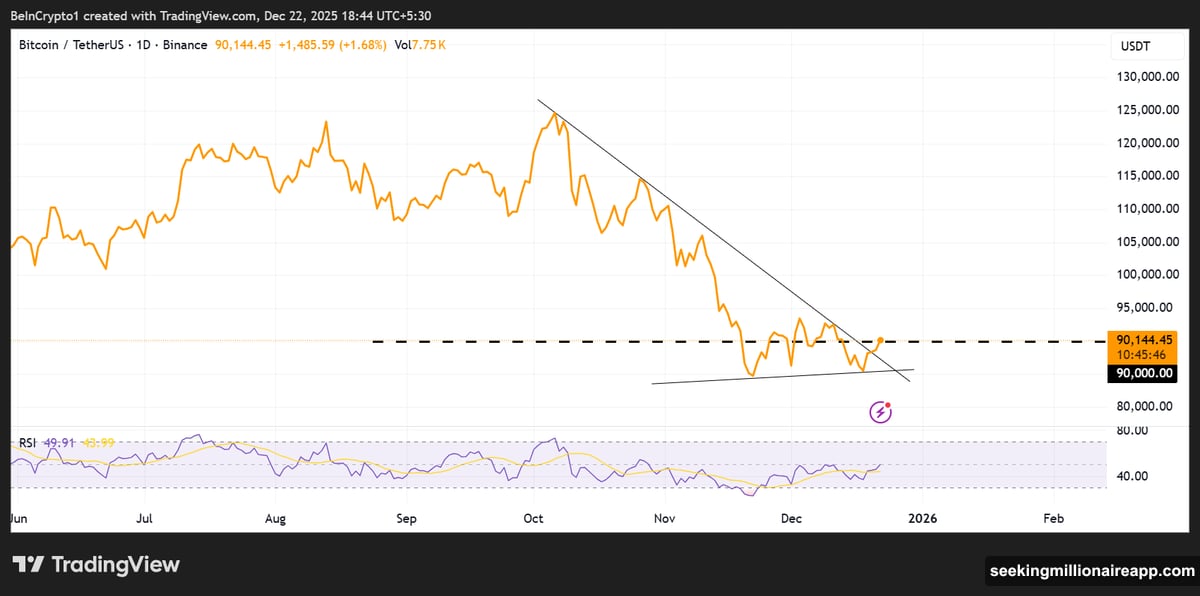

Technical Setup Shows Real Momentum Building

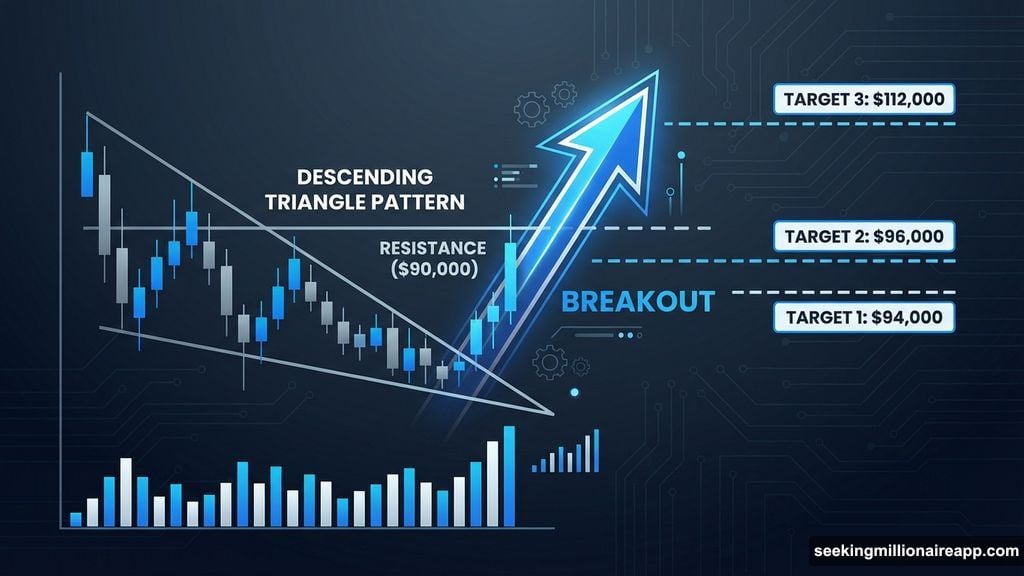

Bitcoin broke out of a descending triangle pattern on the daily chart. That’s a bullish continuation signal when it happens during an uptrend.

The move pushed BTC decisively above $90,000. Now resistance sits around $94,000. If bulls can reclaim that level, the next stop is $96,000, where options max pain sits.

Here’s what matters. The pattern wasn’t just a clean breakout. Momentum built gradually as Bitcoin formed higher lows inside the triangle. That suggests buying pressure accumulated before the move, not just a quick squeeze.

Plus, volume confirmed the breakout. That’s crucial because fake breakouts typically happen on weak volume. This one had follow-through.

However, liquidity is building around $90,800 according to on-chain data. If Bitcoin rejects there, shorts could pile in fast. So the next 48 hours will show whether bulls have real conviction or just got lucky with timing.

On-Chain Data Signals Room to Run

Bitcoin’s realized price sits at $56,000. That’s the average price where all BTC was last bought or moved on-chain.

Current trading price around $90,000 puts Bitcoin well above realized value. But historically, BTC doesn’t hit cycle tops until it reaches 4x realized price. That level sits around $225,000.

The mid-band at 2x realized price ($112,000) typically acts as resistance during bull runs. So Bitcoin has plenty of room before hitting those historical ceiling levels.

Moreover, the gap between market price and realized price shows profit-taking hasn’t reached panic levels yet. When Bitcoin approaches cycle peaks, this spread typically widens dramatically as late buyers chase the top.

Right now, the ratio suggests cautious optimism, not euphoria. That’s actually bullish because it means the rally has room to breathe before overheating.

Friday’s Options Expiry Could Trigger Chaos

Here’s where things get dicey. $24 billion in Bitcoin options expire December 27 on Deribit. That’s 50% of the exchange’s open interest vanishing in one day.

Call options outnumber puts by 2.6 to 1. On paper, that looks bullish. But there’s a catch. Max pain sits at $96,000. That’s the price where option holders lose the most money collectively.

Theory suggests dealers will try to pin Bitcoin near that level to maximize losses for option buyers. So we could see violent swings as the expiry approaches, especially during thin holiday trading.

Plus, Friday is Christmas week. Liquidity dries up. Volatility explodes. A few large orders can move prices 2-3% in minutes when everyone’s away from their desks.

Smart traders are watching $90,800 closely. If Bitcoin grabs that liquidity and rejects hard, shorts will pile in. But if bulls push through $94,000 resistance, a squeeze toward $96,000 becomes likely.

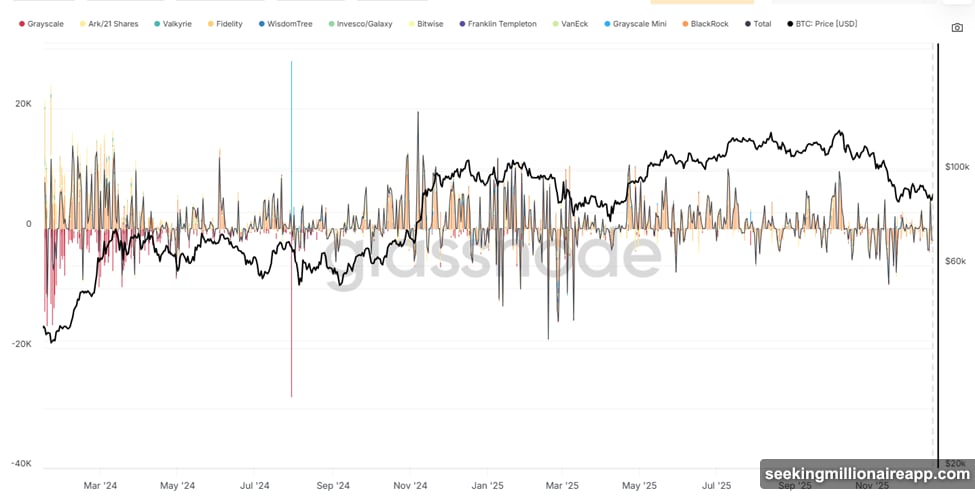

ETF Positioning Creates Year-End Incentives

Spot Bitcoin ETF buyers sit at an average entry price around $83,000. That means most institutional holders are comfortably in profit right now.

But here’s the thing. Fund managers want to show strong year-end performance. A close above $100,000 would make 2025 returns look incredible on quarterly reports.

So there’s real incentive to pump prices into year-end. Not manipulation. Just managers doing what managers do when performance bonuses are on the line.

ETF flows have been relatively stable lately. No massive inflows, but no panic selling either. That steady demand provides a floor under prices even as retail traders chase momentum.

However, institutional money moves slow. If volatility spikes Friday, don’t expect ETF buyers to rescue the market immediately. They plan positions weeks in advance, not hours.

Resistance at $94,000 Is the Real Test

Bitcoin reclaiming $90,000 is nice. But $94,000 is where the real battle happens.

That level held as support multiple times during Bitcoin’s previous consolidation phase. Now it’s flipped to resistance. Breaking back above would confirm strength and open a path toward $100,000.

Analyst Ran Neuner thinks Bitcoin could close the year very close to, if not above, six figures. His logic: too many players are incentivized to push for strong performance numbers.

Maybe. But $94,000 resistance is thick. Order books show significant sell walls there. Unless demand picks up dramatically, grinding through could take days.

The alternative? Bitcoin rejects at $94,000, pulls back to retest $86,500 support, and consolidates into January. Not bearish necessarily. Just realistic given holiday conditions and options dynamics.

What January Could Bring

Michael van de Poppe, a prominent analyst, believes Bitcoin held crucial support at $86,500 and is now grinding higher. He sees this as the early stage of a broader bull market.

His key question: will altcoins outperform Bitcoin next? That could determine whether this rally evolves into a full-blown market-wide run or stays contained to BTC.

Historically, altcoin season begins when Bitcoin consolidates after a strong move. Money rotates from BTC into higher-risk assets chasing bigger percentage gains.

We’re not there yet. Bitcoin dominance remains elevated. But if BTC holds above $90,000 through January, altcoins could finally catch a bid.

Looking further out, Galaxy Digital forecasts remain unclear for 2026. But 2027? They’re more optimistic, though specifics weren’t disclosed.

Right now though, focus stays on this week. Can Bitcoin hold $90,000 through Friday’s options chaos? That answer will set the tone for everything coming next.

The setup is there. Technicals look good. On-chain metrics are healthy. But derivatives markets don’t care about fundamentals when billions expire in thin liquidity.

Watch $94,000. If bulls take it, $100,000 becomes realistic. If not, we’re back to waiting through January consolidation.