Most altcoin investors finished 2025 without profits. Prices dropped 30% from their peaks. Your portfolio probably looks rough right now.

But here’s the twist. Many crypto analysts believe this marks the final phase of the altcoin bear market. Not another fake rally or temporary bounce. The actual bottom.

So what makes them confident when everything looks terrible? Three key signals point to a potential turnaround ahead.

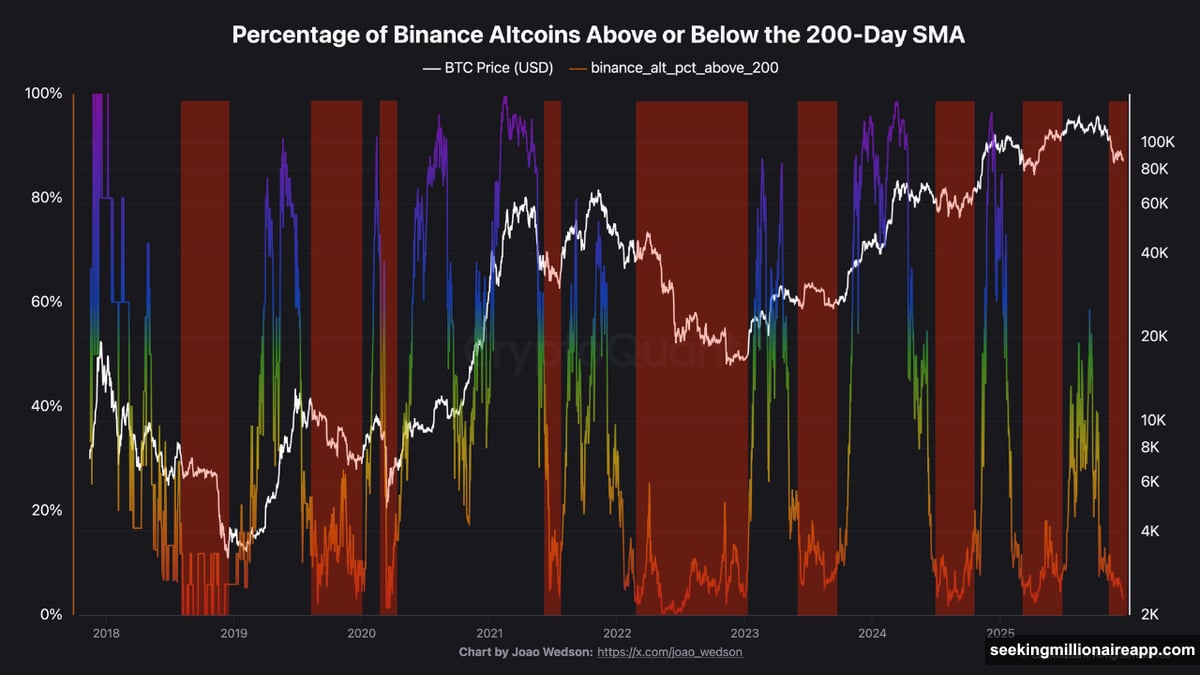

Only 3% of Altcoins Trade Above Key Averages

CryptoQuant data reveals something striking. Just 3% of altcoins on Binance currently trade above their 200-day moving average. That’s a historical low.

Why does this matter? The 200-day moving average acts as a long-term health indicator. When prices fall below it, assets enter oversold territory. When most of the market sits this far underwater, it often signals extreme undervaluation.

CryptoQuant analyst Darkfost attributes this to defensive investor behavior. Traders prioritize protecting capital over taking risks right now. Plus, liquidity dried up across the market.

Yet history shows that periods of maximum pain often create the best opportunities. When nearly everything trades at multi-year lows, patient investors find attractive entry points.

“Even though it may seem counterintuitive, these types of periods often offer the best opportunities,” Darkfost explained.

Strong fundamentals haven’t saved prices either. Recent analysis shows that altcoins like XRP, TON, and ADA maintain solid technical foundations. But their prices still haven’t recovered. That disconnect between value and price often marks market bottoms.

Retail Fear Creates Accumulation Zones

Here’s a counterintuitive truth about crypto markets. The best buying opportunities appear when retail investors lose interest completely.

Prominent analyst CrediBULL Crypto highlighted this pattern recently. Markets don’t move on capital first. They move on attention. And attention follows price action.

“Capital isn’t scarce—attention is,” CrediBULL noted. “The number one driver of attention is when ‘number go up’ quickly.”

So what happens at market bottoms? Retail investors check out entirely. They stop watching prices, reading news, and checking their portfolios. Meanwhile, large investors quietly accumulate at depressed prices.

Then small green candles start appearing. Retail attention gradually returns. As more people notice the recovery, participation accelerates. That creates the momentum needed for the next bull phase.

Right now, retail interest sits at multi-year lows. Social media chatter about altcoins dropped significantly. Trading volumes remain weak. All signs point to the disinterest phase that often precedes major moves.

Technical Indicators Show Strong Support

Multiple technical signals suggest altcoins reached critical support levels. Market analyst Michaël van de Poppe identified current market capitalization zones as “areas to hold.”

He pointed to strong bounces from these levels as evidence. When prices repeatedly test support without breaking lower, it suggests buyers are stepping in. That accumulation activity often marks the transition from bear to bull markets.

Moreover, broader metrics reinforce this outlook. The altcoin market cap ratio (excluding the top 10 projects) versus Bitcoin sits at its strongest support since 2017. Back then, this level preceded a massive rally.

Similarly, altcoin dominance currently matches levels seen during the COVID crisis period. That moment also marked a major bottom before strong recoveries followed.

These technical setups don’t guarantee immediate upside. But they indicate that significant downside may be limited. For investors using dollar-cost averaging strategies, December could mark an advantageous starting point.

Risk Factors Remain Present

Not everyone shares the optimistic outlook. Some analysts warn that altcoin season might skip 2026 entirely.

The main concern? Venture capital inflows remain weak. Crypto startups struggle to raise funds. Without fresh capital entering the ecosystem, sustained rallies become harder to achieve.

Additionally, market sentiment recovery takes time. Even if technical bottoms form, psychological wounds heal slowly. Investors burned by previous cycles often sit on the sidelines for extended periods.

Regulatory uncertainty adds another layer of risk. Governments worldwide continue developing crypto frameworks. Unclear rules make large institutions hesitant to deploy capital into altcoins.

So while multiple signals suggest a bottom, the path forward isn’t guaranteed. Recovery could take months or even years. Investors should prepare for continued volatility.

What This Means for Your Strategy

Consider these points when planning your approach. First, extreme undervaluation doesn’t equal immediate recovery. Markets can remain oversold longer than expected.

Second, accumulation phases favor patient capital. Dollar-cost averaging into quality projects during fear periods historically produces strong returns. But it requires enduring short-term losses without panic selling.

Third, not all altcoins will recover equally. Projects with strong fundamentals, active development, and real utility stand better chances. Speculative tokens without substance may never bounce back.

Finally, position sizing matters more than perfect timing. If analysts prove correct and this marks the final bear market stage, small positions started now could perform well. But if they’re wrong, manageable losses won’t devastate portfolios.

Watch for confirmation signals. Rising trading volumes, breaking above key resistance levels, and sustained attention increases would validate the bottom thesis. Until then, proceed carefully but stay alert for opportunities.