BlackRock doesn’t care about Bitcoin’s daily rollercoaster. They just doubled down anyway.

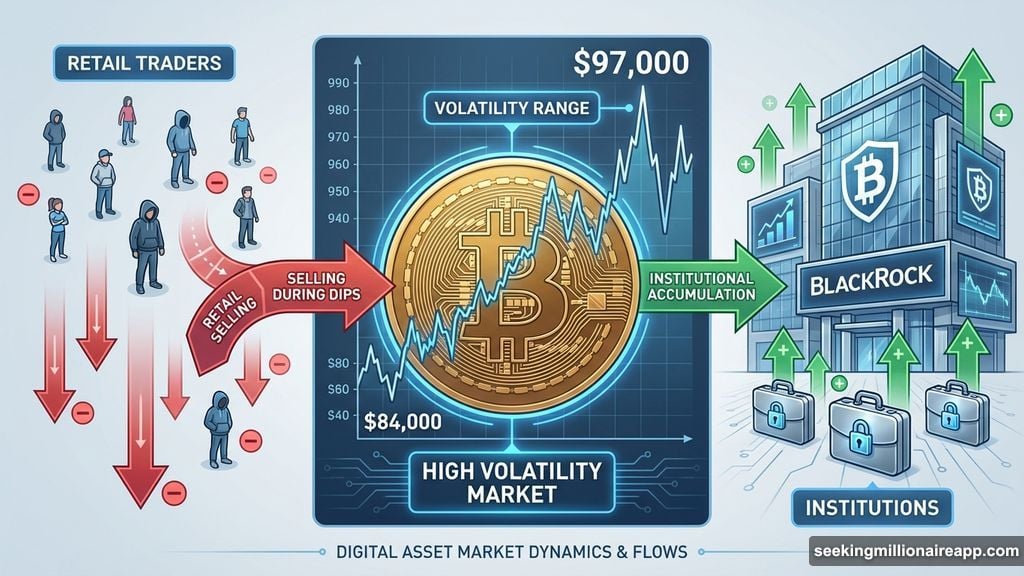

The world’s largest asset manager included its spot Bitcoin ETF among three primary investment themes for 2025. That’s bold. Especially since BTC keeps bouncing around like a pinball between $84,000 and $97,000. So what does BlackRock see that spooked retail investors are missing?

The Money Tells a Different Story

Bitcoin’s price jumped 8% this week to $87,400. Yet half the trading days in December saw ETF outflows. Sounds contradictory until you zoom out.

BlackRock’s Bitcoin ETF pulled in $29.6 billion this year alone. Total cumulative inflows since launch hit $62.5 billion. Those numbers don’t lie. Institutions keep buying despite volatility that scares smaller traders.

Meanwhile, Monday brought $142 million in net outflows across all Bitcoin ETFs. That stings. But compare daily swings against year-to-date accumulation. The long-term trend overwhelms short-term noise.

Here’s what’s actually happening. Retail traders panic on red days. Institutional buyers accumulate on dips. Plus, BlackRock manages $10 trillion in assets. They’re playing a different game with a longer clock.

Futures Traders Are Getting Aggressive

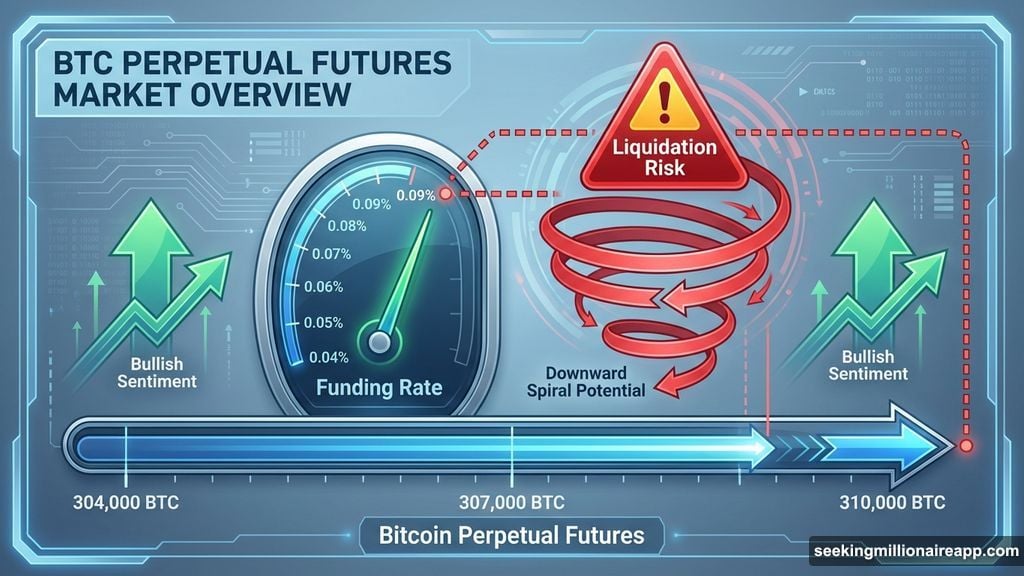

Derivatives markets tell an interesting tale. Bitcoin perpetual futures open interest jumped from 304,000 BTC to 310,000 BTC as price reclaimed $90,000. That’s a 2% increase in leveraged long positions.

Funding rates climbed too. They moved from 0.04% to 0.09%. Translation? Traders are paying premiums to hold long positions. That signals bullish sentiment among sophisticated players.

But there’s a catch. Higher leverage means higher risk. If Bitcoin stumbles below key support levels, those positions could unwind fast. Leveraged liquidations create nasty downward spirals.

So the futures market shows growing optimism. Yet it also sets up potential volatility bombs. Christmas week historically brings thin liquidity. That amplifies both gains and losses.

The Technical Setup Looks Promising

Bitcoin sits just below $88,210 resistance at the time of writing. Breaking through that level could trigger a run toward $90,308. Seasonal factors might help push price higher.

Christmas trading weeks often see increased inflows. Lower volume can magnify upward moves when demand appears. Plus, year-end portfolio rebalancing sometimes creates buy pressure for winning assets.

However, downside risks remain real. Losing $86,247 support would weaken the recovery structure. That could send BTC toward $84,698. Such a move would validate bears and punish overleveraged longs.

The key resistance sits at $88,210. Reclaim that level convincingly and short-term momentum improves. Fail there and we’re stuck in the current range. It’s that simple.

Why BlackRock’s Endorsement Actually Matters

Asset managers don’t make “top 3 investment theme” calls casually. BlackRock runs money for governments, pensions, and sovereign wealth funds. Their recommendations carry weight.

This endorsement signals Bitcoin has crossed into mainstream institutional acceptance. Not as a speculative gamble. As a legitimate portfolio allocation that belongs alongside traditional assets.

Moreover, BlackRock’s long-term focus contrasts sharply with crypto’s short-term obsession. Daily price charts mean nothing to managers thinking in decades. They’re accumulating through volatility, not trading around it.

The timing is notable too. They could have waited for clearer price trends. Instead, they’re making this call during uncertainty. That suggests conviction beyond technical analysis.

The Disconnect Between Spot and Futures

Spot ETFs are bleeding while futures positioning expands. That disconnect reveals something important about market structure.

Retail investors dominate spot ETF flows in the short term. They react emotionally to price swings. So they sell on red days and buy on green days. Classic weak-hand behavior.

Futures traders are typically more sophisticated. They use leverage strategically. Rising open interest and funding rates suggest professional traders are positioning for upside while retail panics.

This dynamic creates opportunity. When retail fear peaks and professionals stay bullish, reversals often follow. We’re not quite there yet. But the setup is forming.

What This Means for Q1 2025

Bitcoin faces a critical test at year-end. Holding $86,000 support while building momentum toward $90,000 would confirm the recovery structure. Breaking down would extend consolidation into Q1.

BlackRock’s endorsement provides a fundamental anchor. Even if price wobbles, institutional accumulation continues. That creates a floor under price over time.

Plus, seasonal factors could help. January often brings strong crypto performance as institutional money flows back after holidays. If that pattern holds, Bitcoin could start 2025 with momentum.

The futures positioning adds fuel. Those leveraged longs need price to cooperate. A move toward $90,000 could trigger aggressive buying as traders chase momentum. But a breakdown creates the opposite.

The Real Risk Nobody’s Talking About

Leverage cuts both ways. Rising open interest creates upside potential. But it also builds fragility. A sudden move below $86,000 could trigger cascading liquidations.

That scenario would send Bitcoin toward $80,000 or lower. Leveraged positions would unwind. Fear would spread. Even long-term holders might question their thesis during a violent selloff.

Moreover, ETF outflows could accelerate if price breaks support convincingly. Retail investors have short memories. They forget accumulation patterns when losses appear.

So the setup is binary. Either Bitcoin breaks higher and leveraged longs profit. Or it breaks lower and liquidations create a washout. The middle ground won’t last much longer.

Why I’m Watching $88,210

That resistance level determines the short-term narrative. Break through and momentum traders pile in. Fail there and we retest lower support.

Christmas week’s thin liquidity amplifies the impact of any breakout. A genuine move above $88,210 on decent volume could spark a quick run to $90,000. That would validate the bullish thesis and reward positioned traders.

Conversely, rejection at resistance would disappoint bulls. It would suggest supply remains strong. That could trigger profit-taking and send price back toward range lows.

The next 10 days matter more than usual. Year-end positioning, holiday liquidity, and leveraged exposure all converge. Bitcoin will likely make a decisive move one direction or another.

BlackRock’s endorsement provides the fundamental case. Now price action needs to confirm the technical setup. We’ll know soon enough which way this breaks.