Bitcoin spent two weeks trapped between $85,000 and $90,000. Bulls tried pushing higher. Bears tried forcing it lower. Neither succeeded.

The reason isn’t weak demand or macro fear. It’s pure derivatives mechanics. Options dealers control $507 million in gamma exposure right now. That’s 13 times bigger than daily ETF flows. These hedging forces mechanically pin Bitcoin in place through forced buying and selling.

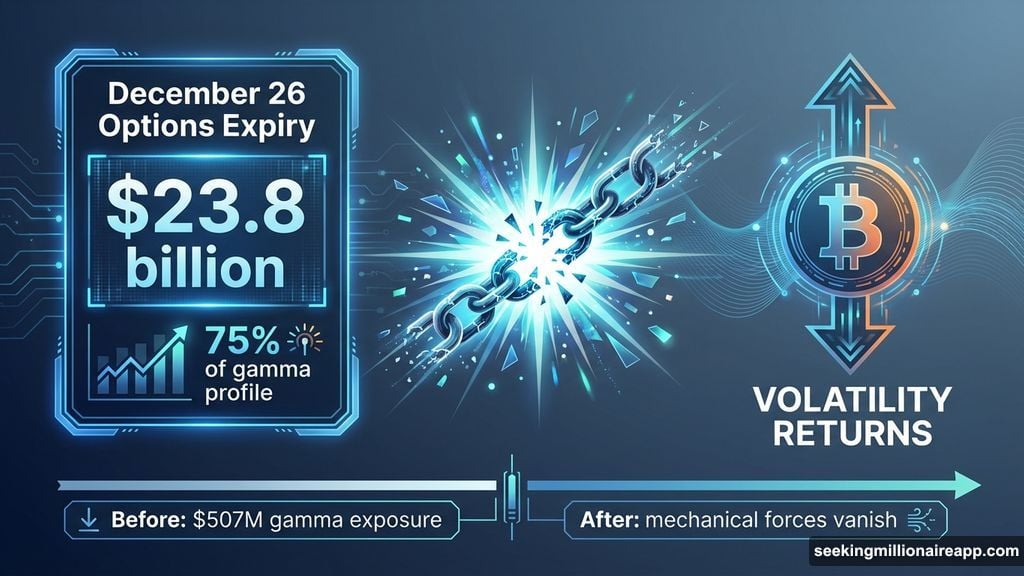

But the trap expires in two days. On December 26, roughly $23.8 billion in Bitcoin options roll off. That removes 75% of the gamma profile currently suppressing price movement. The artificial equilibrium holding Bitcoin hostage since mid-December disappears.

What happens next depends on where Bitcoin sits when those mechanical forces vanish.

Dealer Gamma Creates Artificial Price Ceiling

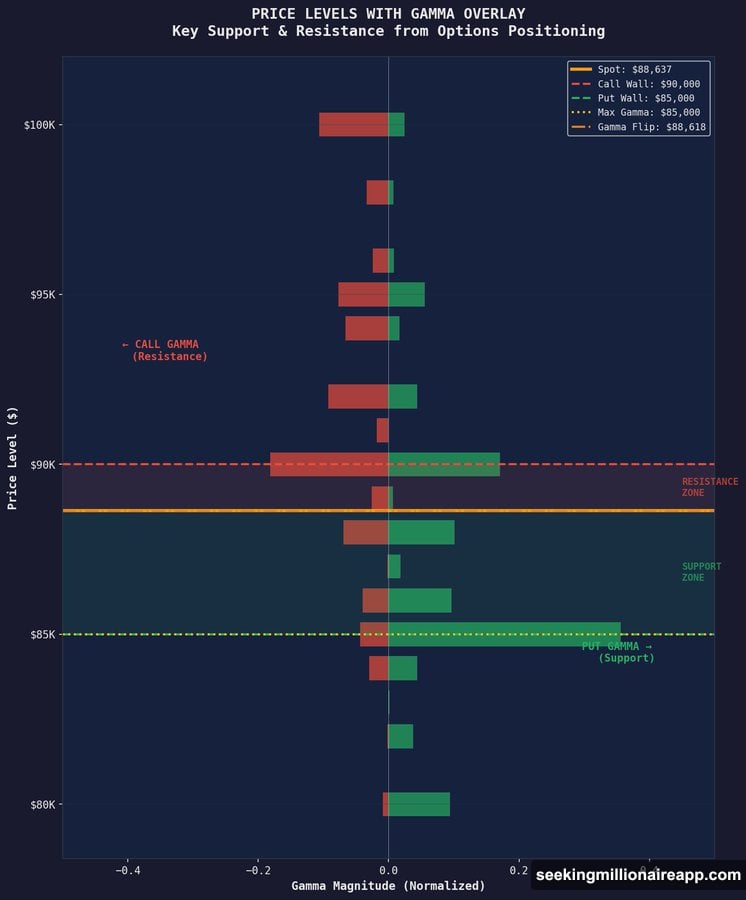

The $90,000 level acts like an invisible wall. Every rally attempt hits resistance at the same spot. The culprit is concentrated call option positioning.

Dealers sold massive amounts of call options at the $90,000 strike. As Bitcoin approaches that level, they must sell spot Bitcoin to hedge their exposure. This creates what looks like organic selling pressure. In reality, it’s forced supply from derivatives hedging.

Every push toward $90,000 triggers this mechanical selling flow. That explains why breakout attempts keep failing. It’s not bearish sentiment. It’s math.

The gamma flip level sits around $88,000 right now. Above this threshold, market makers holding short gamma positions must sell into rallies and buy dips. This behavior dampens volatility and pulls price back toward the range middle.

Below the flip level, the mechanics reverse. Selling feeds on itself as dealers hedge in the same direction as price movement. That amplifies volatility instead of suppressing it.

Put Positioning Creates Floor at $85,000

The downside works exactly opposite. The $85,000 level has held as reliable support through the inverse mechanism.

Heavy put option positioning at this strike means dealers must buy spot Bitcoin as price drops toward that level. This forced demand absorbs selling pressure. It prevents sustained breakdowns.

So the market appears stable on the surface. But it’s actually held in artificial equilibrium by opposing hedging flows. The $85,000 support isn’t conviction. It’s mechanical buying from options dealers protecting their positions.

This creates a range-bound market that frustrates both directional traders. Neither bulls nor bears can win while these forces remain active. Price bounces between the walls like a pinball.

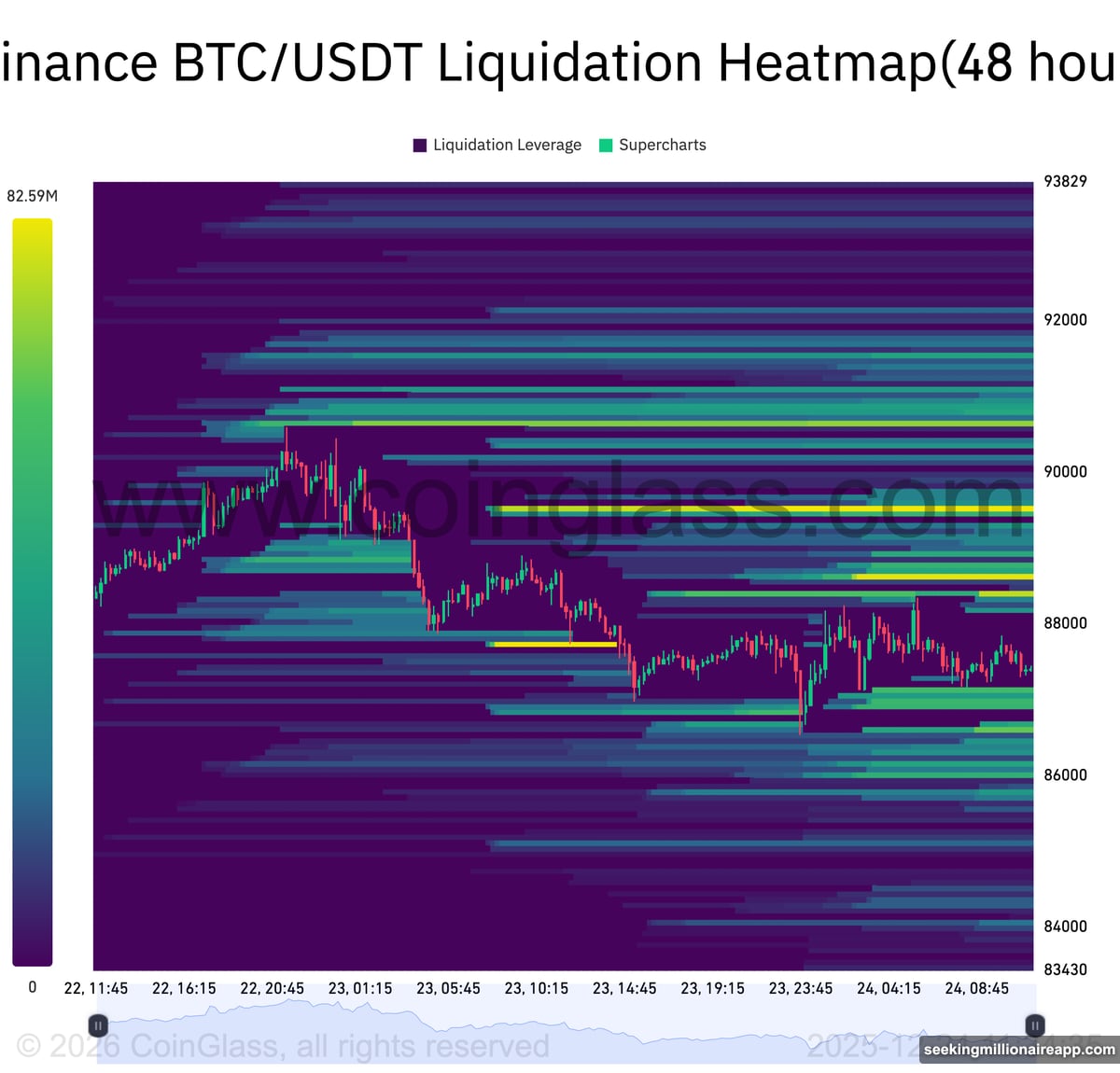

Futures Liquidations Reinforce the Range

The options-driven range doesn’t operate alone. Liquidation heatmap data from Coinglass shows leveraged futures positions clustered around identical price levels.

Above $90,000, significant short liquidation levels accumulated. If price breaks through this ceiling, forced short covering would trigger cascading buy orders. That could accelerate the move higher.

Conversely, long liquidation levels concentrate below $86,000. A breakdown would accelerate as leveraged longs get stopped out. That would feed selling momentum.

Both options dealer hedging and futures liquidation mechanics now align. They double the structural pressure keeping Bitcoin trapped in its current corridor. Two separate derivative forces working toward the same outcome.

December 26 Expiry Removes the Trap

The upcoming options expiry represents the largest in Bitcoin’s history. Approximately $23.8 billion in notional value rolls off on December 26.

For comparison, annual expiries totaled roughly $6.1 billion in 2021. That grew to $11 billion in 2023 and $19.8 billion in 2024. The rapid expansion reflects increasing institutional participation in Bitcoin derivatives markets.

According to analyst NoLimitGains, roughly 75% of the current gamma profile disappears after this expiry. The mechanical forces pinning price in the $85,000-$90,000 range essentially vanish.

This doesn’t guarantee a specific direction. It simply means Bitcoin becomes free to move. The suppression mechanism ends.

Gamma Exposure Overwhelms Spot Demand

The scale of dealer hedging activity currently overwhelms spot market demand. Data shows dealer gamma exposure at approximately $507 million. Daily ETF activity registers just $38 million.

That’s a ratio of roughly 13 to 1. This imbalance explains why Bitcoin ignored seemingly bullish catalysts over the past weeks. The math of dealer hedging matters more than narratives about institutional adoption.

Until the derivatives overhang clears, mechanical forces dominate. Spot buying pressure can’t overcome $500 million in gamma controlling market maker behavior. The tail wags the dog.

But once that gamma disappears on December 26, the math flips. Spot demand and actual market conviction return to the driver’s seat.

What Happens After Expiry

Once the December 26 expiry passes, the suppression mechanism dies. Bitcoin gets freedom to move based on actual supply and demand dynamics instead of derivatives hedging.

If bulls successfully defend $85,000 support through expiry, a breakout toward $100,000 becomes structurally possible. The ceiling at $90,000 no longer has mechanical selling pressure reinforcing it. Price can push through.

Conversely, a break below $85,000 in a low-gamma environment could accelerate downside. The mechanical buying that previously defended that level disappears. Selling pressure would face less resistance.

Traders should expect elevated volatility heading into early 2026. New positioning establishes itself after the expiry. The range-bound price action of recent weeks represents a temporary phenomenon driven by derivatives mechanics.

It doesn’t reflect underlying market conviction. That conviction gets tested once the artificial constraints lift. We’ll discover what Bitcoin actually wants to do without dealer gamma forcing it into a narrow range.

The next 48 hours determine whether Bitcoin breaks out or breaks down. But either way, the two-week prison sentence ends December 26.