Ethereum fell 3% this week. But major investors just poured hundreds of millions into ETH anyway.

That’s a weird split. Retail traders see red candles and panic. Meanwhile, institutions and whales are backing up the truck. The contrast tells us something important about who’s thinking short-term versus long-term.

Let’s break down who’s buying, who’s selling, and what it means for Ethereum’s next move.

BitMine Drops $200 Million on ETH in One Day

BitMine Immersion Technologies made the biggest splash. The firm bought 67,886 ETH worth roughly $201 million in a single purchase.

That wasn’t a one-off move. Just one day earlier, BitMine grabbed another 29,462 ETH valued at $88.1 million from BitGo and Kraken. So they dropped nearly $290 million on Ethereum in 48 hours.

Plus, last week alone BitMine accumulated 98,852 ETH total. Their holdings now exceed 4 million ETH. At current prices around $2,929, that position is worth over $11 billion.

Here’s the interesting part. BitMine’s average entry sits at $2,991. They’re basically at breakeven right now. But they’re still buying aggressively. That signals conviction, not speculation.

Most traders would pause after watching their position dip underwater. BitMine doubled down instead. That’s the behavior of someone expecting much higher prices long-term.

Trend Research Adds $135 Million Despite Massive Losses

Trend Research led by Jack Yi, founder of LD Capital, also jumped in hard. The firm acquired 46,379 ETH today, pushing their total holdings to roughly 580,000 ETH.

They’ve been accumulating since early November when ETH traded around $3,400. Their average cost sits near $3,208. So at today’s price of $2,929, they’re sitting on unrealized losses of approximately $141 million.

Yet they’re not stopping. Yi announced publicly that the firm is preparing another $1 billion for future ETH purchases. He even advised against shorting Ethereum.

Think about that strategy. Most investors would cut losses after being down $141 million. Instead, Trend Research is preparing to deploy another billion dollars. That’s either extreme confidence or extreme stubbornness.

The crypto market tends to reward that kind of conviction during bear phases. But it can also destroy accounts if the thesis breaks.

Large Whales Use Leverage to Maximize Exposure

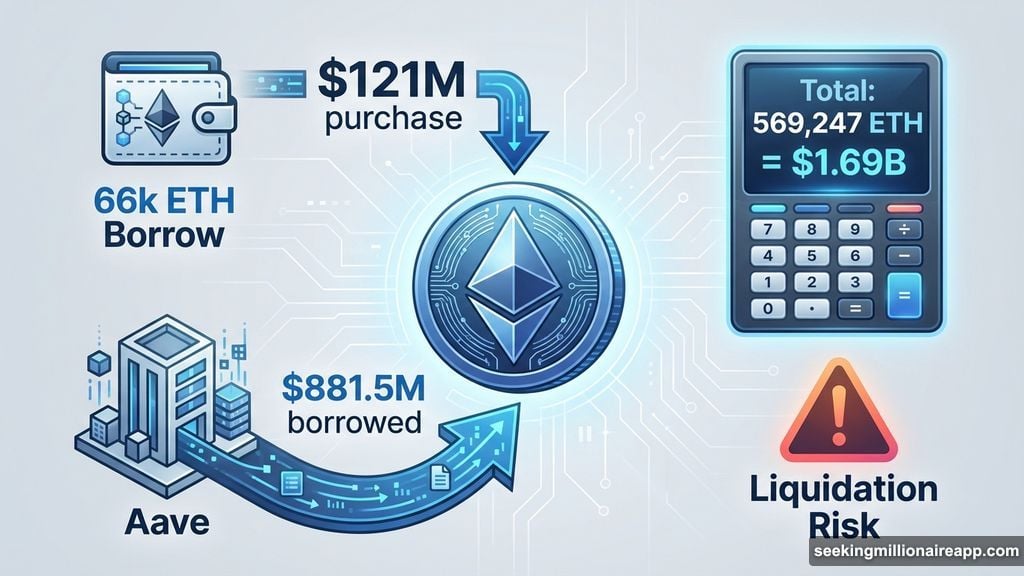

Individual whales are also active. One wallet known as “66k ETH Borrow” added another 40,975 ETH worth roughly $121 million.

This whale has accumulated 569,247 ETH totaling $1.69 billion since November 4. Here’s the aggressive part. They borrowed $881.5 million from Aave to fund these purchases.

That’s leveraged buying at scale. The whale is betting that ETH will rise enough to cover borrowing costs and generate profit. If Ethereum drops significantly, that position faces liquidation risk.

Meanwhile, Fasanara Capital took a similar approach. The firm bought 6,569 ETH worth $19.72 million over two days. Then they deposited it into the Morpho protocol and borrowed $13 million USDC to buy even more Ethereum.

These leveraged strategies amplify both gains and losses. They signal extreme confidence in near-term price recovery. But they also increase systemic risk if prices continue falling.

Some Big Players Are Rotating Out

Not everyone’s buying. Arthur Hayes, co-founder of BitMEX, sent 682 ETH worth approximately $2 million into Binance today.

He’s sold 1,871 ETH totaling $5.53 million this week. But he’s not exiting crypto entirely. Instead, he’s rotating into DeFi tokens like Ethena (ENA), Pendle (PENDLE), and ETHFI.

Hayes explained his thinking publicly. “We are rotating out of ETH and into high-quality DeFi names, which we believe can outperform as fiat liquidity improves.”

That’s a sector rotation, not capitulation. He still believes crypto will rally. He just thinks DeFi tokens offer better risk-reward right now.

Another major holder, known as the “Bitcoin OG whale,” deposited 100,000 ETH worth approximately $292 million into Binance. Large exchange deposits usually signal potential selling, though they don’t always result in immediate liquidation.

ETHZilla also offloaded 24,291 ETH for roughly $74.5 million to repay senior secured convertible debt. That was forced selling due to obligations, not a bearish call.

Long-Term Holders Stop Selling Almost Entirely

Here’s the most bullish signal buried in the data. Selling activity among long-term Ethereum holders collapsed by more than 95%.

That’s massive. Long-term holders are typically the smart money. They understand market cycles. When they stop selling during price weakness, it suggests they expect higher prices ahead.

This pattern has played out before. In previous cycles, long-term holder capitulation marked bottoms. When they finally stopped selling, prices reversed shortly after.

We’re seeing the opposite now. Long-term holders are holding firm despite short-term pain. Some are even accumulating more. That creates a supply squeeze if demand returns.

Short-term holders and traders might panic sell. But the supply held by long-term investors remains locked up. That sets up potential explosive moves if buying pressure increases.

The Split Between Weak Hands and Strong Hands

Two different groups are making opposite bets right now.

Weak hands see Ethereum down 3% this week and 32% from its 2024 high. They’re cutting losses or avoiding entry. The price action scares them away.

Strong hands see the same data and accelerate buying. BitMine, Trend Research, and leveraged whales are deploying hundreds of millions. They’re treating this as a discount.

This divergence happens at inflection points. Either the smart money is catching a falling knife, or they’re front-running the next leg up.

History suggests betting with the smart money works more often than betting against it. Retail investors tend to sell bottoms and buy tops. Institutions usually do the opposite.

The risk is timing. Even if the smart money is right directionally, the bottom could still be weeks or months away. Leveraged positions could get liquidated before the thesis plays out.

What Happens Next

Ethereum faces a test. Can it hold support near $2,900, or does it break lower toward $2,700?

The smart money is betting on recovery. They’re positioning for higher prices in 2025. But markets don’t care about anyone’s thesis. Price action determines winners and losers.

If you’re watching from the sidelines, pay attention to these large buys. When institutions deploy hundreds of millions during weakness, they usually know something retail doesn’t.

But also watch for continued whale deposits into exchanges. If the Bitcoin OG whale actually sells that 100,000 ETH, it could create significant downward pressure.

The next few weeks will reveal whether this accumulation strategy pays off or becomes a cautionary tale. Right now, the smart money is all-in. Time will tell if they’re early or just wrong.