Bitcoin’s recent price action feels off. The asset that historically rallies on cooling inflation just shrugged off a CPI drop to 2.7%. Instead of climbing, it stalled while capital rotated into gold and silver.

That disconnect caught the attention of Jurrien Timmer, Fidelity’s Director of Global Macro. His warning: Bitcoin likely peaked in October, both in price and timing. Plus, the on-chain data since then increasingly supports that grim view.

The question isn’t whether Bitcoin will recover long-term. It’s whether we’re already deep into a bear phase that most investors haven’t acknowledged yet.

Stablecoin Inflows Collapsed After October Peak

Stablecoins act as dry powder for crypto rallies. That fuel has vanished.

Total exchange inflows for ERC-20 stablecoins peaked at 10.2 billion on August 14. By December 24, inflows had crashed to roughly 1.06 billion. That’s a 90% drop in fresh capital ready to deploy.

Moreover, that August peak came right before Bitcoin’s October high above $125,000. The same period Timmer identified as the likely cycle top. Since then, new money has stayed away entirely, reinforcing the idea that distribution replaced accumulation after the peak.

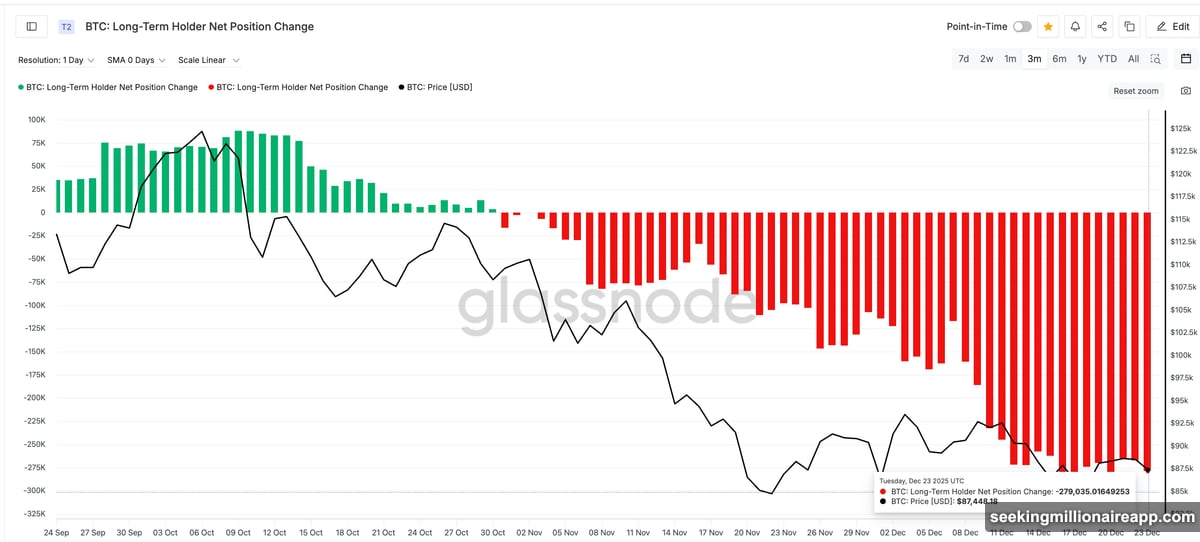

Long-Term Holders Started Aggressive Selling

Conviction holders behave differently now. Bitcoin long-term holder position changes flipped negative shortly after October.

Selling accelerated dramatically. Daily distribution pressure jumped from roughly 16,500 BTC in late October to around 279,000 BTC recently. That’s a 1,500% increase in selling from the market’s most committed holders.

These holders typically weather volatility and accumulate during weakness. Instead, they’re reducing exposure aggressively. That aligns perfectly with Timmer’s thesis that the four-year halving cycle phase ended in October. Smart money appears to agree, exiting rather than defending price.

Bitcoin Dominance Rises for Wrong Reasons

Bitcoin dominance climbed back toward 57-59%, but this isn’t a risk-on signal. After the softer CPI print, capital didn’t rotate into Bitcoin. Instead, it flowed into traditional hedges.

Over the past year, silver rallied over 120% while gold gained roughly 65%. Meanwhile, broader crypto markets lagged badly. In fact, a $10,000 investment at the start of 2025 would have returned $23,000 in silver, $16,500 in gold, but only $9,400 in Bitcoin.

Ray Youssef, founder and CEO of NoOnes, explained why gold won the 2025 debasement trade while Bitcoin remained range-bound. “Gold’s recent run to new all-time highs and 67% year-to-date gains reflect classical defensive investor positioning,” he noted. “Bitcoin, by contrast, has failed to deliver on the hedge narrative. The asset has not traded like digital gold in 2025.”

Bitcoin’s rising dominance isn’t being driven by fresh risk appetite. Instead, capital is retreating into relative safety within crypto as money exits altcoins even faster.

Mega Whales Quietly Reduce Positions

Large holders are stepping back too. The number of Bitcoin addresses holding more than 10,000 BTC fell from 92 in early December to 88. That decline came alongside falling prices, not accumulation.

These addresses often represent institutional-scale players. Their reduction adds another confirmation layer that smart money isn’t positioning aggressively for upside here. When mega whales distribute during weakness, retail typically gets stuck holding the bag.

Bitcoin Remains Below Critical Moving Average

Bitcoin is still trading below its 365-day moving average near $102,000. This level acts as both technical and psychological support. Failure to reclaim it suggests the market shifted from trend continuation to regime risk.

Historically, this moving average was last decisively lost at the start of the 2022 bear market. If price remains below this level, data suggest the next support lies near $72,000, the traders’ minimum realized price band.

Taken together, these signals support Timmer’s warning that Bitcoin may already be in a bear-market phase. Capital dried up, conviction holders are selling, dominance is rising defensively, and macro relief is being ignored.

Why Bear Market Case Isn’t Fully Confirmed

Despite mounting evidence, two long-term cycle indicators still argue against a confirmed structural breakdown.

First, the Pi Cycle Top hasn’t triggered. This indicator compares the 111-day moving average with the 350-day moving average multiplied by two. Historically, when these lines cross, Bitcoin has been near major cycle tops.

As of now, the two lines remain widely separated. That suggests Bitcoin isn’t in an overheated or euphoric phase, even after the October high. In past cycles, true bear markets began after clear Pi Cycle confirmations. That signal is still absent.

The 2-Year SMA Decides Everything

The second and more immediate counter-argument is structural. Bitcoin is still trading near its 2-year simple moving average, which sits around $82,800.

This level has repeatedly acted as Bitcoin’s long-term trend divider. Monthly closes above the 2-year SMA have historically marked cycle survival. Sustained closes below it have marked deep bear phases.

So far, Bitcoin hasn’t confirmed a monthly close beneath this line. That makes December’s monthly close critical. If Bitcoin holds above $82,800 into year-end, the market likely remains in a late-cycle transition rather than a confirmed bear market.

However, if December closes decisively below the 2-year SMA, downside projections toward the $65,000-$75,000 range gain structural backing. That outcome would validate Timmer’s framework entirely.

The Levels That Matter Now

The bearish framework has clear invalidation levels. A reclaim of the 365-day moving average near $102,000 would materially weaken the bear market thesis.

In simple terms, three levels decide Bitcoin’s near-term fate. Above $82,800 into December close means the transition phase remains intact. Below $82,800 on a monthly basis escalates bear market risk dramatically. Back above $102,000 signals bullish structure is rebuilding.

For now, Bitcoin sits between conviction selling and long-term cycle support. The market isn’t confirming strength, but it isn’t fully breaking either.

One thing is clear though. The cooling CPI data that should have helped Bitcoin didn’t. Capital chose gold and silver instead. That preference shift says more about Bitcoin’s current positioning than any single indicator could.

The December close will decide which narrative carries into 2026. Either Bitcoin holds structural support and prepares for delayed upside, or it confirms Timmer’s warning and enters a prolonged bear phase.

Watch $82,800. That line separates transition from breakdown.