Bitcoin dominated financial headlines for years. Now a different metal is stealing the spotlight.

Copper prices smashed records in 2025, climbing past $12,000 per ton for the first time. Meanwhile, Bitcoin dropped roughly 6% year-to-date. That gap has investors asking uncomfortable questions about where to park their capital next.

This isn’t just about one metal beating one cryptocurrency. It’s about a broader shift that’s rewriting investment playbooks across markets.

Metal Season Replaced Crypto Season

The crypto community spent 2025 waiting for altcoin season and fresh Bitcoin highs. Instead, something unexpected happened. Precious metals and base metals quietly outperformed digital assets across the board.

Gold surged 72% year-to-date, adding $13.2 trillion in market capitalization. Silver climbed 155%, becoming the world’s third-largest asset at $4.2 trillion. Plus, platinum jumped 159% in its biggest annual gain ever recorded.

These numbers mirror only one other period in modern history: 1979, when inflation topped 11%. Back then, metals rallied as investors fled currency risk. Today, similar fears about dollar debasement and economic instability are driving capital into physical assets.

The Kobeissi Letter noted that 2025 will be referenced for decades as the year metals dominated. That’s not hyperbole when you look at the performance gap.

Copper’s Supply Crisis Fuels Record Prices

Copper outpaced Bitcoin with over 40% gains this year. But unlike speculative rallies, copper’s surge stems from fundamental supply-demand imbalances.

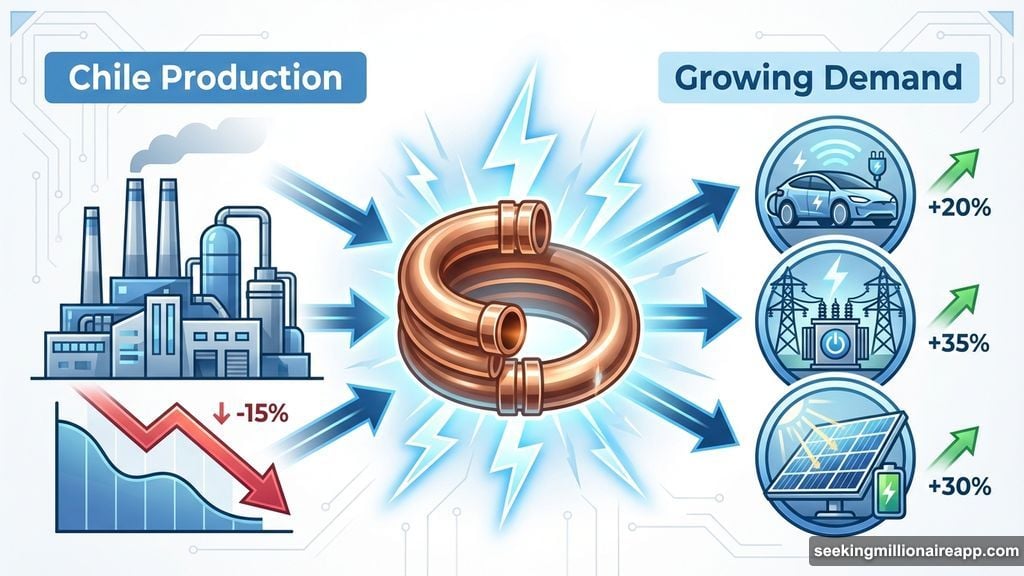

Production hasn’t risen despite prices hovering near record levels. In fact, output in Chile—the world’s largest copper producer—hit its weakest level in more than a decade. So demand is accelerating while supply tightens.

This combination creates explosive potential. Analyst Otavio Costa described copper as “one of the most critical macro assets for 2026” and predicted the metal could enter “true price discovery phase” with highly explosive moves ahead.

Bloomberg Commodities Index confirms broader metals momentum. Analysts expect this trend to extend into next year as Western countries inflate away their debt burdens. Hard assets are devaluing currency in real time.

Investor and trader Zafar Shaikh stated that commodities will continue running in 2026. The fundamentals support his view. Copper demand grows as infrastructure spending, electric vehicle production, and renewable energy projects all require massive amounts of the metal.

Bitcoin Faces Divided Outlook for 2026

Meanwhile, Bitcoin’s future remains unclear. Key indicators suggest a challenging period could lie ahead in early 2026.

Galaxy Digital’s Head of Research, Alex Thorn, called 2026 “too chaotic to predict.” That’s a striking assessment from someone deeply embedded in crypto markets. Plus, Jim Cramer recently turned bearish on Bitcoin—a signal some traders interpret as contrarian bullish, though others view it as genuine concern.

Some analysts still believe Bitcoin could rally and set new all-time highs next year. But the conviction isn’t universal. Market sentiment has shifted noticeably as macro risks intensify and capital rotates into physical assets.

This uncertainty shows in investor behavior. One trader sold all his Bitcoin to buy physical nickels, citing metal-backed arbitrage as more appealing than crypto speculation.

The Nickel Trade: When Bitcoin Meets Metal Arbitrage

BarkMeta made waves by liquidating his entire Bitcoin position to buy physical nickels. His reasoning? A nickel is worth five cents forever as legal tender. But the copper and nickel content inside is currently worth 6.2 cents.

That’s a built-in arbitrage backed by physical scarcity rather than digital narratives. For some investors, this represents tangible value that cryptocurrency can’t match.

Jesse Colombo described copper as a potential “shot at redemption” for investors who missed early phases of gold and silver’s bull markets. Now that copper is breaking records, his prediction looks prescient.

Capital continues rotating from speculative assets into commodities. Copper is increasingly viewed not just as an industrial input, but as a strategic macro asset with supply constraints that support higher prices.

What Drives Different Investor Choices

Why are some investors choosing copper over Bitcoin? Several factors explain the shift.

First, physical scarcity. Copper exists in limited quantities and requires mining, refining, and transportation. Bitcoin’s supply is capped digitally, but copper’s constraints are physical and harder to circumvent.

Second, industrial demand. Copper isn’t just a store of value. It’s essential for infrastructure, electronics, and green energy. That dual utility provides fundamental support beyond speculation.

Third, inflation hedging. Both copper and Bitcoin claim to hedge against currency debasement. But copper has a longer track record and tangible applications that create steady demand regardless of investor sentiment.

Fourth, regulatory clarity. Copper faces no regulatory uncertainty. You can buy, hold, and sell it without worrying about government crackdowns or exchange restrictions.

These factors don’t make copper objectively better than Bitcoin. But they explain why capital is flowing toward metals right now. Different market conditions favor different assets.

Will Metal Season Eclipse Crypto’s Appeal?

Whether this metal season ultimately overshadows cryptocurrency remains uncertain. But the trend is undeniable. Parts of the market are seeking conviction in physical scarcity rather than digital narratives.

Copper’s rally reflects real supply-demand imbalances. Gold and silver’s gains stem from inflation fears and monetary policy concerns. These drivers have staying power as long as macroeconomic fragility persists.

Bitcoin still has passionate advocates and strong technological foundations. Yet its short-term outlook faces more headwinds than copper. Regulatory uncertainty, market volatility, and divided analyst opinions all weigh on crypto sentiment.

For investors, this creates a choice. Chase potentially explosive gains in copper as supply constraints bite? Or bet on Bitcoin’s longer-term narrative despite near-term challenges?

Some will split the difference, holding both physical metals and digital assets. Others will pick sides based on their risk tolerance and market outlook.

Strategic Shifts in Portfolio Allocation

Smart investors don’t chase last year’s winners blindly. But they do adapt to changing market conditions and fundamental shifts in supply-demand dynamics.

Copper’s record run isn’t hype. It’s backed by production shortfalls, infrastructure spending, and energy transition demands. Those fundamentals should persist into 2026 and beyond.

Bitcoin’s story hasn’t ended. But its dominance as the go-to alternative asset is being challenged by metals that offer tangible scarcity and industrial utility.

The question isn’t whether copper will replace Bitcoin entirely. That’s unlikely. Instead, investors must decide how much weight to give physical commodities versus digital assets in their portfolios.

Right now, metals momentum is strong. Copper offers exposure to supply constraints and global infrastructure growth. Whether that outweighs Bitcoin’s potential for explosive gains depends on your outlook and risk appetite.

Choose carefully. Markets are signaling that physical assets matter more than many expected this year. That lesson will shape investment strategies well into next year.