Over 40% of all Ethereum now sits underwater. That’s not a temporary dip. It’s a sustained loss position affecting millions of holders.

The split among major investors tells the real story. Some whales are dumping their positions. Others keep buying despite mounting losses. Plus, four warning signals suggest more pain could be coming.

Let’s examine what’s actually happening and why different investors are making opposite bets.

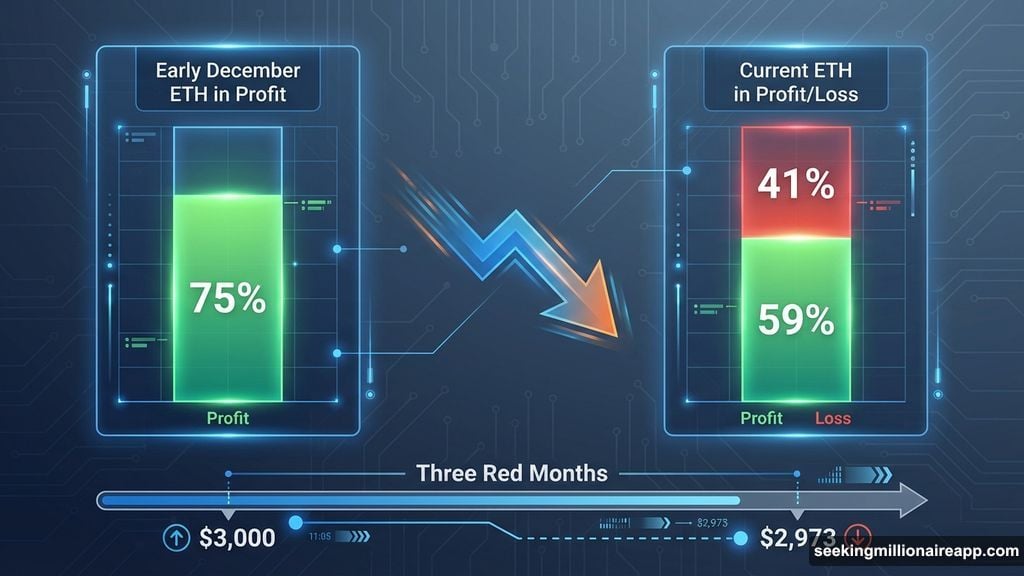

Three Red Months Push ETH Below Critical Levels

Ethereum closed November down 22%. December hasn’t been much better. The asset briefly touched $3,000 before sliding back to $2,973.

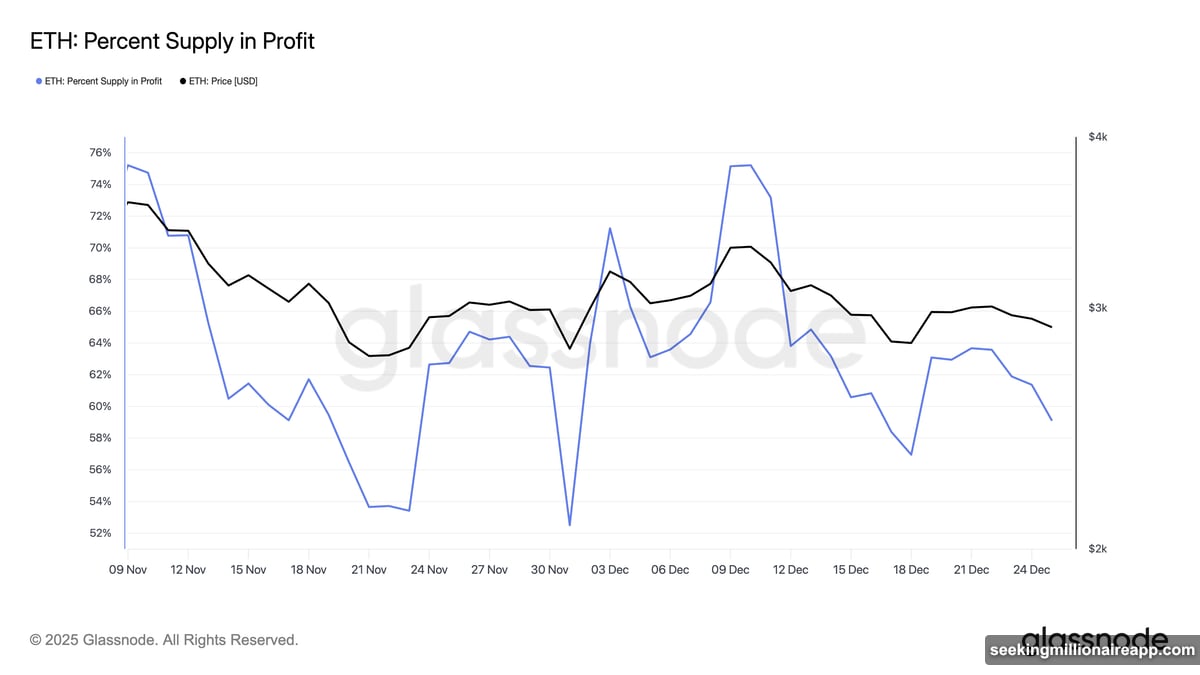

But here’s what matters more than price. Earlier this month, 75% of Ethereum’s supply showed a profit. Now that’s dropped to 59%. That means 41% of all ETH is held at a loss.

This shift happened fast. In just weeks, millions of coins moved from profitable to underwater positions. Moreover, the speed of this change signals mounting pressure on holders.

Big Players Take Different Paths

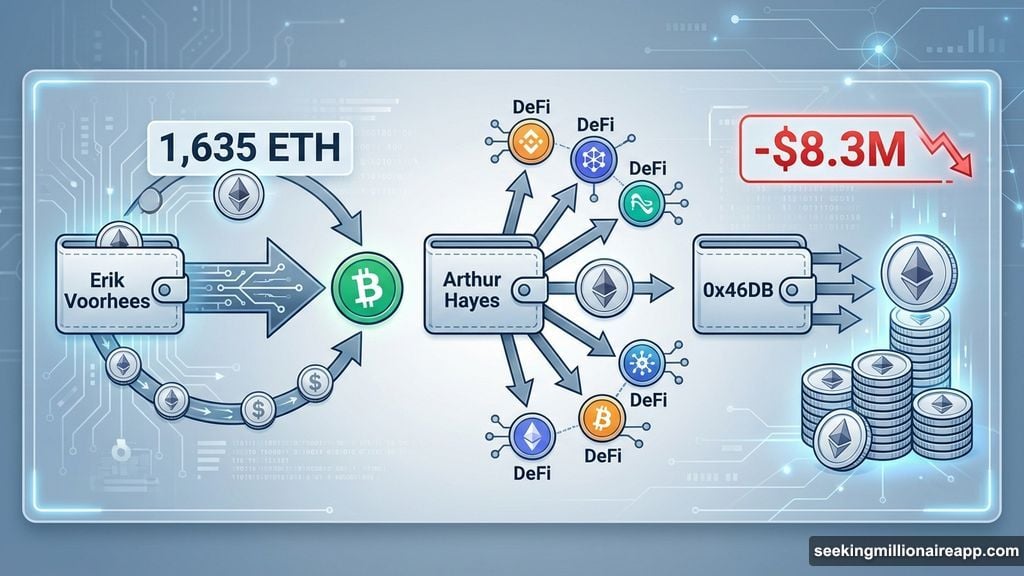

Erik Voorhees just moved 1,635 ETH worth $4.81 million to THORChain. He swapped it for Bitcoin Cash. This follows a similar trade earlier this month from a wallet inactive for nine years.

That’s not a random trade. It’s a deliberate exit from Ethereum exposure.

Meanwhile, Arthur Hayes is “rotating out of ETH into high-quality DeFi names.” He expects select tokens to outperform Ethereum as liquidity conditions improve. Hayes isn’t abandoning crypto. He’s just abandoning ETH.

Then there’s Winslow Strong from Cluster Capital. He transferred 1,900 ETH plus 307 cbBTC to Coinbase. Total value? $32.62 million. Plus, on-chain analysts calculate if he sold, the loss would hit $3.9 million.

These aren’t small positions. These are major holders making significant moves during uncertain times.

Some Whales Keep Buying Despite Losses

Not everyone’s selling. Whale address 0x46DB bought 41,767 ETH since December 3. Average price? $3,130. Current unrealized loss? Over $8.3 million.

Yet the buying continues.

BitMine shows an even bigger unrealized loss of approximately $3.5 billion. Still made notable purchases this week. Clearly believes ETH has upside potential over coming months.

This split reveals something important. Some sophisticated investors see opportunity where others see risk. But it also shows deep disagreement about Ethereum’s near-term prospects.

Four Warning Signals Flash Red

On-chain data points to continued pressure. Exchange reserves are rising. That means more ETH is moving to platforms where it can be sold.

Plus, the Estimated Leverage Ratio has climbed. High leverage amplifies risk in both directions. With prices dropping, leveraged positions face liquidation pressure.

Then there’s the ETF outflows. Institutional money keeps leaving Ethereum investment products. That’s not retail panic. That’s supposedly smart money heading for the exits.

Finally, the Coinbase Premium Index fell to -0.08. That’s the lowest in a month. This metric tracks the price difference between Coinbase and other exchanges. Negative readings suggest US buyers aren’t driving demand.

Together, these signals paint a challenging picture. Selling pressure exceeds buying interest. Leverage creates downside risk. Institutional flows remain negative.

The Real Question Nobody’s Answering

Why are whales split so dramatically? Both sides have access to the same data. Both understand market dynamics. Yet they’re making opposite bets.

Some believe Ethereum’s fundamentals remain strong despite price weakness. Network usage continues. Development progresses. Long-term value proposition holds.

Others think the asset faces extended downside. Maybe they see competition from newer chains. Perhaps they’re worried about regulatory pressure. Or they simply think better opportunities exist elsewhere.

Here’s what bothers me about this situation. The divergence itself creates uncertainty. When major holders can’t agree on direction, smaller investors face impossible decisions. Follow the sellers and potentially miss a bounce? Follow the buyers and risk further losses?

What Happens Next Matters More

Ethereum holders face a tough end to 2025. Over 40% sit on losses. Major players are exiting. Warning signals keep flashing.

Yet contrarian buyers keep accumulating. They’re not throwing good money after bad. They’re betting on recovery despite current weakness.

Whether that bet pays off depends on factors beyond individual holders’ control. Market sentiment could shift quickly. Or selling pressure could intensify and push prices lower.

Smart investors aren’t making emotional decisions either way. They’re sizing positions based on conviction and risk tolerance. Some add to losing positions because they believe in the asset. Others cut losses because they’ve changed their thesis.

The lesson? Major holders splitting this dramatically means heightened uncertainty ahead. Position accordingly.