A draft Bitcoin Improvement Proposal is dividing the community. Some call it necessary spam cleanup. Others call it outright confiscation.

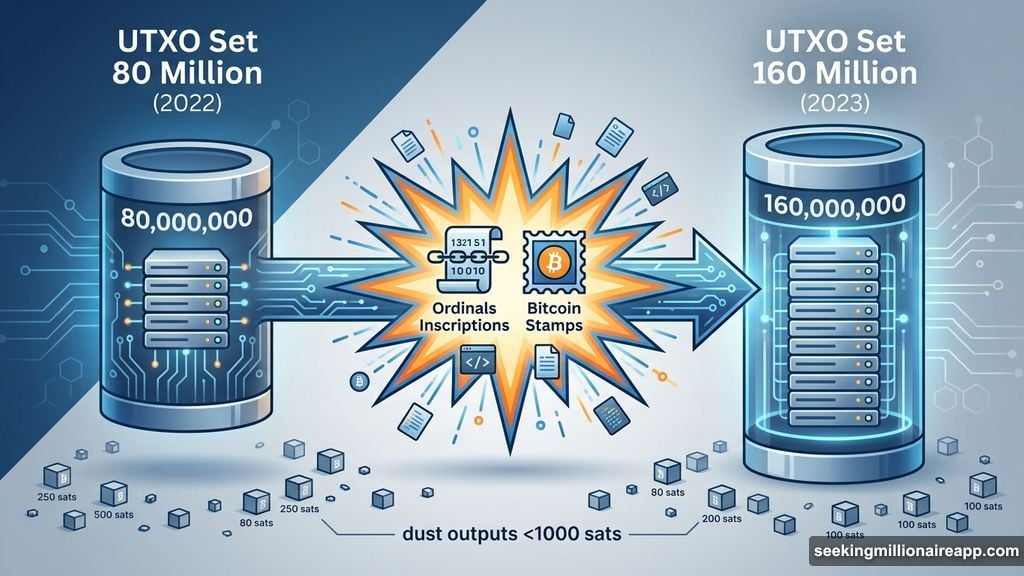

The stakes are high. Nearly half of Bitcoin’s 160 million unspent transaction outputs now contain dust amounts under 1,000 satoshis. Plus, most exist solely to store data, not facilitate payments. So the proposal targets these outputs for permanent freezing.

But here’s where it gets controversial. Critics warn this sets a dangerous precedent for future coin seizures.

What “The Cat” Actually Does

The proposal introduces Non-Monetary UTXOs, or NMUs for short. These would be flagged by indexers and marked unspendable.

Think of UTXOs as chunks of Bitcoin waiting to be spent. Every transaction creates new UTXOs. Moreover, nodes must track every single one to validate new transactions. That’s where the problem starts.

Bitcoin’s UTXO set doubled to 160 million entries during 2023. In fact, the increase came almost entirely from Ordinals inscriptions and Bitcoin Stamps. These techniques exploit Taproot witness fields and fake bare multisig addresses to store arbitrary data on-chain.

The impact hits hard. Node operators face higher storage costs. New users experience slower sync times. Meanwhile, the blockchain grows heavier with each inscription.

Why Supporters Say It’s Necessary

TwoLargePizzas and other advocates see this as economic spam deterrence. They argue inscription outputs clog the network without contributing to Bitcoin’s monetary function.

The numbers back them up. Spam makes up 30 to 50 percent of all UTXOs, according to supporter Nona YoBidnes. Plus, each dust output consumes resources that large-scale services must maintain indefinitely.

“A powerful anti-spam message,” YoBidnes calls it. The proposal sends a clear signal that Bitcoin rejects non-monetary bloat.

Developer Mark Erhardt went further. He described Stamps’ use of the UTXO set as “probably, from a technical perspective, one of the more egregious uses of blockchain.” His point resonates with developers who watched the UTXO set balloon from 80 million to over 160 million entries in just one year.

However, the debate runs deeper than technical efficiency.

The Property Rights Problem

Core developer Greg Maxwell sees this as “asset seizure.” His concern centers on Bitcoin’s fundamental values.

The proposal would freeze millions of UTXOs, making them permanently unspendable. That means actual satoshis would become worthless by consensus rule change. Moreover, Maxwell argues the modest storage savings don’t justify such a drastic step.

Developer Ataraxia 009 raised an even scarier concern. This “represents a dangerous slippery slope,” they warned. If the network freezes some coins today, what stops broader confiscations tomorrow?

The question cuts to Bitcoin’s core identity. Is it just a monetary system? Or does its censorship resistance extend to all valid transactions?

Critics point out that Ordinals and Stamps follow current consensus rules. Therefore, freezing these outputs means judging transaction legitimacy at the protocol level. That’s a power Bitcoin never granted itself before.

Where Ordinals and Stamps Came From

These techniques exploit loopholes in Bitcoin’s data storage policies. OP_RETURN was created specifically to discourage blockchain bloat. It limits non-monetary data to 80 bytes per transaction.

But Ordinals found a way around it. They place data in Taproot witness fields, which face fewer restrictions. Meanwhile, Bitcoin Stamps create unspendable outputs through fake bare multisig addresses.

Both methods circumvent the spirit of OP_RETURN’s limits. That’s why supporters call them spam. Yet they remain technically valid under current rules.

Greg Maxwell himself wrote about OP_RETURN limits years ago. “Part of the idea here is shaping behavior towards conservative needs,” he explained. The goal was guiding users toward efficient blockchain usage without hard restrictions.

Now that guidance proved insufficient. The question is whether Bitcoin should enforce what it once only encouraged.

The Real Cost of UTXO Bloat

Every Bitcoin node must load the entire UTXO set into memory. That requirement creates real infrastructure costs.

Large services running multiple nodes face exponentially higher expenses. New users experience longer sync times when joining the network. Moreover, miners need more resources to validate transactions efficiently.

The proposal’s supporters see this as an attack on Bitcoin’s usability. They argue inscription spam serves no monetary purpose while imposing costs on everyone else.

Yet opponents counter that Bitcoin was designed to resist exactly this type of intervention. The network shouldn’t discriminate between transaction types, they say. All valid transactions deserve equal treatment.

What Happens Next

The draft remains under community review. No official BIP submission has occurred yet. Therefore, developers continue debating the proposal’s merits and risks.

Several key questions remain unresolved. How would nodes identify NMUs consistently? What happens if legitimate outputs get mistakenly flagged? Could this create enforcement mechanisms for future restrictions?

The technical implementation also faces challenges. Classification depends on value thresholds and timing windows. Getting this wrong could freeze legitimate holdings or miss intended targets.

Plus, the proposal requires broad consensus to activate. That seems unlikely given the current opposition from prominent developers.

The Bigger Picture

This debate reflects deeper tensions within Bitcoin development. Efficiency gains clash with foundational principles. Technical optimization competes with property rights concerns.

Both sides present valid arguments. UTXO bloat creates real problems for network operators. But freezing outputs without owner consent violates Bitcoin’s core promise of censorship resistance.

The outcome will shape how Bitcoin handles future challenges. If “The Cat” succeeds, it establishes precedent for protocol-level transaction discrimination. If it fails, inscription spam may continue growing unchecked.

Either way, the community faces hard choices. Storage costs will keep rising. New spam techniques will emerge. Meanwhile, Bitcoin’s identity as censorship-resistant money hangs in the balance.

The network was built to resist exactly this type of central decision-making. Yet decentralization doesn’t solve the UTXO bloat problem by itself. Someone must decide whether efficiency or principle matters more.

That decision will define Bitcoin’s future more than any technical specification ever could.