The crypto market is frozen in place. TOTAL sits at $2.94 trillion, barely moving for 24 hours. Bitcoin is up a meager 0.2%, Ethereum is flat, and BNB gained less than 1%.

Year-end liquidity has dried up. Most traders are sitting on their hands. But one token broke the pattern. Canton jumped 18% in a single day, making it the top gainer among major cryptocurrencies.

The question is whether this move has legs or if it’s just a liquidity trap before the New Year reset.

Market Can’t Break $3 Trillion Ceiling

The total crypto market cap holds above $2.89 trillion. That’s the key support line that broke on December 17 but got reclaimed two days later. So far, buyers keep defending dips whenever price approaches that level.

But there’s a problem. The market hasn’t reclaimed $3 trillion since losing it earlier this month. That psychological barrier remains the ceiling. Until TOTAL closes above $3 trillion, upside momentum stays limited.

Above $3 trillion, the next targets are $3.25 trillion, then $3.59 trillion. Those levels represent full recovery from December’s weakness. Below $2.89 trillion, confidence could crack fast. Thin year-end volumes amplify moves in both directions.

The setup is simple. Watch $2.89 trillion for downside risk and $3 trillion for bullish confirmation. Everything else is noise until volume returns.

Bitcoin Trapped Between $85K and $91K

Bitcoin is stuck in a tight range. It trades between $85,170 and $91,270, with no clear direction. The upper boundary at $91,270 is the first sign of any real rebound. A daily close above that opens room toward $97,960, then $103,380 if buyers show up after New Year.

The lower boundary matters just as much. Losing $85,170 exposes $80,440 again, a level that acted as support during November’s washout. And December is on track to close red for the first time since 2018. If it does, it would mark three straight negative months, a pattern that hasn’t happened since October-December 2018 into January 2019.

Spot Bitcoin ETF outflows add to the caution. About $276 million left on December 26, marking the sixth straight day of exits. That’s not panic selling, but it shows institutional buyers aren’t rushing back in either.

Until one of these levels breaks, Bitcoin stays range-bound. And so does the rest of the market.

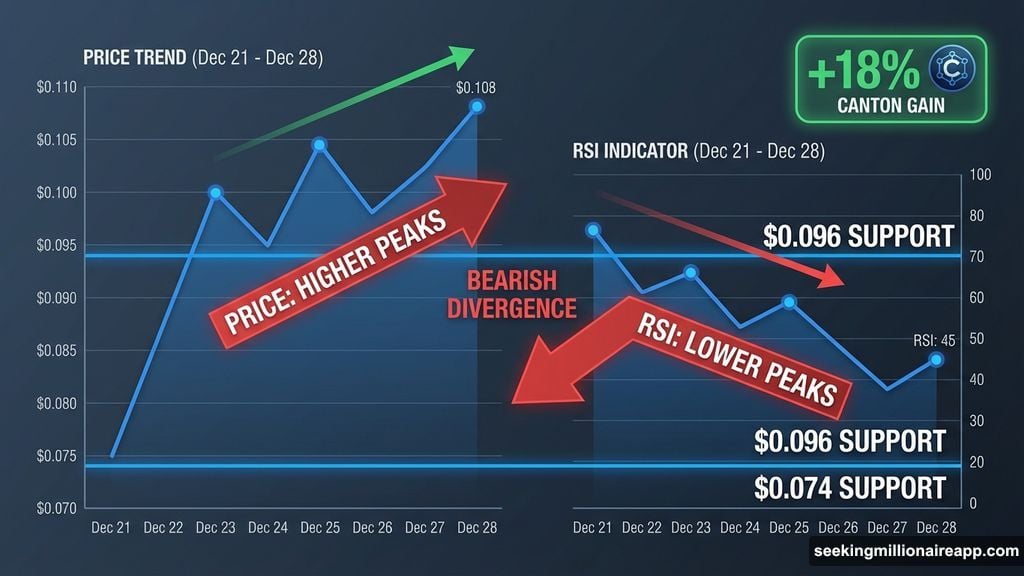

Canton’s 18% Rally Hides a Momentum Warning

Canton is the day’s standout performer, up nearly 18% and now ranked 37th by market cap. The move also brings seven-day gains to 7.6%, which stands out when most top 100 tokens are flat or red.

But there’s a catch. The 12-hour chart shows a bearish divergence. Price made a higher high between December 21 and December 28, but the Relative Strength Index (RSI) made a lower high in the same window. That’s a classic warning sign that momentum is fading even as price climbs.

If profit-taking starts, immediate support sits near $0.096. Losing that exposes $0.074, which has been a strong floor through December. Failure there risks a retest of $0.058. From current levels, a drop to $0.096 alone would roughly mirror the entire 17% gain Canton just recorded.

Still, if CC holds above $0.118 and demand absorbs sellers, bulls get a chance to revisit $0.137. That level would need a confident close to keep the uptrend intact into January.

Midnight Protocol Targets Bitcoin and XRP Ledger

Charles Hoskinson is pitching Midnight as a privacy layer for Bitcoin and XRP Ledger, not just Cardano. He claims Midnight could enable compliant private DeFi and real-world asset tokenization across multiple networks. The goal is to pull liquidity away from permissioned platforms like Canton and give Cardano indirect access to those ecosystems.

The pitch is ambitious. But execution matters more than vision. Midnight would need to integrate with Bitcoin and XRP Ledger without adding friction or breaking existing workflows. That’s a tall order when both networks prioritize simplicity and security over feature expansion.

If Hoskinson delivers, Midnight could become a cross-chain privacy standard. If not, it risks becoming another Cardano sideshow that never gains traction outside the ADA ecosystem.

Pump.fun Dumps Another $50 Million

Pump.fun moved $50 million USDC from ICO proceeds to Kraken, bringing total exchange transfers since mid-November to over $600 million. PUMP token trades 55% below its ICO price, and these steady cash-outs raise questions about runway, treasury strategy, and pressure on retail confidence.

The optics are terrible. Retail buyers are underwater while the team cashes out. That’s not unusual for crypto projects, but the scale and frequency of these moves stand out. Over $600 million in six weeks is aggressive, even for a project generating real revenue.

Treasury management is one thing. But dumping hundreds of millions into exchanges while your token bleeds looks more like an exit than a strategy. Retail should be paying attention.

Bitcoin ETF Outflows Hit Six Straight Days

Spot Bitcoin ETFs logged about $276 million in net outflows on December 26, the sixth consecutive day of exits. Ethereum ETFs saw another $38.7 million leave, showing year-end liquidity is draining from majors instead of rotating back in.

This isn’t panic selling. It’s institutional caution into year-end tax optimization and portfolio rebalancing. But the timing matters. Six straight days of outflows while Bitcoin struggles to hold $95K sends a message. Buyers aren’t convinced this dip is over yet.

If outflows continue into January, that would shift the narrative from seasonal weakness to structural pullback. Watch for any reversal in the first week of 2026. If inflows return, Bitcoin could reclaim $97K fast. If not, the range could stay pinned through mid-January.

What Comes Next

The market is stuck. TOTAL holds above $2.89 trillion but can’t reclaim $3 trillion. Bitcoin trades in a $6K range with no clear direction. Canton rallied 18% but shows bearish divergence on the RSI. And institutional flows are still negative.

Year-end positioning explains some of this. Liquidity always dries up in the final week of December. But three straight red months would be the first time since 2018, and that’s not just noise.

Watch for volume to return in the first week of January. If Bitcoin reclaims $91,270 and TOTAL breaks $3 trillion, that’s your signal for a relief rally. If both fail and $85,170 breaks, expect another leg down toward $80K.

Until then, the setup is simple. Low conviction, tight ranges, and one or two outliers like Canton making noise while everything else sits still.