Bitcoin price just flashed two signs it hasn’t shown in months. Neither guarantees a rally. But together? They might mark the first real shift toward momentum as 2026 approaches.

BTC dropped 2% over the last 24 hours and sits nearly 3% below yesterday’s peak. The chart looks unremarkable at first glance. Yet beneath the surface, something changed for the first time since September. Plus, another signal emerged this week that traders rarely see during downtrends.

Let’s break down what actually matters and what price levels decide whether this turns into a genuine relief rally or just another false start.

The Volume Breakout That Almost Nobody Noticed

On-Balance Volume (OBV) measures buying and selling pressure through volume flow. Between December 21 and December 26, Bitcoin’s price trended higher. OBV didn’t follow. Instead, it made lower highs.

That’s a bearish divergence. It explains why the price failed to break resistance on December 26, shown by that long rejection wick. Volume never supported the move. Without volume confirmation, price advances crumble quickly.

This week, something changed. OBV broke above the trend line connecting those lower highs. That breakout suggests stronger buying pressure is forming beneath the surface.

However, the signal isn’t confirmed yet. OBV needs to make a higher high above 1.58 million. If that happens, Bitcoin price could finally respond with sustained upward movement. Until then, it’s just a potential setup, not a confirmed signal.

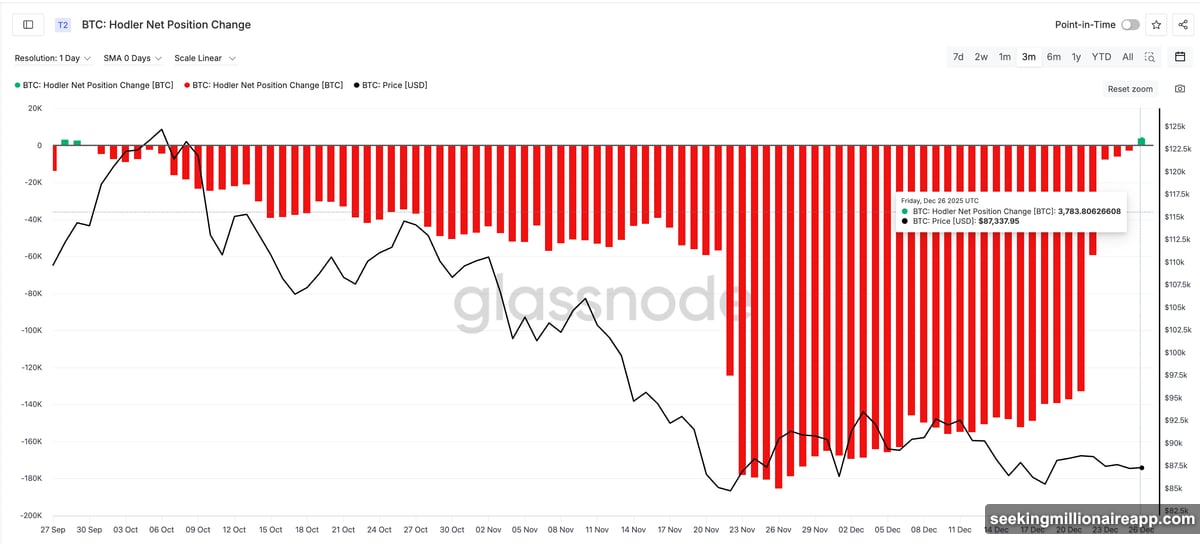

Long-Term Holders Bought Bitcoin for the First Time Since September

The Hodler net position change metric tracks wallets that hold for longer than 155 days. These are the slowest, most conviction-driven participants in the market. They don’t trade noise. They accumulate based on long-term outlook.

On December 26, this metric flipped positive for the first time since late September. Long-term holders added 3,783.8 BTC to their positions. That’s the first meaningful accumulation from the most patient cohort in almost three months.

These holders don’t buy for quick flips. They buy when they believe the worst is behind us. Their return signals shifting sentiment at the foundation of the market.

But here’s the catch. One day of accumulation doesn’t confirm a trend. If Hodlers continue adding over the next week, that confirms conviction is building. If they stop after one day, it’s just a blip.

Both Signals Need to Hold or the Setup Falls Apart

Neither signal works alone. OBV must follow through with a higher high above 1.58 million. Hodlers must continue accumulating, not just add once and disappear.

Volume without long-term conviction fades during pullbacks. Long-term conviction without volume can’t push price through resistance. Both need to align for a relief rally to form and sustain itself.

The timing matters too. Year-end liquidity is thin. Trading volume drops as holidays dominate. That makes price action less reliable. Any move up or down can exaggerate simply because fewer participants are active.

So while these signals are the first positive signs in months, they’re not guaranteed to deliver results until liquidity returns in early January. The setup is forming. Confirmation requires follow-through over the next 7-10 days.

The Price Levels That Actually Decide What Happens Next

Bitcoin price still hasn’t reclaimed $90,840. That level rejected the price on December 12 and has blocked every attempt since. It’s the first major resistance that must fall for any relief rally to gain credibility.

Above $90,840, the next checkpoint sits at $97,190. Bitcoin fell below that level on November 14. Reclaiming it would mark a significant shift in momentum. If the rally extends beyond that, $101,710 and $107,470 become the next targets.

On the downside, support sits at $86,915. That level has held since December 19. Losing it opens room down to $80,560. With thin year-end liquidity, the risk of a breakdown increases if support fails.

For now, Bitcoin’s setup looks like this. If support at $86,910 holds, and if OBV confirms, and if Hodlers continue accumulating, then a relief rally toward $90,840 and potentially beyond becomes possible. That’s three conditions that must align. Remove any one of them and the rally thesis breaks.

Why This Might Actually Work This Time

Previous attempts at relief rallies failed because conviction didn’t show up. Volume spiked briefly, then disappeared. Long-term holders stayed on the sidelines. The market couldn’t sustain any upward momentum.

This time feels different, at least in terms of setup. OBV is breaking out instead of diverging lower. Hodlers are adding instead of distributing. Those are the ingredients needed before a sustained move higher can form.

But ingredients aren’t a finished product. The next week decides whether these signals confirm or fail. If OBV makes a higher high, and if Hodlers continue adding, and if price holds $86,910, then Bitcoin has a real shot at a relief rally into early 2026.

If any of those conditions fail, the setup collapses. Support at $86,910 becomes the line in the sand. Losing it means waiting for the next setup, likely at lower prices.