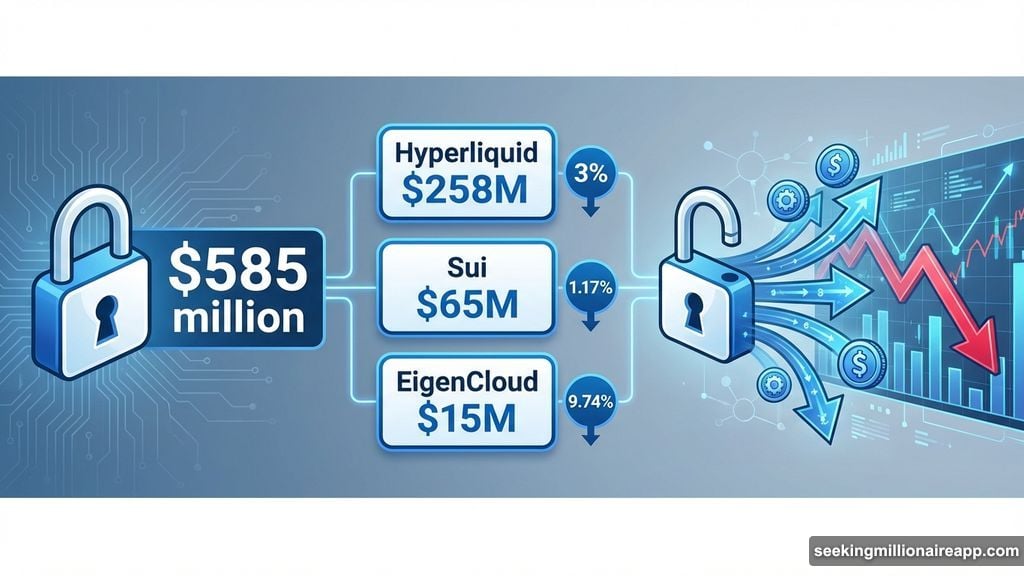

Over half a billion dollars in crypto tokens hit the market this week. That’s not a typo.

Three major projects—Hyperliquid, Sui, and EigenCloud—will release previously locked tokens into circulation. Plus, several smaller projects add to the supply surge. So what does this mean for traders? Potential volatility and price pressure as new supply meets existing demand.

Let’s break down each unlock and what to watch.

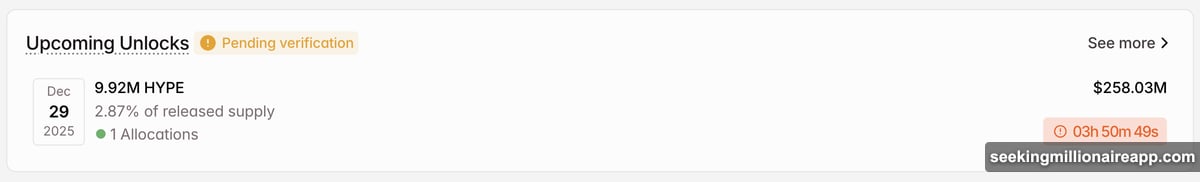

Hyperliquid Dumps $258 Million on Core Team

December 29 marks Hyperliquid’s biggest token release yet. The project unlocks 9.92 million HYPE tokens valued at approximately $258 million.

Here’s the kicker. All those tokens go straight to core contributors. That’s nearly 3% of the current circulating supply landing in the hands of insiders.

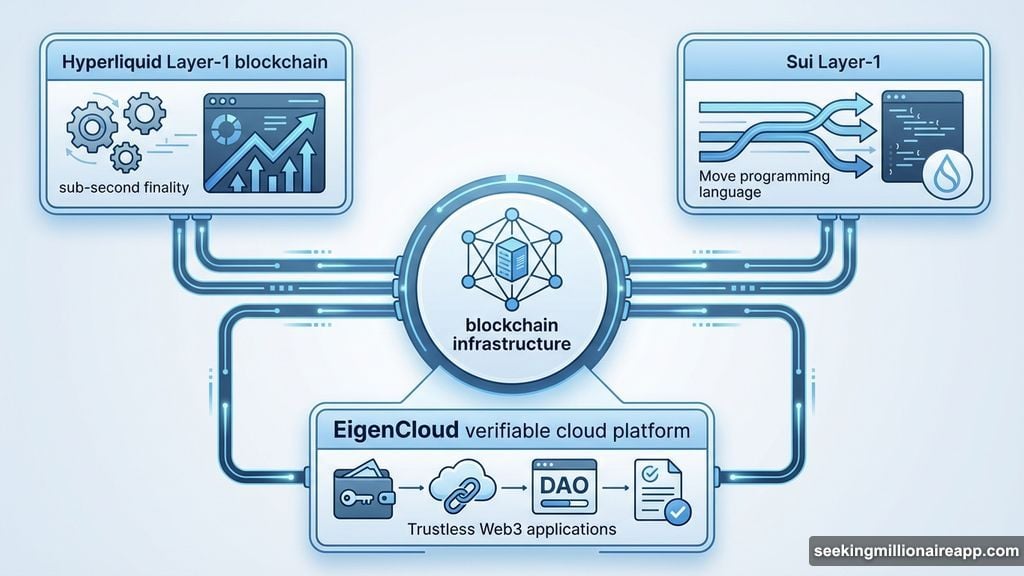

Hyperliquid runs a high-performance decentralized perpetual futures exchange. It operates on its own Layer-1 blockchain with sub-second transaction finality. But technology doesn’t matter if token holders dump on the market.

The project currently has 238.38 million HYPE in circulation. That means this unlock represents a meaningful supply increase. Moreover, on January 6, another 1.2 million HYPE tokens vest to team members.

Will core contributors sell? Nobody knows for sure. However, large cliff unlocks typically create selling pressure as early participants cash out gains.

Sui Adds $65 Million in January

January 1 brings Sui’s monthly vesting schedule into focus. The network releases 43.69 million SUI tokens worth roughly $65 million.

Sui built a Layer-1 blockchain using the Move programming language. It focuses on parallel execution for gaming, DeFi, and Web3 applications. Yet none of that technical prowess shields it from basic supply-demand economics.

This unlock distributes across multiple parties. Series B investors receive 19.32 million SUI. Community reserves get 12.63 million tokens. Early contributors claim 9.98 million SUI. Finally, Mysten Labs takes 2.07 million altcoins.

The unlock represents 1.17% of Sui’s circulating supply. That’s smaller than Hyperliquid’s percentage but still significant. Furthermore, Sui follows a monthly unlock pattern, so expect continued supply pressure throughout 2026.

EigenCloud Team Gets $15 Million Payday

January 1 also triggers EigenCloud’s unlock event. The network releases 36.82 million EIGEN tokens valued at approximately $14.69 million.

EigenCloud (formerly EigenLayer) operates as a verifiable cloud platform. It helps developers build trustless Web3 applications and services. But the platform’s utility doesn’t change the supply dynamics.

This unlock hits harder than the dollar value suggests. Those 36.82 million tokens represent 9.74% of EIGEN’s circulating supply. That’s a massive one-day increase.

The distribution splits between investors and early contributors. Investors receive 19.75 million tokens. Early contributors get 17.07 million EIGEN. Both groups likely include people sitting on significant unrealized gains.

Why Token Unlocks Matter Now

Supply surges create predictable market dynamics. More tokens available means more potential selling pressure. Plus, insiders often view unlocks as liquidity events—chances to cash out after months or years of waiting.

However, not every unlock triggers price drops. Sometimes markets already price in expected supply increases. Other times, demand absorbs new tokens without flinching.

The difference? Market conditions and holder intentions. In bull markets, unlocks barely register. During uncertain periods like now, they can accelerate downtrends.

Three Smaller Unlocks Add Pressure

Hyperliquid, Sui, and EigenCloud aren’t alone. Ethena (ENA), Kamino (KMNO), and Renzo (REZ) also release tokens this week.

These smaller unlocks might seem trivial compared to the big three. But combined, they add millions more in selling pressure. Each project dumps new supply into markets already digesting major releases.

Ethena operates in the DeFi space with synthetic dollar products. Kamino builds lending infrastructure on Solana. Renzo focuses on liquid staking solutions. All legitimate projects. Yet all adding supply at the same time.

That’s the real risk. Not one massive unlock but six simultaneous supply events testing market demand.

Historical Patterns Don’t Lie

Past unlock events show mixed results. Some tokens rally before unlocks as traders front-run expected buying. Others crash as insiders dump immediately.

The key factor? Token holder composition. If early contributors and investors control most unlocked tokens, expect selling. If community members or long-term believers hold the supply, prices might stabilize.

Hyperliquid’s all-insider unlock seems particularly risky. Core contributors getting $258 million in tokens rarely hold forever. They’ve earned their payday and many will take it.

Sui’s broader distribution across investors, contributors, and reserves might absorb better. Multiple parties with different motivations could balance selling pressure.

EigenCloud’s split between investors and contributors creates uncertainty. Nearly 10% supply increase in one day rarely ends well for token prices.

What Traders Should Watch

First, monitor social media and insider wallets after unlocks. If large addresses move tokens to exchanges, selling pressure follows. Projects sometimes announce voluntary lock-ups or staggered selling plans to ease concerns.

Second, check trading volume. If volume drops after unlocks, new supply might overwhelm buyers. Healthy markets absorb supply increases without dramatic volume spikes or crashes.

Third, watch Bitcoin and overall market conditions. Strong crypto markets handle unlocks better than weak ones. If Bitcoin stays stable, these projects might weather their supply increases.

The Bigger Picture

Token unlocks expose a fundamental crypto tension. Projects need to reward early supporters and team members. Yet dumping large supplies on retail traders feels predatory.

Some projects solved this with smart vesting schedules that gradually release tokens. Others front-load unlocks and hope for the best. Hyperliquid, Sui, and EigenCloud all chose aggressive unlock schedules.

That creates opportunity for prepared traders. Short-term volatility around unlocks can generate profits for those positioned correctly. But it also punishes holders who ignore supply dynamics.

Over $585 million in new tokens this week. Three major projects and several smaller ones. Multiple unlock events clustered in days.

Markets will react. Whether that means crashes, rallies, or choppy sideways action depends on factors nobody fully controls. Demand, sentiment, and timing all matter.

One thing’s certain though. Supply increases put downward pressure on prices until proven otherwise. These three unlocks deserve close attention from anyone holding or trading HYPE, SUI, or EIGEN.