Coinbase just gave Lighter’s new LIT token a major stamp of approval. The exchange announced plans for spot trading within hours of the token’s debut.

That’s a big deal for visibility. Most new tokens wait months for major exchange listings. But LIT got the green light on day one, pending liquidity requirements.

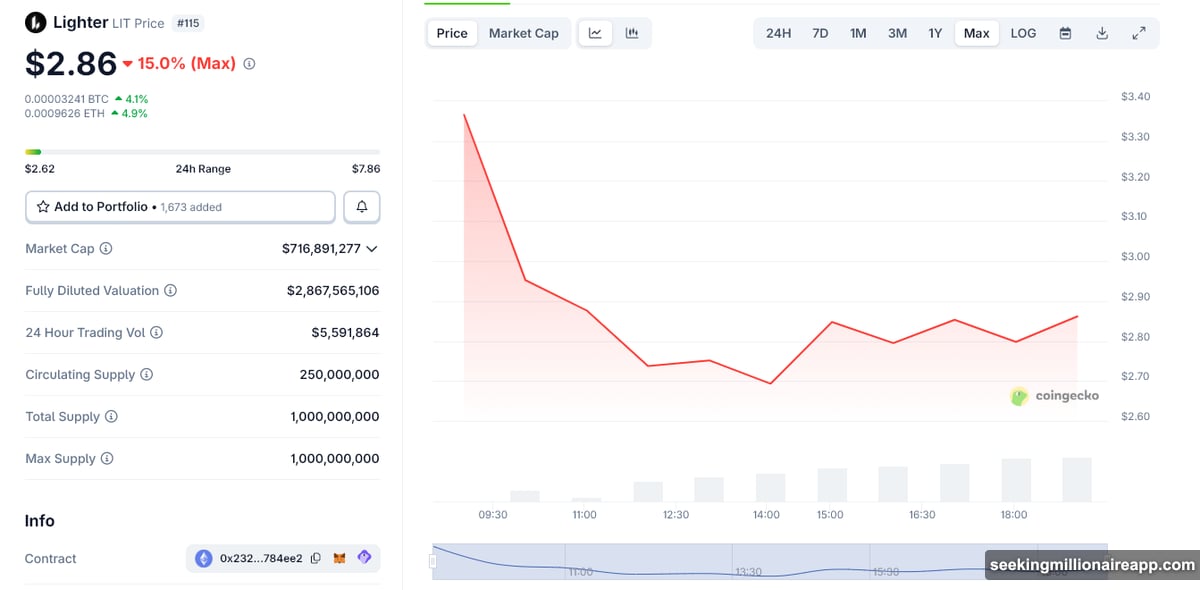

Meanwhile, the token itself rode a wild volatility wave. Early trading saw sharp swings before LIT settled near the $3 mark during initial price discovery.

Coinbase Moves Fast on Perpetual DEX Token

The listing announcement came the same day Lighter completed its token generation event. Coinbase Markets stated that LIGHTER-USD trading will activate once liquidity thresholds are met in supported regions.

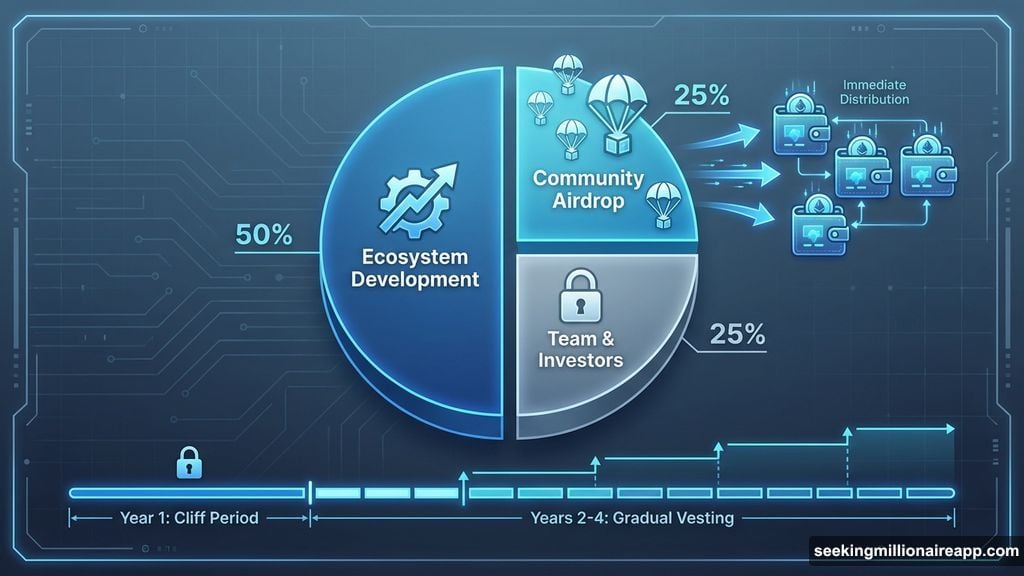

LIT launched with roughly 25% of its 1 billion total supply already circulating. That’s a substantial float for a brand new token. Plus, the timing suggests Coinbase had been monitoring the project closely before launch.

Initial trading showed exactly the kind of chaos you’d expect. The token sold off hard at first. Then it found buyers and stabilized in the $2.70 to $2.90 range. By late in the day, LIT was pushing toward $3 as traders absorbed the supply.

Lighter built the token as the centerpiece of its Ethereum-based perpetual futures exchange. So LIT handles governance, incentives, and future fee mechanisms across the protocol.

Massive Community Airdrop Hits Markets

Half of LIT’s total supply got earmarked for ecosystem development. That includes a 25% allocation dropped directly to the community.

Early users who racked up points during 2025 incentive campaigns received tokens immediately. No vesting, no delays. Just instant liquidity hitting wallets and exchanges simultaneously.

That created selling pressure out of the gate. Some airdrop recipients cashed out immediately. Others held, betting on longer-term upside. The result was choppy price action as the market figured out fair value.

Team and investor allocations stayed locked up. They face a one-year cliff before vesting gradually over three years. So the immediate supply comes entirely from the ecosystem allocation and airdrop.

This structure is deliberate. Lighter wants active users to own and govern the protocol. But it also means significant sell pressure in the early days as recipients make decisions about their new tokens.

Competing Perp DEX Tokens Take a Hit

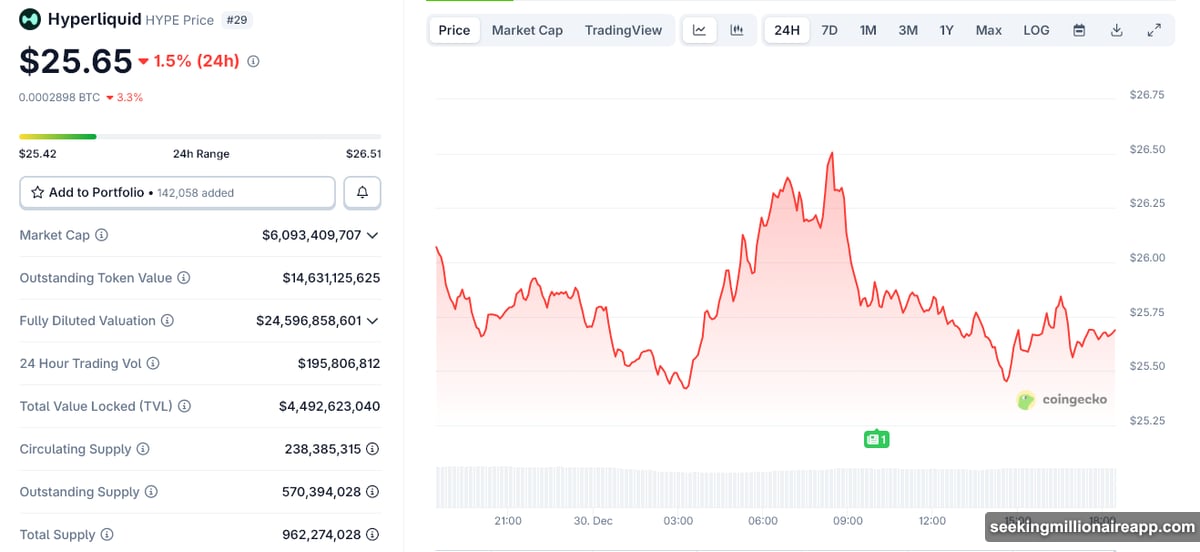

Hyperliquid’s HYPE token dropped around 1.5% on the day. Aster’s ASTER token also trended lower. Neither protocol made announcements that would explain the decline.

Instead, traders pointed to capital rotation. When a major new competitor launches with strong backing, money flows out of existing positions. Speculators hedge. Liquidity fragments across more venues.

This pattern repeats every time a high-profile perp DEX token enters the market. Established platforms with deep liquidity suddenly face a new rival for trader attention and capital.

Hyperliquid dominated the narrative for months before LIT arrived. Now it shares mindshare with another well-funded protocol backed by a major exchange listing signal.

The competitive pressure extends beyond just token prices. Trading volume, user activity, and developer attention all become contested resources. Lighter needs to convert launch-day hype into sustained usage.

What Happens Next for LIT

Short-term volatility seems guaranteed. Airdrop recipients are still deciding whether to hold or sell. That means supply will continue hitting the market in waves.

The Coinbase listing helps. Once spot trading goes live, LIT gains access to millions of retail traders who don’t use DEXs. That’s a massive liquidity boost compared to launching on decentralized venues alone.

But there’s a catch. Coinbase’s announcement was conditional. The exchange will list LIT “when liquidity conditions are met.” That’s vague language. It could mean days or weeks before spot trading actually begins.

In the meantime, LIT needs to prove it can maintain price stability and trading volume. If the token crashes or liquidity dries up, Coinbase might delay or cancel the listing entirely.

For competing protocols, the question becomes whether LIT steals market share or simply expands the overall perpetual futures trading market. Hyperliquid and Aster both have established user bases and product-market fit.

Lighter enters with strong financial backing and exchange support. But that doesn’t guarantee success. The protocol needs to deliver superior trading experiences, lower fees, or better liquidity to justify its valuation.

Perpetual DEX Tokens Face Reality Check

Here’s what bothers me about this launch. Lighter raised massive capital, distributed a quarter of its supply via airdrop, and secured a Coinbase listing signal all on day one. That’s impressive infrastructure.

But none of that guarantees the actual protocol will succeed. Perpetual futures trading is brutally competitive. Established platforms have network effects, deep liquidity, and proven track records.

New entrants need to be materially better to steal users. Slightly better isn’t enough. So the real test for LIT comes in the next few weeks as traders evaluate whether Lighter’s exchange actually delivers.

Token prices often diverge from protocol fundamentals in the short term. Launch-day hype can push valuations way above what usage justifies. Then reality sets in.

For now, LIT trades near $3 with strong exchange backing and fresh capital. Whether it stays there depends entirely on whether traders actually use the underlying platform. Watch trading volume and user growth, not just token price.

The perpetual futures DEX market just got more crowded. That’s good for competition. But it’s brutal for token holders if their protocol can’t differentiate.