Luxury real estate in China just lost its crown. Wealthy investors now compare ¥60 million homes directly against Bitcoin, Nvidia stock, and BNB. And property keeps losing.

The shift hits hard in Shenzhen Bay, once mainland China’s most prestigious housing market. Now even this elite enclave faces brutal repricing. Investors openly question whether concrete still deserves status as a safe store of value.

This isn’t about speculation anymore. It’s about survival.

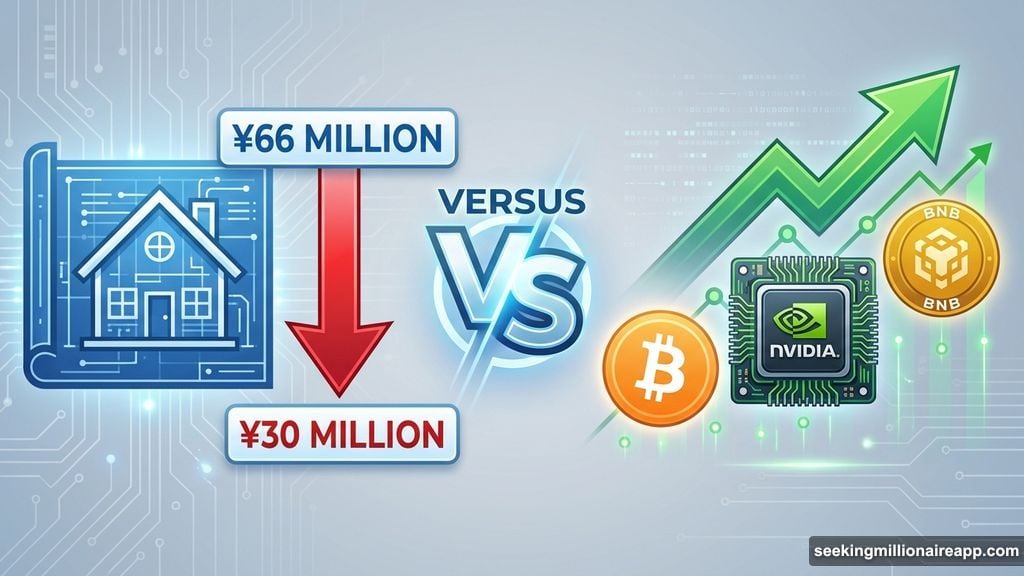

The ¥66 Million Reality Check

One viral post captured the anxiety perfectly. An investor toured a ¥66 million Shenzhen Bay property while warning a friend about catastrophic losses ahead.

The assessment? That home could drop to ¥30 million within three years. Prices in the area already fell nearly 50%. Plus, a broader financial crisis could accelerate the decline.

“Houses themselves don’t have intrinsic value; buying a house must be viewed from an investment perspective,” the investor wrote, citing TRON founder Justin Sun’s commentary. When stacked against globally liquid assets like Bitcoin, Nvidia shares, and BNB, the conclusion becomes uncomfortably clear.

Moreover, other wealthy Chinese echo this concern. One admitted taking a ¥60 million mortgage in Shenzhen, unsure “whether to be happy or uneasy.” Another joked about becoming a “house slave,” noting that only paying in full spared the psychological burden of massive debt.

Why Liquid Assets Beat Luxury Homes Now

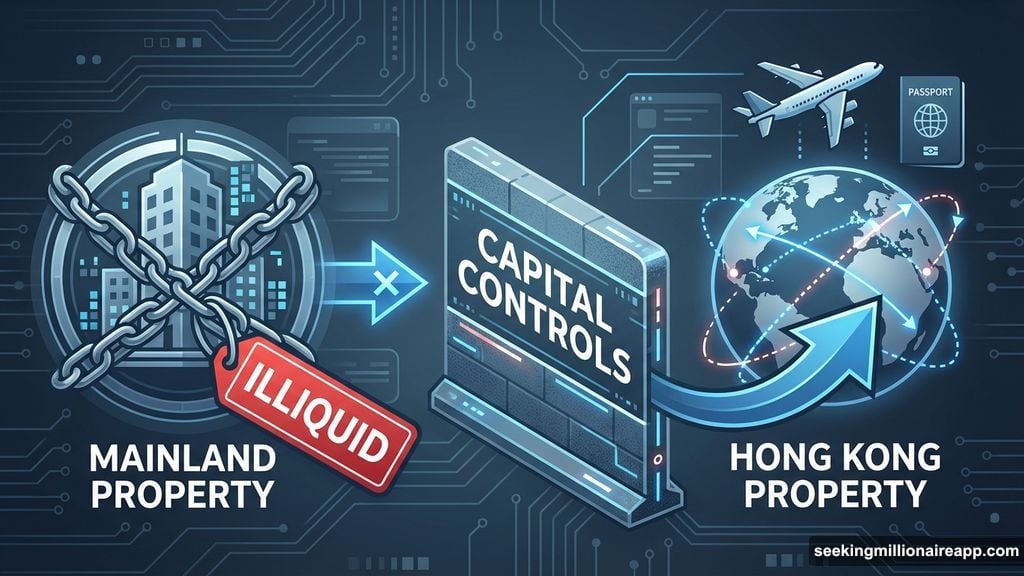

The debate reveals something deeper than price declines. It’s about liquidity and political exposure.

High-end properties have become increasingly difficult to exit quickly. Also, they’re highly visible to regulators. Buying a home worth ¥100 million or more can invite tax scrutiny and investigations. That adds serious risk during policy tightening periods.

In contrast, crypto and global equities offer easier hedging, trading, and cross-border movement. For wealthy Chinese, capital mobility now matters more than physical prestige.

Furthermore, some investors liken mainland luxury housing to China’s A-share equities. Domestic assets tend to fall during geopolitical stress but fail to rally when global markets rise meaningfully. Real estate in Shenzhen Bay exhibits this asymmetry perfectly.

It drops during downturns. Yet it stagnates during risk-on periods. That makes it a terrible store of value.

Hong Kong Property Sells Freedom, Not Returns

This comparison reframes why Hong Kong property continues commanding a premium despite its own price pressures.

The appeal lies less in expected returns and more in “trading money for freedom.” Hong Kong property can facilitate international mobility and financial flexibility. European real estate offers similar benefits, often providing residency or passport pathways for far less capital.

Mainland luxury housing? It offers neither strong returns nor optionality. Just exposure to policy risk and illiquidity.

So wealthy Chinese increasingly opt out. They favor digital assets and international equities that provide clearer risk profiles and easier access.

Crypto Reframed as Capital Preservation Tool

Bitcoin and crypto are no longer framed primarily as speculative bets. Instead, they’re strategic tools for capital preservation and flexibility.

Younger investors, largely priced out of luxury housing, skip property altogether. They move directly into digital assets and global stocks. These offer transparent pricing, 24/7 liquidity, and protection from local policy shocks.

Meanwhile, older wealthy investors reconsider their property holdings. Many face the uncomfortable reality that their most valuable assets have become their riskiest.

This represents a structural shift in Chinese wealth management. As capital mobility becomes paramount and political scrutiny intensifies, liquid global assets are displacing property as the preferred vehicle for preserving value.

What Comes Next for Chinese Capital

Regulators face a dilemma. Tightening crypto access could accelerate capital flight. Allowing it could undermine property markets further.

Property prices may stabilize if the government intervenes aggressively. But that intervention carries its own costs and risks. Plus, investor trust, once broken, proves difficult to rebuild.

Meanwhile, global crypto adoption could accelerate if wealthy Chinese continue repricing their assets against digital alternatives. That capital needs somewhere to go. Bitcoin, BNB, and international equities offer the most obvious destinations.

The implications extend beyond China. If the world’s second-largest economy sees its wealthiest citizens abandon property for crypto, that signals something fundamental about the future of wealth preservation globally.

Housing worked as a store of value when capital controls were tight and alternatives were scarce. But in 2025, capital moves faster. Information spreads instantly. And wealthy investors compare options globally.

In that environment, illiquid domestic assets lose. Liquid global alternatives win. The repricing has started. And it’s not stopping.