New Year energy hit meme coins hard this week. While most crypto assets drifted sideways, three event-driven tokens posted double-digit gains.

These aren’t your typical blue-chip plays. Instead, they’re speculative meme coins riding trend waves and social momentum. But the technical setups look compelling enough to watch as 2026 kicks off.

Let’s break down what’s happening with each token and whether the rallies have legs.

NOBODY Sausage Crushes Competition

NOBODY outperformed nearly every comparable meme coin this week, trading near $0.0181 despite bearish conditions across the broader market.

That relative strength matters. When risk assets bleed and one token holds gains, it signals real buying interest. Plus, NOBODY’s price action shows resilience that typically precedes larger moves.

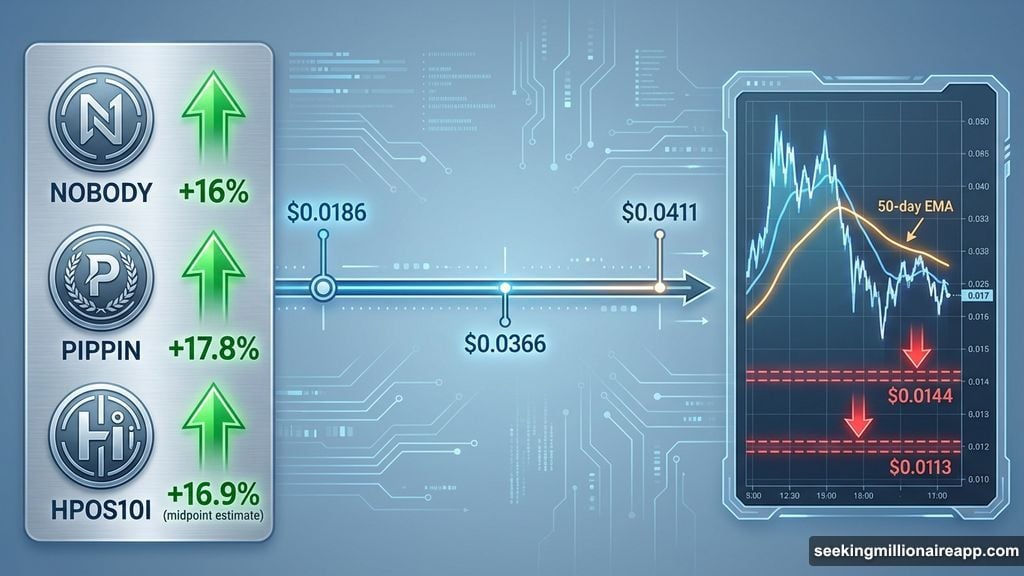

The 50-day exponential moving average sits just above current levels at $0.0186. If NOBODY can flip that level into support, the path opens toward $0.0246. That would represent a 35% gain from current prices.

However, momentum can flip fast with meme coins. A failed breakout could send NOBODY tumbling toward $0.0144 support. Losing that zone would invalidate the bullish thesis entirely. Further selling might push the token down to $0.0113, erasing recent gains.

The setup looks favorable. But watch that $0.0186 level closely. Everything hinges on whether buyers can sustain pressure above it.

PIPPIN Holds Steady Despite Cooldown

PIPPIN posted impressive 16% gains over the past seven days, though momentum slowed compared to earlier this month.

That deceleration warrants attention. After a strong monthly run, profit-taking often emerges. Yet PIPPIN’s technical structure remains intact. The Parabolic SAR indicator still shows an active uptrend, suggesting the bullish case isn’t dead yet.

If buyers step back in, PIPPIN could break above $0.434 resistance. That would open the door to $0.500 and potentially $0.600. Those levels represent significant upside from current prices.

But here’s the risk. Meme coins attract short-term traders who secure profits quickly. Increased selling pressure could push PIPPIN below $0.366 support. A confirmed breakdown there would weaken the technical picture and likely erase recent gains.

The token hasn’t crashed. It’s just catching its breath. Whether that breath turns into a second wind depends on whether speculative interest returns or fades.

HPOS10I Flips Bullish for First Time in Months

HPOS10I (trading under the BITCOIN ticker) jumped 17.8% over four days, accelerating from $0.0350 to $0.0411.

The price action looks sharp. But what really stands out? The Relative Strength Index entered positive territory for the first time in two months. That shift signals genuine momentum change, not just a dead cat bounce.

If this momentum holds, HPOS10I could push through $0.0418 resistance. A clean break would target $0.0448, representing another 9% gain. The technical setup supports continuation if volume follows through.

Yet history suggests caution. HPOS10I has rejected at similar levels before. If buyers can’t sustain pressure above $0.0418, the token might slip back below $0.0395 support. Further weakness could drag prices toward $0.0376, invalidating the bullish case entirely.

The token’s turning bullish after weeks of underperformance. But one good week doesn’t confirm a trend. Watch how price reacts at $0.0418. That level determines whether this momentum is real or fleeting.

Meme Coins Thrive on Timing

These tokens share a common trait: they’re event-driven.

New Year energy, social media trends, and narrative shifts fuel meme coin rallies. When attention flows toward speculative plays, gains can explode overnight. But that same attention evaporates just as quickly when trends fade.

That’s why technical levels matter so much. With fundamentals absent, price action and support zones become the only reliable signals. NOBODY’s $0.0186 resistance, PIPPIN’s $0.366 support, and HPOS10I’s $0.0418 barrier—these levels aren’t arbitrary. They represent zones where buyers and sellers made decisions before.

So the question isn’t whether these tokens will keep rallying. It’s whether enough speculative capital flows in to break key resistance levels. If yes, gains could accelerate fast. If no, pullbacks happen even faster.

Why This Matters Now

Meme coins typically surge at the start and end of years. New Year optimism, renewed risk appetite, and social media buzz create perfect conditions for speculative rallies.

We’re in that window right now. NOBODY, PIPPIN, and HPOS10I are already moving. But early momentum doesn’t guarantee sustained gains. These tokens live and die by attention spans measured in days, not months.

If you’re watching these plays, track the technical levels mentioned above. Breaks above resistance could signal continuation. Failures below support would suggest the party’s ending.

Just remember: meme coins reward timing more than conviction. The strongest performers often reverse fastest when sentiment shifts. That’s the game. Know it before playing.