XRP can’t catch a break. The altcoin ended 2025 down nearly 10%, stumbling through December with failed recovery after failed recovery.

But here’s the twist. While retail traders bailed, institutional investors kept buying. That divergence tells us everything about where XRP might head in 2026.

Let’s break down what the data actually reveals about XRP’s immediate future.

Institutions Bought While Everyone Else Sold

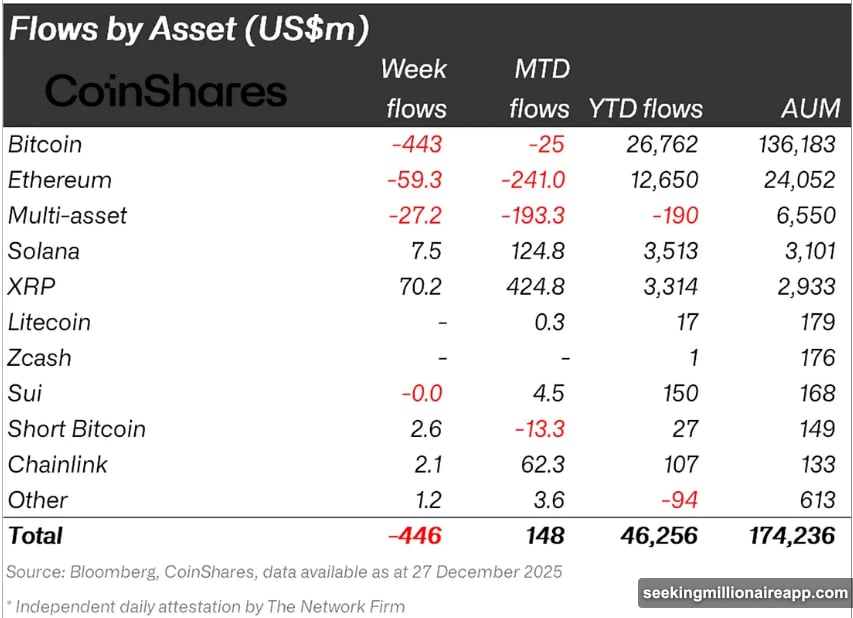

Institutional money became XRP’s only lifeline during 2025’s final quarter. According to CoinShares data, XRP pulled in $70 million during the week ending December 27 alone.

That pushed December’s total institutional inflows to $424 million. For the entire year, institutions poured $3.3 billion into XRP positions.

Compare that to Bitcoin’s $25 million in outflows and Ethereum’s brutal $241 million exit during the same period. XRP outperformed both giants in institutional appeal despite losing ground on price.

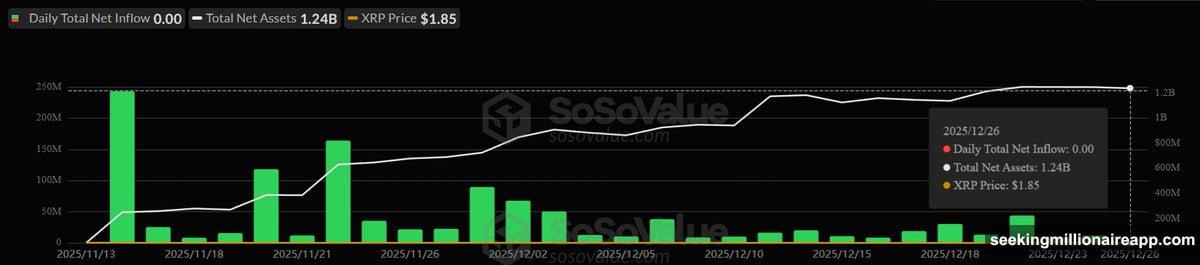

Plus, here’s what really stands out. XRP ETFs launched earlier this year and never recorded a single day of net outflows. Only one trading session closed flat without fresh capital coming in.

Ray Youssef, CEO of crypto app NoOnes, explained the strategy behind this buying. “XRP’s early December accumulation was strategic positioning by market participants to catch the ETF momentum upside,” he told BeInCrypto exclusively.

However, institutional confidence hasn’t translated to price recovery yet. That gap between capital inflows and price action signals something deeper going wrong with demand.

Long-Term Holders Started Dumping

Long-term XRP holders flipped from supporters to sellers during Q4 2025. This group typically holds through market volatility, providing stability when prices drop.

Not this time. Distribution dominated their behavior throughout the quarter, showing declining confidence in XRP’s near-term prospects.

Historical patterns suggest sustained selling from long-term holders often precedes extended consolidation or deeper corrections. So if this cohort keeps distributing into 2026, downside risk increases significantly.

Indeed, the shift from accumulation to distribution marks a concerning change in sentiment among XRP’s most committed supporters. These holders accumulated earlier in 2025 but reversed course as uncertainty mounted.

Moreover, weak retail participation compounds the problem. Institutional buying can’t offset both retail absence and long-term holder distribution indefinitely.

January Looks Flat Before Recovery Attempts

XRP traded near $1.87 at year’s end after dropping 38% during Q4 2025. The December decline cemented negative sentiment entering the new year.

But January might not improve much. Ray Youssef predicts continued consolidation between $2.00 and $2.50 throughout Q1 2026 unless major catalysts emerge.

“The market has yet to recover from persistent volatility and geopolitical disruptions caused by strained trade relations,” Youssef noted. “The numerous deleveraging and risk-off episodes have made traders hesitant to increase directional exposure.”

Historical data supports caution. Over the past 12 years, XRP averaged 3% gains in January. But the median return shows a 7.8% decline, meaning underperformance happens more often than not.

December’s weakness stemmed from broader market struggles. “XRP underperformed in December due to structural weakness. The crypto market saw one of its worst Q4 performances in almost 7 years,” Youssef added.

For meaningful recovery, XRP needs to break above $3.00. That would reestablish bullish structure and open a path toward the $3.66 all-time high.

On the downside, a break below $1.79 support would expose the $1.50 zone. That move would confirm bearish dominance and invalidate any neutral-to-bullish outlook.

Why Institutional Support Might Not Matter

Institutional inflows tell only half the story. Yes, professional investors keep buying. But their capital hasn’t stopped the bleeding.

Three factors explain this disconnect. First, retail traders remain mostly absent. Without broad participation, institutional buying lacks the momentum to drive sustained rallies.

Second, long-term holders distributed aggressively during Q4. This selling pressure counteracts institutional accumulation, creating a tug-of-war that keeps prices stuck.

Third, macroeconomic headwinds continue weighing on risk assets. Trade tensions, liquidity contraction, and weak risk appetite all work against XRP regardless of institutional interest.

Youssef emphasized this point: “Traders still consider current price points as suitable entry opportunities to capture growth potential once XRP’s performance finally reflects the ETF’s momentum.”

That “once” carries significant weight. It suggests institutional investors are positioning for future gains, not expecting immediate price recovery.

So the question becomes: How long can institutions support XRP while retail stays away and long-term holders sell? History suggests this dynamic can persist for months before resolution one way or the other.

The Catalyst XRP Desperately Needs

XRP needs a decisive macro catalyst to break out of current consolidation. Regulatory clarity around Ripple’s legal battles could provide that spark. So could broader crypto market recovery driven by Bitcoin or Ethereum strength.

But absent those catalysts, XRP faces a grinding start to 2026. Seasonal patterns, weak retail demand, and long-term holder distribution all point toward continued sideways action or modest declines.

Institutional accumulation provides a floor but not necessarily a springboard. Professional investors often build positions over extended periods, waiting patiently for market conditions to improve.

For traders, that means risk management becomes critical. The $1.79 support level represents a key line in the sand. Breaks below that threshold would likely trigger accelerated selling toward $1.50.

Conversely, sustained moves above $2.50 could signal the start of institutional positioning paying off. That would attract fresh retail participation and potentially flip long-term holder sentiment back to accumulation.

Until then, XRP trades in no man’s land—too weak for bulls, too supported for bears.