Cardano just bounced 13% off its Christmas low. But this isn’t another dead cat bounce. Three technical signals converged this week that suggest ADA might finally reverse its brutal two-month slide.

The setup looks clean. Falling wedge pattern. Bullish RSI divergence. And whales quietly added $41 million worth of coins while retail traders slept through the holidays.

Here’s what matters now. ADA trades near $0.38, the line that decides whether this becomes a real breakout or just another fake pump before more downside.

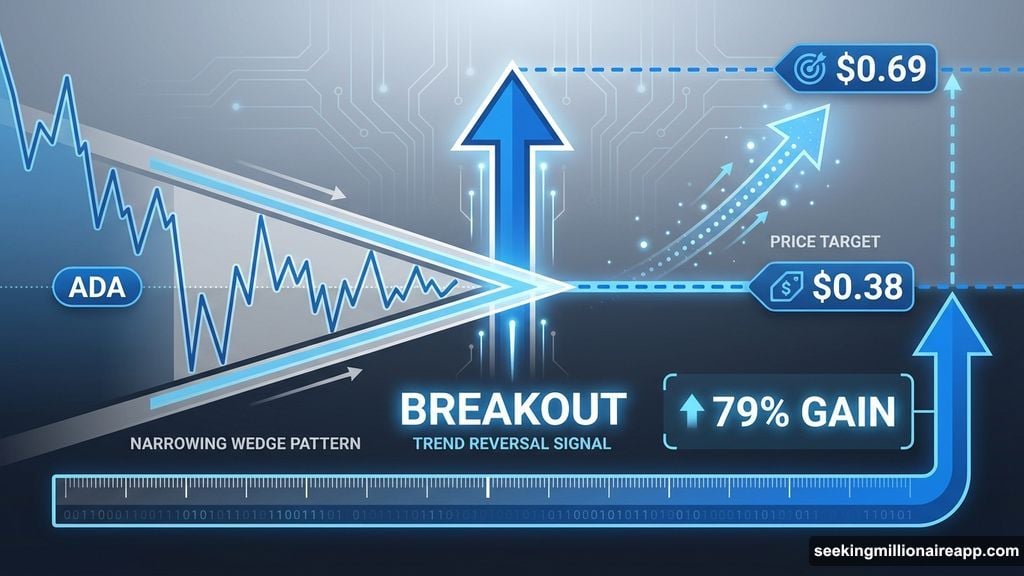

The Wedge That Could Unlock 79% Upside

ADA has been grinding lower inside a falling wedge since early November. This week, price pushed toward the upper trendline of that wedge near $0.38.

Now here’s where it gets interesting. A daily close above $0.38 triggers a measured move target of $0.69. That’s a 79% gain from current levels.

How do we get that number? You measure the widest vertical distance inside the wedge, then project it upward from the breakout point. Simple pattern-based math that’s worked reliably in previous crypto cycles.

But wedges mean nothing without confirmation. ADA needs to actually break and hold above $0.38. So far, it’s just testing the line.

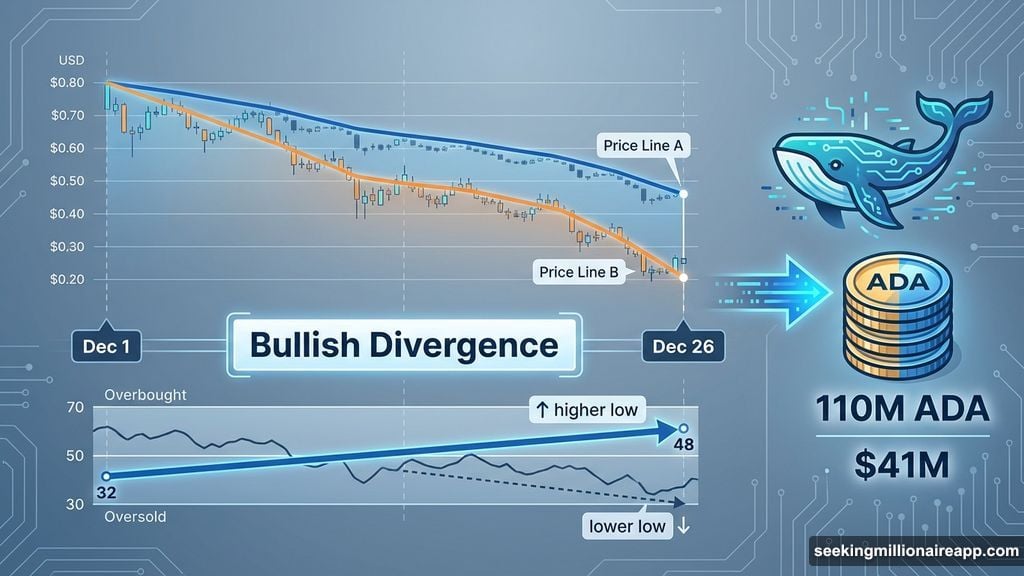

RSI Flashed Bullish Divergence Before The Bounce

Between December 1 and December 25, ADA made a lower low on the price chart. Meanwhile, the Relative Strength Index made a higher low.

That’s textbook bullish divergence. It means selling pressure weakened even as price kept dropping. Smart money spotted this setup days before the bounce started.

The divergence already triggered the current 12.8% rally. If ADA confirms the wedge breakout above $0.38, this divergence shifts from “relief bounce signal” to “trend reversal signal.”

Plus, divergences like this tend to precede bigger moves when they align with chart patterns. Right now, that alignment exists.

Whales Added 110 Million ADA During The Setup

Large holders between 100 million and 1 billion ADA increased their positions from 3.72 billion to 3.83 billion coins. That’s roughly $41 million added in just four days.

The timing matters here. Whales started accumulating on December 26, right after the RSI divergence appeared. They bought as price approached wedge resistance, not after it broke out.

That’s classic smart money behavior. Accumulate before the crowd notices, then profit when retail chases the breakout.

Meanwhile, coin activity dropped 22% over the same period. Fewer old coins moving on-chain means reduced sell pressure. When whales buy and coin activity falls, it removes supply from the market right when demand might spike.

$0.47 Becomes The Real Test After $0.38

Breaking $0.38 confirms the wedge. But $0.47 decides if this reversal has legs.

ADA failed twice to reclaim $0.47 in the past six weeks. First on November 17, then again December 9-10. Both times, sellers defended that level and pushed price back down.

Reclaiming $0.47 would flip the trend structure. It signals buyers regained control of a key resistance zone. From there, $0.51 and $0.55 become the next stops before the full $0.69 target comes into view.

However, if ADA loses $0.34, the wedge remains active but the breakout thesis weakens considerably. Right now, price sits at the most important decision point in over a month.

Why $0.69 Isn’t Guaranteed Even With A Breakout

Look, pattern targets work until they don’t. The $0.69 projection assumes perfect conditions: strong breakout, sustained buying, and no major Bitcoin dump that takes everything down.

Reality is messier. ADA could break $0.38, rally toward $0.42, then get rejected hard. Or Bitcoin could drop 10% tomorrow and invalidate this entire setup.

That’s why $0.47 matters so much. If buyers can’t reclaim that level with conviction, the $0.69 target stays theoretical. Pattern targets give you a roadmap, not a guarantee.

Also worth noting: ADA is still down nearly 10% for December. This bounce recovered some losses but hasn’t changed the monthly trend yet. One good week doesn’t erase weeks of selling.

The Signals Aligned But Confirmation Pending

Three independent signals now point the same direction. Falling wedge approaching breakout. Bullish RSI divergence already triggered. Whales accumulating while coin activity drops.

That’s rare alignment. But alignment without confirmation is just potential, not profit. ADA needs to close above $0.38 on the daily chart, then defend that level as support.

If it does, and if buyers push through $0.47, this setup could deliver the 79% move toward $0.69. But if $0.38 fails, these signals become just another almost-breakout that crypto traders love to forget.

Right now, ADA sits at its inflection point. The next 48 hours likely decide whether this becomes a trend change or another fake breakout. Watch $0.38. Watch $0.47. Everything else is noise until those levels confirm or break.