Hedera just announced an aggressive fee increase that caught many investors off guard. Starting January 2026, the network’s ConsensusSubmitMessage transaction fee will jump from $0.0001 to $0.0008—an 800% spike.

That sounds dramatic. But before panic sets in, let’s examine what this actually means for HBAR’s price and whether holders have real reason for concern.

The Fee Hike Nobody Asked For

Hedera’s ConsensusSubmitMessage service lets users submit data to the network for timestamping and ordering. It’s a core function for enterprise applications that need trusted, verifiable records.

The fee increase was announced back in July. So this isn’t breaking news. But the January 2026 implementation date is approaching fast, and market sentiment shows traders are bracing for impact.

Here’s the thing. While 800% sounds massive, the absolute cost remains tiny. Moving from $0.0001 to $0.0008 means transactions that cost one-hundredth of a cent will now cost less than a tenth of a cent.

Hedera positioned this as necessary for long-term sustainability. Plus, they argue the new fee structure still makes them one of the cheapest networks in Web3. That’s technically true. But optics matter, and an 800% increase creates negative headlines regardless of the final dollar amount.

Market Data Shows Bearish Positioning

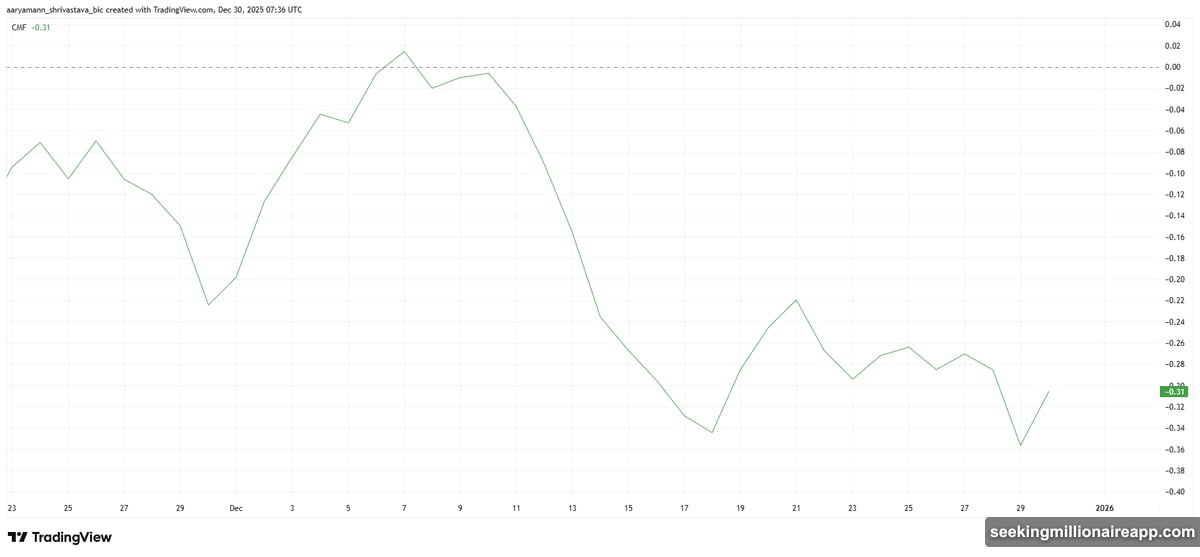

On-chain metrics paint a concerning picture for HBAR holders. The Chaikin Money Flow indicator sits well below zero, signaling sustained capital outflows.

Translation? Investors are reducing exposure rather than accumulating. Money is leaving HBAR faster than it’s coming in.

This isn’t surprising given broader crypto market conditions. Risk appetite for altcoins remains muted. But HBAR’s specific technical weakness suggests the fee increase narrative may be weighing on sentiment more than Hedera anticipated.

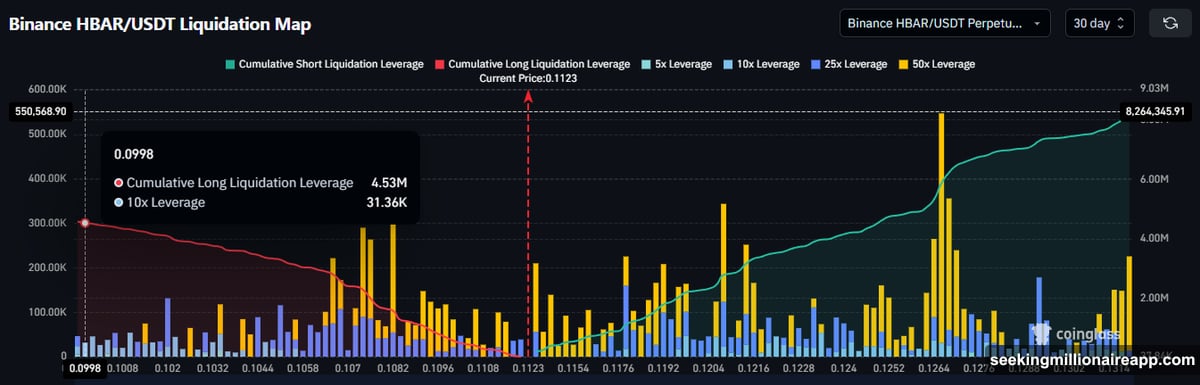

Moreover, derivatives data reveals traders are positioning for downside. Short contracts on HBAR currently total around $8.21 million. Meanwhile, long exposure sits significantly lower at approximately $4.5 million.

That imbalance tells you everything. Traders are betting on price declines, not recoveries. Such skewed positioning often amplifies volatility during periods of low liquidity—exactly the environment we’re in now.

HBAR Price Stuck Below Key Resistance

HBAR trades at $0.112 at press time. That puts it above immediate support at $0.109 but capped below critical resistance near $0.115.

This $0.115 level corresponds to the 23.6% Fibonacci Retracement line. It’s been a stubborn barrier preventing any meaningful recovery attempt. Until HBAR flips this level into support, upside momentum remains limited.

The technical setup suggests range-bound consolidation above $0.109 is more likely than a decisive breakout. Weak demand and limited speculative interest continue to dominate market behavior.

However, if broader crypto market conditions turn decisively bullish, HBAR could benefit from renewed risk appetite. Successfully breaking above $0.115 would open a path toward $0.120. But that scenario requires a catalyst—something beyond just the fee adjustment narrative.

Enterprise Impact Versus Retail Sentiment

The fee increase primarily targets enterprise use cases. For large-scale applications submitting thousands of transactions, the cost difference becomes noticeable. But for retail users or smaller projects, the change barely registers.

This creates an interesting disconnect. The actual economic impact is minimal for most participants. Yet the psychological impact—seeing “800% fee increase” in headlines—creates negative sentiment that weighs on price.

Hedera argued the move ensures predictable pricing and network sustainability. Those are reasonable long-term goals. But short-term market reaction has been skeptical at best.

Some industry observers question whether setting a precedent for aggressive fee increases could hurt adoption. Others argue the fee remains so low that no rational user would change behavior based on this adjustment alone.

Both perspectives have merit. The truth likely falls somewhere in between.

What Happens Next for HBAR?

The January 2026 implementation date is approaching. If the fee increase rolls out without major user backlash or network disruption, the narrative could shift positive.

Conversely, if the change triggers migration to competing networks or visibly impacts transaction volume, bearish sentiment could deepen. Right now, the market is pricing in caution rather than catastrophe.

Current on-chain and derivatives data suggest traders expect continued weakness. But HBAR has held above $0.109 support despite the negativity. That resilience matters.

For holders, the key level to watch is $0.115. A clear break above that Fibonacci resistance would signal improving momentum. Until then, consolidation and choppy price action remain the most probable outcome.

The fee hike itself isn’t catastrophic for HBAR’s fundamentals. But perception often matters more than reality in crypto markets. How investors interpret this change over the next several weeks will determine whether HBAR can build meaningful upside or remains stuck in its current range.