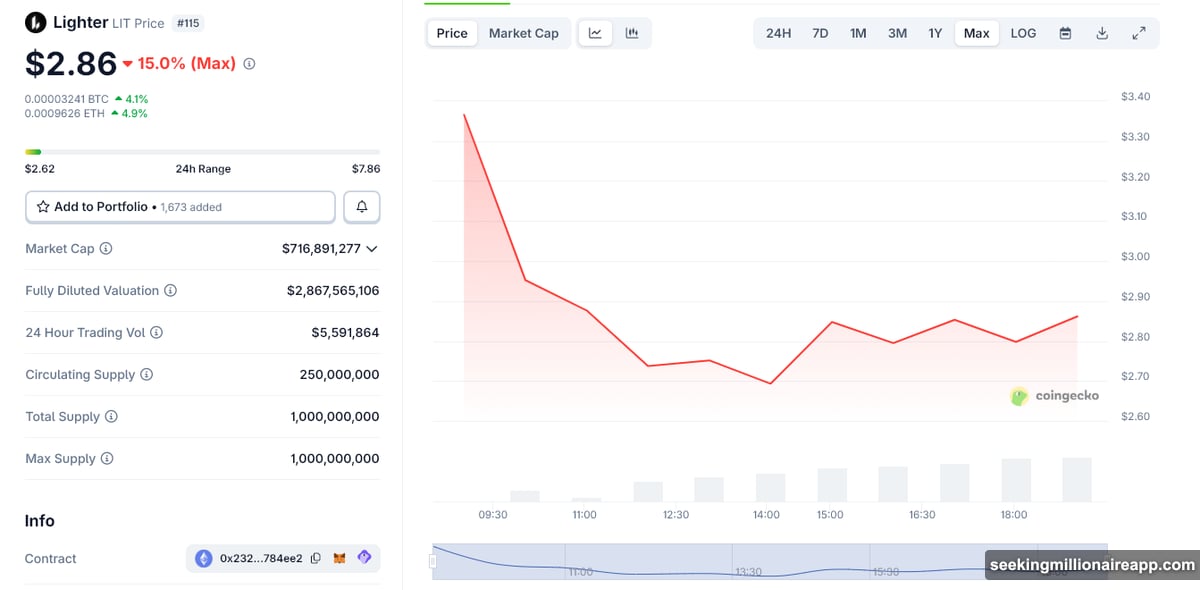

Coinbase signaled support for Lighter’s LIT token hours after launch. The move triggered immediate volatility as traders scrambled to position themselves in the newest perpetual DEX token.

LIT traded near $3 during chaotic early price discovery. Meanwhile, established competitors like Hyperliquid’s HYPE and Aster’s ASTER dipped as capital rotated toward the fresh listing. Plus, the timing couldn’t be more interesting for the perpetual futures market.

Coinbase Moves Fast on Lighter Support

Coinbase announced spot trading for LIT will activate once liquidity conditions stabilize. That’s significant timing. The exchange made its move on the same day Lighter completed its token generation event.

The listing applies to regions supporting the LIGHTER-USD pair. So availability varies by location. But the signal matters more than immediate access. Coinbase doesn’t typically rush listings for new tokens unless something catches their attention.

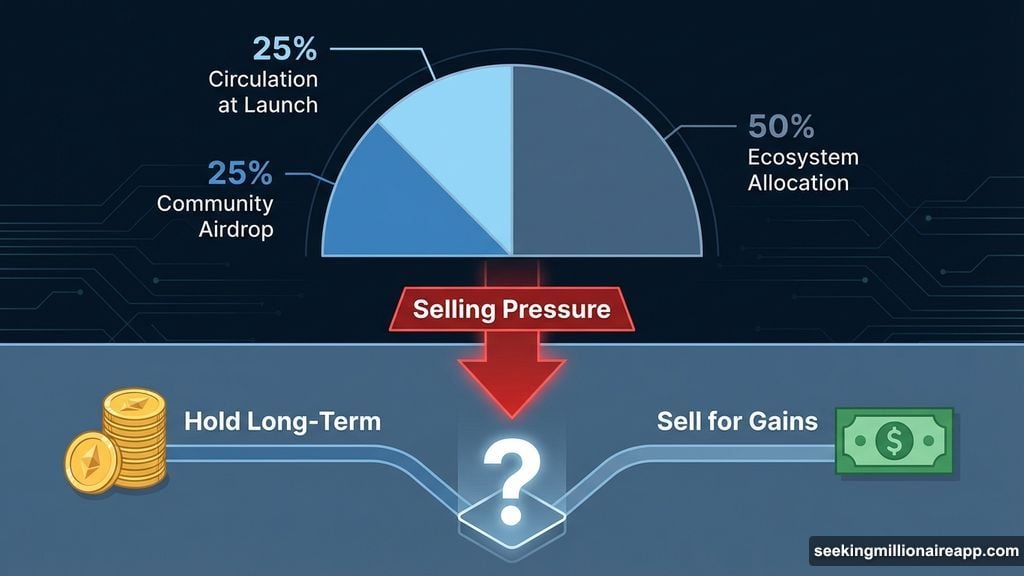

Lighter released roughly 25% of its 1 billion total token supply into circulation at launch. That’s a substantial float for day one. Early trading showed exactly what you’d expect with that much supply hitting the market at once.

Launch Day Volatility Showed Real Price Discovery

LIT experienced sharp swings right out of the gate. The token initially sold off before finding support between $2.70 and $2.90. Then it climbed toward the $3 level as buyers stepped in.

This pattern is typical for major token launches. Early recipients often sell immediately to lock in profits. Then the market needs time to figure out what the token is actually worth beyond initial hype.

Lighter built its protocol as an Ethereum-based perpetual futures exchange. LIT serves as the core asset for governance, user incentives, and future fee structures. So the token has clear utility beyond pure speculation.

However, half the total supply went to ecosystem allocation. That includes a massive 25% community airdrop distributed to users who participated in 2025 incentive campaigns. Team and investor tokens remain locked for one year, then vest gradually over three years.

Airdrop Recipients Face the Hold or Sell Decision

Community airdrops create immediate selling pressure. Recipients who earned tokens through participation often dump holdings to capture gains. That’s exactly what happened in LIT’s first hours of trading.

The question now is whether airdrop recipients will hold long-term or continue selling into strength. Market depth during these early days reveals a lot about community conviction and genuine adoption potential.

Moreover, Lighter needs to convert launch-day attention into sustained trading activity. One-day spikes mean nothing if volume disappears by next week. The protocol must prove it can compete with established platforms that already have deep liquidity and loyal user bases.

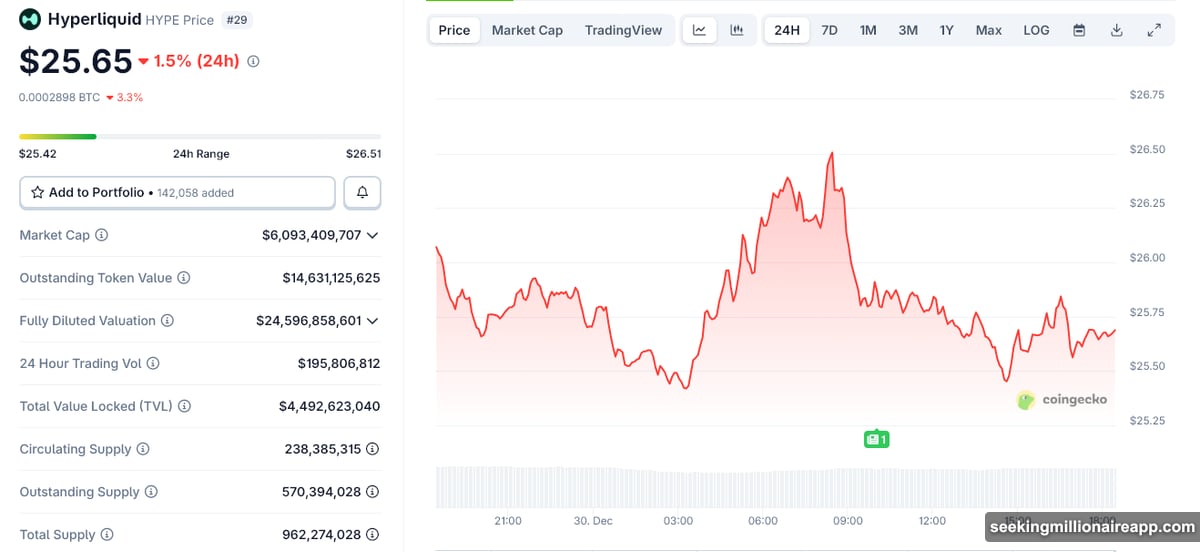

Established Perp DEX Tokens Felt the Pressure

Hyperliquid’s HYPE token dropped approximately 1.5% on the same day LIT launched. Aster’s ASTER token also trended lower despite no protocol-specific announcements from either project.

Traders attributed the synchronized decline to capital rotation. When a new high-profile token enters the market, money flows from existing positions into the fresh opportunity. That’s basic market mechanics.

Plus, some traders likely hedged their LIT positions by shorting competitors. This strategy protects against sector-wide volatility while maintaining exposure to the new token’s potential upside.

Historically, large perpetual DEX token launches trigger temporary pressure across the entire category. Liquidity fragments as traders spread capital across multiple protocols. Then the market needs time to consolidate again.

Competitive Landscape Just Got More Crowded

Lighter’s entry adds another high-valuation protocol into an already competitive market. Hyperliquid dominates with established liquidity and a proven track record. Other platforms like Aster offer differentiated features that attract specific user segments.

So where does Lighter fit? The protocol must carve out its own niche or risk becoming just another perpetual DEX fighting for scraps. Building differentiation takes time and requires sustained development beyond token launch hype.

The perpetual futures market on-chain continues growing rapidly. But that growth doesn’t guarantee success for every new entrant. Users gravitate toward platforms with the best execution, lowest fees, and deepest liquidity. Lighter needs to prove it can compete on these metrics.

Furthermore, the token’s price action over the next few weeks will reveal whether genuine demand exists or if this was just launch-day speculation. Sustained volume and stable pricing signal real adoption. Declining interest and falling prices suggest the opposite.

What Happens Next Determines Everything

Short-term volatility across perpetual DEX tokens will likely remain elevated. The market needs time to absorb this new addition and figure out appropriate valuations for all competing protocols.

Airdrop recipients will continue making hold-or-sell decisions over the coming days. That selling pressure could push LIT lower before establishing a stable base. Or strong demand might absorb the supply and push prices higher.

Coinbase’s listing signal provides legitimacy and visibility. But legitimacy doesn’t guarantee success. Lighter must now execute on its roadmap, attract genuine users, and prove it offers something competitors don’t.

The perpetual DEX sector is heating up fast. More competition usually benefits users through better features and lower fees. Whether it benefits token holders remains to be seen. That depends entirely on execution and adoption, not launch-day hype.

Watch how LIT behaves as initial volatility settles. The token’s price after excitement fades tells the real story about long-term viability. Plus, keep an eye on volume trends across all major perp DEX platforms. Capital rotation isn’t finished yet.