Bitcoin can’t catch a break at $90,000. The world’s largest cryptocurrency keeps bouncing off this psychological ceiling, and now we know why.

Mega whales just sold over $4.4 billion worth of BTC in four days. Yet price refuses to collapse. Instead, Bitcoin hovers near $89,543, showing surprising strength despite massive selling pressure. That tells us something important about current market dynamics.

Mega Whales Are Bailing Fast

The biggest Bitcoin holders are heading for the exits. Wallets containing 10,000 to 100,000 BTC sold more than 50,000 coins since late December. That’s their lowest balance in two months.

These aren’t small players. Mega whales shape market direction through sheer size. When they dump this aggressively, prices usually crater. But that’s not happening this time.

Instead, other buyers are absorbing every coin whales sell. Retail traders, institutions, or smaller whales are stepping in at these levels. So while the selling creates resistance, it hasn’t triggered a broader collapse.

Three Key Price Zones Hold the Line

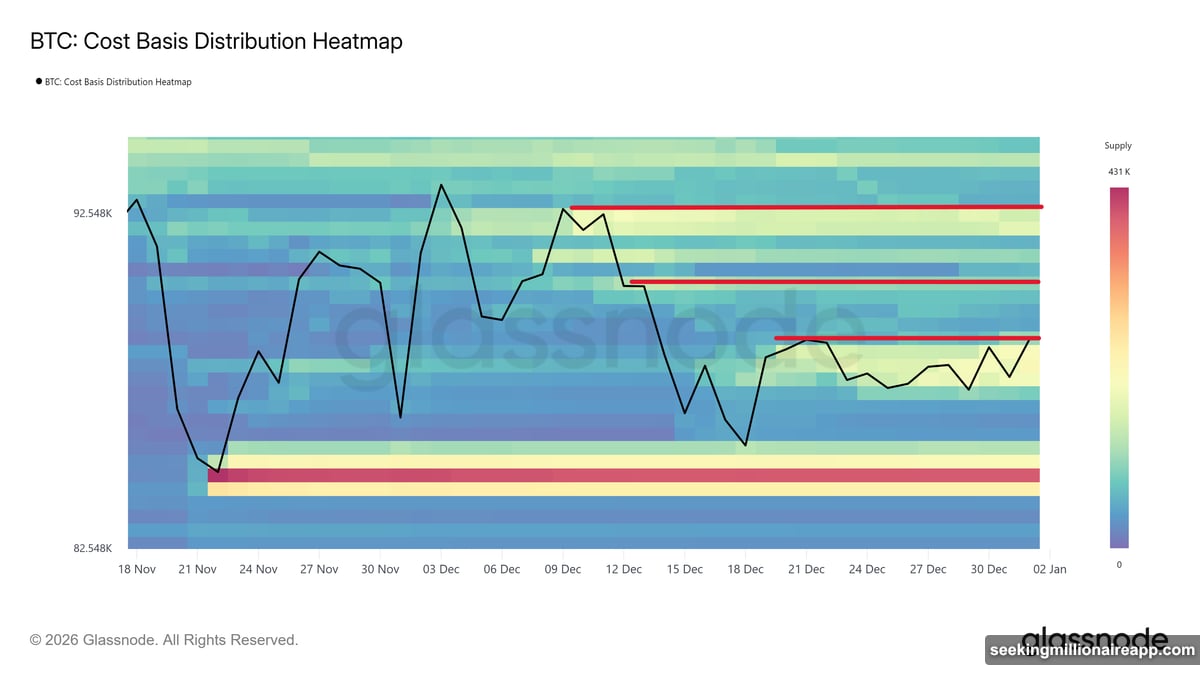

Glassnode’s Cost Basis Distribution Heatmap reveals where support exists. The data shows three critical zones based on historical accumulation.

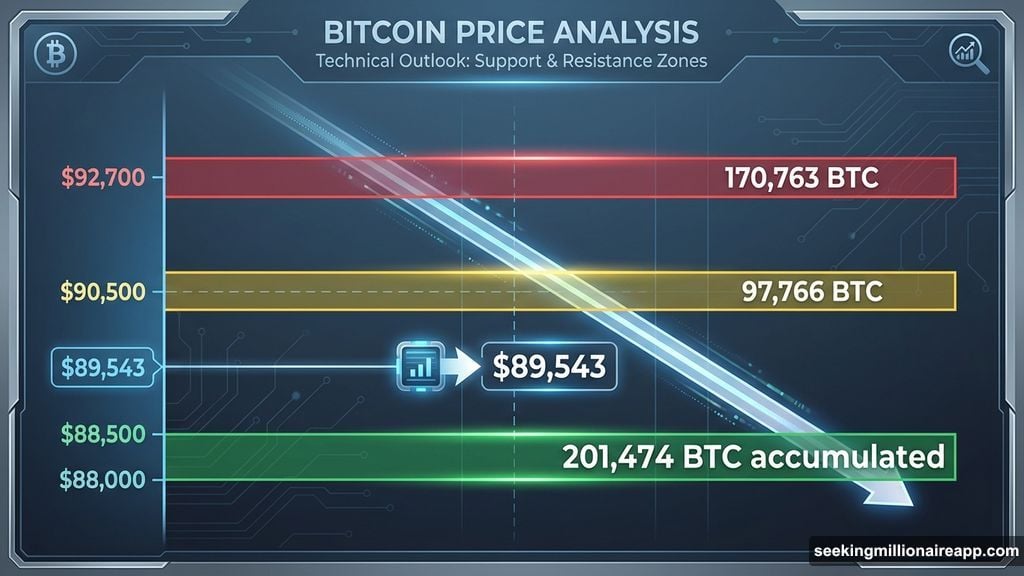

First comes $88,000 to $88,500. Roughly 201,474 BTC changed hands here, creating a strong demand floor. Bitcoin already cleared this level and keeps bouncing off it. That’s bullish confirmation.

Next resistance sits near $90,500. Buyers accumulated about 97,766 BTC at these prices. Breaking through without heavy profit-taking could unlock momentum toward higher targets.

Beyond that, $92,700 emerges as the major ceiling. Approximately 170,763 BTC were purchased around this mark. Clearing it would signal genuine strength and potentially trigger FOMO buying.

Demand Zones Are Holding Firm

Bitcoin’s ability to stay above $88,500 matters more than most realize. This zone represents real buying interest, not just speculative bids.

When price tests support and bounces repeatedly, it confirms demand. Each successful test strengthens the foundation for eventual breakout attempts. Plus, holding above cost basis zones prevents cascading liquidations that often accompany breakdowns.

However, progress now depends on whether holders at higher cost bases resist selling. If participants who bought between $90,500 and $92,700 start distributing aggressively, upward momentum stalls fast.

Downtrend Line Still Caps Upside

Technical charts show Bitcoin trading below a month-long descending trendline. Price action continues compressing toward the $90,000 threshold despite this overhead resistance.

This setup typically precedes explosive moves. Prolonged consolidation builds energy. When price finally breaks out from narrowing ranges, momentum often accelerates quickly.

A close above $90,000 and confirmation of support at $90,308 would flip sentiment bullish. From there, Bitcoin could target $92,031 assuming whale selling doesn’t intensify further.

Downside Risk Hasn’t Disappeared

The bullish scenario assumes mega whale selling moderates. But what if it doesn’t?

Increased distribution could easily push Bitcoin back toward $88,210 support. That would extend range-bound trading and delay any sustained move above $90,000. Worse, breaking below $88,000 might trigger stop losses and accelerate decline.

Market structure looks constructive for now. Yet large holders clearly lack conviction at current prices. Their continued selling creates real risk that outweighs technical optimism.

What Happens Next

Bitcoin faces a clear choice at these levels. Either demand absorbs remaining whale supply and price breaks out, or selling pressure overwhelms buyers and price retreats.

The fact that BTC held up during $4.4 billion in selling suggests underlying strength. Demand zones above $88,500 continue functioning as advertised. Momentum is building even if progress feels slow.

But mega whales dumping this aggressively rarely signals immediate upside. They’re exiting for a reason, whether profit-taking, risk management, or negative outlook. Their actions create resistance that technical analysis alone can’t overcome.

Watch $90,308. If Bitcoin secures this level as support, the path to $92,031 opens up. If it fails and drops below $88,500, expect several more weeks of sideways grinding while the market digests whale supply.