US stock futures jumped when 2026’s trading began. The rally wasn’t massive, but it signaled something important: investors felt ready to take risks again.

Bitcoin climbed to $97,000 by Friday morning. Ethereum hit $3,330. Plus, the timing wasn’t random. When traditional markets show strength, crypto tends to follow. That pattern held true again.

The real question? Whether this early momentum lasts or fades by February.

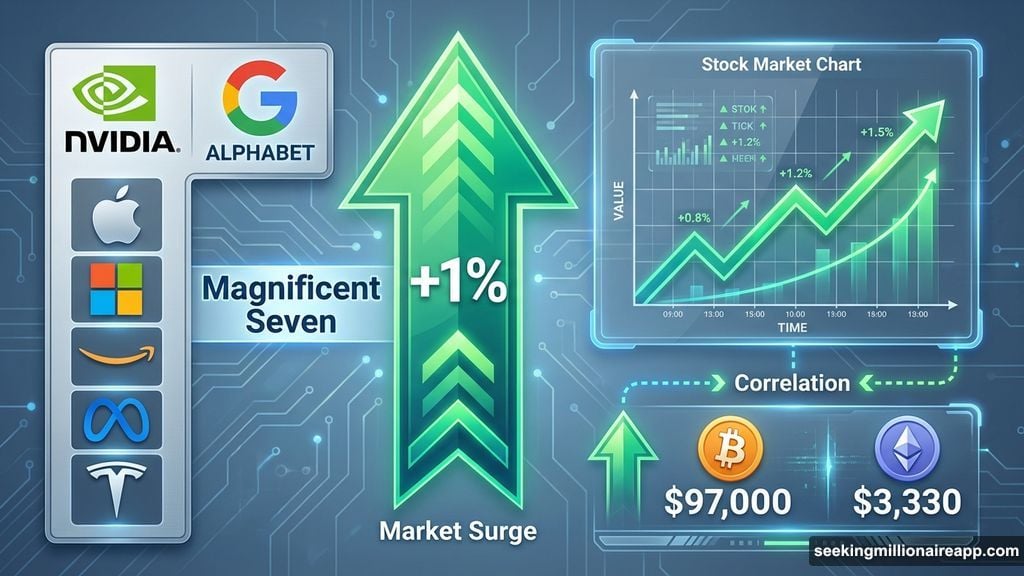

AI Stocks Sparked the Rally

Nvidia and Alphabet led the charge. Both gained over 1% in early trading. In fact, all seven “Magnificent Seven” tech stocks traded higher.

These companies drove most of 2025’s equity gains. So their strength in early 2026 reassured nervous investors. The AI narrative still has legs, at least for now.

But here’s the catch. AI stocks carry enormous expectations. Markets funded this boom with leverage, not just equity. That creates fragility. If AI companies fail to deliver profits soon, confidence could crack fast.

Remember, narrow leadership means weak foundations. A handful of mega-cap stocks props up the entire market. When just seven names control momentum, any stumble hits hard.

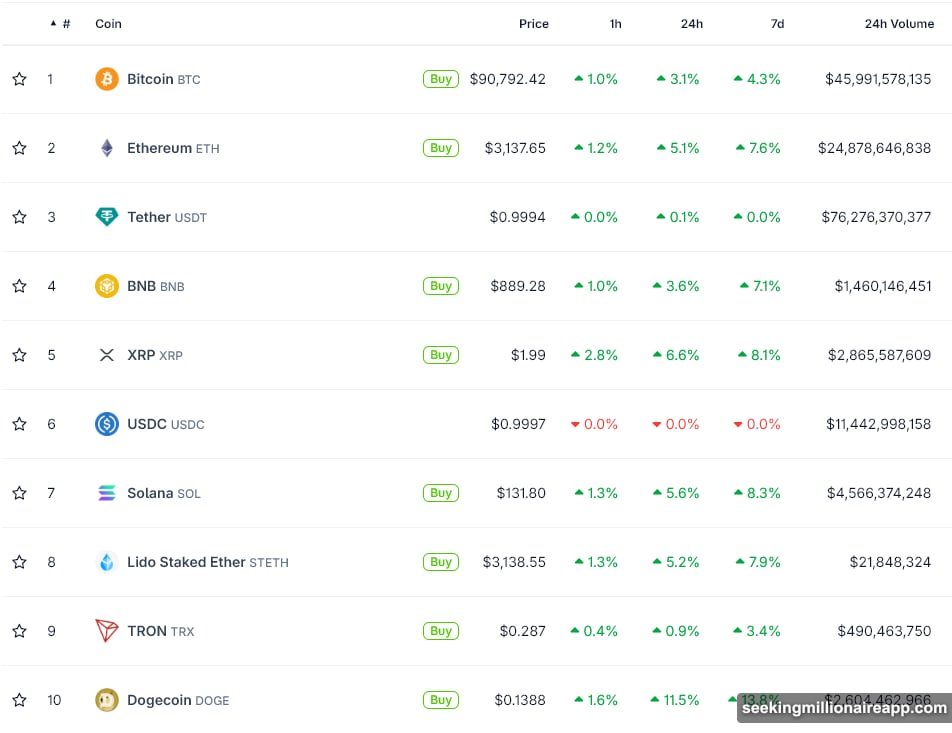

Crypto Rides Equity Sentiment

Bitcoin and Ethereum both jumped when Wall Street opened positive. The correlation between crypto and tech stocks keeps strengthening.

Why does this matter? Crypto increasingly trades like a risk asset. When investors feel confident about equities, they pour money into digital assets too. When fear dominates, both markets sell off together.

Early 2026 data shows $670 million flowed into crypto ETFs on the first trading day. That’s real money chasing exposure. However, one strong day doesn’t confirm a trend. Markets need sustained inflows to maintain upward pressure.

The danger? If AI leadership falters, crypto faces immediate downside. These assets move in tandem now. You can’t separate crypto performance from broader risk appetite anymore.

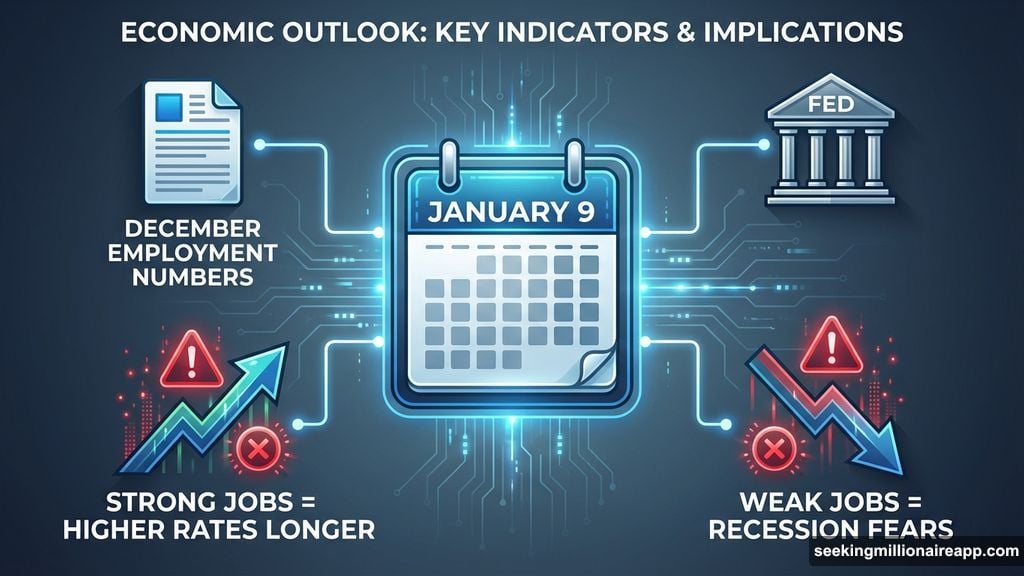

Labor Data Will Determine What Comes Next

Markets open January 9 awaits like a landmine. That’s when December employment numbers drop.

Strong jobs data means the Fed might hold rates higher for longer. Weak data revives recession fears. Either scenario creates problems. High rates squeeze liquidity. Recession expectations kill risk appetite.

Fed Chair Jerome Powell already cautioned against aggressive rate cuts. So even dovish policy shifts face limits. Markets wanted easy money in 2026. They’re learning that’s not guaranteed.

Plus, inflation hasn’t disappeared. If labor markets stay hot, price pressures could resurge. That forces the Fed’s hand toward tighter policy. Meanwhile, if jobs crater, recession risks spike.

Neither outcome helps risk assets much. The sweet spot of moderate growth with falling rates looks increasingly unlikely.

Liquidity Concerns Lurk Beneath Surface Strength

Early 2026 optimism masks deeper structural issues. Markets funded AI expansion with leverage and structured cash flows. That creates systemic fragility.

One investor compared this to 2008’s housing bubble. Back then, weak collateral assumptions brought down the financial system. Today, AI investment rests on similar shaky ground.

If large AI bets fail to generate profits, collateral values collapse. Leveraged positions unwind. Markets seize up. This isn’t conspiracy theory thinking. It’s basic risk assessment.

Furthermore, concentration in a few mega-cap stocks amplifies problems. When leadership narrows, broader participation weakens. If Nvidia or Alphabet stumble, contagion spreads fast.

Crypto faces the same dynamic. Digital assets rely on continuous liquidity inflows. When traditional markets tighten, crypto suffers immediately. There’s no decoupling anymore.

First Trading Days Often Mislead

Here’s an uncomfortable truth. Strong starts to the year rarely predict what follows.

Markets frequently rally in early January as investors reposition portfolios. Fresh capital enters. Optimism runs high. Then reality sets in by February.

Historical data shows first-day gains correlate poorly with full-year performance. So today’s green candles don’t guarantee sustained momentum.

Instead, watch upcoming economic releases. Labor data, inflation reports, and Fed signals will shape actual trends. Early optimism means little if macro conditions deteriorate.

Moreover, AI stocks need to prove their investments generate returns. Markets gave these companies a free pass in 2025. That grace period ends now. Revenue growth and profitability matter again.

What Smart Money Watches Now

Several factors will determine whether this rally continues or collapses.

First, AI leadership must hold. If Nvidia, Microsoft, or Alphabet falter, equity momentum dies. Crypto follows immediately. These stocks carry too much weight to fail quietly.

Second, labor data needs to hit a narrow target. Too strong, and rates stay high. Too weak, and recession fears spike. Markets want moderate cooling, not extremes in either direction.

Third, liquidity conditions matter most. If money flows remain steady, risk assets can rally. If liquidity tightens, even strong fundamentals won’t help. Cash is king when credit freezes.

Finally, watch crypto ETF inflows. Sustained institutional demand signals genuine interest. One-day spikes mean nothing. Track weekly patterns to gauge real appetite.

Why This Feels Different Than Past Rallies

Previous risk-on periods felt broader. Multiple sectors participated. Leadership rotated. Strength appeared sustainable.

This rally concentrates narrowly. AI stocks dominate. Everything else lags. Crypto rides coattails rather than leading independently.

That concentration creates binary outcomes. Either AI delivers and everything rallies. Or AI disappoints and everything crashes. No middle ground exists.

Plus, leverage levels worry experienced traders. Markets built this rally on borrowed money. That works great until it doesn’t. When leveraged bets unwind, they cascade violently.

Crypto amplifies this dynamic. Digital assets already trade with high volatility. Add leverage and weak liquidity, and you get extreme swings in both directions.

Early 2026 opened strong. But strength born from narrow leadership and high leverage rarely lasts. The next few weeks will reveal whether this rally has substance or just reflects portfolio rebalancing and false hope.

Watch the labor data. Track AI stock earnings. Monitor liquidity conditions. Those factors will determine whether crypto follows equities higher or both collapse together when reality intrudes.