A dormant crypto whale just woke up with a specific mission. After vanishing for seven months, they’re now betting thousands on Israeli military action against Iran.

The timing feels suspicious. This trader’s history shows 100% accuracy on Israel-related bets. Now they’re back, wagering $8,198 across multiple positions. Plus, this resurfaces right after similar Polymarket controversies involving Venezuela.

Something doesn’t add up here.

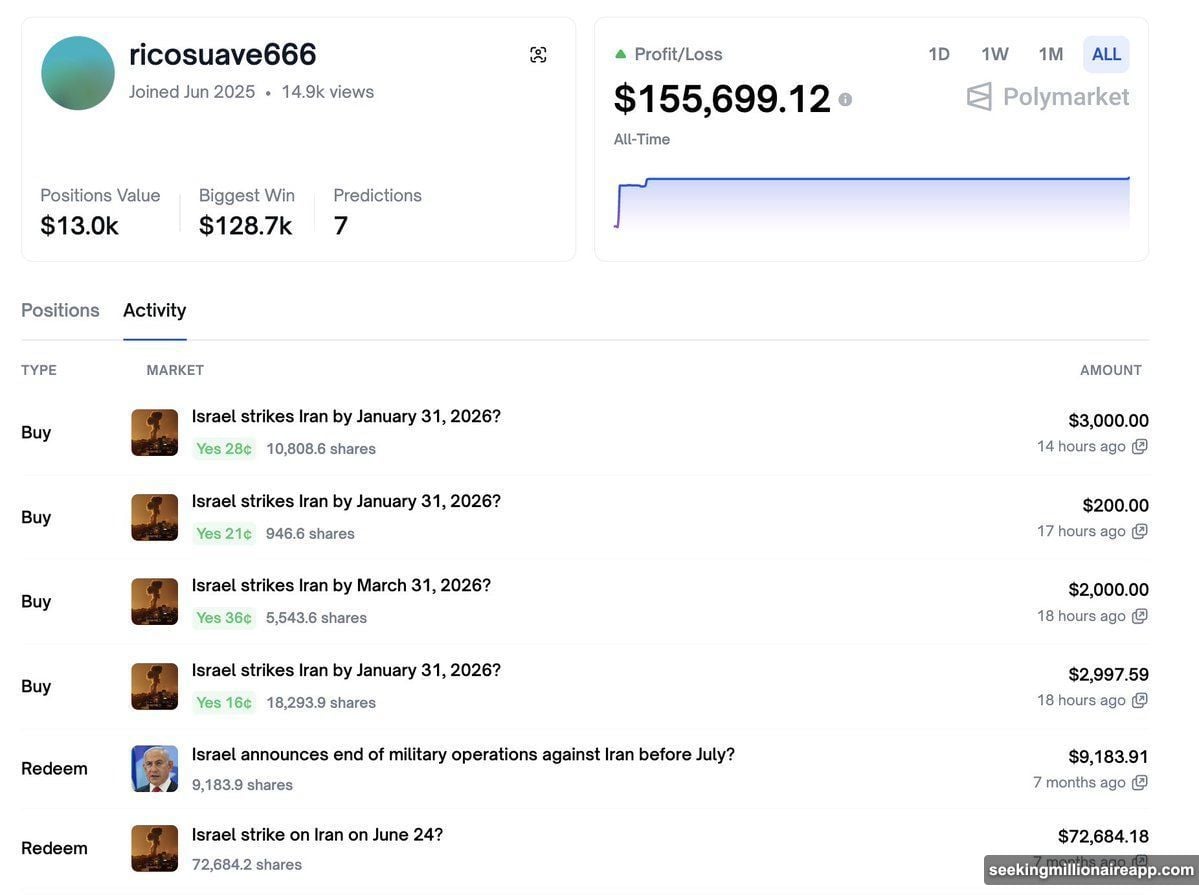

The Suspicious Return of ricosuave666

The account ricosuave666 sat idle since June 2025. Then suddenly, activity resumed in early January 2026. All bets focus on one question: Will Israel strike Iran?

Blockchain analytics firm Lookonchain flagged the pattern immediately. They noticed something unusual. This trader’s track record shows $155,699 in total profits. More importantly, every single Israel-related bet previously placed proved correct.

That’s not normal luck. It’s either incredible analysis or something else entirely.

The current wagers target two specific dates. First, they’re betting on strikes by January 31, 2026. Second, they’ve positioned for action by March 31. Polymarket currently shows 38% odds for the January scenario. Those odds climb to 54% for March.

But here’s what makes this interesting. The trader joined Polymarket seven months ago. Every Israel bet since then hit. Now they’re back for round two.

Regional Tensions Fuel Market Speculation

Middle East instability reached new heights recently. Iran’s currency collapsed against the dollar in late December. That triggered widespread protests across the country.

Israeli Prime Minister Benjamin Netanyahu publicly supported those demonstrations. Iran’s government accused Israel of trying to destabilize their national unity. Meanwhile, Iran warned it might launch preemptive strikes if threats become concrete.

So the geopolitical backdrop supports these bets. Israeli-Iranian tensions are real and escalating. However, that doesn’t explain the trader’s perfect record or convenient timing.

The National Defense Council in Iran issued vague warnings about “long-standing enemies.” They didn’t name Israel or the United States explicitly. Yet everyone understands the message.

The Maduro Connection

This isn’t Polymarket’s first brush with insider trading accusations. Just weeks ago, three wallets made over $630,000 betting on Venezuelan President Maduro’s arrest. Those bets came hours before it happened.

The timing seemed impossible to explain without inside information. Now ricosuave666 emerges with another perfectly timed series of wagers. The pattern repeats itself.

Lookonchain asked the obvious question: “Is he an insider?” They pointed out the statistical improbability of such consistent accuracy. Yet no concrete evidence proves wrongdoing.

Polymarket operates in a gray area anyway. Prediction markets technically aren’t gambling. But they certainly attract people with privileged information. And blockchain transparency only shows what happened, not why.

What This Means for Prediction Markets

Polymarket faces a credibility problem. These recurring patterns damage trust in the platform. Users wonder whether they’re competing against informed traders or genuine speculation.

The platform doesn’t verify who places bets or their information sources. That’s part of its decentralized appeal. But it also creates opportunities for abuse.

Moreover, high-stakes geopolitical events attract exactly this kind of attention. If someone has intelligence connections, they could profit massively. The blockchain records everything except intent.

Still, alternative explanations exist. Maybe ricosuave666 employs sophisticated analysis. Perhaps they monitor intelligence sources and military movements closely. Open-source intelligence can reveal a lot if you know where to look.

Or maybe it’s just remarkable coincidence. Unlikely? Sure. Impossible? Not quite.

The Bigger Picture Nobody Mentions

Prediction markets theoretically aggregate collective wisdom. That only works if participants bet on genuine beliefs, not insider knowledge. When informed traders dominate, the entire model breaks down.

Polymarket generated over $3.7 billion in trading volume during 2024. That massive liquidity attracts serious money and potentially serious manipulation. The platform can’t easily distinguish between smart analysis and illicit information.

Plus, crypto’s anonymity makes tracking participants nearly impossible. Anyone can create multiple wallets. Coordination between accounts becomes trivial. Enforcement against insider trading remains mostly theoretical.

So we’re left watching patterns that look suspicious but prove nothing definitive. Meanwhile, traders like ricosuave666 keep winning while regulators struggle to catch up.

The next few weeks will tell the story. If Israeli strikes happen by January 31, this trader nails another perfect prediction. That would push their winning streak into statistically absurd territory. If nothing happens, maybe the magic finally fails.

Either way, Polymarket’s reputation takes another hit. These patterns erode confidence faster than the platform can build legitimacy.