Ethereum crashed nearly 3% this week. But price action tells only half the story.

The real issue? US institutions stopped buying. And until they come back, breaking through that stubborn $3,300 resistance looks increasingly unlikely.

Let’s dig into what’s actually happening behind the scenes.

The Coinbase Signal Everyone Missed

Ethereum started 2026 strong with an 11.3% gain in the first six days. Then it hit a wall. Now trading around $3,113, ETH reversed course as broader crypto markets shed 2.2% of total value.

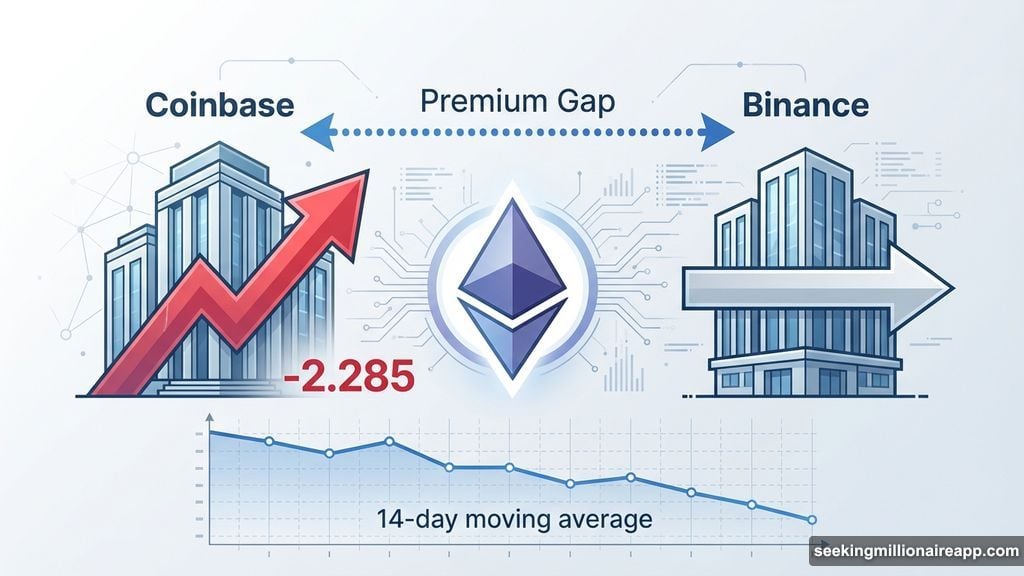

CryptoOnchain spotted the warning sign before most traders. The Coinbase Premium Gap just hit -2.285 on its 14-day moving average. That’s the lowest reading since early February 2025.

What does this mean? Coinbase primarily serves US institutional investors. Binance reflects global retail activity. When the gap goes negative, institutions are selling while retail buys. Or more accurately, institutions simply aren’t buying at all.

Plus, this divergence matters for a specific reason. Historically, sustained Ethereum rallies coincide with positive Coinbase premiums. When big money flows through US exchanges, prices tend to follow. Right now, that flow dried up completely.

ETF Outflows Paint a Brutal Picture

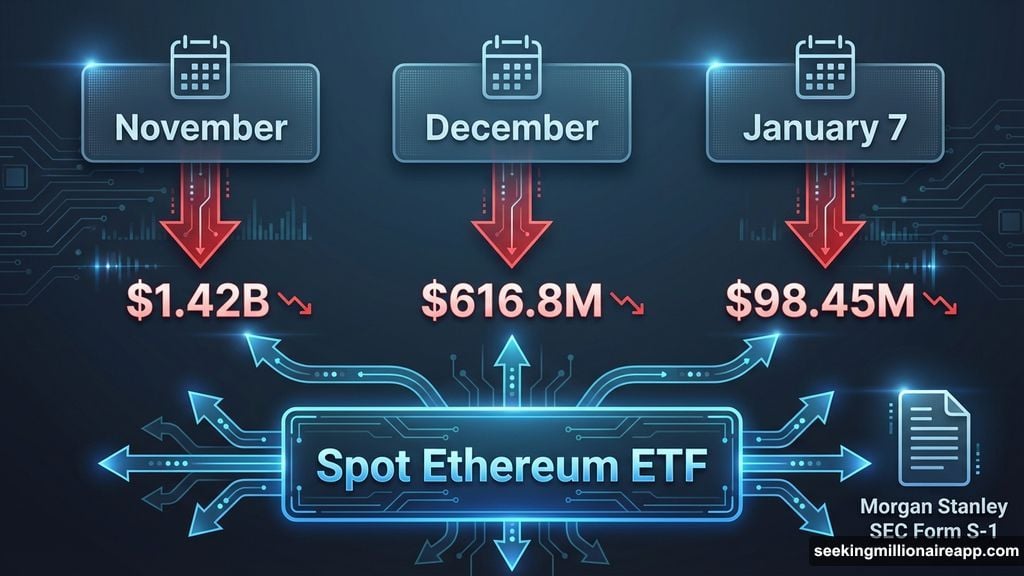

Spot Ethereum ETFs tell the same story. The numbers don’t lie.

November saw $1.42 billion exit these products. December added another $616.8 million in outflows. Then on January 7, 2026 posted its first outflow of the new year at $98.45 million.

That’s three consecutive months of institutional exits. Moreover, Bitcoin and XRP ETFs experienced simultaneous outflows on January 7. So this isn’t just an Ethereum problem. The entire sector faces demand weakness.

Yet here’s the kicker. Institutional caution doesn’t mean complete abandonment. Morgan Stanley filed an SEC Form S-1 for a spot Ethereum ETF on January 6. They already submitted applications for Bitcoin and Solana ETFs earlier.

So some big players still see long-term value. But they’re clearly not rushing to buy at current levels.

Technical Signals Hint at Something Different

Despite weak institutional metrics, technical analysis tells a more optimistic story. Several market watchers spotted bullish patterns forming.

One analyst identified a hidden bullish divergence on the ETH chart with valid support intact. This setup often precedes upward price movement if support holds firm.

Another trader pointed to tightening Bollinger Bands. When these bands squeeze together, large price moves typically follow. The direction remains uncertain, but volatility looks imminent.

Plus, Ethereum broke out of its previous range and is now retesting support above the 21-day moving average. That’s textbook bullish behavior if the level holds.

The $3,300 Resistance Remains Intact

CryptoOnchain made the case clear. Until the Coinbase Premium Gap returns to positive territory, breaking $3,300 stays improbable.

Why does this level matter so much? It represents a heavy resistance zone where previous rallies stalled. Sellers consistently overwhelm buyers at this price point.

However, technical patterns suggest a breakout could materialize if conditions shift. The contradiction creates uncertainty for traders trying to position themselves.

On one hand, institutional money shows zero interest. On the other, technical indicators point toward accumulation and potential upside.

What Needs to Happen Next

Ethereum faces a credibility test. Price alone won’t break through $3,300 without fundamental demand shifts.

First, US institutional buying must resume. The Coinbase Premium Gap needs to flip positive. That signals real conviction from big money managers who move markets.

Second, ETF outflows must reverse. Three consecutive months of exits can’t continue if Ethereum wants sustained upward momentum. Net inflows would demonstrate renewed confidence.

Third, Bitcoin needs to stabilize. Since ETH often follows BTC’s lead, broader market strength matters. If Bitcoin continues declining, Ethereum faces additional headwinds regardless of its individual metrics.

The technical setup looks promising. Hidden bullish divergences and tightening Bollinger Bands suggest something’s brewing. But technicals don’t override fundamental demand destruction.

The Real Challenge

Ethereum closed 2025 down 10.9%. Starting 2026 with weak institutional demand and persistent ETF outflows doesn’t inspire confidence.

Moreover, the disconnect between technical signals and institutional behavior creates confusion. Traders see bullish patterns. Institutions see exit signs. Who’s right?

Both might be correct on different timeframes. Technical patterns could drive short-term bounces while institutional absence caps medium-term upside. That’s the frustrating reality traders must navigate.

Until American institutions return to buying, expect $3,300 to act like concrete. Price might test it. Might even briefly break through. But sustained movement above requires demand that simply doesn’t exist right now.

Watch the Coinbase Premium Gap. When it flips positive and stays there, then we can talk about real breakouts. Until then, optimistic technical patterns fight against pessimistic fundamental reality.

That’s not a battle technical analysis usually wins.