Zcash just had a very bad week. The entire development team walked out. And now, something interesting is happening with Monero.

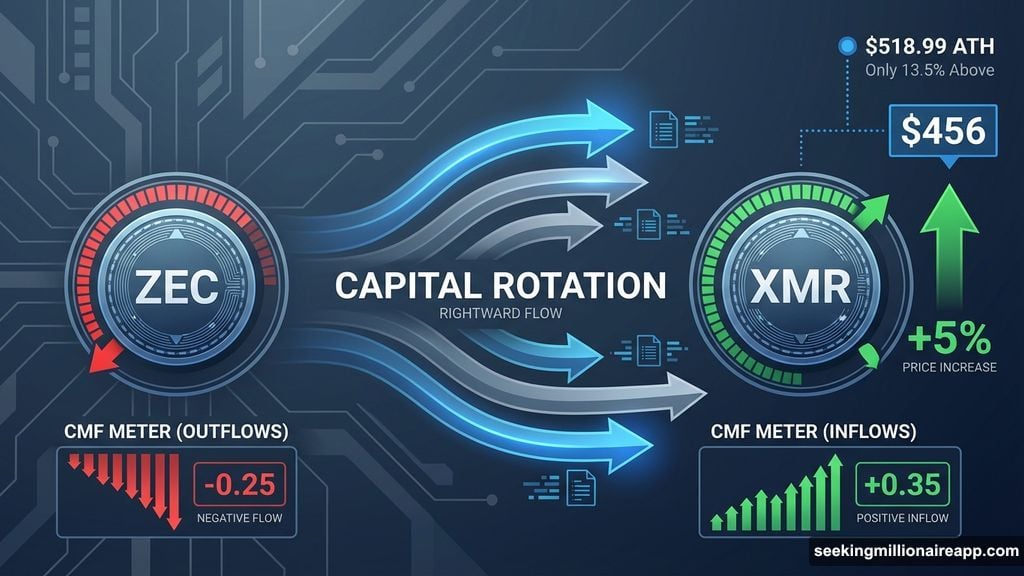

Capital appears to be flowing out of ZEC and straight into XMR. The timing isn’t coincidental. Plus, Monero now sits just 13.5% below its all-time high. That gap could close fast.

The Entire Zcash Team Just Quit

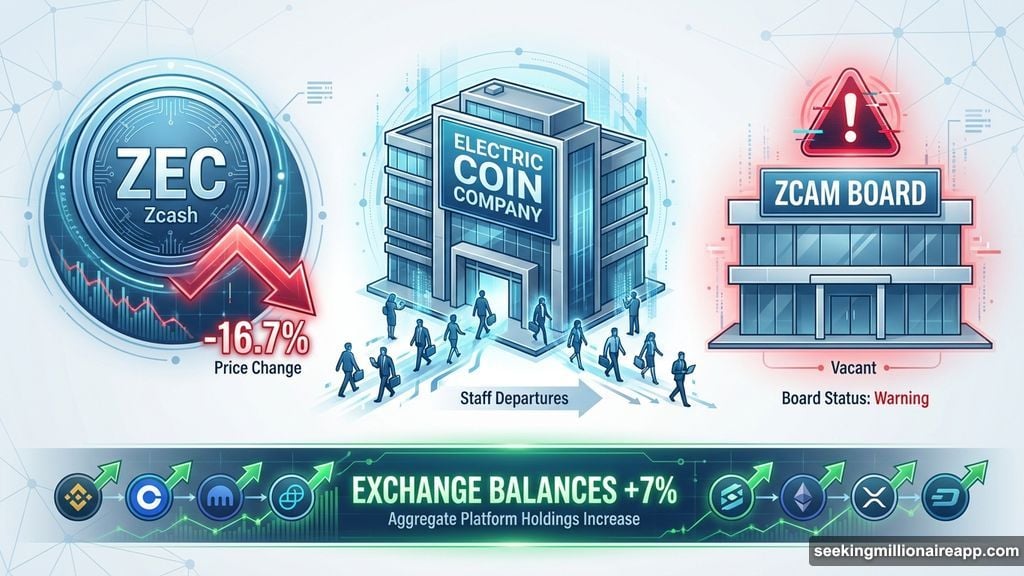

Electric Coin Company CEO Josh Swihart dropped a bomb. His entire team resigned. Not because they wanted to. Because they felt forced out.

Swihart used the term “constructive discharge.” That’s legal speak for when your employer makes conditions so unbearable you have no choice but to leave. In this case, the board overseeing ECC made decisions that gutted the team’s independence.

“Yesterday, the entire ECC team left after being constructively discharged by ZCAM,” Swihart announced. “We’re founding a new company, but we’re still the same team with the same mission: building unstoppable private money.”

He added something important. The Zcash protocol itself remains unaffected. But that’s not what the market heard. Investors saw leadership chaos and hit the sell button.

Holders Dumped ZEC Immediately

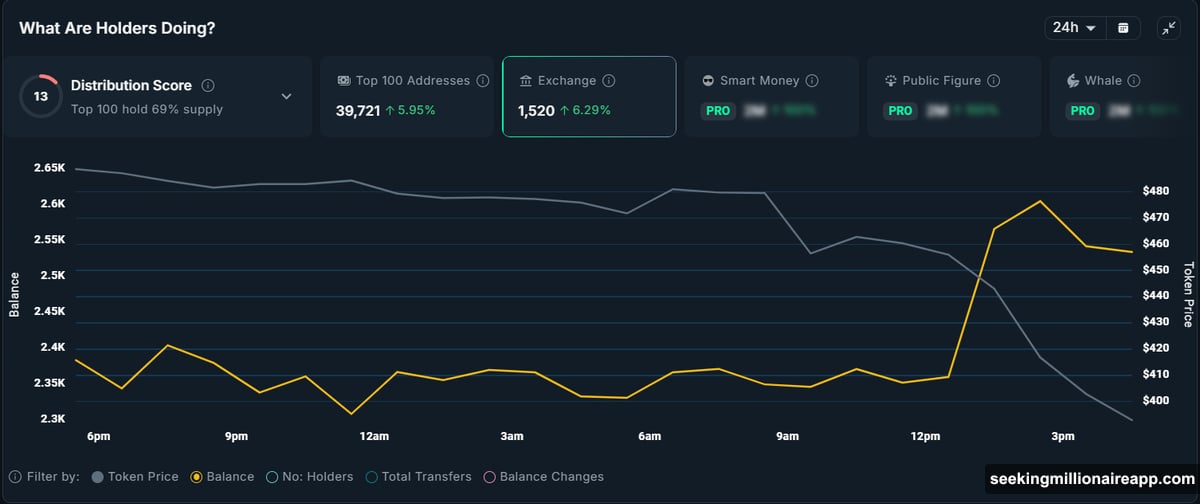

On-chain data tells the story. Selling pressure spiked within hours of the announcement. Nansen tracked a roughly 7% jump in ZEC balances on exchanges over 24 hours.

Rising exchange balances mean one thing. People are preparing to sell. This wasn’t gradual either. It was sudden and coordinated.

When governance shocks hit, confidence evaporates fast. Short-term and mid-term holders exit first. They don’t wait to see how things play out. They reduce risk immediately.

That behavior creates a doom loop. More selling drives prices down. Lower prices trigger more panic. And the cycle feeds itself.

Capital Is Rotating Into Monero

Here’s where it gets interesting. While Zcash holders were selling, Monero holders were buying. The numbers suggest a direct rotation.

Zcash’s Chaikin Money Flow turned negative. That measures buying versus selling pressure. Negative CMF means net outflows. Money is leaving the asset.

During the same period, Monero’s CMF spiked upward. That indicates strong inflows. Money is entering the asset.

The price action confirms it. ZEC crashed 16.7%, trading near $398. Meanwhile, XMR climbed roughly 5% during the same window.

These opposing trends didn’t happen by accident. Investors appear to be reallocating within the privacy coin sector. They’re not abandoning the narrative. They’re just picking a different horse.

Monero’s Momentum Is Building

Momentum indicators back this up. XMR’s Money Flow Index surged right after the Zcash news broke. MFI tracks buying and selling pressure using both price and volume.

A rising MFI means strong demand. Buyers are stepping in with conviction. In Monero’s case, that demand looks real.

XMR currently trades near $456. That puts it just 13.5% below its all-time high of $518.99. For context, that’s striking distance.

If capital keeps flowing from ZEC into XMR, Monero could punch through that ceiling. Sustained buying pressure acts as a catalyst. And right now, that pressure is building.

Why Investors Are Choosing XMR

Governance matters. Zcash just demonstrated why. When core teams implode, holders get nervous. They start questioning long-term viability.

Monero doesn’t have that problem right now. Its development remains decentralized. No single company controls it. That insulates it from the kind of leadership drama that’s crushing ZEC.

Privacy coins also operate in a small niche. When one falters, capital doesn’t leave the sector entirely. It rotates into the strongest alternative. In this case, that’s clearly Monero.

Moreover, Monero already established itself as the default privacy coin. It has deeper liquidity and wider acceptance. For investors fleeing Zcash, XMR is the obvious choice.

What Comes Next for XMR

Technical indicators point upward. The Money Flow Index shows strong buying. The Chaikin Money Flow confirms inflows. And the price action reflects real demand.

If these trends continue, Monero could test its all-time high within weeks. It only needs to climb 13.5%. That’s achievable if buying pressure persists.

But here’s the caveat. Market conditions can shift fast. If broader crypto sentiment turns negative, even strong projects get hit. Monero isn’t immune to macro headwinds.

Still, the setup looks promising. Capital rotation out of Zcash provides fuel. Strong fundamentals provide stability. And technical momentum provides direction.

Zcash’s loss might genuinely become Monero’s gain. The market is voting with its wallets. And right now, those wallets are choosing XMR.