The crypto market just lost serious ground. Total market cap dropped below $3.09 trillion and now hovers at $3.08 trillion after a brutal 48-hour decline.

Bitcoin barely held $90,000. Meanwhile, Zcash crashed 7.45% as developer drama sparked panic selling. Plus, the weekend’s coming, and nobody knows if buyers will step in or sit this one out.

Let’s break down what’s hammering prices and which levels matter most right now.

Bitcoin Defended $90,000 But Momentum Is Fading

Bitcoin dipped below $90,000 briefly during the past 24 hours. But buyers jumped in fast, pushing the price back to $91,063. That quick rebound shows demand still exists at lower levels, preventing a deeper breakdown into the $80,000 zone.

Still, the Relative Strength Index (RSI) indicates fading bullish momentum. Recent liquidations saturated the market and scared off leveraged traders. So Bitcoin will likely stay above $90,000 or the stronger support at $89,241 unless conditions deteriorate further.

These support zones have historically attracted demand during corrections. They reduce the probability of an extended decline for now. But if macro conditions worsen or bad news hits, even these levels won’t hold forever.

Weekend Rally Could Push BTC Toward $95,000

If bullish momentum returns over the weekend, Bitcoin could reclaim $91,511 as support. From there, the path opens toward $93,471 and potentially $95,000.

Securing these levels would restore short-term confidence. It would also rebuild upward momentum after the latest volatility-driven setback. But that’s a big “if” considering current sentiment.

Traders are watching volume closely. Low weekend volume often means whipsaw moves in both directions. High volume on a push above $91,511 would signal genuine buying interest, not just a dead cat bounce.

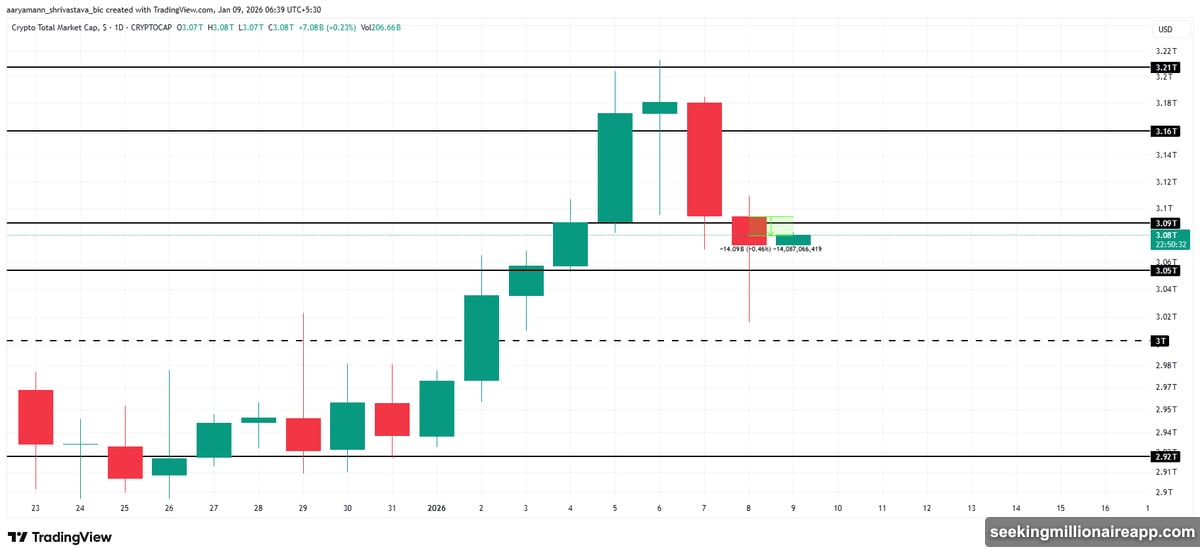

Total Crypto Market Cap Lost Key Support

The total crypto market cap (TOTAL) dropped $14 billion in the past 24 hours. That’s nothing compared to Thursday’s intra-day collapse, which erased nearly $80 billion in value.

TOTAL now sits at $3.08 trillion after losing the $3.09 trillion support level. It’s holding above $3.05 trillion for now, but deteriorating conditions could push the market toward $3.00 trillion. Such a move would signal broader weakness and rising risk-off behavior among investors.

The rebound from Thursday’s lows suggests buyers stepped in at lower levels. They prevented deeper losses across major assets. But those buyers aren’t aggressively pushing prices higher yet. They’re just defending key support zones.

Reclaiming $3.09 Trillion Opens Path to $3.16 Trillion

If market sentiment improves heading into the weekend, TOTAL could reclaim $3.09 trillion as support. A sustained move above this level may open the door for a climb toward $3.16 trillion.

That would help restore short-term bullish structure. More importantly, it would prove that Thursday’s $80 billion wipeout was just a liquidity grab, not the start of a deeper correction.

However, Friday’s price action needs to show strength. Sideways grinding or another failed breakout attempt would keep sellers in control going into next week.

Zcash Crashed 7.45% on Developer Exit Drama

Zcash (ZEC) got hammered by controversy surrounding its developers’ exit. The altcoin fell 7.45% in the last 24 hours to trade at $434. That’s a brutal decline driven by investor panic over the project’s future direction.

But ECC CEO Josh Swihart stepped in with reassurance. He confirmed the team remains committed to the Zcash protocol and is building a new wallet. That eased some concerns and helped ZEC post a brief 3% rebound before sellers pushed back.

Still, the broader trend remains weak. ZEC is trading inside an ascending wedge pattern that projects a potential 27% drop toward $363 if a bearish breakout confirms. That would take Zcash back to levels not seen since late 2024.

ZEC Needs to Reclaim $442 to Avoid Deeper Drop

Zcash can attempt recovery if it reclaims $442 as support. Securing this level would allow momentum to build toward the $500 mark, invalidating both the bearish thesis and the wedge pattern.

Interestingly, $3.2 million in accumulation activity suggests some big players are buying the dip. But that buying hasn’t been enough to reverse the downtrend yet. It’s just slowing the decline and preventing capitulation.

If ZEC falls below $400, the next stop is $363. That’s where the wedge pattern projects support. Below that, things get ugly fast with limited support until the $300 zone.

Polymarket Refuses to Pay $10.5 Million in Bets

In other news, Polymarket faced backlash after refusing to pay out about $10.5 million in bets tied to Nicolás Maduro’s capture by U.S. forces. The platform ruled the operation was not an “invasion,” classifying it as a snatch-and-extract mission under its contract terms.

This decision sparked outrage from bettors who believed they won fair and square. But Polymarket pointed to specific contract language that defined “invasion” differently than participants expected.

The controversy highlights ongoing challenges with prediction market platforms. Clear contract terms matter. But when real-world events happen, interpreting those terms becomes subjective and contentious.

Truebit Suffers Suspected $26 Million Exploit

Cyvers Alerts reported a suspected Truebit incident after detecting a suspicious transaction linked to an estimated $26 million loss. TRU’s on-chain price briefly collapsed by 99.95%, suggesting a liquidity failure or faulty price feed rather than normal selling.

The collapse happened fast. Within minutes, TRU went from normal trading to near-zero pricing on some exchanges. That kind of move indicates something broke in the infrastructure, not just heavy selling pressure.

Whether it’s an exploit, a bug, or a liquidity issue remains unclear. But $26 million disappearing in minutes is serious. Truebit holders are understandably panicked, and the project team hasn’t provided clear answers yet.

What Happens Next Depends on Weekend Volume

Markets heading into weekends typically show lower volume. That makes them vulnerable to sudden moves in either direction based on thin order books.

If buyers step in with conviction, Bitcoin could push back toward $93,000 and TOTAL could reclaim $3.09 trillion. That would ease short-term pressure and set up a potential run at new highs next week.

But if selling pressure continues, Bitcoin risks testing $89,241 support and TOTAL could slip toward $3.00 trillion. Those moves would confirm the bearish shift and likely trigger more liquidations.

The market is at a critical juncture. The next 48 hours matter more than usual. Traders should watch volume closely and avoid overleveraging into weekend uncertainty. Because when liquidity dries up, bad things happen fast.