The December jobs report drops Friday. Wall Street’s watching closely because it might kill hopes for an early Federal Reserve rate cut.

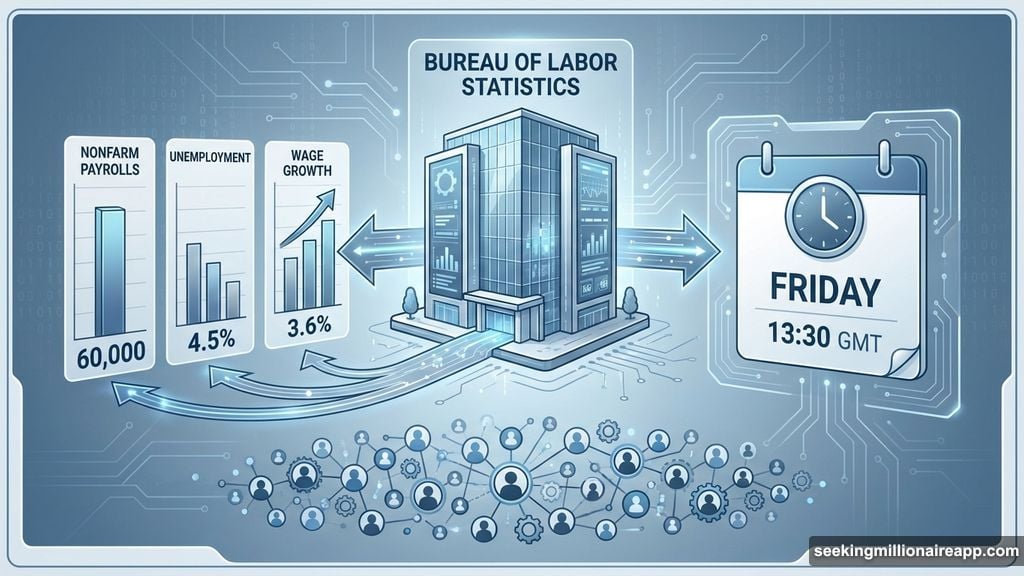

Economists expect modest payroll growth of 60,000 jobs. Meanwhile, the unemployment rate should tick down slightly to 4.5%. But these numbers pack more punch than usual right now.

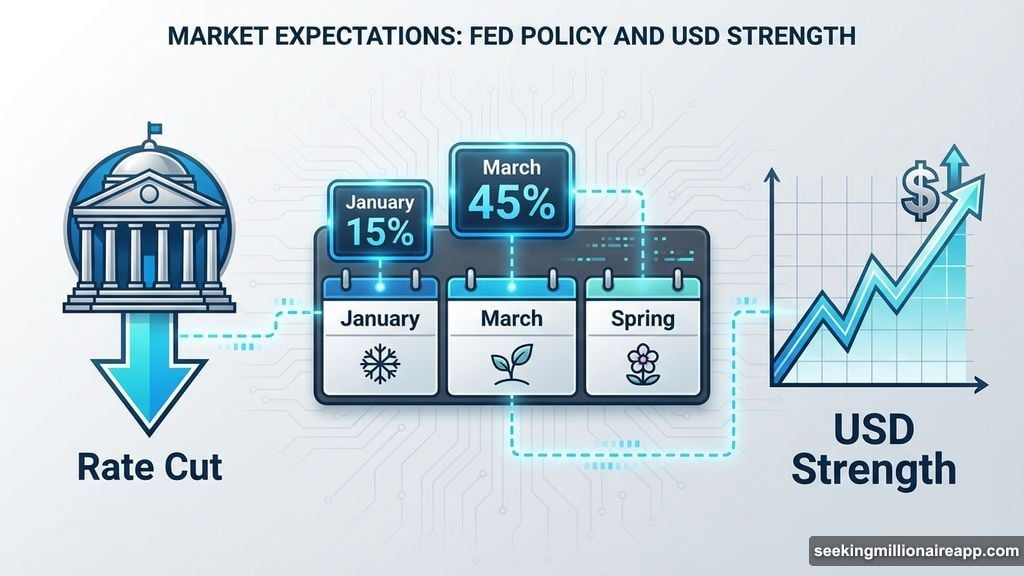

Here’s why this matters. The Fed just turned cautious about cutting rates. Plus, markets already slashed their bets on a January cut to under 15%. So Friday’s data could either revive rate cut hopes or bury them until spring.

What the Numbers Should Show

The Bureau of Labor Statistics releases employment data Friday at 13:30 GMT. Expectations paint a picture of steady but unspectacular growth.

Nonfarm payrolls likely rose by 60,000 in December. That’s barely changed from November’s 64,000 gain. However, unemployment should improve marginally to 4.5% from 4.6%. And wage growth might edge up to 3.6% annually from 3.5%.

These forecasts track with recent private sector data. The ADP report showed 41,000 private jobs added in December after a 29,000 drop in November. Moreover, the ISM Services employment index finally broke above 50 after six months in contraction territory.

TD Securities analysts expect private payrolls to hit 50,000 while government jobs drop by 10,000. They also predict the unemployment rate normalizes to 4.5% after a shutdown-driven spike last month. Wage growth should clock in at 0.3% monthly and 3.6% yearly.

Fed Officials Send Mixed Signals

Richmond Fed President Thomas Barkin said rate decisions need “finely tuned” calibration. Unemployment stays low but he doesn’t want it deteriorating further. That’s central banker speak for “we’re nervous about the job market.”

Minneapolis Fed President Neel Kashkari sounds more worried. He noted the job market is clearly cooling and warned the unemployment rate could “pop from here.” That’s unusually direct language for a Fed official.

These conflicting views reflect the Fed’s uncomfortable position. Inflation remains stubborn. Yet the labor market shows cracks. So they’re stuck between two bad options.

Currently, markets price in barely a 45% chance of a March rate cut. That’s down significantly from just weeks ago. Friday’s jobs data could shift those odds dramatically either direction.

Dollar Strength Complicates the Picture

The US dollar finished 2025 on a tear and kept climbing into 2026. That strength persists despite the Fed’s dovish December meeting.

Markets now see under 15% odds of a January rate cut. Most traders expect the Fed to stay on hold this month. But March remains up for grabs depending on incoming data.

Rabobank analysts note markets will “fine-tune” rate cut timing expectations based on Friday’s report. They expect choppy trading as investors digest the numbers. However, they also predict the dollar maintains safe haven appeal throughout the year.

A strong jobs report above 80,000 with falling unemployment would cement Fed policy hold expectations. That scenario would likely crush EUR/USD and strengthen the dollar further. Conversely, a weak print of 30,000 or less could spark dollar selling and revive rate cut hopes.

Three Scenarios for Friday’s Report

Strong jobs growth would kill rate cut hopes until summer at least. Payrolls above 80,000 plus unemployment dropping to 4.4% would signal the labor market remains resilient. The Fed would have no justification for easing policy. Plus, the dollar would surge against major currencies.

Weak jobs growth would flip the script entirely. Payrolls under 30,000 would raise recession fears and pressure the Fed to cut sooner. That would hammer the dollar and boost stocks temporarily. But it also signals deeper economic problems brewing.

In-line growth around 60,000 leaves everything murky. Markets would stay stuck in this uncomfortable limbo. Rate cut odds for March would hover around 50-50. And traders would obsess over every Fed speech hunting for hints.

Technical Signals Flash Warning

EUR/USD just dropped below its 20-day moving average for four straight days. The relative strength index fell under 50 for the first time since late November. Those are classic bearish signals.

If the pair breaks below 1.1665 (the 100-day moving average), technical sellers will pile on. First support sits at 1.1600, then 1.1560 at the 200-day average. However, a bounce above 1.1740 could trigger recovery toward 1.1800 and 1.1870.

The charts suggest downside pressure building. Friday’s jobs data could either confirm the breakdown or spark a reversal. Either way, volatility looks certain.

The employment report matters more than usual right now. Fed policy hangs in the balance. Market positioning looks stretched. And economic signals remain mixed.

Expect sharp moves Friday afternoon. The dollar will likely swing hard in either direction. Plus, those moves could set the tone for weeks ahead as markets reassess Fed timing.

One thing’s certain though. This jobs report won’t satisfy everyone. The data never does.