Ripple cleared one of crypto’s toughest regulatory hurdles. Yet XRP barely moved.

The company’s UK subsidiary secured official registration from the Financial Conduct Authority. This places Ripple among a tiny group of crypto firms that survived Britain’s notoriously strict approval process. Meanwhile, XRP traded up just 0.7% to $2.10, showing almost no reaction to what should be landmark news.

So why does this matter for XRP holders? The muted price action hides something bigger happening beneath the surface.

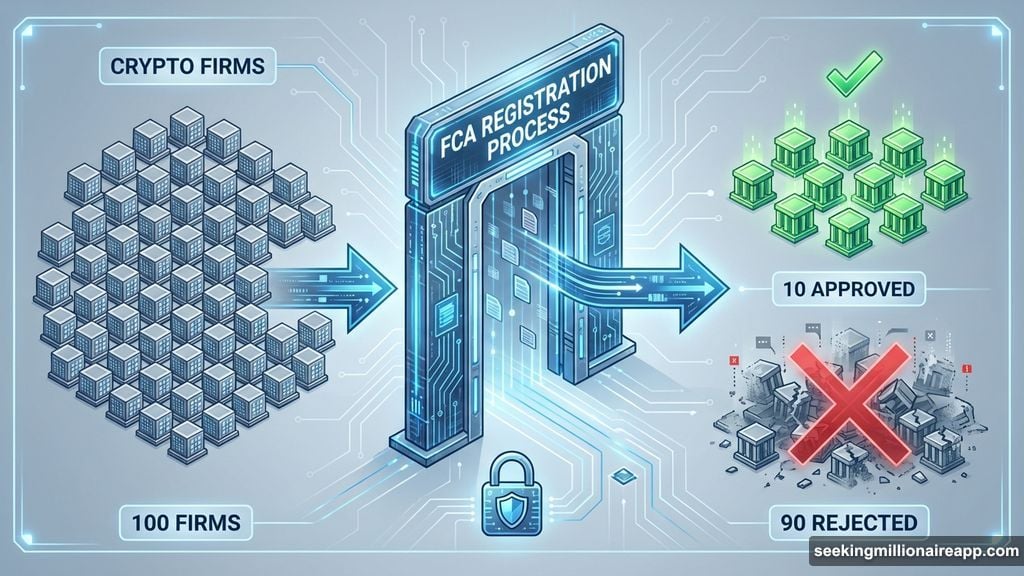

The FCA Doesn’t Hand Out Approvals Easily

Nearly 90% of crypto firms attempting FCA registration have failed. That’s not an exaggeration. Britain’s financial regulator maintains standards so rigid that most applicants can’t meet them.

Ripple Markets UK Ltd. just joined the exclusive club of firms that passed. Plus, this wasn’t a rubber stamp approval. The FCA’s process examines governance structures, financial crime prevention measures, operational resilience, and alignment with traditional finance principles.

Most crypto companies lack the infrastructure to satisfy these requirements. Indeed, the high failure rate reflects how few firms can demonstrate institutional-grade compliance. Ripple’s success signals it operates at a different level than typical crypto startups.

However, markets didn’t seem to care. XRP’s price movement suggests traders either missed the significance or don’t believe it matters yet.

What FCA Registration Actually Unlocks

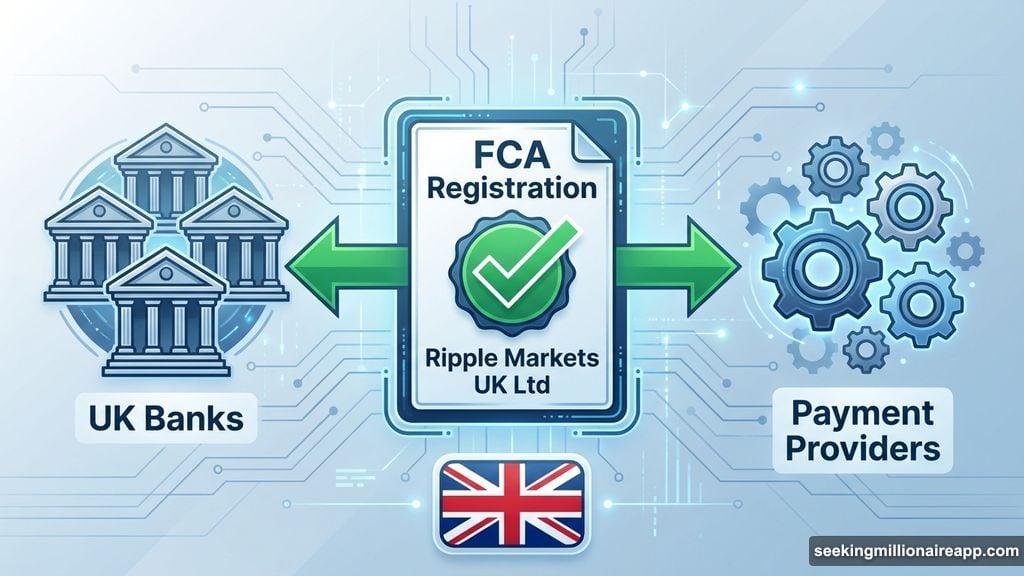

Britain’s approval transforms Ripple’s ability to operate in one of the world’s leading financial centers. The company can now work directly with UK banks and payment providers that cannot engage with unregulated entities.

Moreover, this timing aligns perfectly with Britain’s evolving crypto framework. The FCA recently published consultation paper CP25/25, which outlines how existing financial regulations will apply to crypto firms. Ripple entered this new regulatory environment with full approval already secured.

That positioning creates real advantages. As the UK develops frameworks for tokenized financial products, settlement infrastructure, and potential CBDC pilots, Ripple can participate from day one. Competitors without FCA registration face months or years of approval processes before accessing the same opportunities.

Furthermore, regulatory clarity has historically moved XRP’s price more than pure market sentiment. The four-year legal battle with the US SEC demonstrates how uncertainty creates downward pressure. Britain’s approval removes one major source of doubt from the equation.

Institutional Credibility Changes the Game

FCA registration sends a clear message to banks and financial institutions worldwide. Ripple passed scrutiny in a jurisdiction known for rigorous standards. That credibility matters more than short-term price movements.

Traditional finance operates conservatively. Banks require partners with proven compliance track records. So when institutions evaluate blockchain payment solutions, FCA registration becomes a deciding factor. Competitors without similar approvals face automatic disqualification from many partnership opportunities.

Additionally, this approval strengthens Ripple’s position as crypto integrates into mainstream finance. The UK isn’t pushing crypto firms offshore like some jurisdictions. Instead, Britain is building frameworks to incorporate compliant companies into its TradFi system.

Ripple now stands ready to capitalize on this integration. The company can participate in experiments with tokenized settlement systems, cross-border payment infrastructure, and other institutional applications. Each successful implementation builds the case for broader XRP adoption.

Yet markets remain skeptical. The minimal price reaction suggests traders want to see concrete results from this approval before bidding XRP higher.

Why the Price Didn’t Move

Several factors explain XRP’s muted response to genuinely positive news. First, the broader crypto market has been ranging sideways. Strong headwinds from macroeconomic uncertainty and risk-off sentiment have kept most assets contained regardless of fundamentals.

Second, FCA approval represents a long-term catalyst rather than an immediate price driver. The benefits will materialize gradually as Ripple secures partnerships and expands UK operations. Markets typically discount future developments slowly until they become obvious.

Third, XRP holders have weathered years of regulatory battles and false starts. The community has grown cautious about celebrating wins that don’t translate to adoption or price appreciation. So even legitimate milestones face initial skepticism.

However, perception could shift as Ripple demonstrates what FCA registration enables. Announcements of UK bank partnerships, payment corridor expansions, or institutional adoption could trigger reassessment of XRP’s value proposition.

Plus, other jurisdictions often follow Britain’s regulatory lead. If the FCA’s endorsement influences European or Asian regulators to view Ripple favorably, the approval’s impact multiplies beyond the UK market alone.

The Bigger Picture Nobody’s Discussing

Ripple’s FCA registration matters because it proves crypto firms can meet traditional finance standards without abandoning blockchain innovation. That balance has eluded most of the industry.

Too many projects prioritize decentralization ideology over practical compliance. Others rush to regulatory approval but sacrifice the technology’s core benefits. Ripple threaded this needle by building institutional-grade infrastructure while maintaining its blockchain foundation.

Britain’s approval validates this approach. The FCA wouldn’t register a company it viewed as fundamentally incompatible with financial regulation. So this milestone signals that blockchain payments can exist within established frameworks rather than outside them.

That matters enormously for adoption. Banks won’t adopt solutions that operate in regulatory gray areas. Governments won’t embrace technologies they can’t supervise. Ripple’s path through FCA registration provides a template other serious projects can follow.

Meanwhile, XRP holders should watch what happens next rather than fixating on today’s price action. The real test comes in the months ahead as Ripple leverages its UK approval to secure partnerships and expand operations.

Regulatory wins mean nothing if they don’t translate to network activity and adoption. But if Ripple can convert FCA registration into meaningful growth, the market will eventually price in that reality. Patience pays off more often than panic in crypto’s regulatory marathon.