Ethereum’s staking system just buckled under institutional pressure. New validators now wait 30 days to start earning rewards.

The culprit? BitMine dumped over 1 million ETH into staking last month. That’s $3.2 billion in a single move. Plus, newly approved US staking ETFs piled on simultaneously. The result? The longest entry queue since 2023.

Here’s the weird part. Staking yields hit record lows. Yet institutions keep flooding in anyway.

BitMine’s Massive Bet Clogs the System

BitMine moved fast and hard. Over 30 days, they staked 1.03 million ETH from their corporate treasury.

That represents exactly one-quarter of their total ETH holdings. So this wasn’t tentative testing. BitMine went all-in on staking despite knowing yields had tanked.

Their deposit alone swelled the validator entry queue to 1.7 million ETH. That’s the highest backlog in three years. Blockchain analyst Ember CN flagged the surge on January 9, noting the exit queue had completely cleared while new entrants piled up.

Meanwhile, validators joining today face roughly 30 days before their staked ETH starts generating returns. That’s a long wait in crypto time. But BitMine clearly doesn’t care about short-term delays.

US Staking ETFs Add Fuel to the Fire

BitMine wasn’t alone in this rush. Two new US ETFs started distributing staking rewards this month.

The Grayscale Ethereum Staking ETF and 21Shares’ TETH ETF both paid out their first rewards last week. That proved regulated investment vehicles can successfully pass protocol earnings to shareholders. No technical barriers. No compliance roadblocks.

This matters because institutional money follows proven pathways. Once ETFs demonstrated working reward distribution, expect more traditional funds to follow. The queue probably gets longer before it gets shorter.

However, these products arrived at an awkward moment. Ethereum’s staking yields had already collapsed to uncomfortable levels.

Record-Low Yields Don’t Deter Institutions

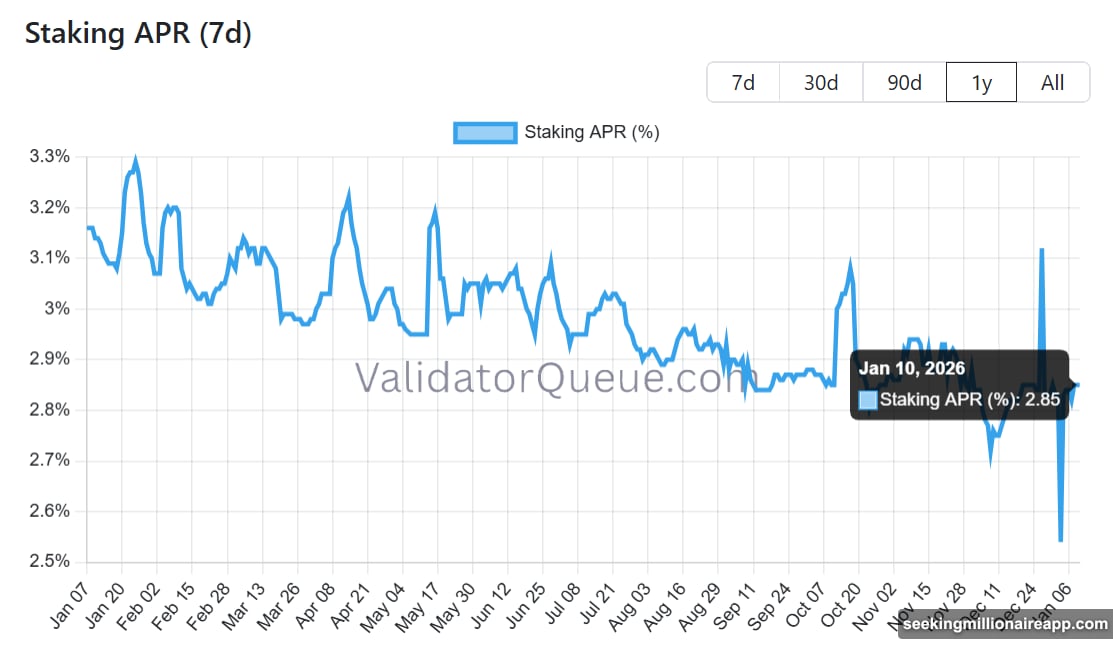

Ethereum’s staking annual percentage rate (APR) dropped to 2.54% earlier this year. That’s an all-time low since the network switched to proof-of-stake.

The rate has since recovered slightly to 2.85% as of now. Still, that’s well below the 3%+ average from the past year. Most yield-focused investors would run from returns this low.

Yet institutions poured in anyway. Why?

Network exposure seems to be the real priority. BitMine and similar players want Ethereum validator status more than they want immediate returns. Staking locks up their ETH while giving them direct network participation and influence.

Plus, these institutions play long-term games. A few months of compressed yields don’t matter when you’re positioning for years ahead. They’re betting Ethereum remains the dominant smart contract platform regardless of current staking rates.

Staking Power Stays Concentrated Despite Growth

Despite this flood of new participants, control remains centralized among familiar names. Lido DAO dominates with 24% of all staked Ether.

That’s concerning for decentralization advocates. One liquid staking provider shouldn’t control nearly a quarter of network security. But users prefer Lido’s liquidity and ease of use over running their own validators.

Behind Lido, the usual suspects appear. Binance holds 9.15% of staked ETH. Ether.fi has 6.3%. Coinbase, the largest US exchange, controls 5.08%. These four entities alone secure nearly half the network.

Then there’s the shadow majority. Untagged entities control approximately 27% of total stake. That’s more than Lido. Nobody knows who these operators are or where they’re located.

This concentration creates vulnerability. If regulators pressure major exchanges or Lido faces technical issues, significant portions of Ethereum’s security could fail simultaneously. The network needs broader distribution, but market forces push toward consolidation.

The 30-Day Wait Signals System Strain

Ethereum’s validator activation queue wasn’t designed for this volume. The protocol limits how many new validators can join per day to maintain network stability.

When demand stays moderate, new validators activate within hours. But when institutions dump millions of ETH simultaneously, the queue backs up for weeks.

Right now, approximately 1.7 million ETH sits waiting. At current activation rates, that translates to roughly 30 days before new stakers earn their first rewards. Some validators might wait even longer depending on when they joined the queue.

This creates opportunity cost. That ETH could generate yield elsewhere while it waits. DeFi protocols often pay better rates than staking anyway. Yet institutions choose to lock up capital for a month just to get into Ethereum’s validator set.

That tells you something about their conviction. They’re not chasing quick profits. They’re securing positions in what they believe remains crypto’s most important network.

What This Means for Smaller Validators

Individual stakers face a tough decision. Wait 30 days for 2.85% annual returns? Or put that ETH to work immediately in DeFi?

Liquid staking tokens like Lido’s stETH offer a middle ground. Stake through Lido, get immediate liquidity, and avoid the queue entirely. But that concentrates power further into Lido’s hands.

Solo staking becomes less attractive as yields compress and queues extend. Running your own validator requires technical knowledge, upfront costs, and now a month-long wait before earning anything. Most retail participants will choose liquid staking or skip staking altogether.

This dynamic strengthens existing powerhouses like Lido and Binance. They aggregate retail demand while providing instant liquidity and simplified interfaces. Decentralization takes another hit in the name of user experience.

Why Institutions Accept Low Yields

Traditional finance offers context here. US Treasury bonds currently yield around 4-5%. Corporate bonds pay similar or slightly higher rates. So why would institutions accept 2.85% on ETH staking?

First, they already hold massive ETH positions. BitMine’s treasury consists primarily of Ethereum. Staking generates some return on assets they planned to hold anyway. Even 2.85% beats zero.

Second, staking provides network participation rights. Validators help secure Ethereum and can potentially benefit from future protocol changes. That governance element has value beyond immediate yields.

Third, institutions think long-term. Current low yields might not last. As staking demand stabilizes or Ethereum usage increases, rewards could rise. Locking in validator spots now positions them for future opportunities.

Finally, these firms operate differently than retail traders. They don’t need 10% monthly returns. Steady, reliable yields combined with strategic network positioning align with institutional mandates better than chasing DeFi farming yields.

The Exit Queue Cleared Completely

While new validators pile up, the exit queue sits empty. Zero validators currently waiting to leave.

That’s unusual. Typically, some validators always want out for various reasons. Technical issues, changing strategies, or just taking profits. But right now? Nobody’s leaving.

This suggests strong conviction among existing validators. Despite low yields, those already staking choose to stay rather than exit. Perhaps they see something coming that makes current positioning valuable.

Or maybe exiting creates tax complications they’d rather avoid. Unstaking triggers taxable events in many jurisdictions. Staying staked defers those tax bills while maintaining network exposure.

Either way, the cleared exit queue combined with the massive entry queue paints a clear picture. Institutional money is flowing into Ethereum staking, not out.

Anonymous Validators Raise Questions

That 27% of stake controlled by unidentified entities deserves more attention. These aren’t small hobby validators. They collectively control more ETH than Lido.

Who are they? Chinese miners who pivoted to staking? Privacy-focused institutions? Nation-states quietly accumulating influence? We simply don’t know.

This opacity creates risk. Regulated entities like Coinbase face compliance requirements and operational transparency. Anonymous validators face none of that. If they behave maliciously or get compromised, we might not know until damage occurs.

Moreover, these unknown operators could coordinate without detection. Geographic concentration, shared infrastructure, or common control could exist without public visibility. That’s not great for a network meant to be decentralized.

Ethereum needs better validator identification and transparency. But the protocol itself doesn’t enforce this, and validators have strong incentives to remain anonymous when possible.

The Yield Compression Puzzle

Why did Ethereum staking yields collapse to record lows? Simple supply and demand.

More validators joined faster than network activity increased. More stakers split the same reward pool. Each individual validator earns less.

This trend will likely continue as more institutional products launch. Every new staking ETF brings fresh capital. Every corporate treasury allocation adds more validators. Unless Ethereum usage and fees increase proportionally, yields will stay compressed.

However, low yields might eventually self-correct. If returns drop enough, marginal validators will stop joining or exit entirely. That reduces competition for rewards and pushes yields back up. Basic economics.

But we haven’t reached that equilibrium point yet. Institutions keep joining despite 2.85% returns. That suggests yields could fall further before stabilizing.

What Comes Next

This institutional wave probably continues through 2026. More ETFs will launch. More corporate treasuries will allocate. The entry queue might become permanent rather than temporary.

For Ethereum, this creates both opportunities and challenges. More staked ETH strengthens network security. But concentration among a few large players and anonymous entities undermines decentralization goals.

Individual stakers face increasingly tough competition. Running solo validators makes less financial sense as yields compress and operational complexity increases. Liquid staking providers will likely capture most retail demand going forward.

Meanwhile, watch how regulators respond. Staking reward taxation remains unclear in many jurisdictions. Classification as securities could trigger new compliance requirements. Any regulatory pressure would hit centralized providers like Coinbase and Binance hardest.

The next few months determine whether Ethereum’s staking ecosystem evolves toward true decentralization or entrenches existing power structures. Right now, the trend points toward concentration despite good intentions.

Choose your staking approach carefully. The landscape is shifting faster than most people realize.