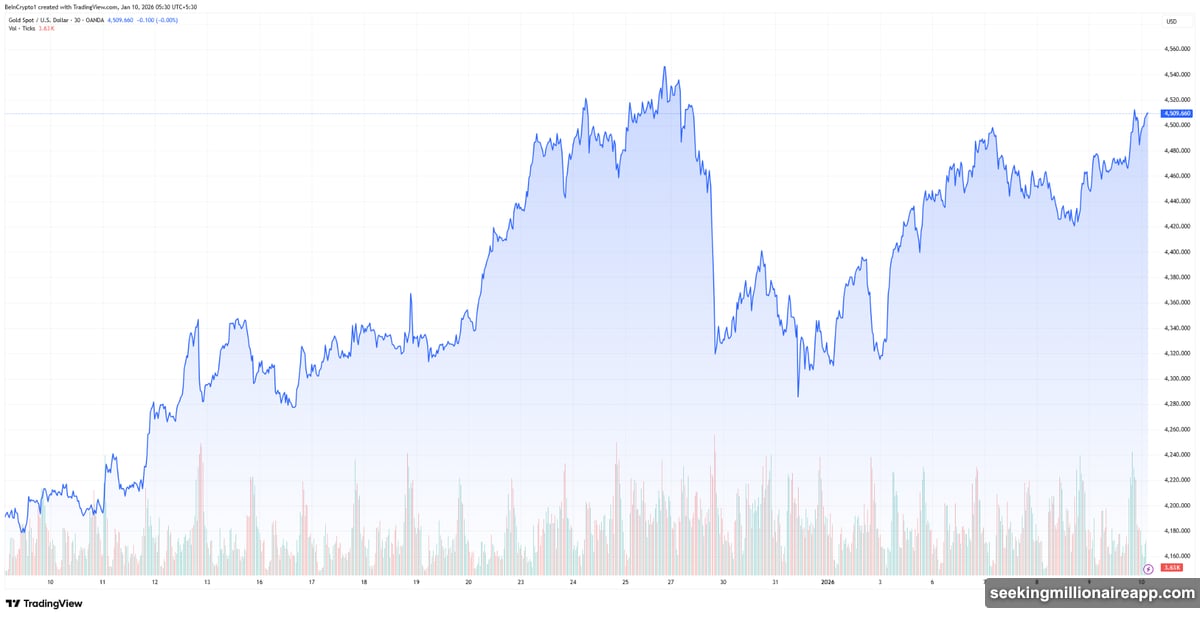

Gold kicked off 2026 with dramatic price swings. After dropping 4% in late December, prices bounced back sharply this week. Now traders face a critical question: Will the rally hold?

The volatility reflects deeper market tensions. US economic data sends mixed signals. Geopolitical conflicts escalate. Meanwhile, precious metals compete for investor attention as Bitcoin tumbles from its peak.

Let’s break down what’s driving gold’s erratic behavior and what comes next.

December Collapse Sets Stage for January Rally

Gold crashed during the holiday week. Prices fell more than 4% between Christmas and New Year’s Day.

What triggered the selloff? Profit-taking in thin markets. With most traders on vacation, even modest selling pressure moved prices significantly. Low trading volumes amplified every transaction.

But conditions changed fast. As markets reopened in early January, gold surged 2.5% on Monday alone. By Tuesday, prices climbed another 1%. That’s a remarkable recovery in just two days.

The rebound wasn’t random. Real drivers pushed gold higher after the holiday dip.

Geopolitical Chaos Sends Investors to Safety

Military tensions spiked over the weekend. US forces entered Venezuela and detained President Nicolás Maduro and his wife. The operation shocked markets.

Investors immediately sought safe-haven assets. Gold benefits most when geopolitical stability crumbles. This event fit that pattern perfectly.

However, the rally couldn’t sustain momentum. By Wednesday, fresh headwinds emerged. The CME Group raised margin requirements on gold and silver futures. That forced leveraged traders to reduce positions or add capital.

Plus, the US dollar strengthened. Gold typically moves opposite the dollar. So renewed currency strength pressured precious metal prices lower midweek.

US Economic Data Delivers Mixed Messages

Employment numbers painted a confusing picture. Private sector payrolls rose 41,000 in December, according to ADP. That reversed November’s 29,000 job loss.

Sounds positive, right? But there’s more to the story.

The Institute for Supply Management reported services sector growth accelerated. Their PMI jumped to 54.4 from 52.6. Even better, the employment component expanded for the first time since June.

Then Friday brought official jobs data. Nonfarm payrolls increased just 50,000 jobs. That missed expectations of 60,000. Yet the unemployment rate improved to 4.4% from 4.6%.

What does this mean for gold? Mixed employment signals keep Federal Reserve policy uncertain. The Fed looks set to hold rates steady in January. That removes one potential headwind for gold prices.

Silver Surges on China Export Controls

Silver stole headlines this week. Prices jumped more than 10% in two days.

China announced new export restrictions on silver. That’s a massive deal. China controls 60-70% of global refined silver supply, despite ranking second in mine production. Their dominance comes from refining capacity.

The announcement sent silver prices soaring. The gold-to-silver ratio plunged nearly 4% for the week. At around 57, the ratio hit its lowest level since August 2013.

What’s the gold-to-silver ratio? It shows how many ounces of silver equal one ounce of gold. A falling ratio means silver outperforms gold.

The CME’s margin hike caused silver to correct sharply. Still, the metal held significant weekly gains. This suggests genuine demand, not just speculative froth.

Capital Rotation from Crypto Boosts Precious Metals

Bitcoin dropped 26% from its October peak. That decline triggered massive capital flows.

Where’s the money going? Straight into precious metals. Year-to-date performance tells the story:

- Platinum: up 159%

- Silver: up 155%

- Gold: up 72%

- Copper: up 40%

These gains reflect more than just gold’s appeal. Investors are diversifying away from volatile crypto markets. Precious metals offer stability that digital assets can’t match.

Supply concerns also drive copper prices higher. Analysts expect copper to enter “true price discovery” in 2026 as supply crunches intensify.

Trump Policies Add New Risk Factors

President Trump’s statements inject fresh uncertainty. His administration eyes Greenland acquisition. “Ownership is very important,” Trump told the New York Times. “That’s what I feel is psychologically needed for success.”

He’s planning meetings with Danish and Greenland officials. Any escalation between the US and EU could boost gold demand. Investors typically buy gold when major powers clash.

Iran presents another flashpoint. Anti-government protests spread across Iranian cities, including Tehran. Trump warned of potential US military action if authorities use lethal force against demonstrators.

Deepening Middle East conflicts traditionally benefit gold. The metal thrives on geopolitical instability.

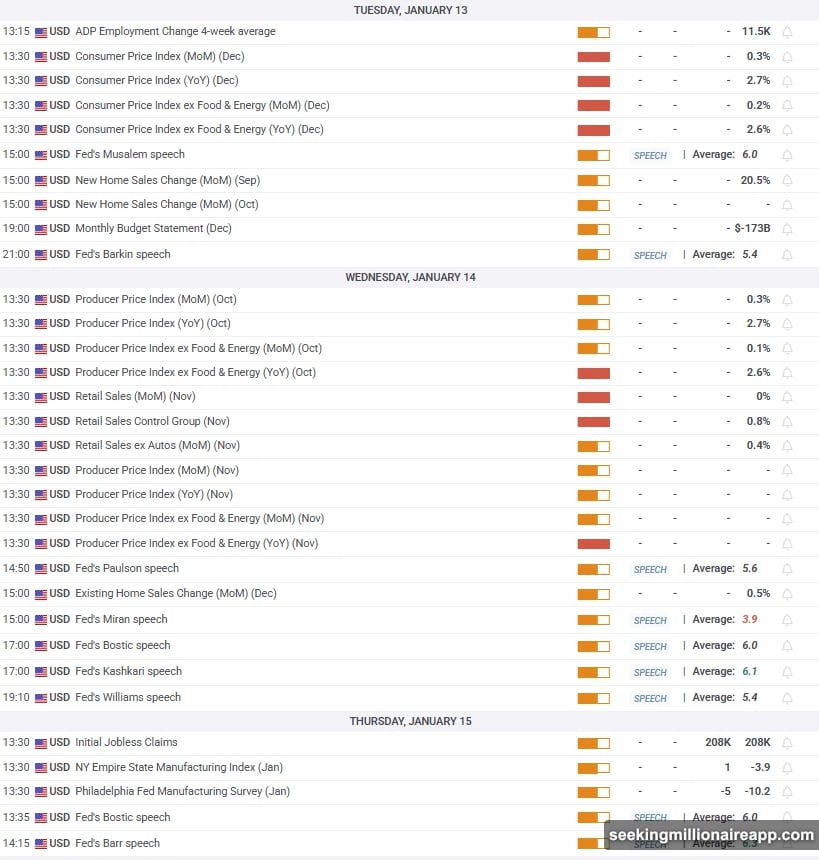

December Inflation Data Holds Key to Next Move

Tuesday brings crucial inflation numbers. The Consumer Price Index for December could shift sentiment fast.

A core CPI reading of 0.3% or higher would alarm markets. That signals persistent inflation pressure. The dollar would likely strengthen. Gold would face selling pressure.

Conversely, a reading below 0.2% eases inflation fears. The dollar weakens. Gold catches a bid.

The Fed won’t change policy in January regardless. But inflation data shapes expectations for later in 2026. Those expectations move markets now.

Mining Stocks Disconnect from Metal Prices

Gold and silver mining stocks show strange behavior. They react wildly to intraday precious metal price moves. Yet those short-term fluctuations barely matter for company valuations.

Analyst Peter Schiff noted that mining stocks remain “ridiculously cheap even at much lower precious metals prices.” The disconnect creates opportunity for patient investors.

Current metal prices support healthy mining margins. Yet stocks trade as if metals will crash. This gap suggests either mining stocks offer value or metal prices face correction.

Gold Consolidates After Volatile Week

Gold entered a holding pattern after Tuesday’s rally. Prices stabilized in the upper half of the weekly range heading into the weekend.

The 50,000 December payroll gain and falling unemployment rate didn’t move markets much. Traders already anticipated Fed policy staying unchanged.

Instead, attention shifts to inflation data and geopolitics. These factors will drive gold’s direction in coming days.

Gold finished the week with solid gains despite midweek volatility. That resilience suggests underlying support remains strong. Investors aren’t abandoning precious metals despite crypto’s recovery attempts.

What Comes Next for Gold Prices

Several scenarios could unfold. Higher inflation readings boost dollar strength and pressure gold lower. But escalating geopolitical tensions counter that effect.

Trump’s aggressive foreign policy stance creates persistent uncertainty. Markets hate uncertainty. Gold loves it.

Supply dynamics favor precious metals broadly. China’s silver export controls demonstrate how government policies can shock markets overnight. Similar actions affecting gold seem unlikely but not impossible.

The gold-silver ratio’s collapse signals strong precious metal demand across the board. When both metals rally together, it suggests genuine safe-haven buying rather than relative value trades.

Watch the Iran situation closely. Widespread protests threaten regime stability. US military involvement would escalate tensions dramatically. That scenario strongly favors gold.

Economic data matters less than usual. The Fed’s path looks set. Unless inflation surprises massively, monetary policy won’t shift soon. So geopolitics takes center stage.

Gold’s weekly performance shows buyers stepping in after the holiday selloff. That suggests $2,600 support held during the December decline. Rallies face resistance around $2,700, where selling emerged this week.

Breakout above $2,700 targets the all-time high near $2,800. But reaching that level requires either terrible geopolitical news or surprisingly weak economic data. Neither seems imminent but both remain possible.

The next few weeks will test gold’s resilience. Can prices hold recent gains? Or does consolidation turn into correction? Inflation data on Tuesday provides the first major test.